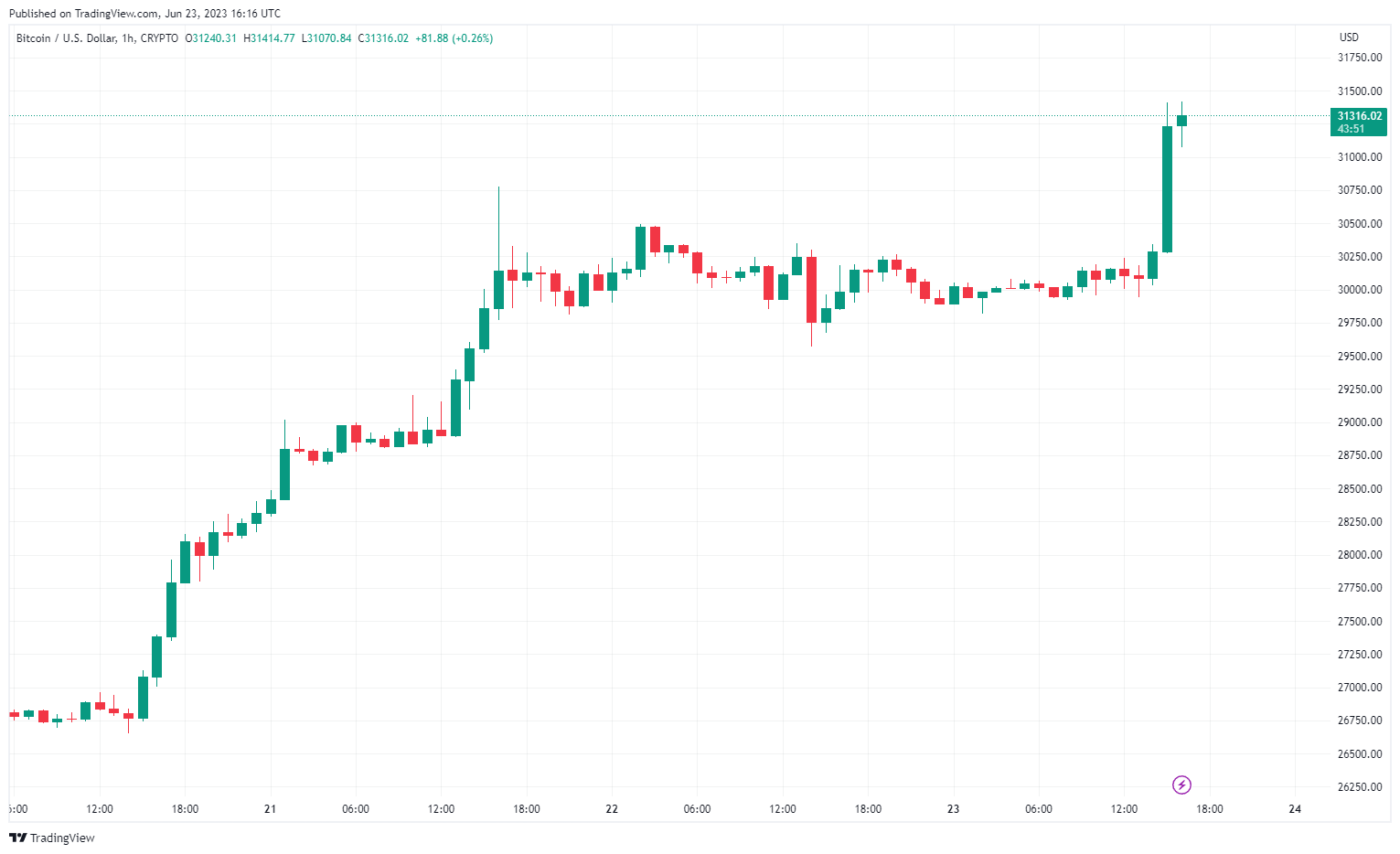

As ongoing regulatory pressure mounts towards several cryptocurrencies, Bitcoin (BTC) has shown impressive resilience, breaking the $31,000 mark today and marking the year’s highest close.

This jump comes after a long period of stagnant trading, with Bitcoin fluctuating between $25,000 and $30,000 since March 16.

The liquidation volumes for each cryptocurrency in the past 4 hours, $30.01 million were in Bitcoin, $17.27 million in Ethereum (ETH), and $3.15 million in Bitcoin Cash (BCH), according to Coinglass data. These values add up to the total 4-hour liquidation amount of $72.20 million, consisting of $13.01 million in long positions and $59.18 million in short positions.

Bitcoin was trading at $31,234 at the time of writing.

BTC Rises on Institutional Interest

This rise in Bitcoin follows a wave of institutional interest. Global investment giant BlackRock filed with the US Securities and Exchange Commission last week for a spot Bitcoin ETF. The regulator has yet to approve a spot Bitcoin ETF.

In addition to the positive sentiment surrounding Bitcoin, the launch of EDX Markets on June 20, which coincided with Bitcoin reclaiming the $28,000 mark, was well received by the market. Backed by heavyweights Fidelity, Charles Schwab, and Citadel Securities, EDX Markets is a promising institutional crypto exchange.

Bitcoin’s rise stands in stark contrast to the rest of the cryptocurrency market, which is struggling in the wake of the SEC’s unprecedented lawsuits against Binance and Coinbase. The SEC has asserted that several popular cryptocurrency tokens are, in their opinion, unregistered securities.

SEC Chairman Gary Gensler has been explicit about his plan to take action against crypto companies he believes are operating outside US law. Gensler has stated that all cryptocurrencies, with the sole exception of Bitcoin, qualify as securities under US law. However, Gensler’s stance on Ethereum, the second largest cryptocurrency by market capitalization, remains unclear.

The post Bitcoin Breaks $31k As It Continues To Shrug Recent Slumps appeared first on CryptoSlate.