- Bitcoin surpasses Amazon in market capitalization and affects $ 2,045 trillion and a price level of $ 104k.

- Amazon insisted on the strategy of Bitcoin Treasury to assume in the midst of the rising institutional influence of BTC.

Bitcoin [BTC] has again broken the $ 100k threshold and has reached a remarkable $ 104k after weeks of downward pressure.

According to the latest data from Mint market capBTC traded at $ 103.234.98 at the time of the press, booking a daily profit of 3.67% and an impressive increase of 33.63% in the past month.

But perhaps the most striking development is the newest milestone of Bitcoin, and that is, it has officially overtaken Amazon in market capitalization.

Bitcoin surpasses Amazon

From 9 May, the rating of Bitcoin rose to $ 2,045 trillion, closely along Amazon’s $ 2,039 trillion cap.

While Amazon Stock continues to climb, trade For $ 192.08 with a profit of 1.79%, signals from Bitcoin more than just a price rally.

With this step it has also surpassed the market hoods of Silver, the parent company Alphabet and Meta of Google, positioned according to Companymarketcap as the world’s fifth active active by market capitalization.

Note about the same, Sina G., co-founder and COO of 21st Capital, noted”

“Bitcoin just exceeded Amazon to become the 5th largest active in the world.

– No CEO

– No head office

– No marketing team

Simply code, conviction and worldwide question. Next stop: Nvidia. “

Source: Sina/X

Once considered an edge investment, Bitcoin is now shoulder to shoulder with traditional financial powerhouses, which indicates the evolution in a mainstream store.

Bitcoin’s growth so far

That said, this is not the first time that Bitcoin has challenged Big Tech’s dominance.

In April 2025, it briefly caught up with both Amazon and Google with a rating of $ 1.86 trillion, with $ 94,000 per coin in the midst of relieving the trade stresses of the US china and a technically guided market trally.

However, the newest increase of more than $ 100,000 seems much more resilient, with Bitcoin surpassing his earlier peak and firmly claims the world’s most valuable assets, especially after he had briefly beaten $ 109,000 during the re-cauguration of President Trump in January 2025.

Needless to say that the explosive rally of Bitcoin has not only shaken the trader’s utiment; It has had broader conversations between business giants.

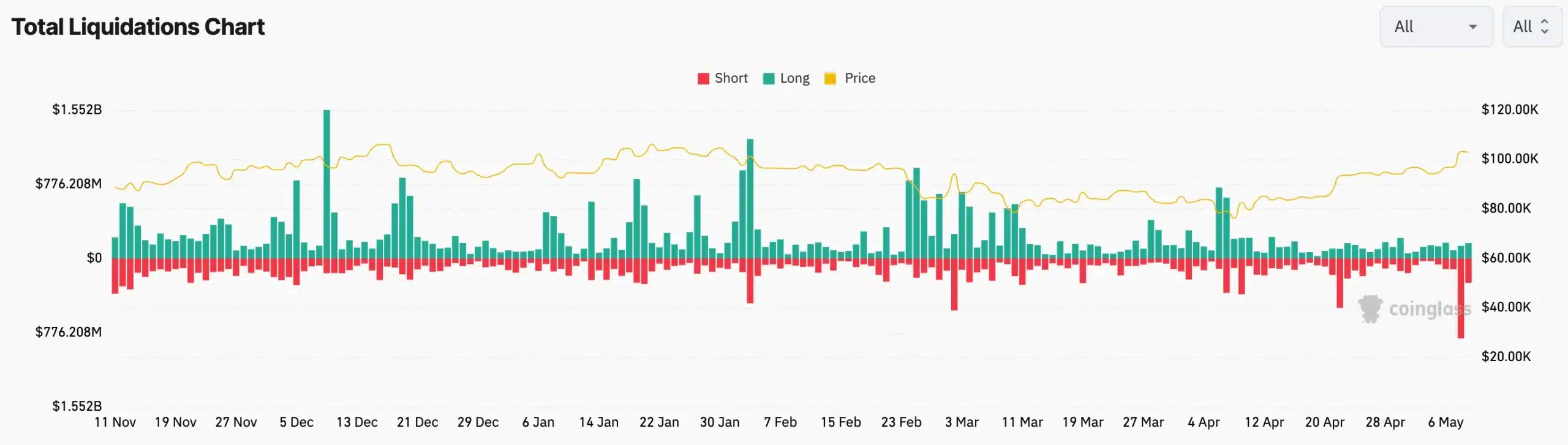

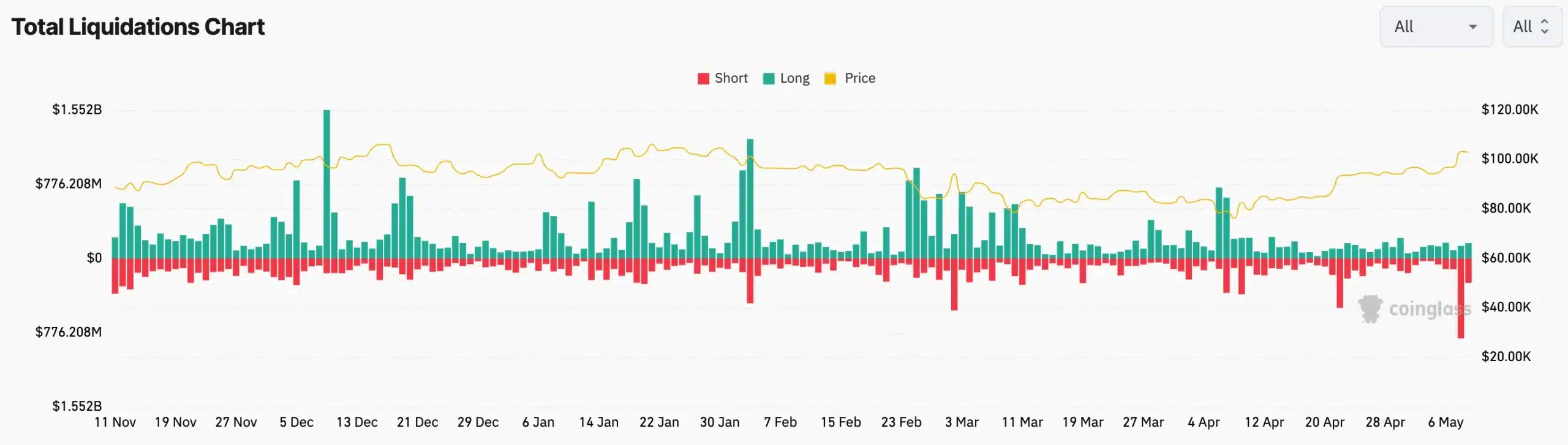

With almost $ 1 billion in liquidations and more than 190,000 traders, the market has been experiencing its most important short squeeze since 2021, according to the recent Coinglass analysis.

Source: Coinglass

Amazon is considering adding Bitcoin

Therefore, since BTC continues to claim as a dominant financially active, even traditional players are starting to notice.

In December 2024, Amazon was mainly under pressure from the National Center for Public Policy Research to consider taking on a Bitcoin Treasury strategy.

The proposal urges the technology giant to allocate part of its $ 88 billion in reserves to BTC, underlining the climb of the cryptocurrency and starts to influence the decisions of the management room and long -term strategies for company financing.