Since the launch of Ordinal Inscriptions, Bitcoin-based non-fungible tokens (NFTs) have increased in number, with the blockchain documenting $3.82 billion in NFT sales in over 3 million transactions. Bitcoin has now risen to the fourth largest blockchain in terms of total NFT sales.

From counterparty to ordinal: Bitcoin NFTs reached $3.82 billion in sales

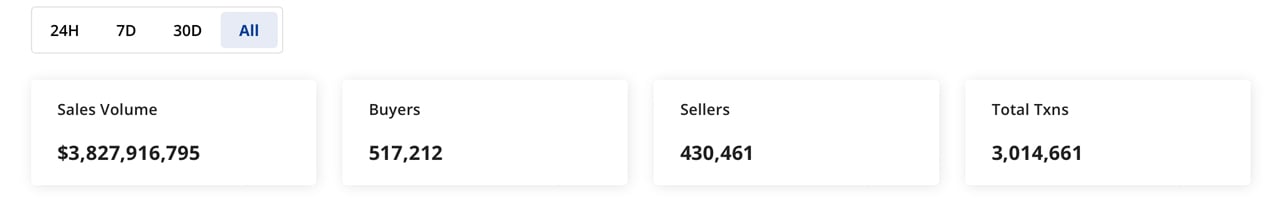

In the first week of June 2024, data showed that the Bitcoin blockchain generated $3.82 billion in NFT sales. While Bitcoin-based NFTs were previously available through technologies such as Counterparty, the introduction of Ordinal inscriptions has significantly increased the popularity of BTC-based NFTs, even amid a general decline in the digital collectibles market. The $3.82 billion has positioned BTC among the top five blockchains for NFT sales, securing the fourth spot just below the Ronin chain.

All-time Bitcoin-based NFT sales data collected by cryptoslam.io.

Of the $3.82 billion, it is estimated that just over 2% of Bitcoin-based NFT transactions are wash trades, totaling $81.95 million. Ethereum, the all-time leader in NFT sales, controls a significant $43.81 billion in NFT sales, but 43% of that total is considered wash trades. Bitcoin NFTs have seen 517,207 buyers and 430,455 sellers in over 3 million transactions. Of the 3 million transfers, 15,828 of these transactions were considered wash transactions.

The most expensive NFT ever sold on the Bitcoin blockchain was a digital collectible called Budgie, which sold for $1.44 million three months ago. A Bitcoin-based digital collectible of one of Van Gogh’s paintings was the second most expensive sale to date, selling for $1.19 million six months ago. Two more Van Gogh paintings followed, each selling for just over $1 million per token.

Interestingly, some sales show that the buyer would have been better off if he had kept his BTC. For example, the fifth most expensive NFT sale on the Bitcoin blockchain sold a year ago for $966,962, but the buyer paid 35 BTC, which is now worth $2.37 million. There are also several BTC-based NFT collections with multi-million dollar market caps. According to Magic Eden statistics, Nodemonkes is the largest with a market value of $178.4 million.

The Runestone NFT collection is the second largest at $128.2 million, followed by Ordinal Maxi Biz NFTs with a market cap of $98 million. To round out the top five, Bitcoin Puppets and Quantum Cats follow with $94.7 million and $68.2 million respectively. Other notable collections include Bitmap and Bitcoin Frogs with market caps of $55 million and $40.2 million respectively. A market cap of an NFT collection is the minimum value price times the number of digital collectibles in the compilation, even though some specific NFTs in the collection may have sold for much higher values than the current minimum value.

Bitcoin’s impressive rise to the NFT market underlines a significant shift in the digital collectibles landscape, driven in large part by the innovative use of Ordinal inscriptions. While blockchain carves out a robust niche among the giants, the evolving dynamic between traditional leaders like Ethereum and emerging platforms highlights a diversifying ecosystem. This adjustment not only broadens horizons for investors, but also sets the stage for a more complicated interplay of digital asset values and market behavior, suggesting a vibrant future for Bitcoin-based NFTs amid shifting tides in the overall market.

What are your thoughts on the rise of Bitcoin-based NFTs over the past year? Let us know what you think about this topic in the comments below.