- Indication from whales’ activity on exchanges suggested a decline in sell-offs

- The current market condition does not consider BTC to be undervalued.

Although the crypto market has not had the best of times lately, Bitcoin [BTC] remains a key asset for traders. This is because the king coin is mostly responsible for the direction the market drives.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

While it is no new development Bitcoin faced selling pressure and underwent a price correction, the widespread dump seemed to have cooled off. It was also followed by speculation that the BTC price could stabilize soon.

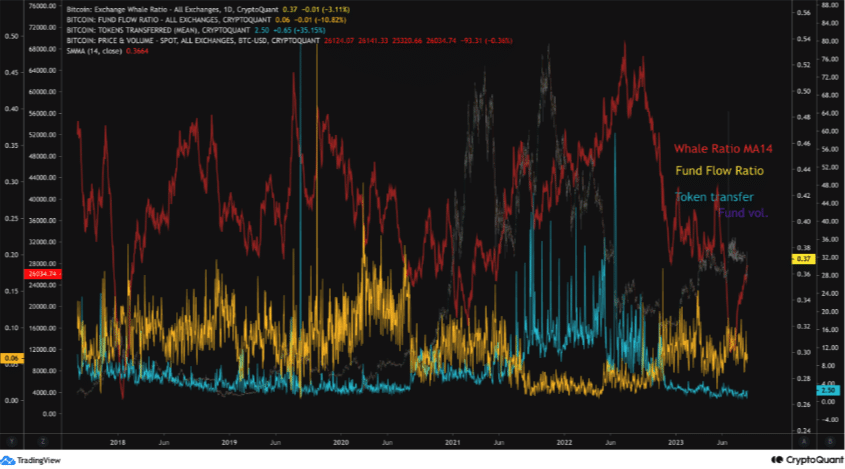

To address the possibility of stability or a price increase, CryptoQuant author Crypto_Lion considered the Fund Flow Ratio (FFR) and Whale Ratio (WR). The FFR helps to understand the behavior of whales and transaction volume on exchanges.

It’s not yet time to rejoice

The metric does this by measuring the total amount of BTC flowing in and out of exchanges. This is done in relation to the amount of BTC transferred on the Bitcoin network. On the other hand, the Whale Ratio is the ratio of the top 10 inflows to the total inflows on exchanges.

Source: CryptoQuant

When the WR is high, it means whales are actively trading on exchanges. But when the WR is low, it implies a low trading activity on exchanges. Regarding both metrics and the chart above, Crypto_Lion said,

“Selling pressure has dropped considerably. This is a recommended indicator because it shows where to monitor (exchanges or OTC), as the characteristics change significantly from year to year. This year, when the FFR rises, it is the point of price increase.”

But can the slide in selling pressure trigger a BTC uptick just yet? Well, one metric that might have a say in this is the Bitcoin realized cap. The realized cap is one way to attempt to measure a coin’s value by looking at the stored value on the Bitcoin network. It also considers the Volume- Weighted Average Price (VWAP).

At press time, the realized cap was $395.81 billion. Equally, the market cap was higher at over $500 billion.

Source: CryptoQuant

In order not to be fooled by the market value, the realized cap being lower than the market cap suggests that BTC was not undervalued in the current market conditions. Therefore, it is possible not to experience a noteworthy rise in price in the short term.

Realistic or not, here’s BTC’s market cap in ETH terms

BTC’s price may remain within reach

Another way to evaluate the possibility of a rally or not is by considering the technical angle. And from the BTC/USD four-hour chart, neither buying nor selling pressure has attempted to dominate the market over the last few days.

This quiet time has caused the Relative Strength Index (RSI) to remain at 36.16. Although the RSI value indicated that BTC was close to the oversold region, it is likely that the coin will continue to hover around $25,000 to $26,000.

Source: TradingView