- Bitcoin’s 24-hour cumulative net-donation volume comes green territory after weeks of dominance on the sales side.

- Despite optimism in the short term, long -term towing flows remain negative, which is careful for a complete trend removal.

Bitcoin [BTC] The power seems to be getting back because the sales pressure of aggressive customers continues to fall. Without a big macro opposite, BTC can be on its way for moderate growth this week.

How sustainable is the rally?

24-hour Net Toning Volume shows Bullish Transition

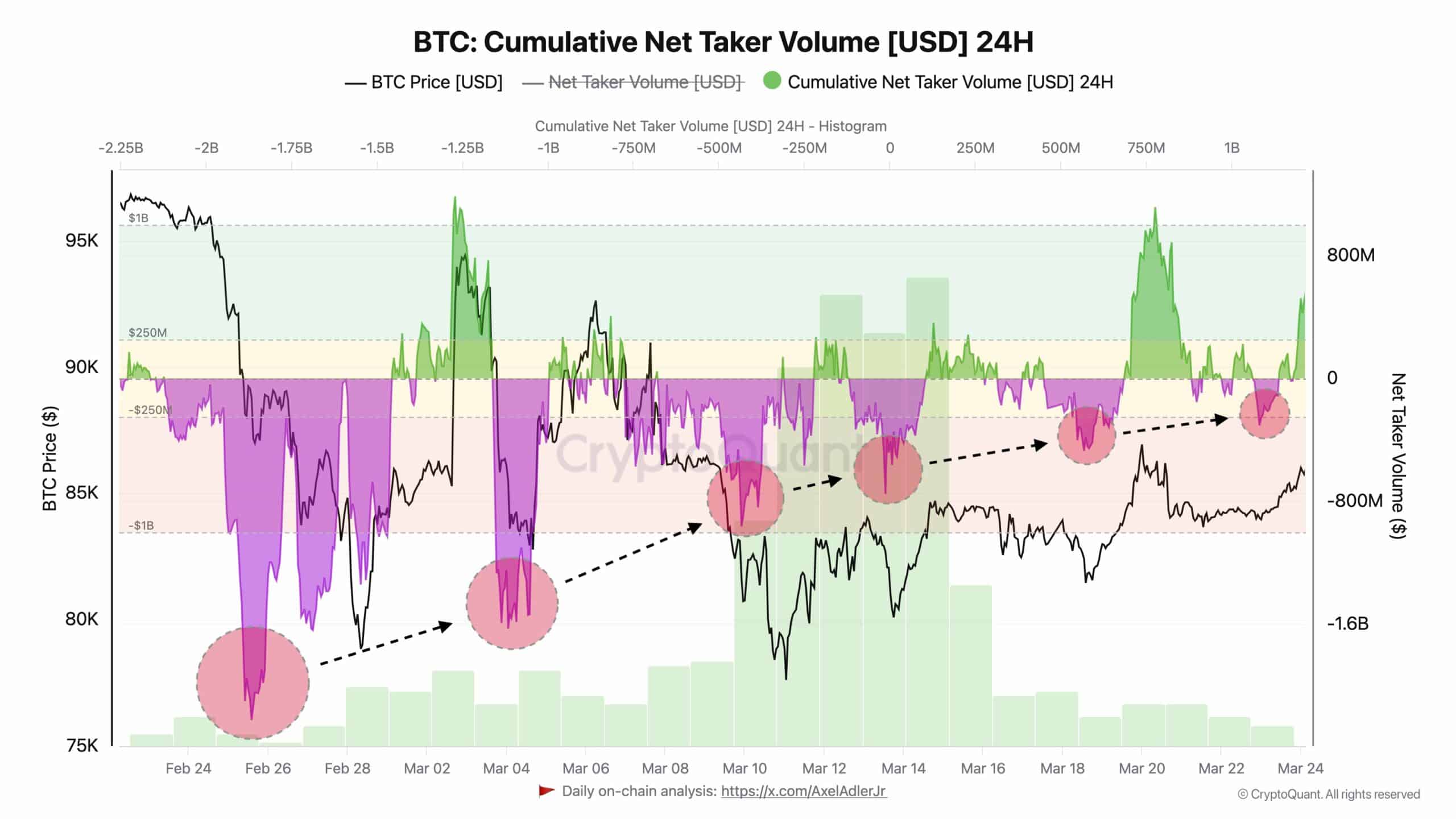

Bitcoin’s cumulative net tone volume – 24 hours has seen a remarkable shift in the past month.

This statistics, which measures the aggressiveness of market participants, had spent a large part of February deep in negative territory -with net toning volume that deposited as low as -$ 1 billion.

In recent days, however, the cumulative figure has returned to a positive area. This transition suggests that aggressive buyers started dominating the market after weeks of heavy sales side check.

Historical patterns indicate that every time this metric shifts from negative to positive, the price of BTC tends to respond with a gradual uptrend.

The most recent rise in BTCs ongoing recovery from sub-$ 80k levels to more than $ 87k.

Bitcoin Net Taker-Volume in the long term still bears scars of sales scars

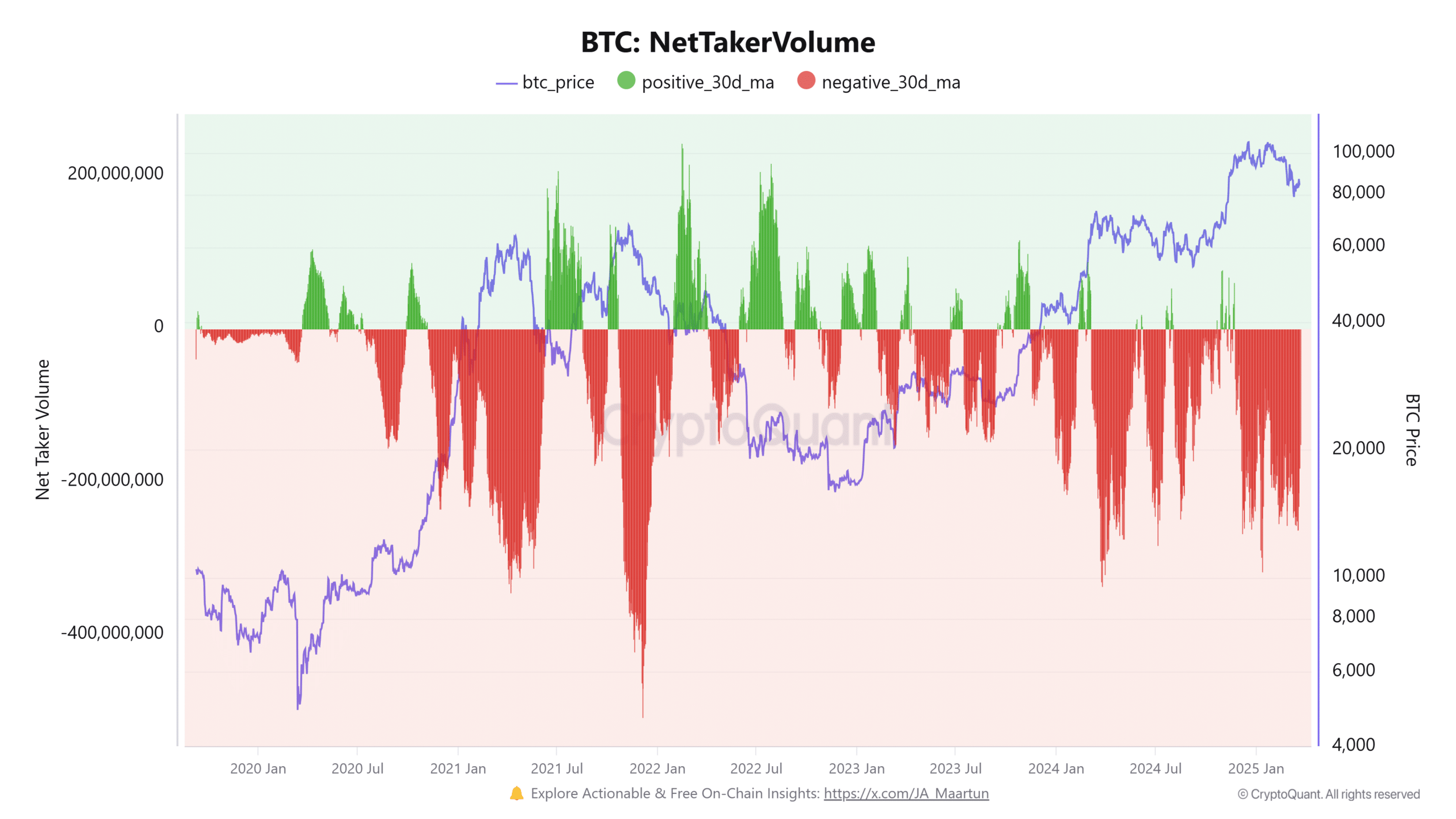

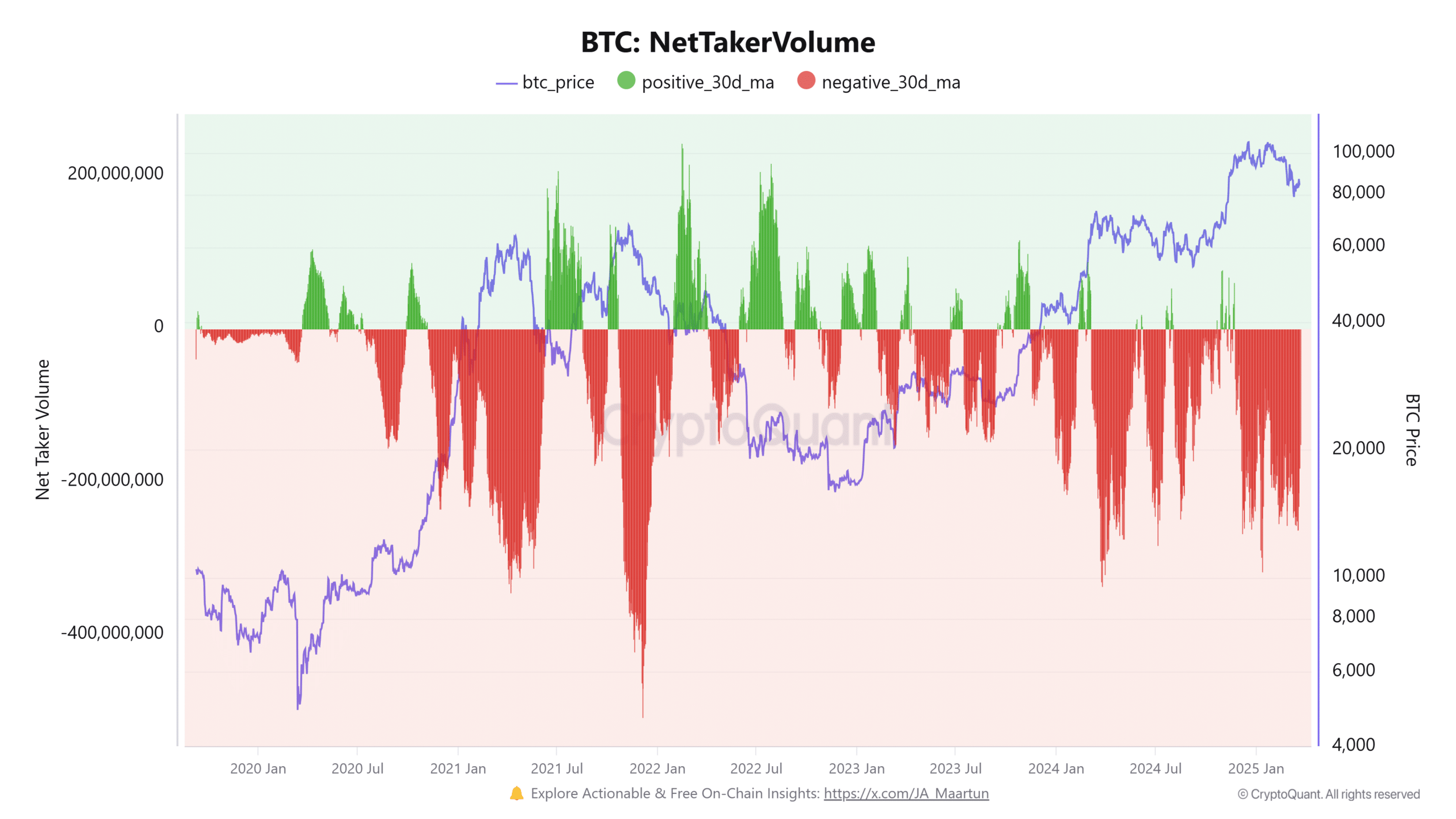

While the 24-hour metric bullish signals flashes, the net-tone volume offers a more tempered prospects in the longer term-30-day advanced average.

This graph shows that negative net -branch flows dominate the wider trend, with ongoing red rods that indicate the cumulative pressure of sellers.

Source: Cryptuquant

Although there have been short eruptions of a positive net tone volume in recent months, they still have to create a consistent green run.

This suggests that although sellers can withdraw in the short term, the market still has previous aggressive sales phases.

A complete shift to a persistent green phase on this graph would considerably strengthen the bull shop.

BTC price closes above the key support

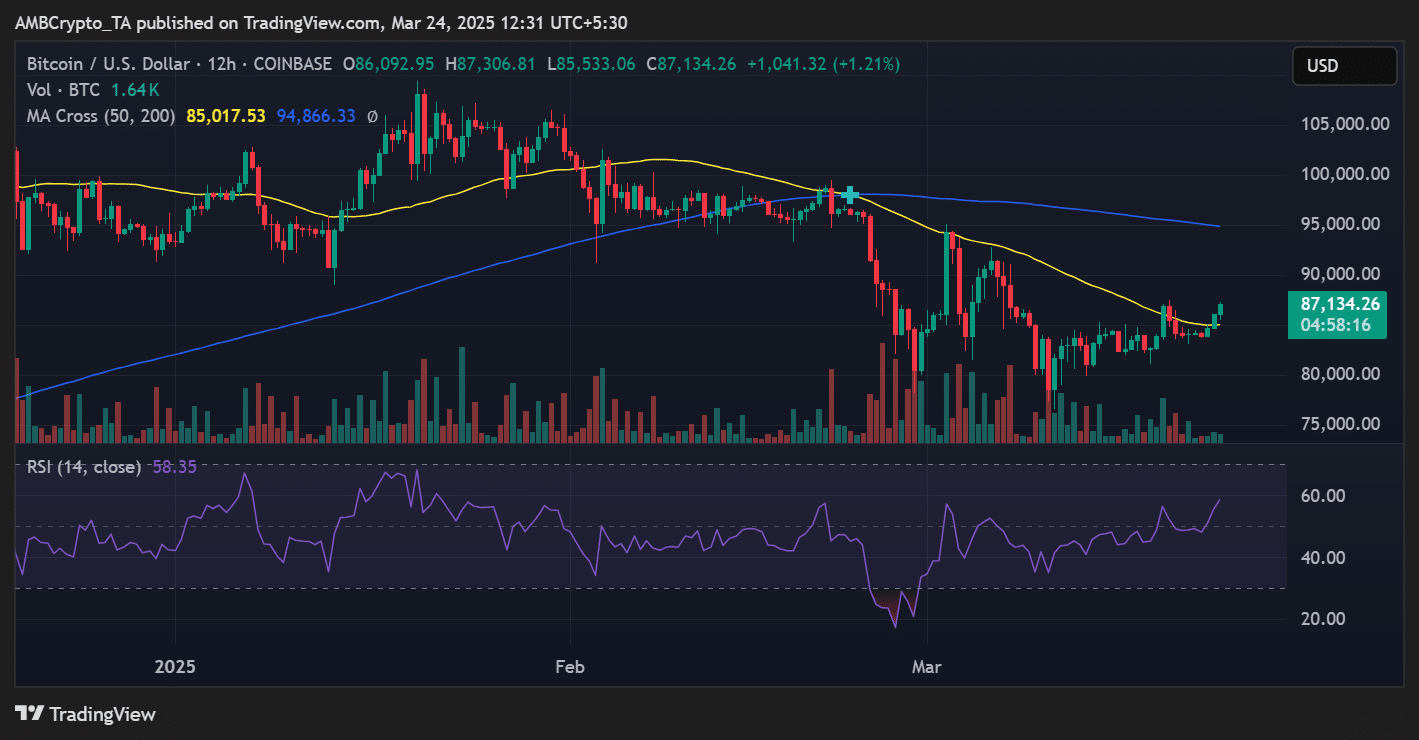

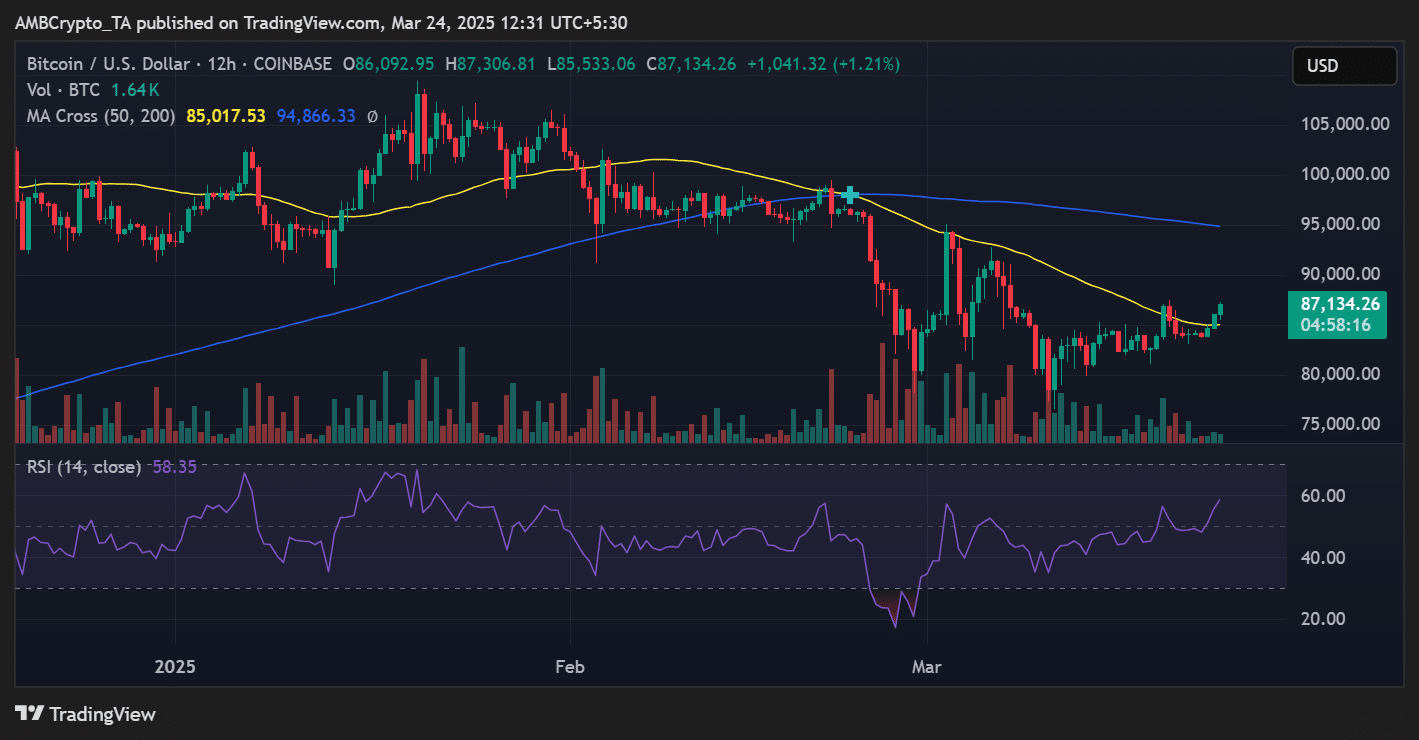

Bitcoin broke through the 50-day advancing average on the price front [MA] For $ 85,017 and traded at $ 87,134.

The 12-hour graph also showed improvement of the momentum, with the relative strength index [RSI] rises to 58.35 – Bullish Territory are approaching but not yet overbought.

Source: TradingView

The volume remained relatively stable, but if BTC knew the 200-day MA resistance at $ 94,866, it could open a path to the re-testing of the $ 95k $ 100k region. However, rejection near that band would imply more lateral action.

What to expect this week?

The most important variable is whether the buyer’s question can retain the momentum without external catalysts. Until now, data suggests a decent risk arrangement for a constant recovery.

Nevertheless, careful optimism is justified, especially with BTC that is approaching a psychologically significant resistance zone.

Bulls could push to higher goals if the cumulative network volume applies above zero and BTC remains above its 50-day MA.

On the other hand, a drop below $ 85k would signal the weakness and possibly re -introduce the bearish pressure in the short term.