- BTC buying sentiment in the derivatives market was dominant.

- Bitcoin is down over 1% in the last 24 hours and a number of indicators have been bearish.

After a long wait, Bitcoin [BTC] has surged above the $28,000 mark, sparking excitement among investors. Data from Santiment revealed that the uptrend occurred when a large number of BTC tokens were accumulated in the recent past. Although high accumulation was the driving force behind the uptrend, other factors were also at play at the same time.

Is your portfolio green? Check the BTC profit calculator

Bitcoin is getting loose!

Bitcoin is finally showing signs of recovery as its price has risen in recent days. The recent uptrend helped the coin lift its price above $28,000. At the time of writing, BTC was trade at $28,324.76 with a market cap of over $552 billion.

According to Santiment’s tweet, a major reason behind the uptrend was BTC‘s increase in accumulation.

#Bitcoin‘s number of wallets with at least 100 $BTC has jumped to 15,970 after the biggest single-day jump of 2023 on Saturday. Since this accumulation $BTC‘s price is +5.3%, and they may not get done. We will continue to monitor. https://t.co/l0drhvkf7E pic.twitter.com/0mDAmys7N4

— Santiment (@santimentfeed) October 18, 2023

To be precise: the number of wallets with at least 100 BTC has risen to 15,970 after the biggest single-day jump of 2023 on October 14. Shortly after the accumulation, the price of the coin increased by more than 5%.

A look at BTC’s on-chain performance revealed that quite a few other factors were also helping the coin rise. The foreign exchange reserve, for example, was decreasingmeaning it was not under selling pressure.

This happened while transmission volume was increasing, which is generally a positive signal. Bitcoin’s taker buy/sell ratio also turned green, indicating that buying sentiment was dominant in the derivatives market.

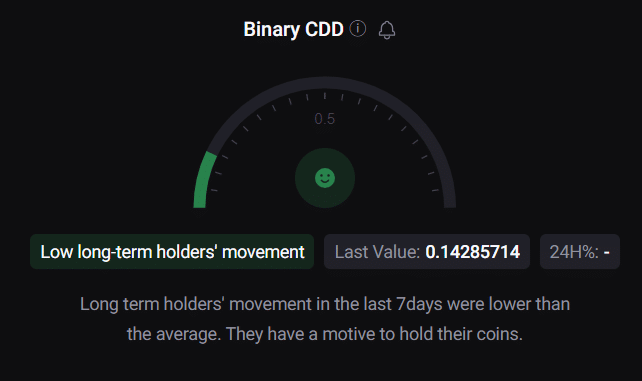

BTC’s binary CDD was also green. This meant that long-term holders’ movements over the past seven days were lower than average.

Source: CryptoQuant

The weather changed quickly

Although Bitcoin price showed a promising rally, the scenario changed quickly. The price of the king of cryptos has fallen by more than 1.2% in the past 24 hours. This was also accompanied by a decline in BTC trading volume, indicating that investors were unwilling to trade the coin.

Read Bitcoins [BTC] Price prediction 2023-24

A check from BTC‘s daily chart provided clarity on what investors could expect from the coin in the coming days. Bitcoin’s Money Flow Index (MFI) registered a downward trend.

The Chaikin Money Flow (CMF) was also below the neutral line, increasing the chances of a sustained move south. Nevertheless, the MACD was bullish as it showed a bullish crossover.

Source: TradingView