On-chain data shows that the Bitcoin Binary Coin Days Destroyed (CDD) has remained low recently. This says this about the current market.

Bitcoin Binary CDD has been staying at very low levels lately

This is evident from data from the on-chain analytics company Glasnodethis indicator reached high values during the 2021 bull run. To understand the CDD metric, one must first look at the concept of “coin days”.

Whenever 1 BTC remains stationary on the blockchain for 1 day, 1 “coin day” is accumulated. If a coin that has been unmoved on the network for a while, meaning it has accumulated a certain amount of coin days, is now suddenly transferred, the coin days counter will of course be reset to zero.

The coin days it previously carried would have been “destroyed”. The CDD indicator measures the total number of coin days that are reset across the network on a given day.

When this indicator has a high reading, it means that there are a large number of coin days being reset in the market right now. In general, this kind of trend is a sign of movement from the “long-term holders” (LTHs).

This group includes investors who have owned their BTC for at least 155 days, so these holders tend to accumulate large numbers of coin days. For this reason, the CDD registers a spike with every transfer.

In the context of the current discussion, the CDD itself is of no concern, but a modified version of it called the Binary CDD is. This indicator basically tells us how the CDD currently compares to the historical average value of the metric.

As the name makes clear, this indicator can only reach two values: 0 and 1. It has a value of 0 when the CDD is below the historical average, while it is 1 when the metric is above it.

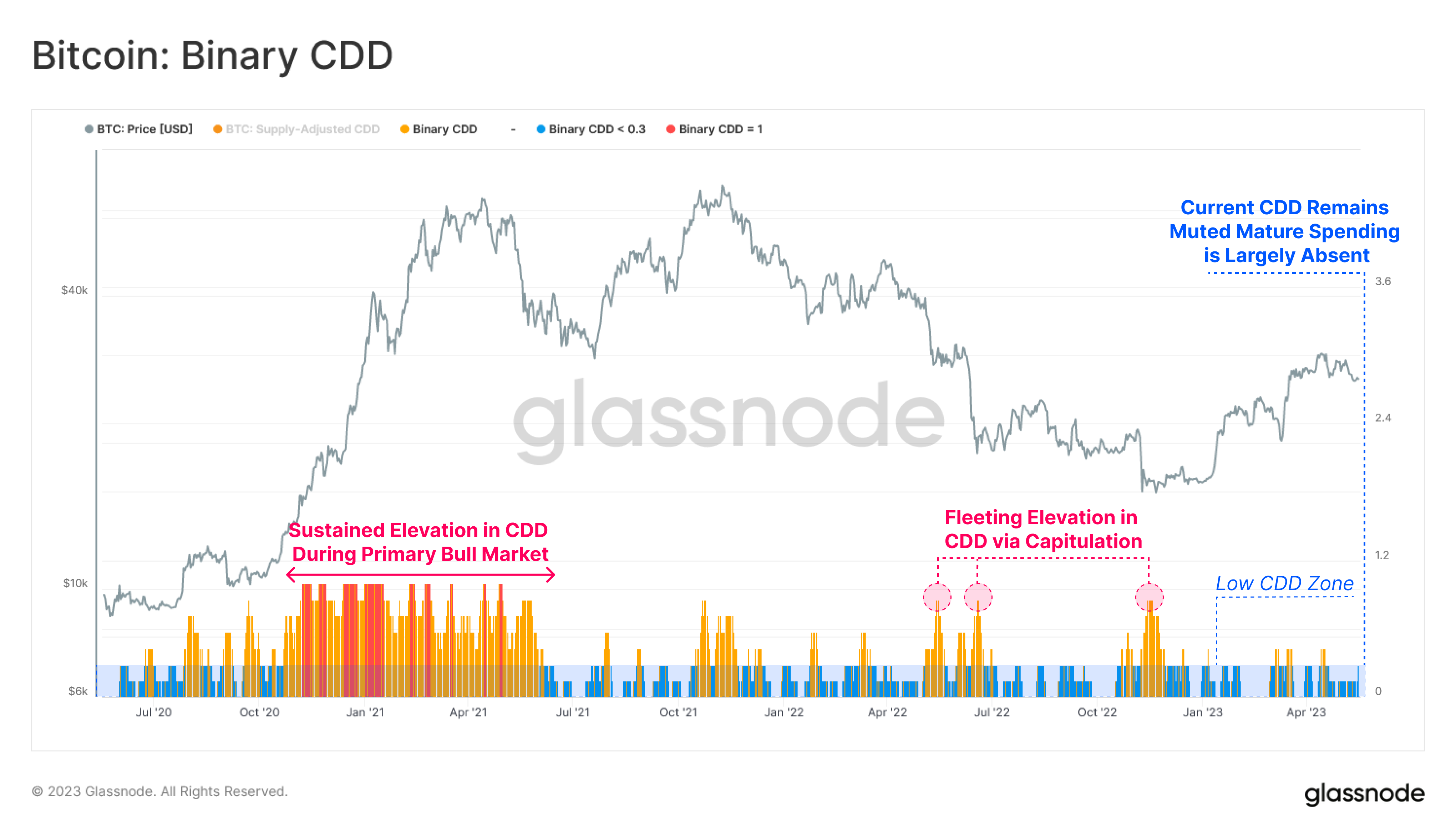

Here is a chart showing the trend in the 7-day average Bitcoin Binary CDD over the past few years:

The value of the metric seems to have been low in recent days | Source: Glassnode on Twitter

As can be seen in the chart above, the 7-day average Bitcoin Binary CDD has been at a fairly low value for some time now. This suggests that there has been no significant destruction of coin days in the market recently.

Of course, this means that the LTHs have not made any unusual moves, despite the price seeing a notable increase in recent months.

The LTHs are generally the most determined group in the market, so transfers from them could have a significant impact on the industry as they are a sign that even these holders may be forced to sell.

During the Bitcoin bull run in the first half of 2021, the 7-day average binary CDD remained near 1, implying that LTHs were selling at full steam. Since this has not been the case in the rally so far, it seems that current gains are not enough to move these diamond hands, and they are likely to expect better odds later on.

These investors who continue to hold such a bullish belief can be constructive for the price in the long run.

BTC price

At the time of writing, Bitcoin is trading around $27,300, down 1% over the past week.

The asset continues to consolidate | Source: BTCUSD on TradingView

Featured image of Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Glassnode.com