- BTC is up 2% in the past 24 hours.

- Statistics suggested that selling sentiment was dominant in the market.

Bitcoins [BTC] The price witnessed a major correction recently as its value touched the $67,000 mark. However, the king of cryptos recovered from that plunge and managed to paint his daily card green.

Let’s take a look at the state of BTC and how different exchanges and investors behaved during this entire episode.

Selling pressure on Bitcoin increased

Bitcoin’s price took a major hit on March 15 when its value reached $67,200. During that price drop, major stock exchanges and investors traded interestingly.

The latest from Lookonchain tweet revealed that a Binance deposit wallet moved 4,637 BTC, worth over $329 million, to a Binance hot wallet. Coincidentally, the deposit wallet also moved 4,876 BTC, worth $319 million, to Binance Hot Wallet during the BTC drop on March 5.

AMBCrypto reported how BTC liquidation increased during the price correction. To be precise, Bitcoin’s liquidation volume rose to over $143.6 million on March 14.

IntoTheBlock is recent tweet also highlighted that selling pressure on BTC was high. According to the tweet, more than $750 million worth of BTC was pulled from the exchanges, the most since May 2023. The majority of this sell-off came from Bitfinex and Kraken.

Bitcoin’s path to recovery

Despite the increase in liquidations, BTC managed to recover somewhat from the horrors as the daily chart turned green. According to CoinMarketCapBitcoin has risen by more than 2% in the past 24 hours.

At the time of writing, BTC was trading at $68,996.20 with a market cap of over $1.36 trillion.

Since the king of cryptos was on the mend, AMBCrypto planned to take a look at the stats to see what they had to say. An analysis of CryptoQuant facts it turned out that BTC’s foreign exchange reserve decreased, which reduced selling pressure.

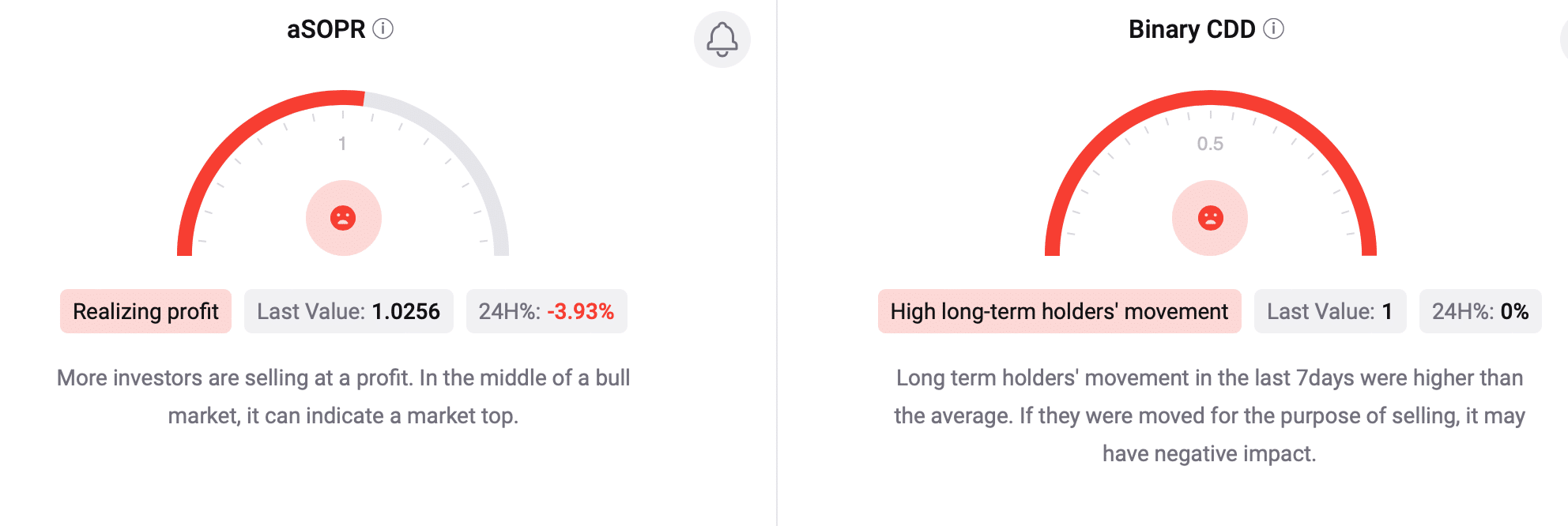

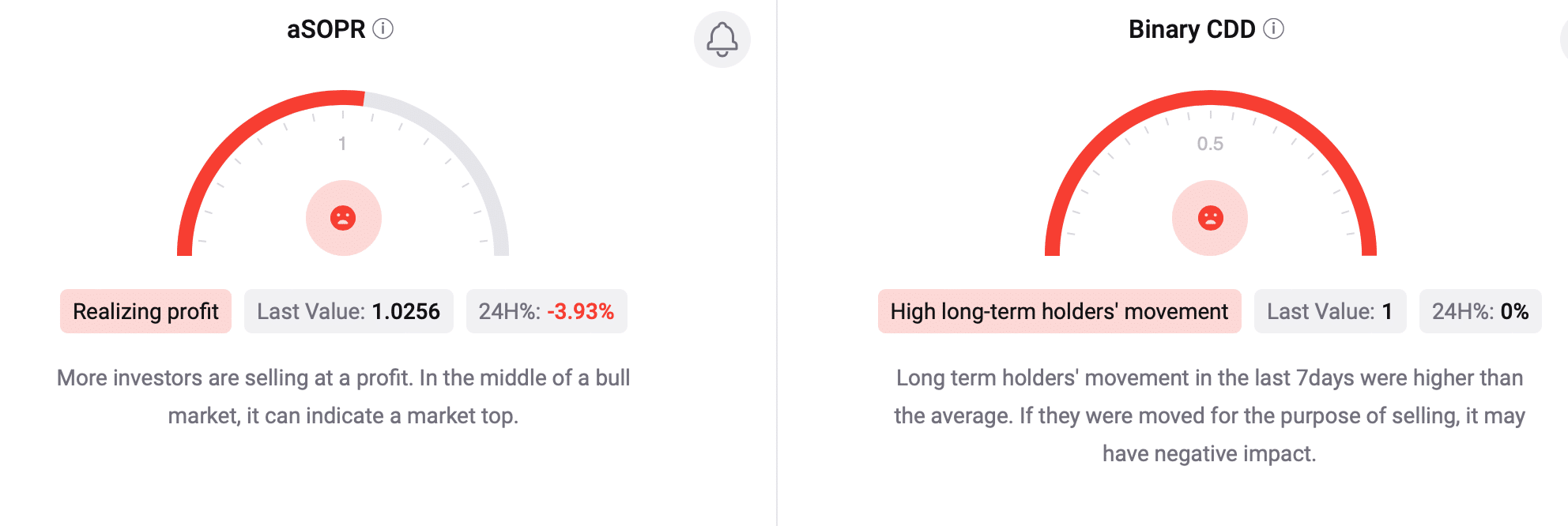

However, the rest of the metrics looked bearish. For example, the aSORP was red.

Source: CryptoQuant

This means more investors are selling at a profit. The binary CDD also remained red, indicating that long-term holders’ moves have been higher than average over the past seven days.

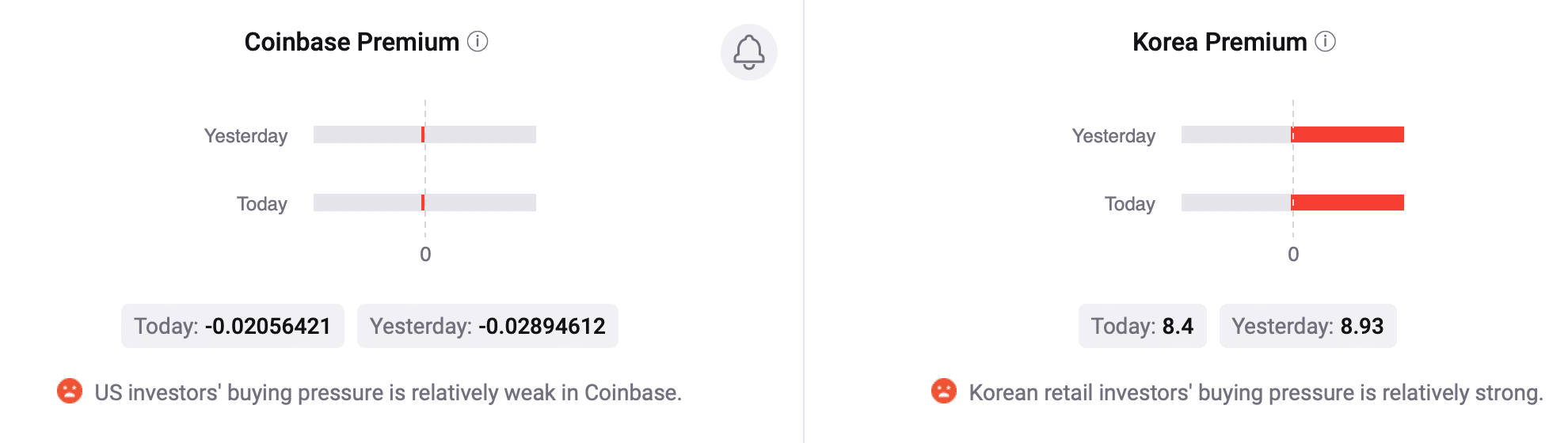

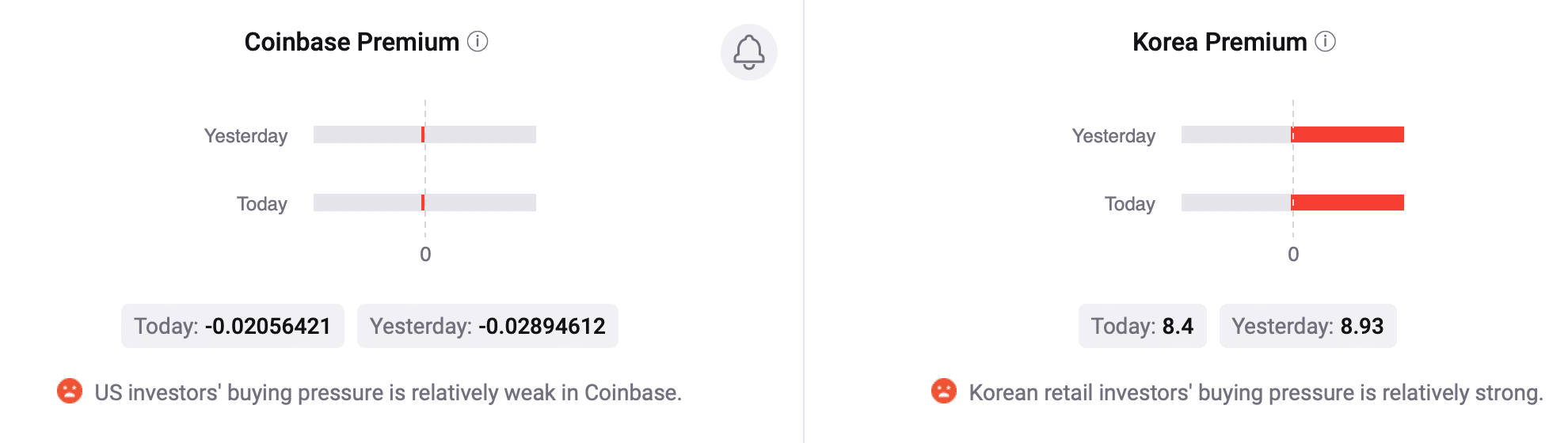

If they are moved for the purpose of sale, this could have a negative effect. Furthermore, selling sentiment remained dominant among both US and Korean investors as BTC’s Coinbase and Korea premiums were in the red.

Source: CryptoQant

Read BTCs [BTC] Price prediction 2024-25

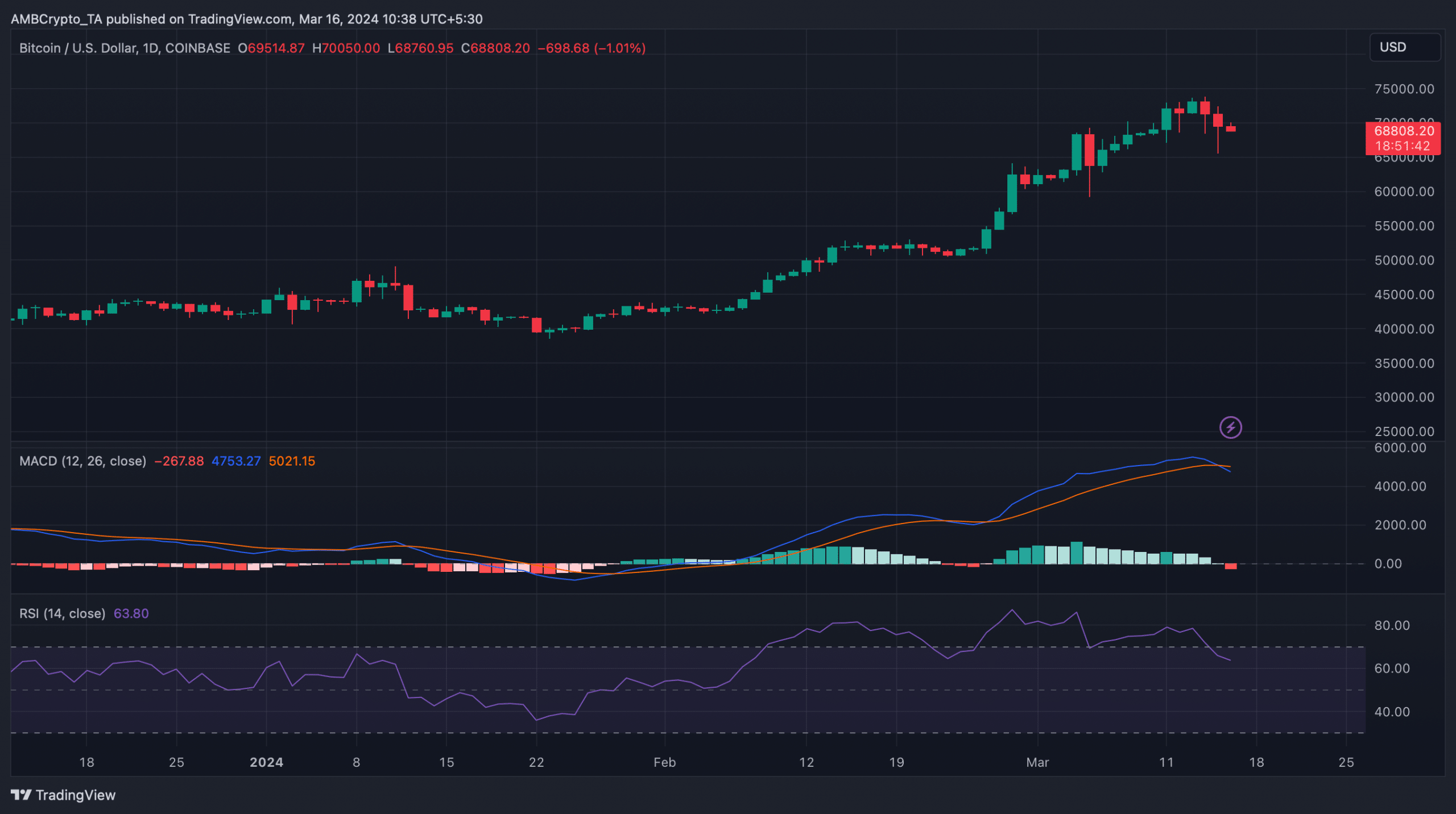

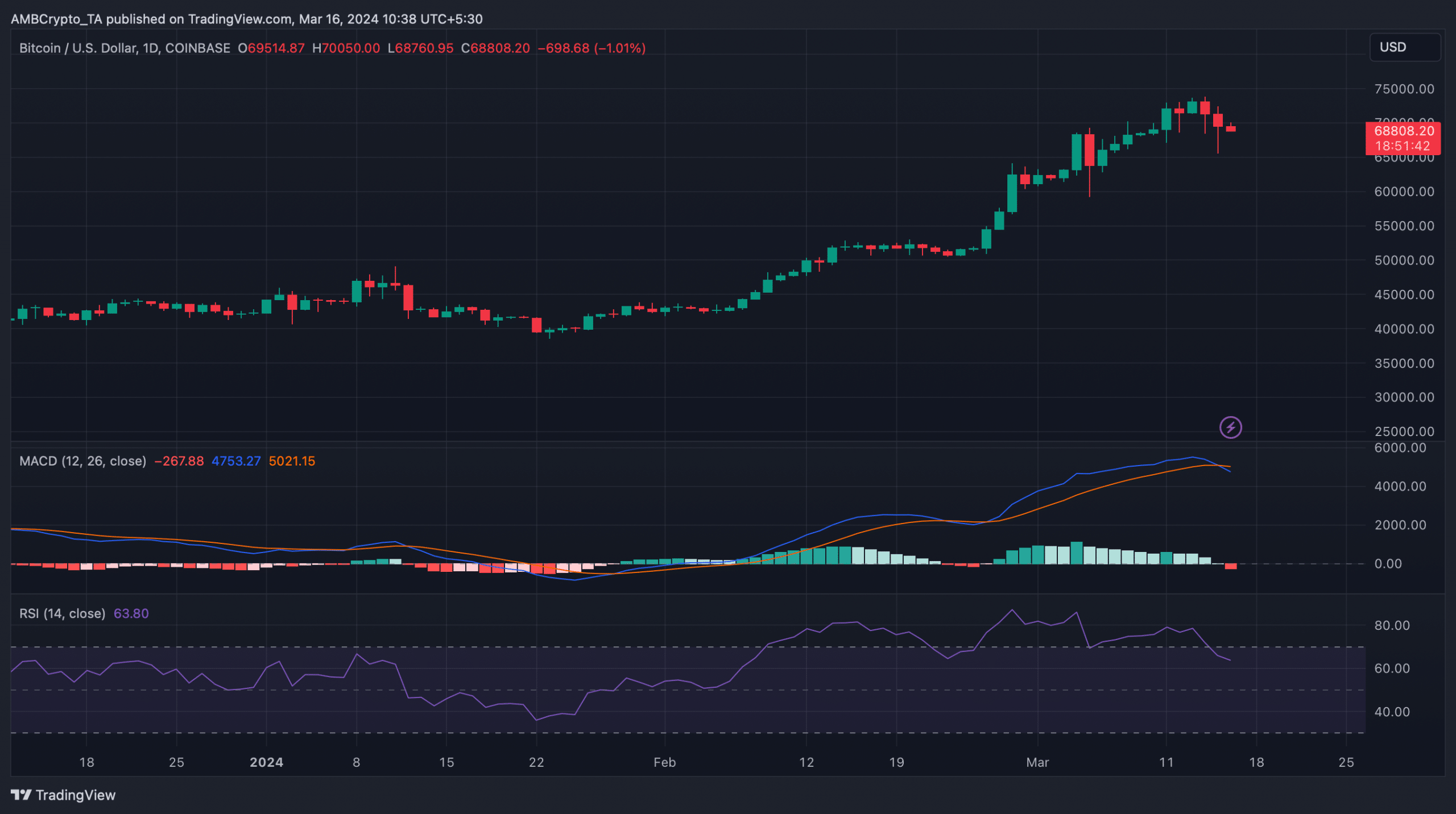

The technical indicator MACD supported the sellers and showed a bearish crossover. Bitcoin’s Relative Strength Index (RSI) also looked quite bearish as it fell.

These indicators suggest that there is a good chance that BTC will fall victim to a price correction again.

Source: TradingView