A leading crypto analytics firm says Bitcoin (BTC) and Ethereum (ETH) costs are plummeting as the speculative frenzy around digital assets loses momentum.

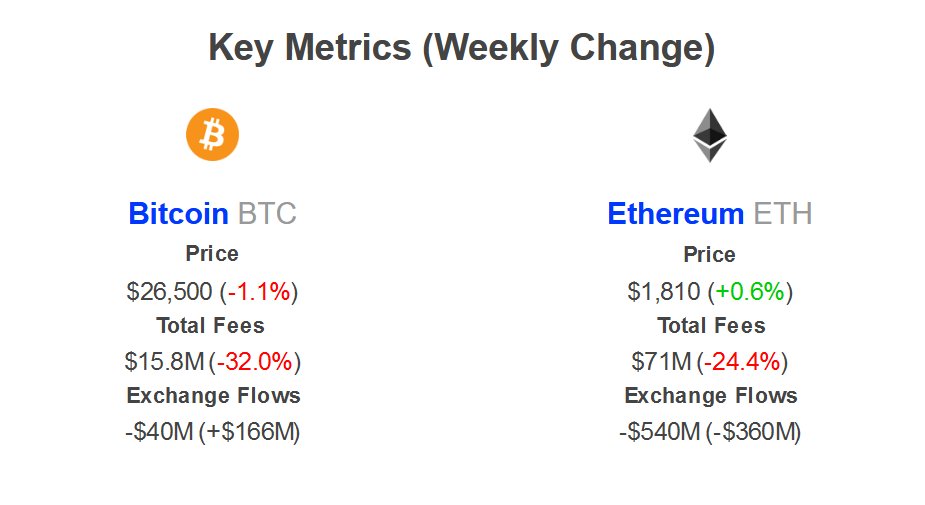

New data from market information platform IntoTheBlock reveals that total fees associated with the crypto king and leading smart contract platform fell by 32% and 24.4% respectively this week.

“Bitcoin and Ethereum fees took a notable plunge this week, down 32% and 24% respectively. It seems that the speculative frenzy is simmering. Will this trend continue or is it just a temporary hiatus?”

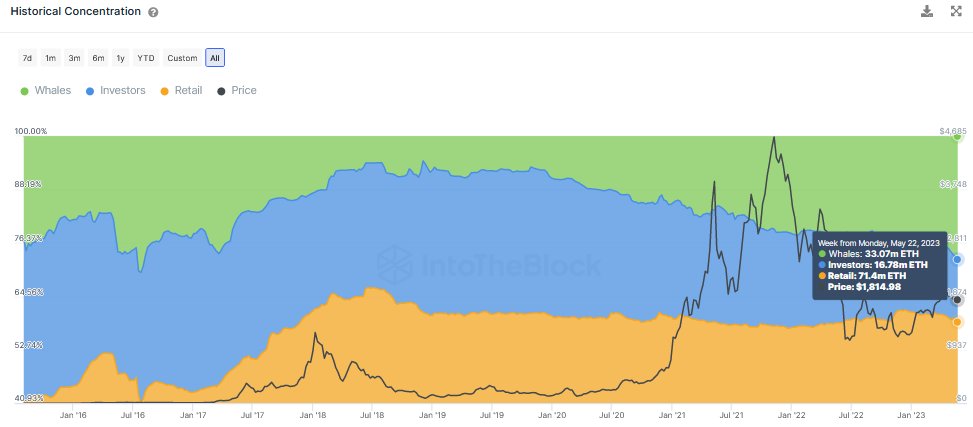

IntoTheBlock too notes that whale activity around the top altcoin has kicked into high gear as big-pocketed ETH investors now hold about 3.5 million more tokens than earlier in 2023.

“Ethereum whales are on the rise! They now have 30.07 million ETH, up from 26.56 million ETH in early 2023. The increasing ownership of addresses by more than 0.1% of the supply suggests continued accumulation.

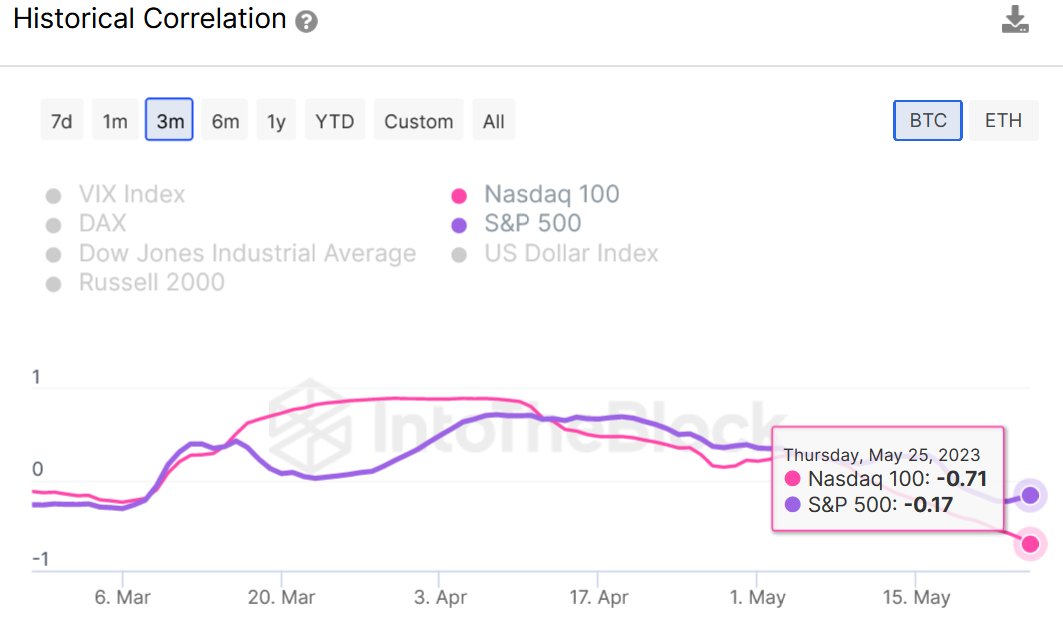

On its way to the top crypto assets by market capitalization, the analytics firm finds that BTC and stocks are increasingly exhibit a lack of correlation or negative correlation, which could mean fresh capital is on its way to Bitcoin.

“Bitcoin and stocks are currently showing a remarkable lack of correlation, even showing a negative correlation! Studies show that investing 10-20% of your wealth in uncorrelated assets can significantly reduce risk. Could this emerging trend attract new capital to Bitcoin?”

Bitcoin is trading at $26,791 at the time of writing, up 0.94% over the last 24 hours, while Ethereum is moving at $1,833, up 1% in the last day.

Don’t Miss Out – Subscribe to receive crypto email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey