- The divergence statistics between global liquidity and Bitcoin has flashed a rare green buy signal.

- Buy Binance and Metaplanet BTC because the sales pressure is noticeably decreased in the past month.

Logarithmic measurement of the price of Bitcoin [BTC] And global liquidity on the same scale showed intriguing dynamics.

Historically, this combination of Green has emerged when Z-score -3 reached under zero and red sales signals that were developed when Z-score above +3 climbed.

Bitcoin, for example, saw his substantial price increase from less than $ 500 to more than $ 1,000 during the period that started at the beginning of 2016 when a transaction signal appeared.

The red warning board was created at the end of 2017 before Bitcoin achieved its maximum value at $ 20,000, which caused a rapid price fall.

Source: Alpha Extract

At the beginning of 2020, the purchase indicator was activated when Bitcoin surpassed the level of $ 10,000, which would later result in reaching his highest price ever.

The current green signal revealed an opportunity for a Bitcoin price increase due to the growing market liquidity.

Buy Binance and Metaplanet BTC

Institutional investors such as Binance and Metaplanet also participated in BTC purchases after a buy -indicator that appeared on the market, suggesting that it suggests the potential for an increase in the BTC value.

Binance remains purchasing Bitcoin with the last 24 hours, to see tokens worth $ 250 million are purchased and sent to the market maker, winter mute, while the cryptocurrency continues to get the presence on the market.

In addition to the strategic purchase of binances, Metaplanet has also made additional purchases of 150 bitcoin according to them Post on X (formerly Twitter).

The purchasing activities of institutions could stimulate BTC price growth through increased market demand and therefore create both buying capacity if the market confidence reinforces.

Extensive purchases showed the potential to send the BTC price higher because they can attract extra investors to participate in this rising market.

Buying coincides with other settings such as BlackRock and micro strategy that also collect BTC during the recent dip up to $ 80k.

What is the impact of lowering the sales pressure?

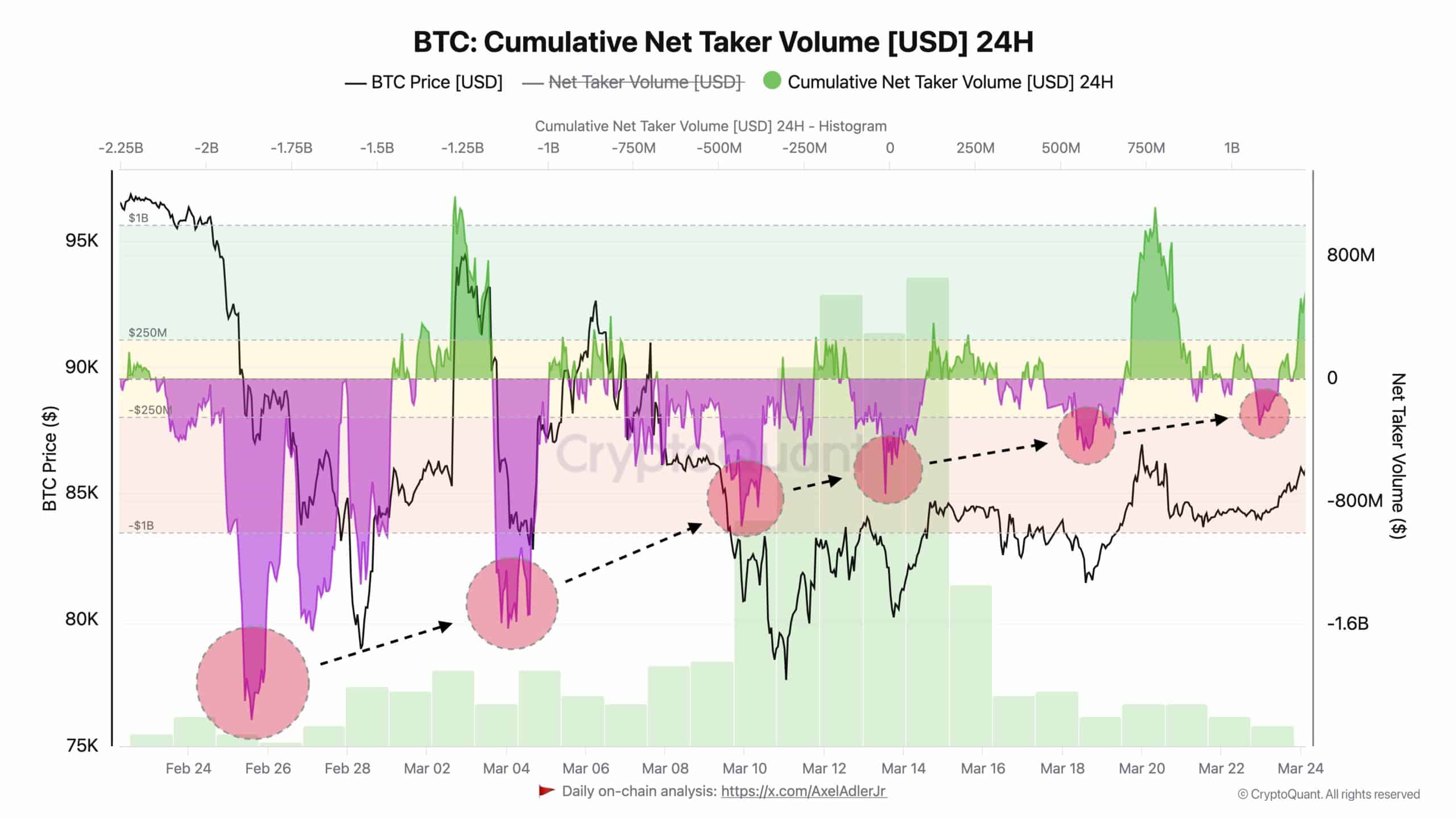

The cumulative network volume also indicated how aggressive BTC sales have been decreased since February due to lower net tone volume changes.

Since 24 February to mid -March, Bitcoin has had to deal with mass sales pressure that reduced its price from $ 95k to almost $ 75k.

However, BTC prices have seen stabilization with every important sale event and then started to recover slowly.

The negative net tone volume reached a point of decline during mid-March, indicating a reduction in the marketing activity of the market.

Source: Cryptuquant

Bitcoin then experienced its price rebound above $ 85k when the green cumulative network volume on the market came on the market on March 20.

The absence of an important economic delay together with controlled assets -reading points to a reasonable BTC price expansion according to the current market patterns.