- Worldwide liquidity is increasing and touches recent highlights while investors transfer capital to foreign markets.

- Bitcoin is the biggest winner as investors turn to BTC in the midst of unrest on the market.

Despite the devastating impact of Donald Trump’s policy on the world markets, global liquidity has increased to achieve new levels, according to Alfa -Extract.

Bitcoin has seen the increase in liquidity market [BTC] Keep rising on his price charts despite the unrest on the market. The recent peak means that the markets are almost in September 2024 levels, just before Bitcoin gathered up to $ 100k.

Source: Alpha Extract

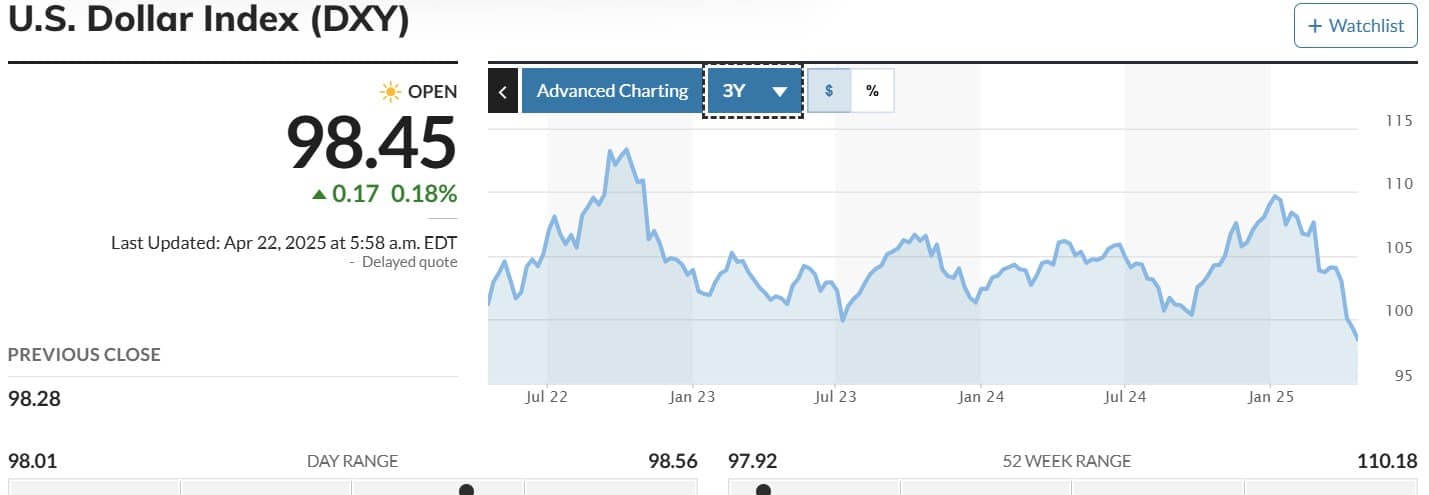

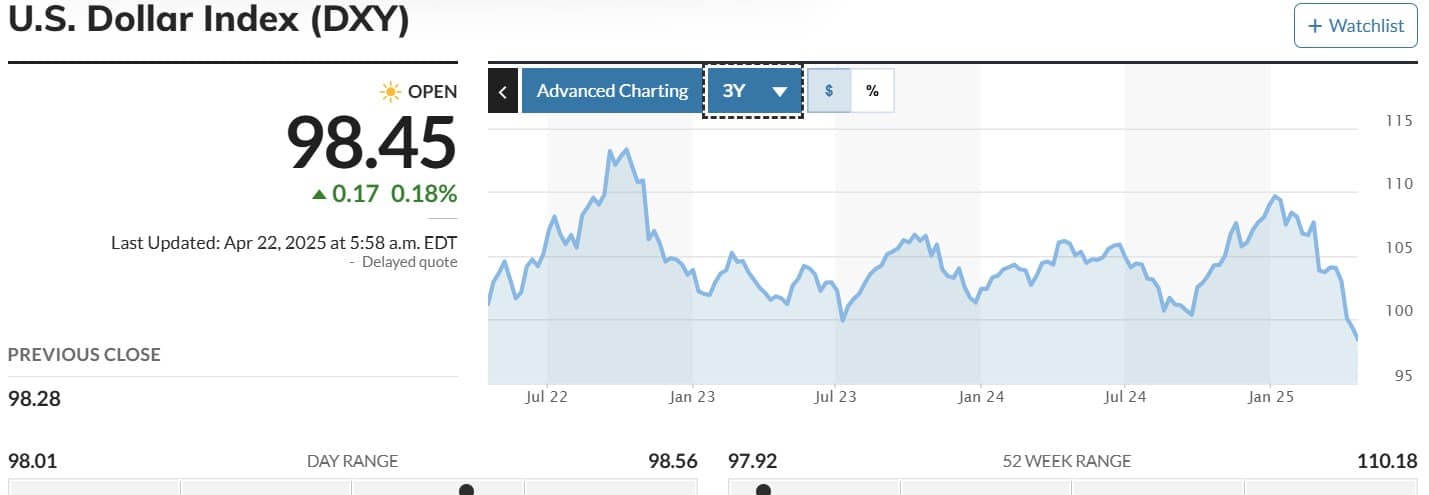

The US Dollar Index (DXY) is in a strong downward trend, after having broken a range of two years and has fallen to the lowest levels since March 2022. This decline suggests that global markets stabilize and the liquidity is increasing.

As Dxy drops, large capital appears to flow from the US to foreign markets, which indicates a preference for better investment conditions.

Capital tends to move where it is treated well, and the American market is currently struggling to keep it.

Source: Marktwatch

Is this the golden moment for BTC?

When global liquidity increases, Bitcoin tends to follow capital flows, which often leads to price increases over time. This week the global liquidity index rose by $ 4.175 trillion, which marks an increase of 3.31%.

At the same time, the price of Bitcoin jumped from $ 78k to $ 88k, which demonstrated the positive impact of the increased capital inflow on the world markets.

Investors return to accumulate BTC, with American institutional buyers re -entering the market.

The Coinbase Premium Index became positive after three days in the negative, signaling of institutional interest in Bitcoin in the midst of market uncertainty.

Source: Cryptuquant

The Korean Premium index remained in a positive area, which further confirmed the strong investor interest in Bitcoin.

With both Korean and American investors who turn to BTC, this suggests that large players regard Bitcoin as a refuge in the midst of extreme market volatility.

As the uncertainty grows, Bitcoin is seen as a reliable value storage, so that it is placed for considerable opportunities in the current market landscape.

Source: Cryptuquant

Under the assets of the store, only gold has performed better than Bitcoin. BTC is currently above SPX, NDQ and NLT, and emphasizes the growing power against shares.

The comparative rolling performance of Bitcoin suggests a strong preference, which indicates further growth potential if the unrest remains on the market due to American policy security.

Source: Checkonchain

Simply put, As global liquidity increases, Bitcoin is considerably for the better, as a reliable value storage next to gold.

In the midst of uncertainty in traditional finances, investors are increasingly turning to BTC, making it a scene for further growth.

If BTC’s preference persists, this can win $ 90k and possibly gather up to $ 100k.

However, if the Fed intervenes to tackle the impact of the Trump era policy, financial markets can stabilize, leading to a BTC decline up to $ 85k.