- BTC fell to $94,000 due to quantum concerns and profit-taking.

- Will the King Coin Rise Above $100,000?

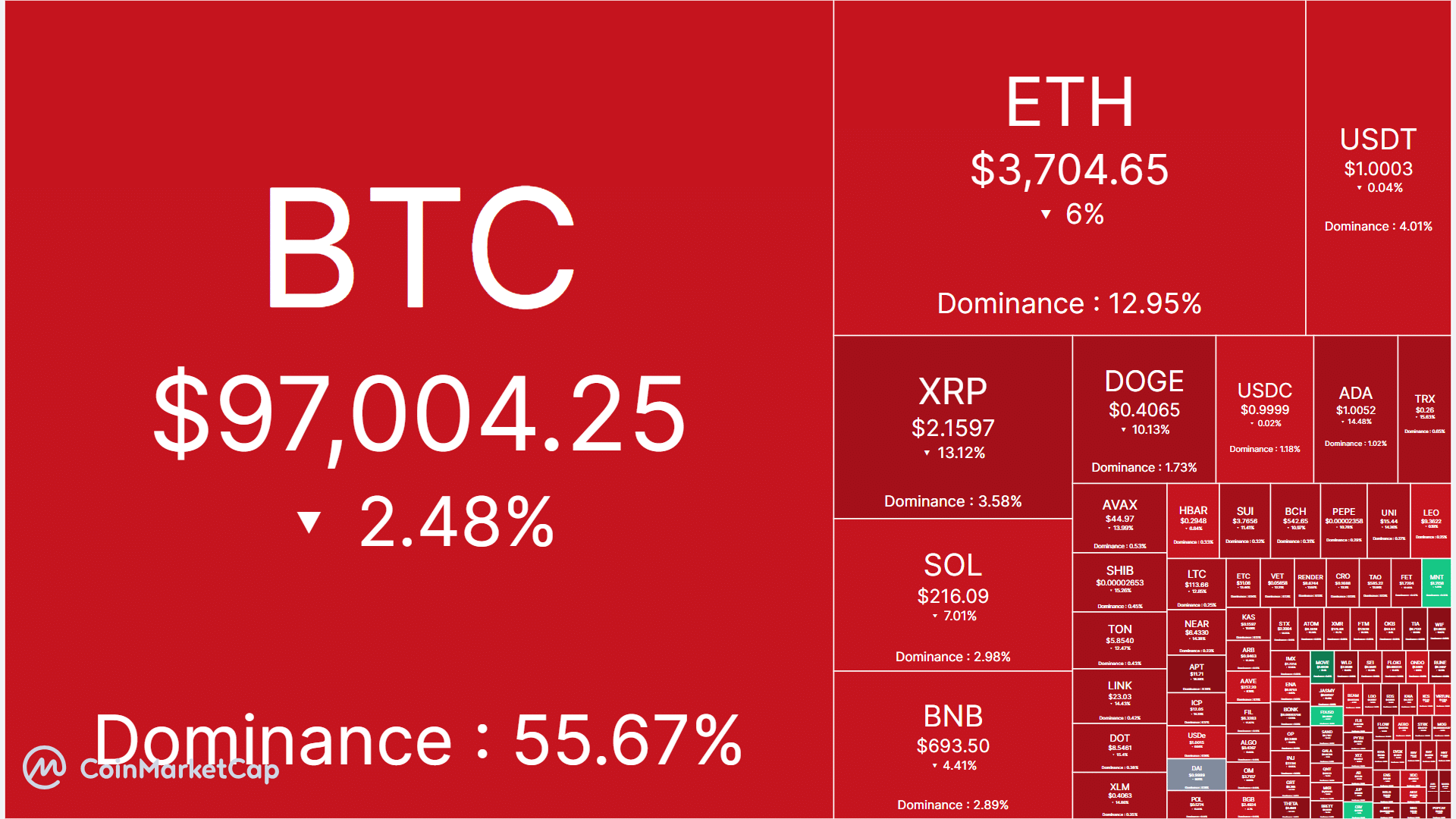

On Monday, December 9, Bitcoin [BTC] fell to $94.1K, which market watchers linked to increased profit-taking and security concerns after Google’s quantum update.

Source: CoinMarketCap

Profits and quantum problems

According to crypto trading firm QCP Capital, players with large options made profits when BTC reached $100,000 and the profits rolled over to March 2025 call options (bullish bets) targeting $130,000-$150,000.

“Today we saw takers taking profits on their long BTC-27DEC24-100k-C positions and potentially rolling them out into March (130k-150k).”

This could delay a strong move above $100,000 in the near term, per QCP Capital. In fact, the company added that the cryptocurrency would remain within reach for the rest of the December holidays.

“Profit taking on #BTC-100k options indicates a wide range of options. Perp funding is flat or slightly increased. A holiday period with a limited supply seems more likely.”

The weak market sentiment could also be accelerated by the recent quantum breakthrough of Google’s Willow – a perceived existential threat to Bitcoin encryption.

Unlike classical computers, which cannot crack the current cryptographic algorithms that protect BTC networks and wallets, quantum computers can break these security.

Google’s update thus roiled the crypto community, with some members raising concerns about BTC’s security. One user claimed,

“Google CEO brings the Great Bitcoin Short Thesis to life just as #BTC hits $100,000.”

However, some analysts downplayed the short-term impact of quantum computers. to report that the technology was decades away from cracking BTC security.

Some added that Willow only had 105 qubits, while millions of qubits would be needed to break BTC.

“Willow is 105 qubits. To encompass Bitcoin, an estimated 13 million to 1.9 billion qubits are needed.”

That said, the update underlined the urgency of developing quantum-resistant BTC. As researchers discover the best options, a soft fork (upgrade) could probably make this a reality.

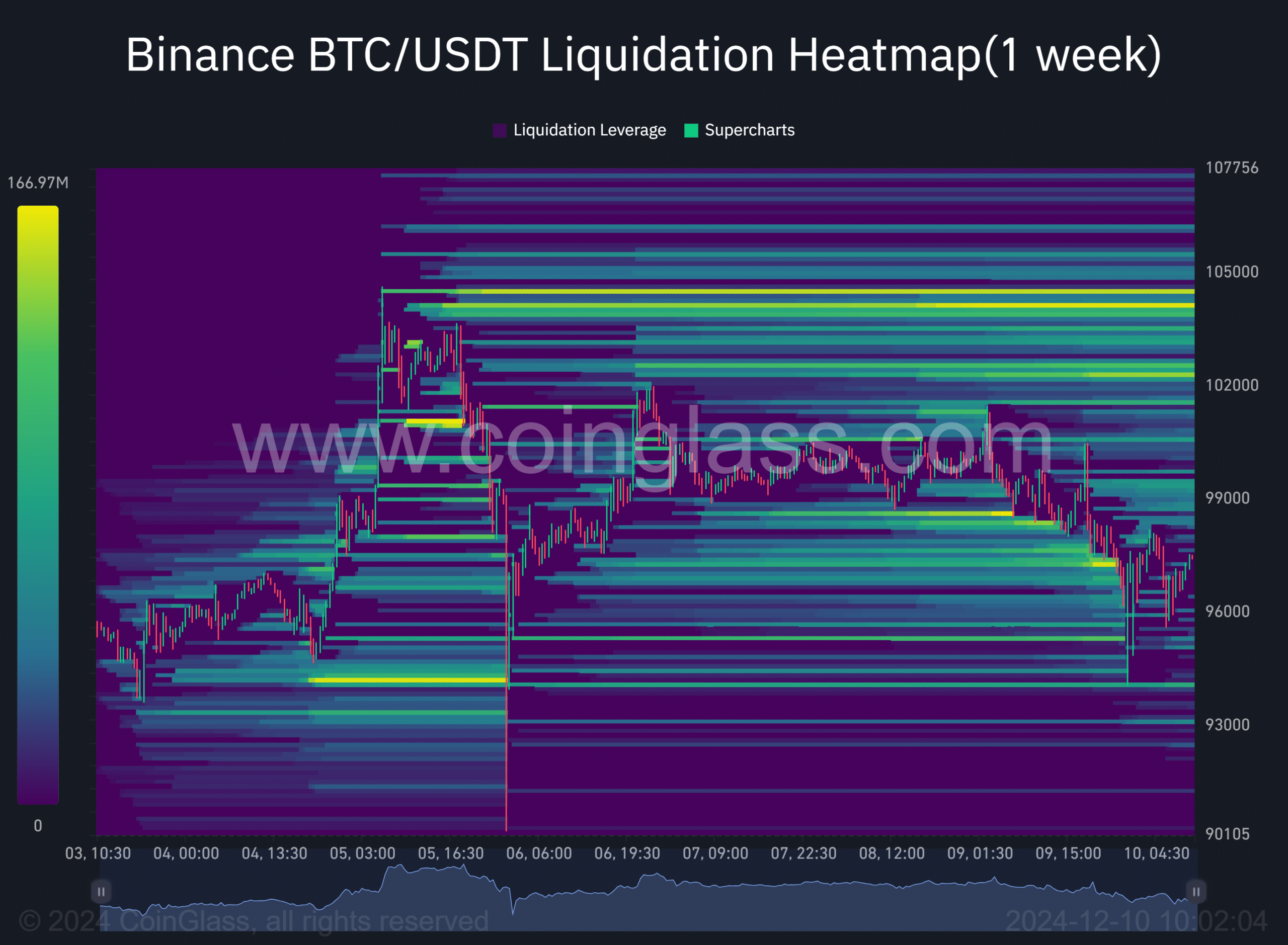

From a technical chart perspective, BTC also had a huge price imbalance after the December 5 flash crash. In most cases, price always retests these imbalances before continuing the trend.

Source:

On Sunday, December 9, BTC trader Cryp Nuevo predicted that BTC could slide to $94K to clear the price imbalance (half of the candlestick wick) before a surge occurs. His projection was validated hours later.

Will the price rise further now that the price imbalance has been resolved?

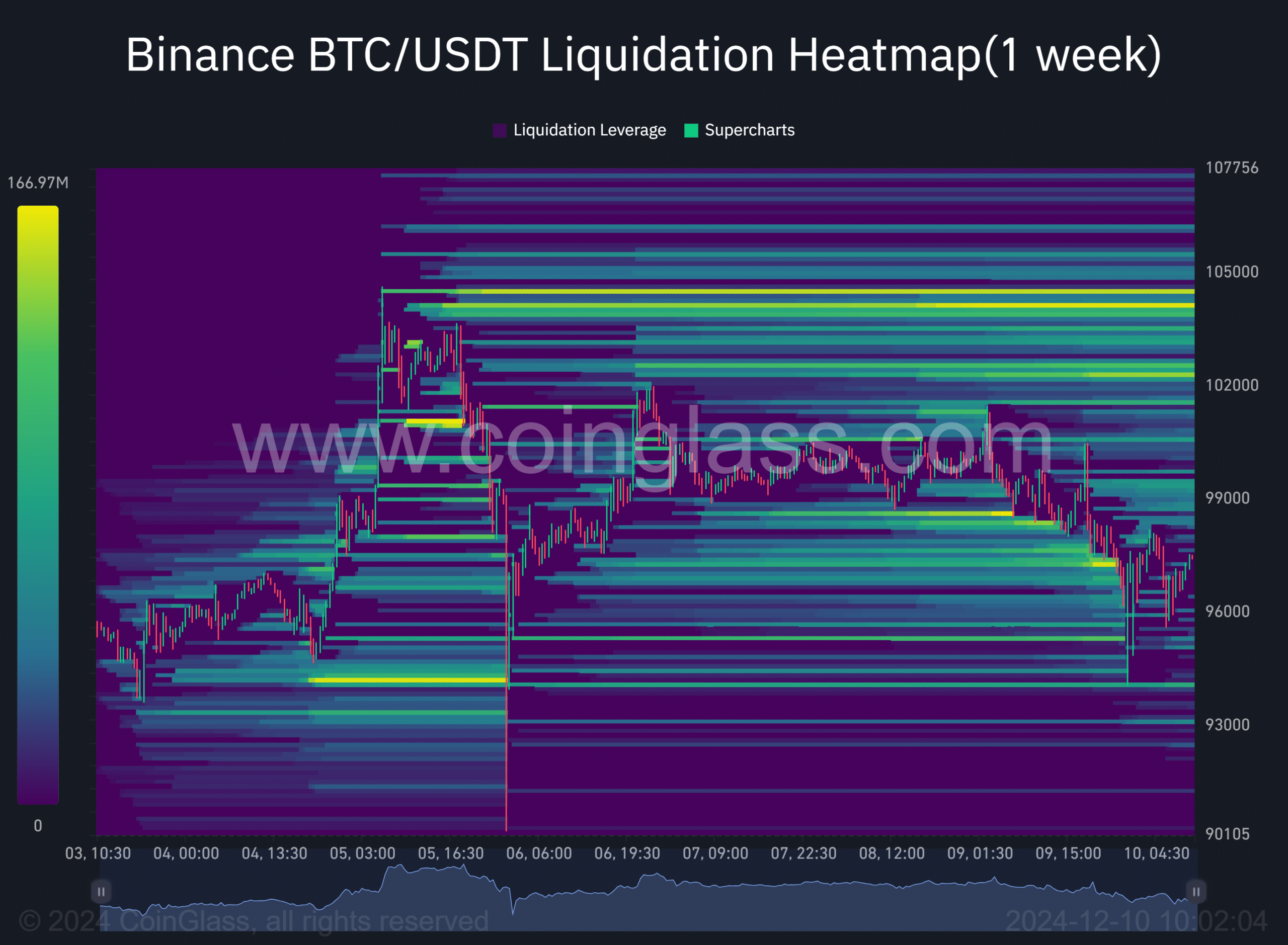

That remains to be seen. However, at the time of writing, there was significant upside liquidity (leveraged shorts) between $98,000 and $104,000 (bright orange levels). This could attract higher price action.

Source: Coinglass