The overall cryptocurrency market appears to be struggling, including major players like Bitcoin (BTC), Ethereum (ETH), and others. Amid this ongoing downturn, whale transaction tracker Look at chain shared a post on

Whale buys $183 million worth of Bitcoin

However, this notable pullback comes at a time when BTC has fallen to a support level near $97,300. Additionally, it follows MicroStrategy’s acquisition of 21,550 BTC worth $2.1 billion, purchased at an average price of $98,783, as reported by CoinPedia.

These recent acquisitions suggest that this whale and the institution are taking advantage of a perfect buy-the-dip opportunity.

$335 million in BTC outflows from exchanges

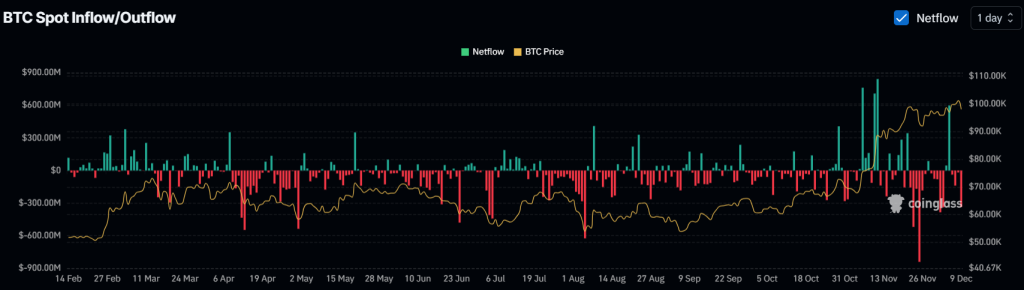

In addition to the recent withdrawals of BTC by whales and institutions, on-chain analytics firm Coinglass revealed that exchanges experienced a significant outflow of $335 million worth of Bitcoin in the past 24 hours. This signals a potential buying opportunity and signals possible upside momentum in the coming days.

Bitcoin technical analysis and upcoming level

According to expert technical analysis, BTC has been trading in a pattern of higher highs and higher lows since November 11, 2024. Currently, BTC has made a higher low in this pattern.

Historically, when BTC reaches this level, it tends to experience upward momentum. This time, however, investors and traders are speculating whether the same upward momentum will materialize, which could explain the increasing interest from whales and institutions.

Based on the recent price action, there is a high possibility that BTC could rise by 6.5% to reach the $104,160 level in the coming days.

On the upside, BTC’s Relative Strength Index (RSI) currently stands at 44, close to oversold territory, indicating a potential upside rally in the coming days. Furthermore, BTC is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend.

Current price momentum

Currently trading around $97,700, BTC has registered a price drop of over 2.15% in the past 24 hours. During this period, trading volume increased by 85%, indicating greater participation from traders and investors amid rising price activity.