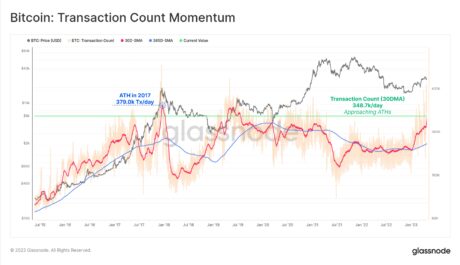

While Bitcoin (BTC) has continued a downward trend, the asset has recently recorded a high volume of daily transactions approaching its all-time high. According to a report by on-chain analytics provider Glassnode, “Bitcoin daily transaction numbers are approaching all-time-highs and will see an explosive increase in 2023.”

Regardless of this news, Bitcoin has continued to fall after the weekend trading plateau by just between $29,300. Asset trading volume has also increased slightly, pointing to a possible violent sell-off.

Bitcoin records daily transactions approaching peak levels

According to Glassnode, daily Bitcoin transactions have reached 348,700 on the 30-day moving average. While the peak level seen in 2017 remains at 379,000 transactions per day. This has proven that Bitcoin’s daily transactions are starting to approach an all-time high of about 5 years ago.

Moreover, according to the Glassnode report, this increase in daily Bitcoin transactions is due to the Ordinal inscriptions. The ordinal inscriptions, also known as Bitcoin non-fungible tokens (NFTs), or ordinals, are inscriptions (digital artifacts) engraved on satoshis (sats) – small units of Bitcoin.

Glasnode noted the subscription accounts for about 30% to 40% of trades mined and 10% to 20% of fees paid. Meanwhile, the remaining majority of transactions are monetary in nature, often conducted through exchanges.

According to Glassnode, compared to Ordinals activity on the Bitcoin blockchain, BTC exchange activity is relatively low, accounting for about 30% of fees and transactions.

The trend of making inscriptions initially became popular in February when users started writing NFTs on satoshis. However, the recent resurgence has been dominated by text-based inscriptions.

Glasnode noted:

Number of Bitcoin transactions, address activity, subscriptions and Mempool congestion all increased. Like the degree of HODLing and the supply obtained under $30,000. Conviction remains.

BTC Continues Downward Trend

Bitcoin (BTC) has not made a significant move in recent days. Instead, it just seemed to pick up from where it was stopped in the downtrend the past weeks. In the last 24 hours, the top crypto is down almost 4% with a market price of $28,435, at the time of writing.

This downward trend follows a remarkable drop of the $30,000 region in recent weeks. So far, Bitcoin has a 24-hour range between a low of $28,315 and a high of $29,944.

Meanwhile, BTC market cap is still in the green as trading volume indicates sales pressure, indicating a possible ongoing bearish trend.

Over the past week, Bitcoin’s market cap has surged from a low of $528 billion on April 24 to $550 billion today. Trading volume has also increased from a daily trading volume of $15.4 billion to $19.8 billion over the same period.

Featured image of Unsplash, chart from TradingView