- Buying pressure on Bitcoin has increased over the past 24 hours.

- In the event of a price correction, BTC might as well drop back down to $57,000.

Bitcoin [BTC] has finally managed to cross the $60,000 mark after quite a few days of struggling. This jump above $60,000 gave hope for a further price increase. But it may face strong resistance in the future.

Bitcoin climbs above $60,000 again!

Ali, a popular crypto analyst, posted one tweet which showed that BTC’s sequential TD indicator gave a sell signal. The tweet mentioned that there might be a short correction.

Remarkably, that actually happened, as BTC fell from $59k to $58,000. The good news was that the king coin then gained bullish momentum as it rose above $60k.

The price of the coin has risen by more than 4% in the last 24 hours and was at the time of writing trade at $60,363.00 with a market cap of over $1.19 trillion.

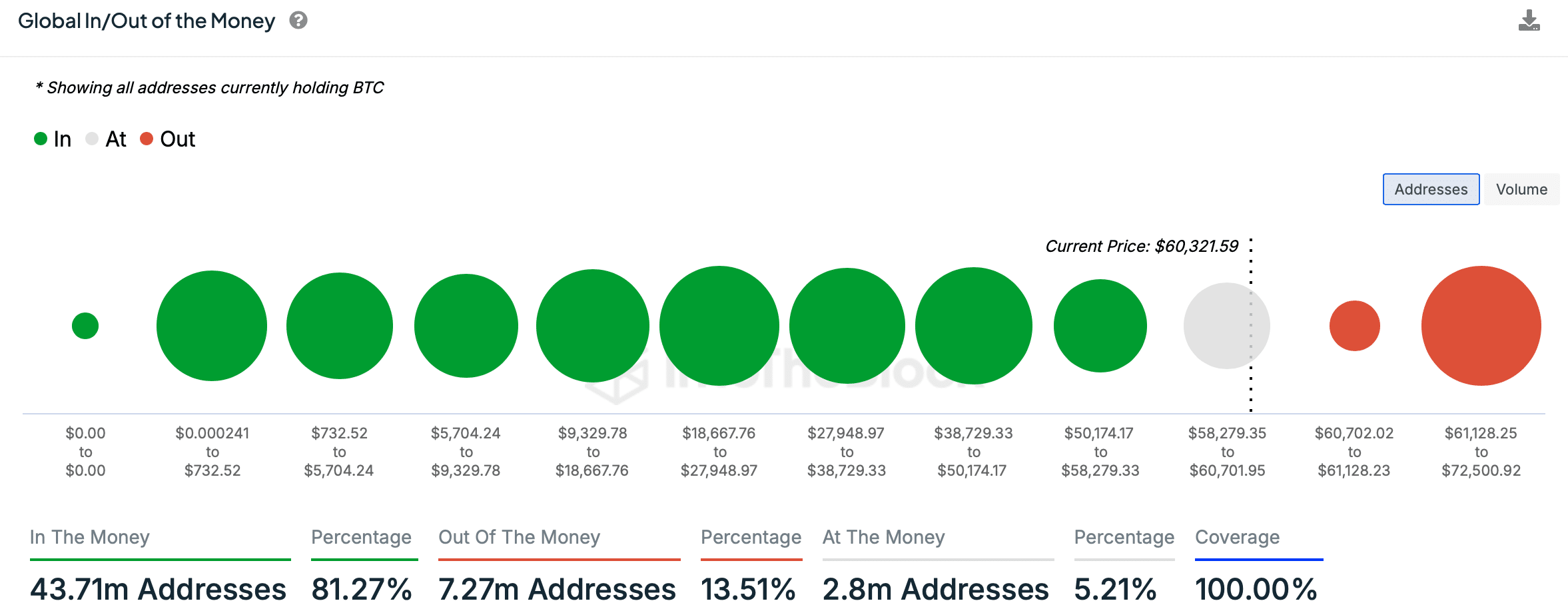

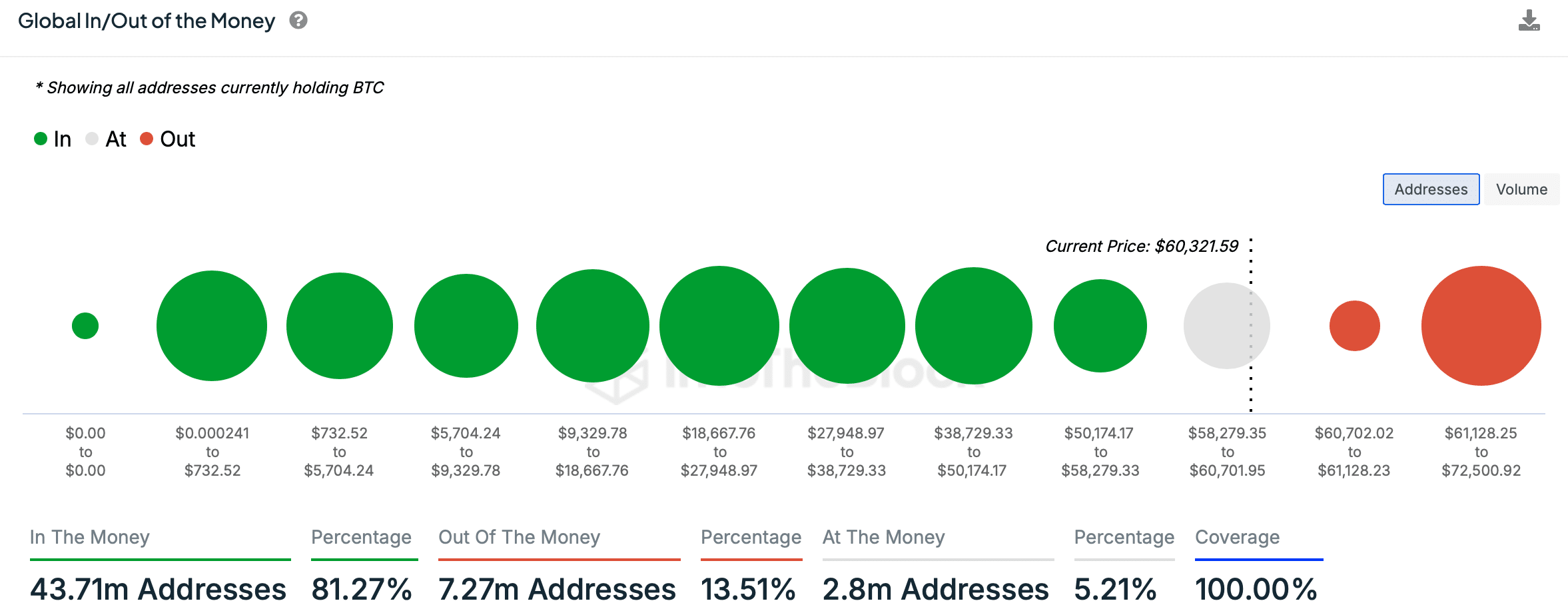

Thanks to the price increase, more than 43 million BTC addresses became profitable, accounting for 81% of all Bitcoin addresses.

Source: IntoTheBlock

AMBCrypto then checked CryptoQuant’s facts to see how this price increase affected market sentiment. We found that Bitcoin’s exchange rate reserve was declining, indicating an increase in buying pressure.

Additionally, both Coinbase Premium and Korea Premium indicated that buying sentiment was relatively strong among U.S. and Korean investors.

Source: CryptoQuant

The next objectives of BTC

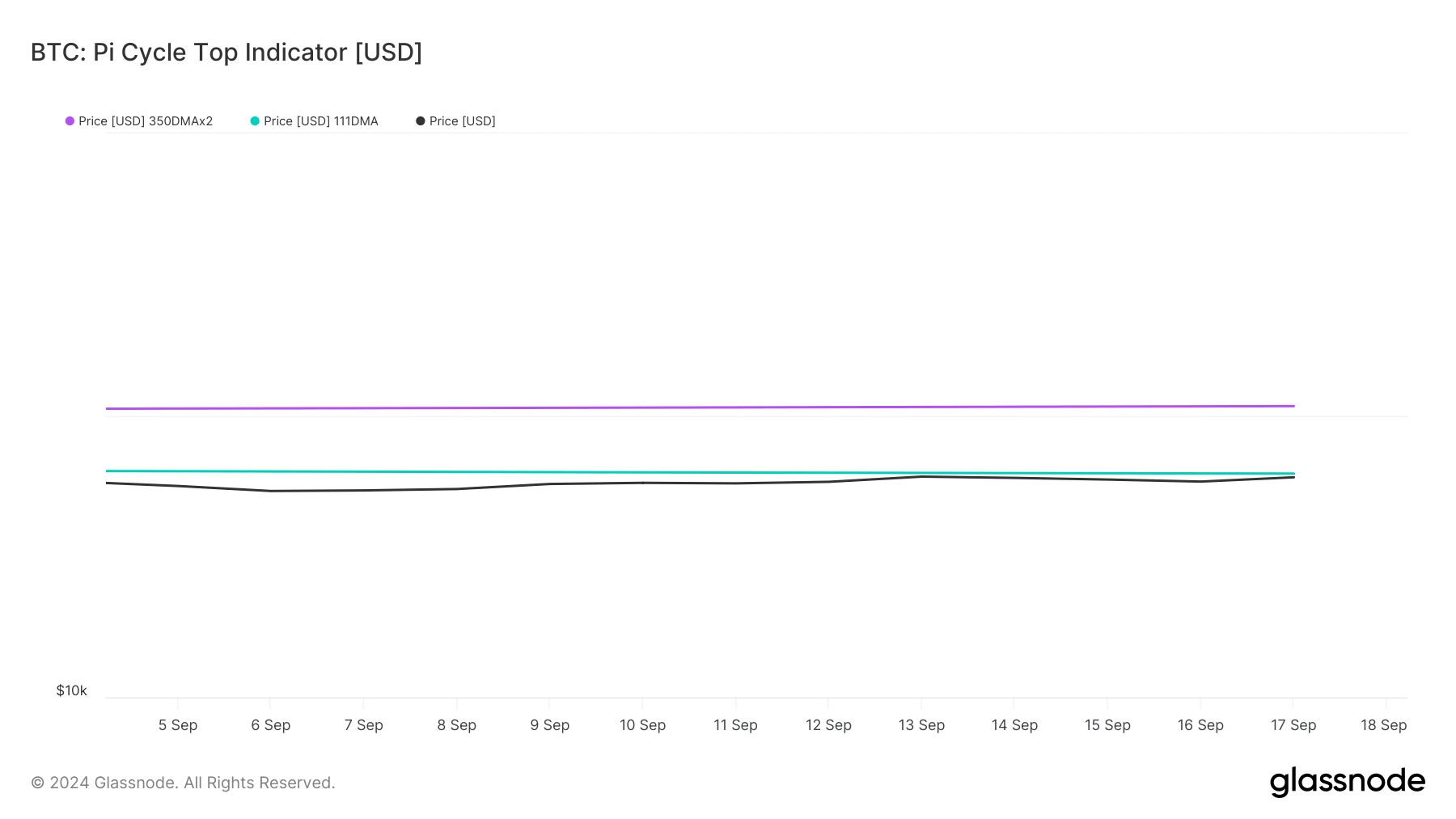

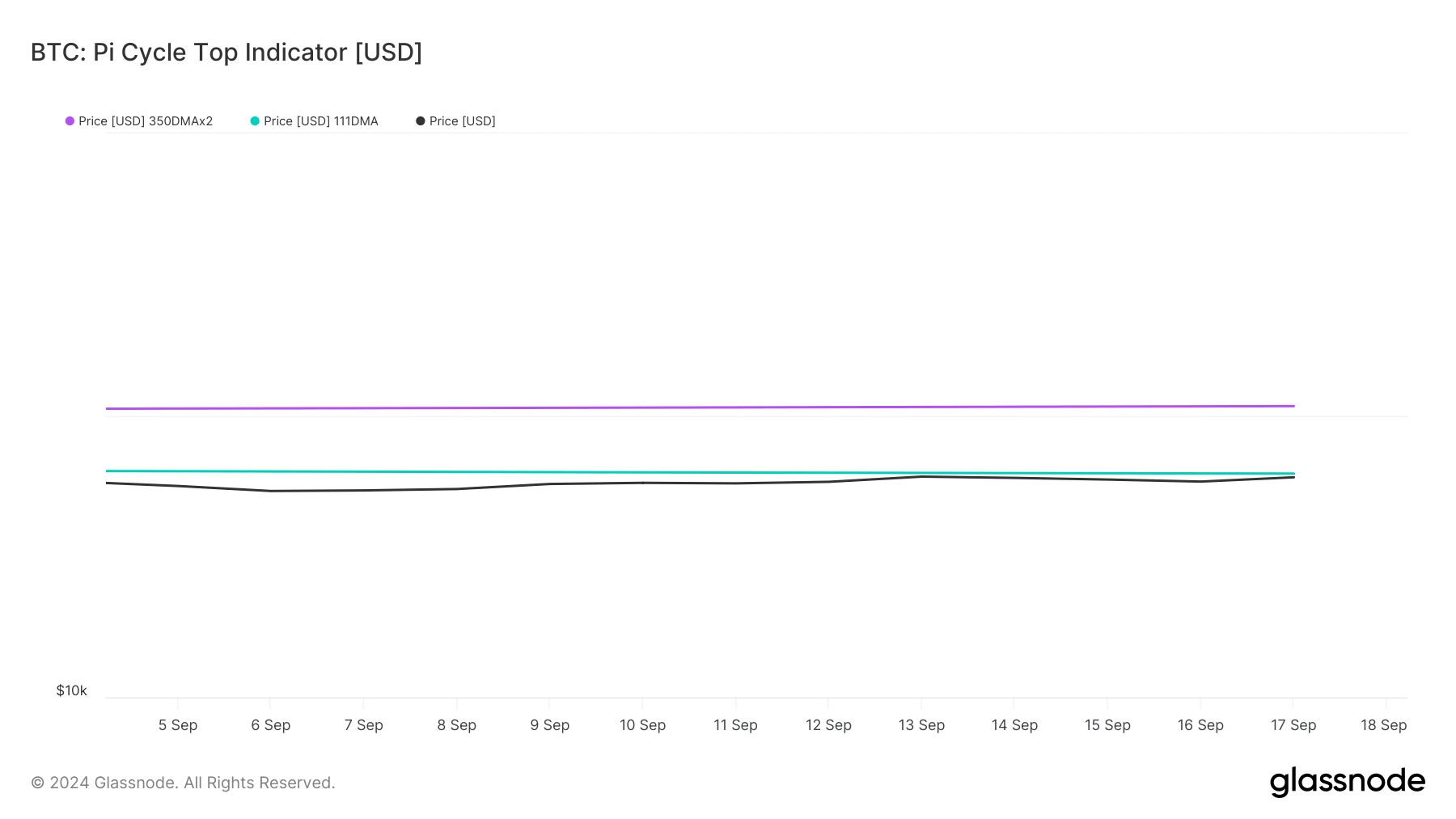

Our look at Glassnode’s data showed that BTC was finally approaching its possible market bottom, having been trading below it for several weeks.

The Pi Cycle Top indicator also suggested that Bitcoin’s possible market top would be above $100,000.

Source: Glassnode

In the meantime, IntoTheBlock also posted one tweet with some notable updates. According to the tweet, resistance levels across the chain were relatively evenly distributed, but a key level to watch was $64,000, where 1.57 million addresses are currently experiencing losses.

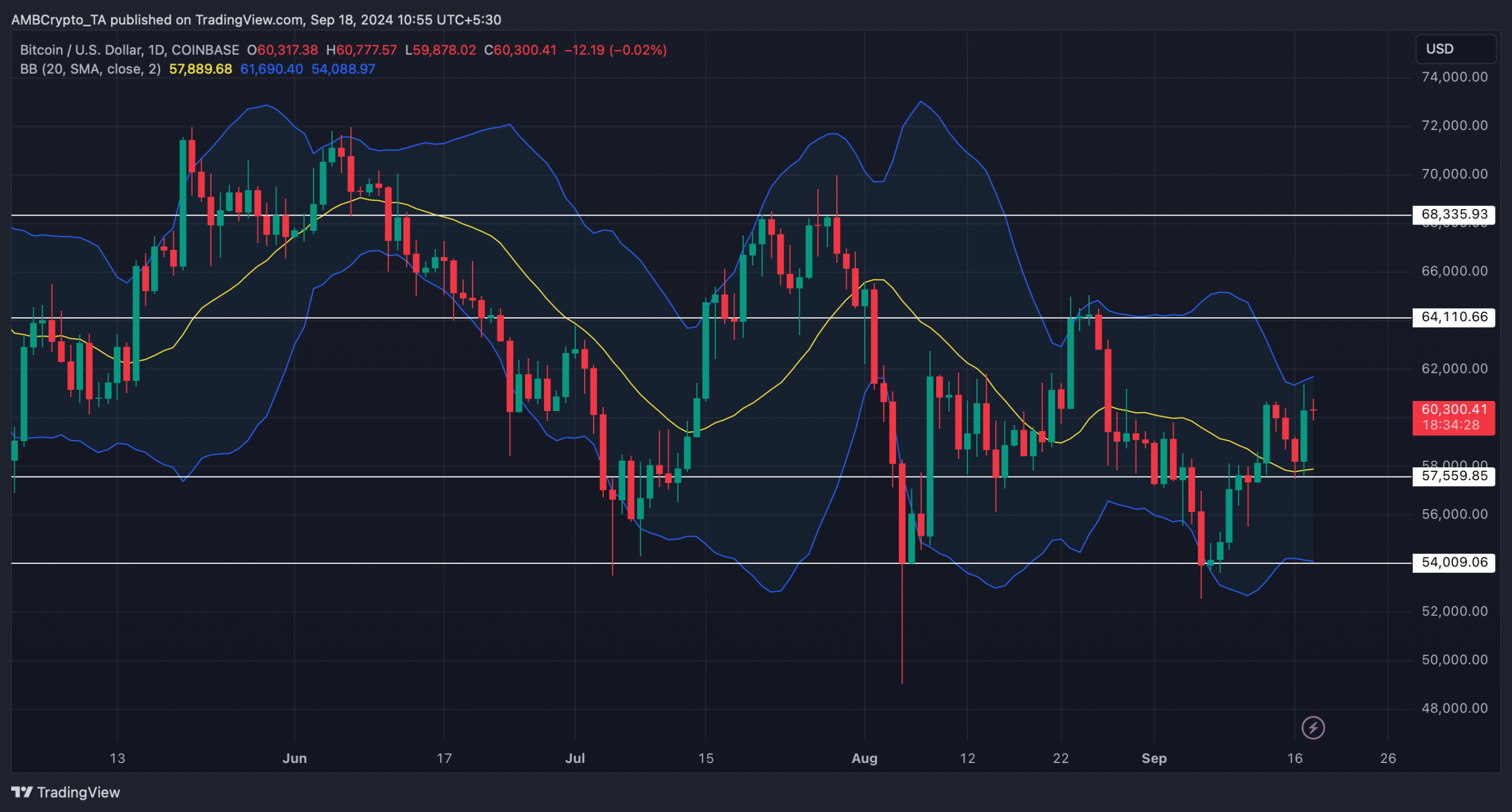

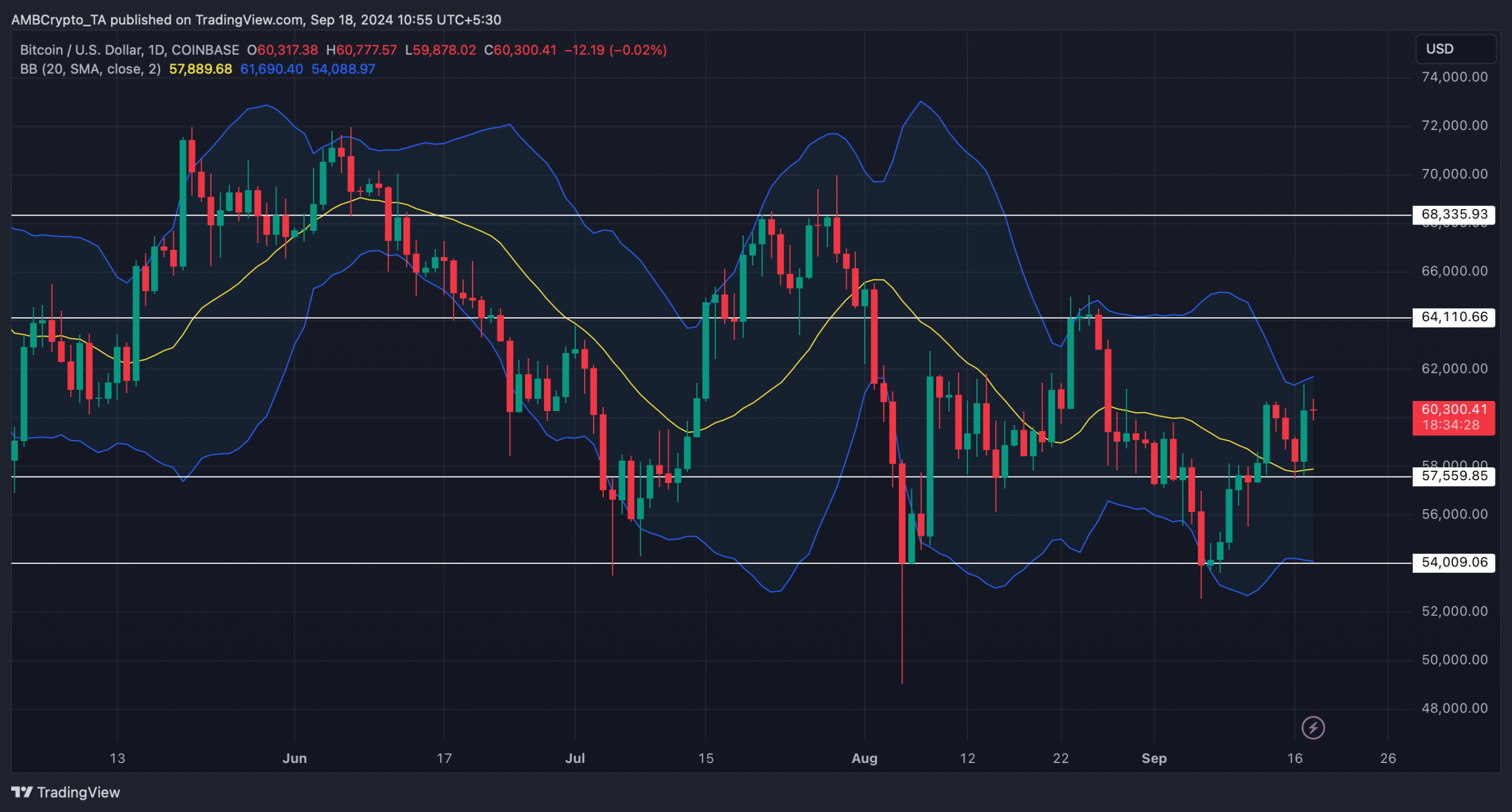

Therefore, AMBCrypto checked Bitcoin’s daily chart to see what market indicators were suggesting regarding a price increase towards $64,000.

According to our analysis, BTC had successfully tested and remained well above its 20-day simple moving average (SMA), as indicated by the Bollinger Bands.

However, Bitcoin’s price had reached the upper limit of the same measure, which often results in price corrections.

Source: TradingView

Read Bitcoins [BTC] Price prediction 2024-25

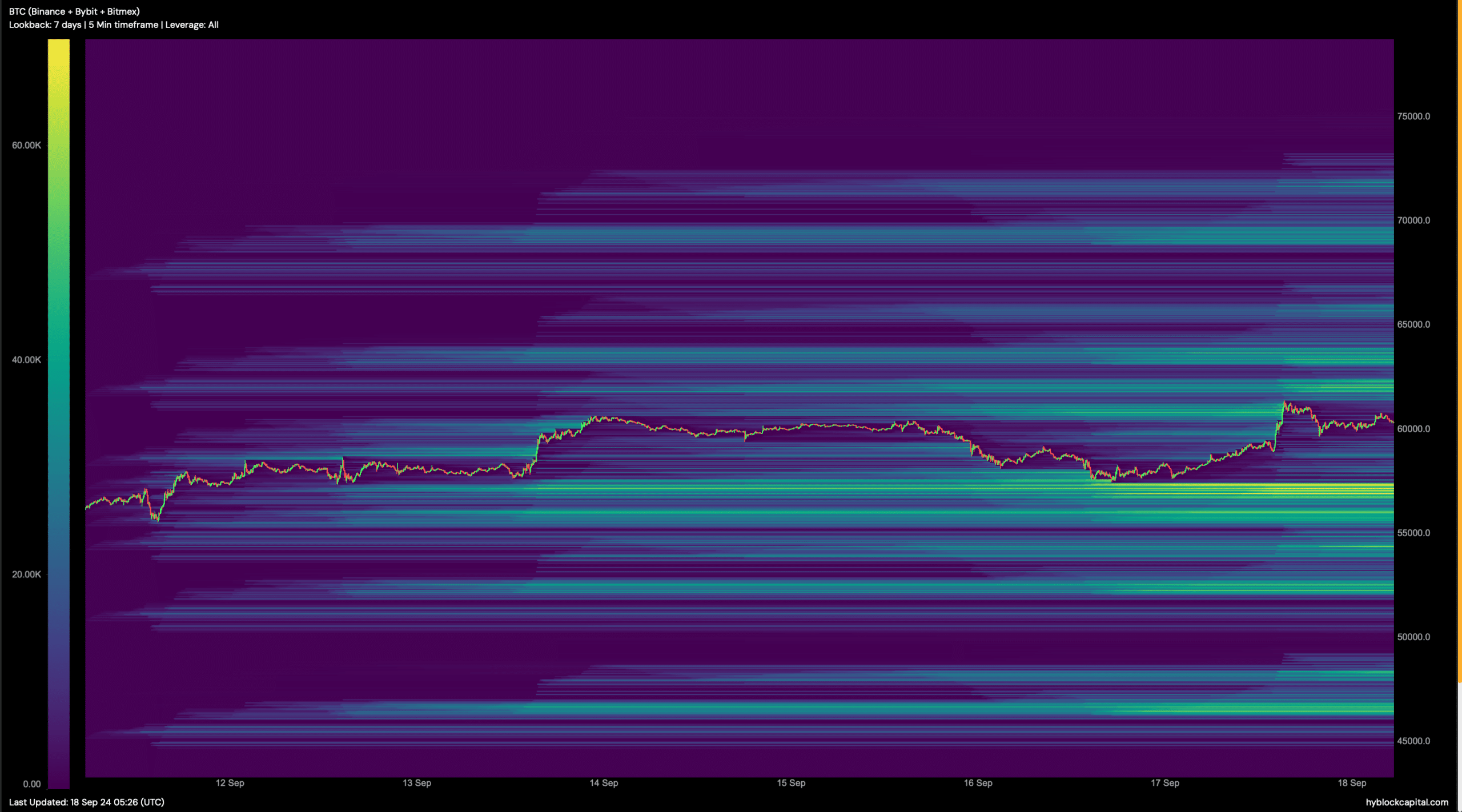

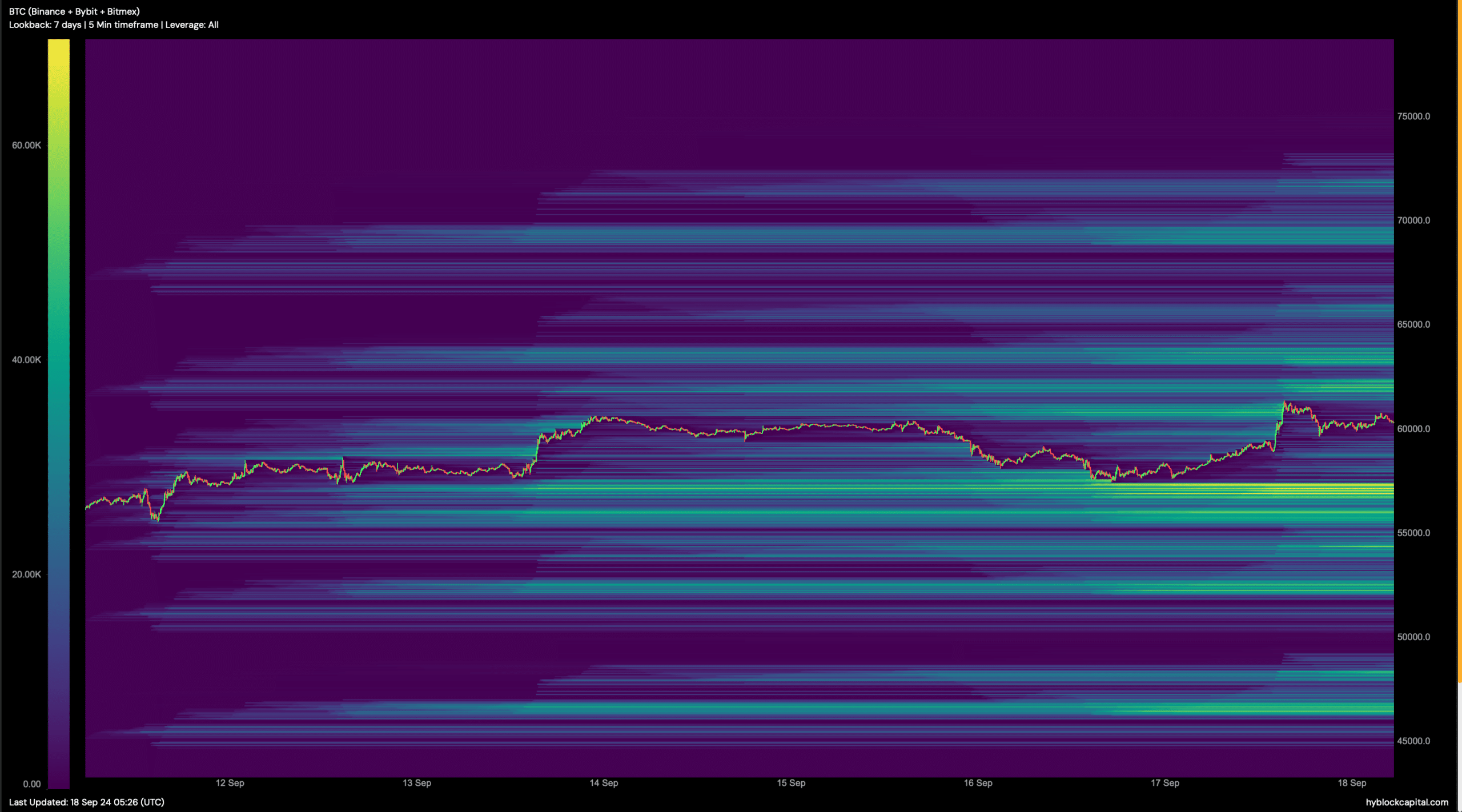

Should the test of the upper limit of the Bollinger Bands result in a price drop, it will not be surprising to see BTC fall again to $57,000. This seemed to be the case as liquidation would increase at that point.

Nevertheless, if the bull run continues, it will be crucial for BTC to break above $62,000 before targeting $64,000.

Source: Hyblock Capital