- The number of long positions in the Bitcoin market increased.

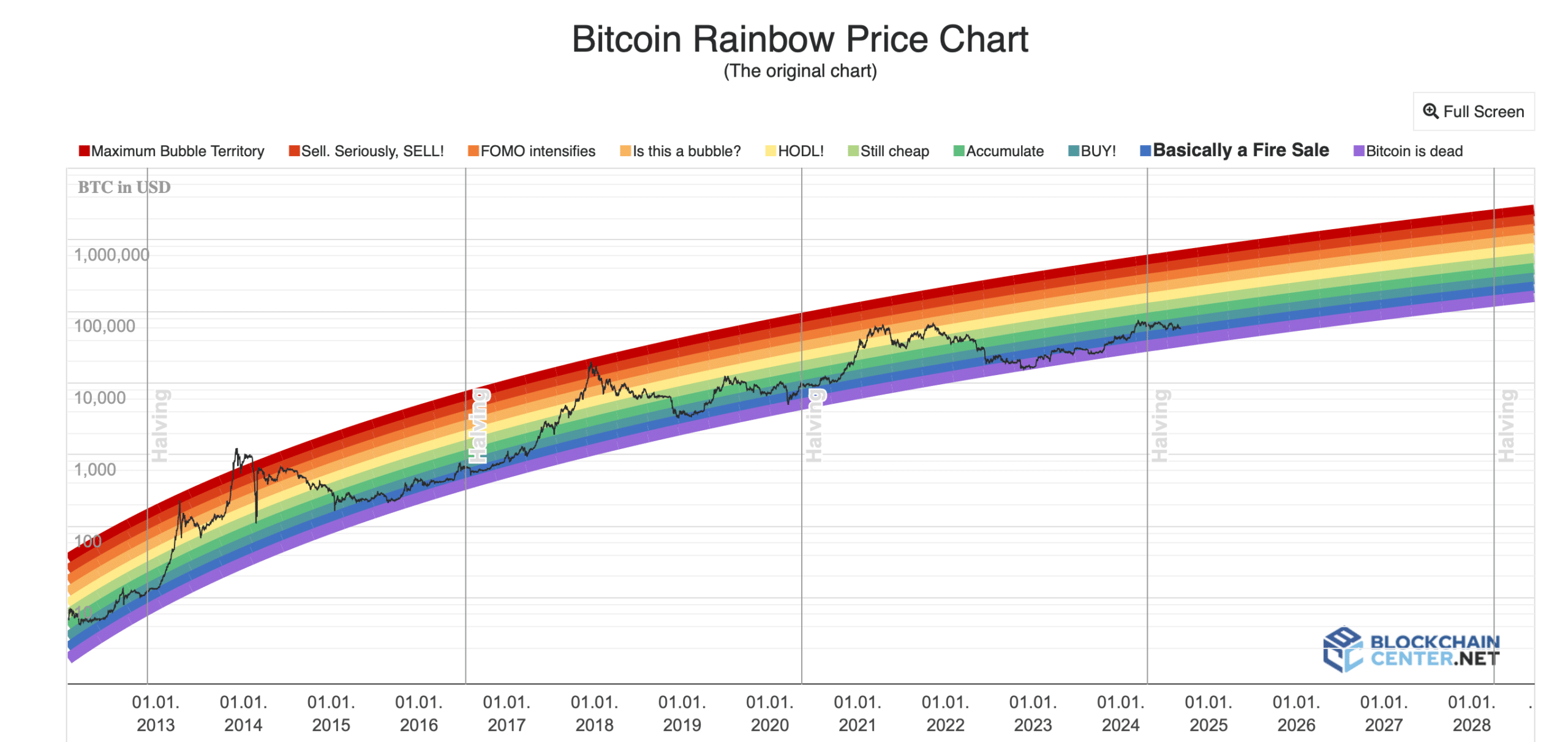

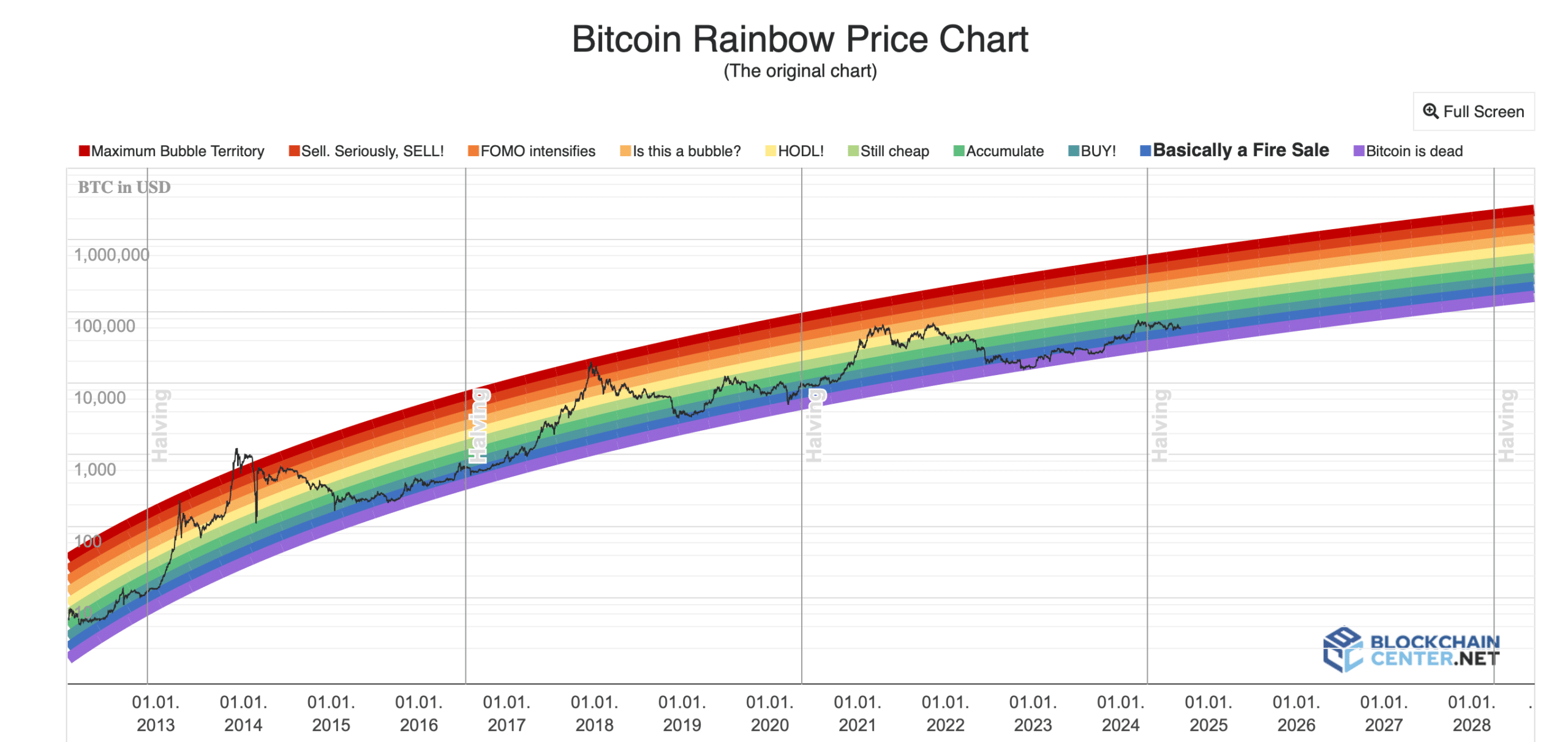

- The Rainbow Chart pointed out that the price of BTC was significantly lower than it should be.

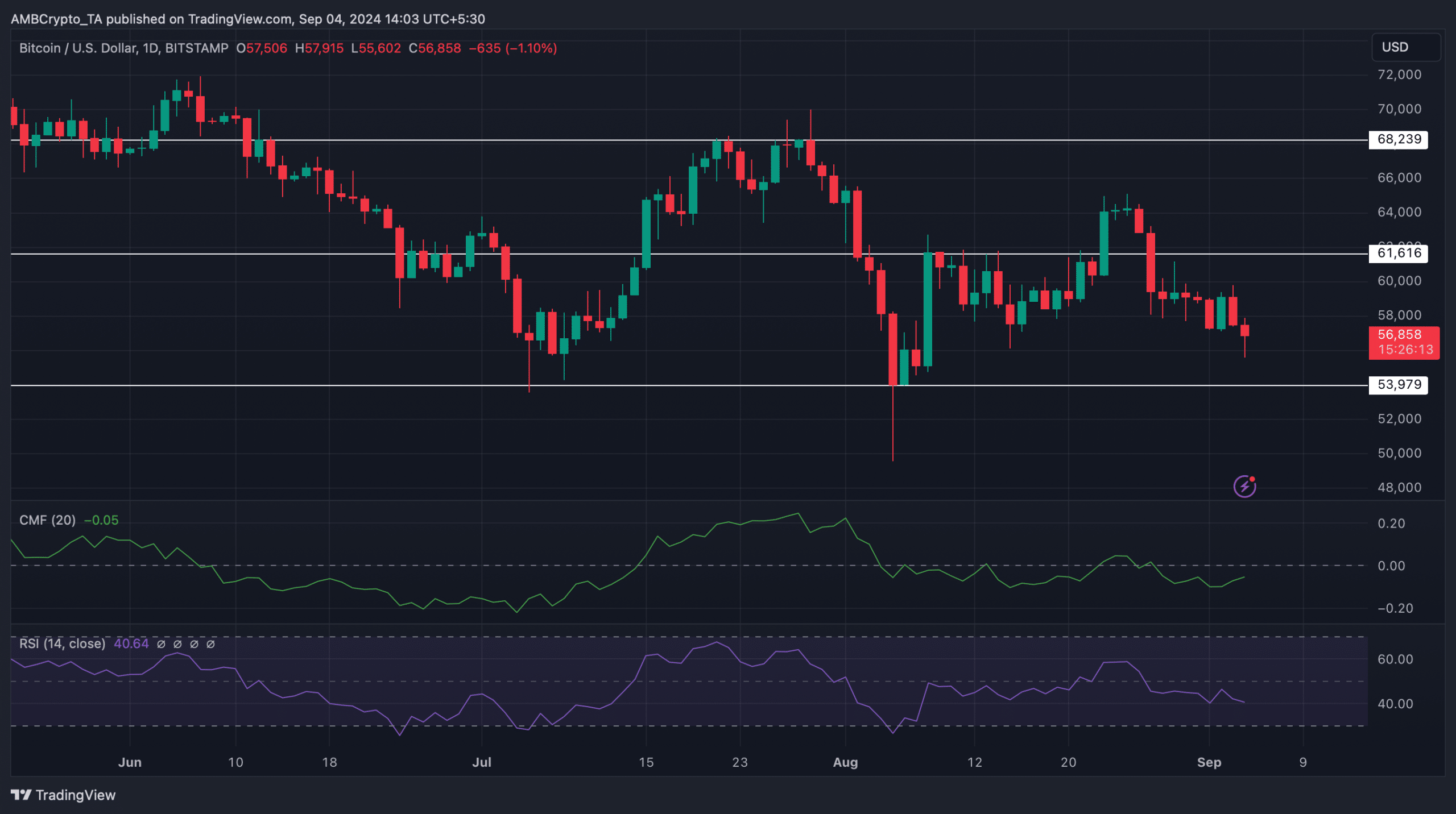

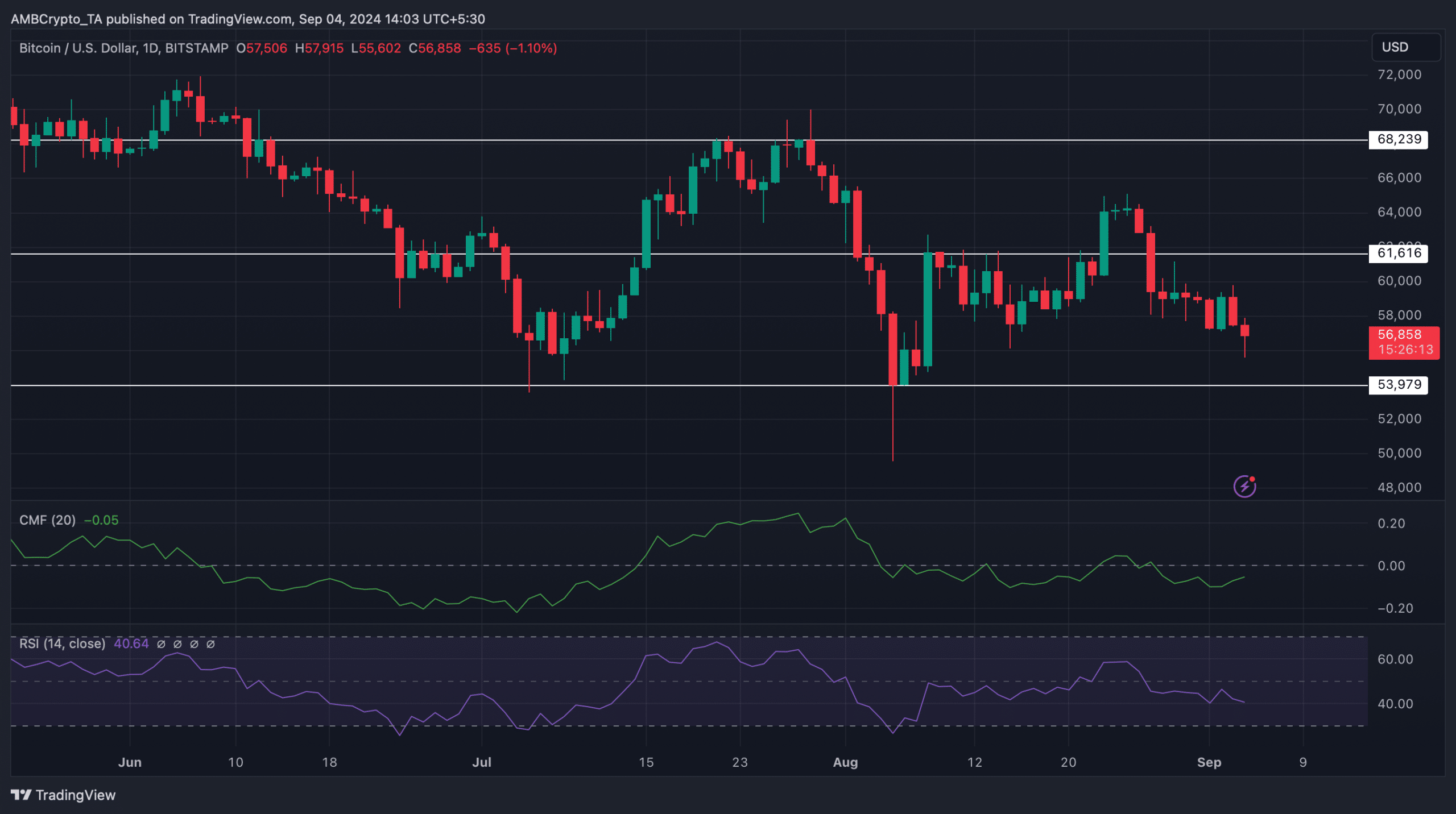

Bitcoin [BTC] remained bearish as the king coin was trading below $57,000 at the time of writing. While this initially looked disastrous, this might as well be a good opportunity for smart investors to buy the dip.

According to CoinMarketCapThe price of BTC has fallen by more than 3% in the past seven days. In the last 24 hours alone, the king coin witnessed a price drop of almost 4%.

At the time of writing, BTC was trading at $56,760.06, with a market cap of over $1.12 trillion.

Should You Buy Bitcoin’s Dip?

Meanwhile, Ali, a popular crypto analyst, posted one tweet which shows a bullish development. Top BTC traders on Binance showed a slight bullish tilt, with 51.79% of investors holding long positions on BTC.

In general, an increase in the number of long positions in the market indicates an increase in bullish sentiment around an asset.

Therefore, AMBCrypto planned to take an in-depth look at the state of BTC to find out whether investors should consider buying the dip.

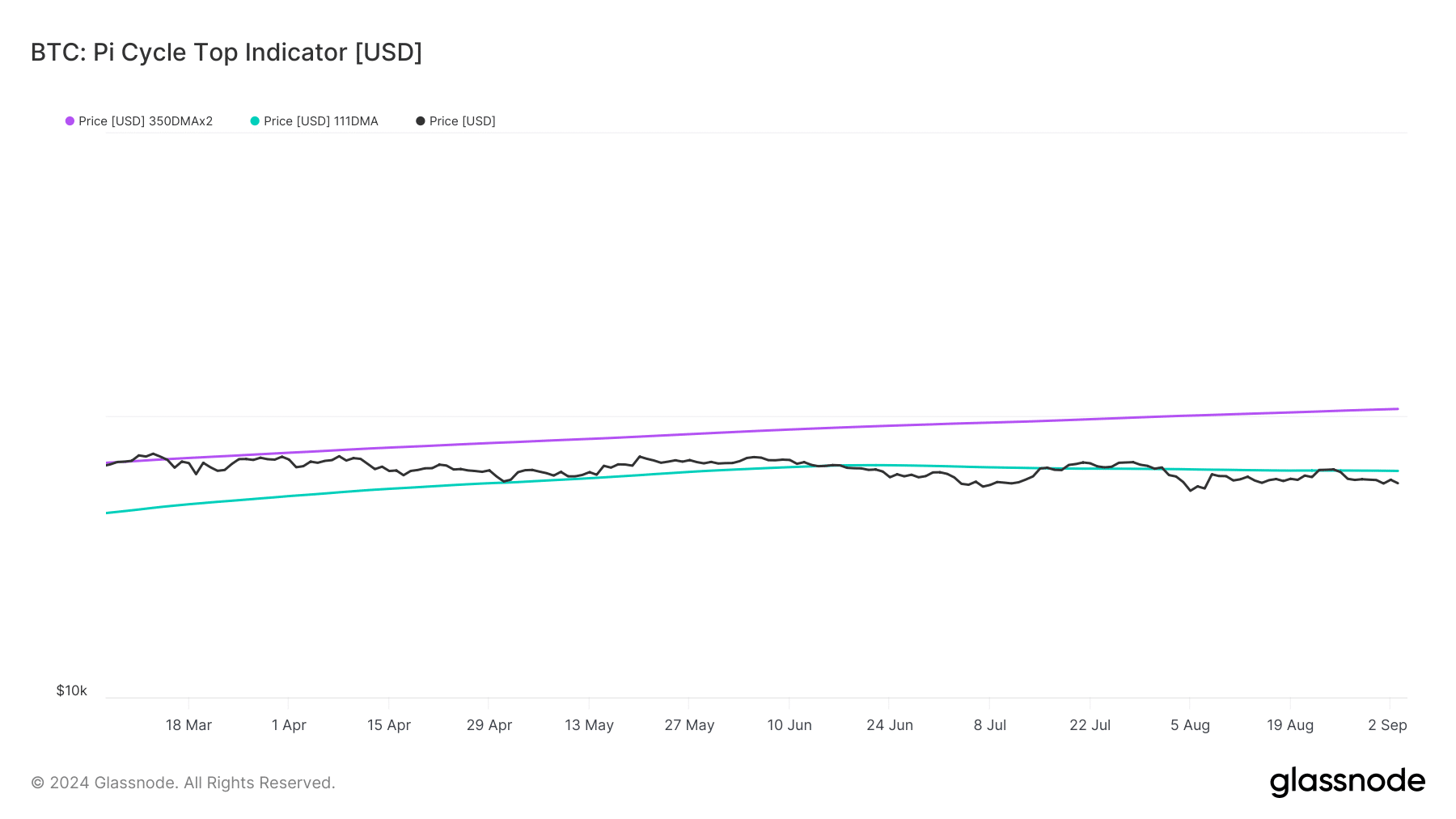

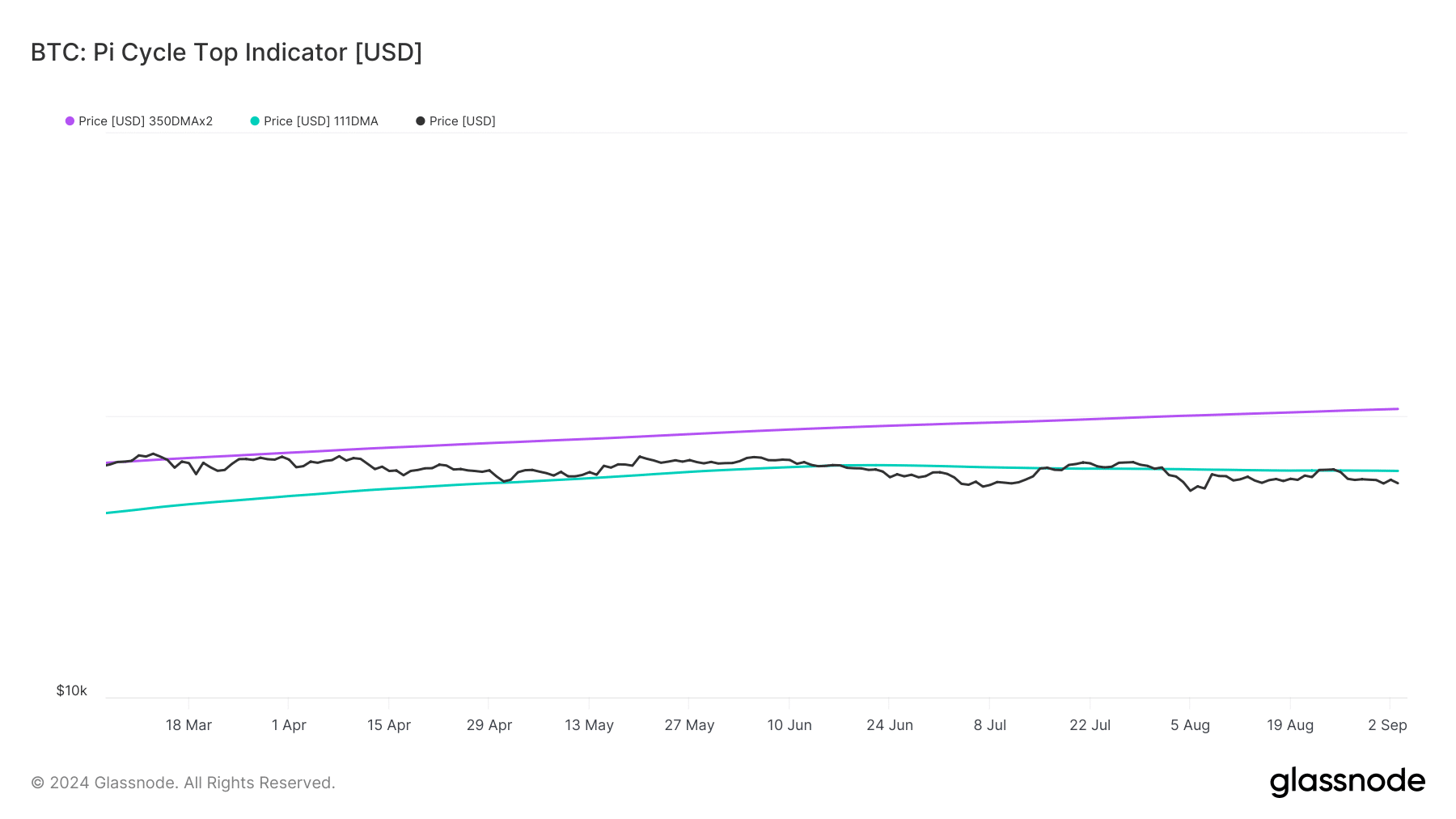

Our look at Glassnode’s data showed that BTC was trading well below its possible market bottom. According to the Pi Cycle Top indicator, BTC’s possible bottom was at $58.9k.

This suggested that BTC could move towards $58.9k in the coming days.

Source: Glassnode

Evaluating the future path of BTC

With BTC trading well below its market bottom, AMBCrypto checked other data sets to figure out if this was the right time to accumulate.

According to the Bitcoin Rainbow Chart, the price of BTC was in the zone of “Fundamentally a Fire Sale.” This meant that the current price of BTC was significantly lower than it should be, revealing a high opportunity for accumulation.

Source: Blockchaincenter

AMBCrypto then checked CryptoQuant’s facts to see if investors have already started buying more BTC. We found that the King Coin Exchange Reserve was falling, signaling an increase in buying pressure.

The Korea Premium was also green, meaning buying sentiment was dominant among Korean investors. However, the Coinbase Premium turned red. This suggested that US investors are considering selling BTC.

Source: CryptoQuant

Read Bitcoins [BTC] Price prediction 2024–2025

The Chaikin Money Flow (CMF) registered an upswing. This indicated that BTC’s bearish price action might end soon.

However, the Relative Strength Index (RSI) has moved south, meaning that the possibility of BTC falling further cannot yet be ruled out.

Source: TradingView