- The recent Bitcoin spike leads to $285 million in liquidations, impacting short orders.

- The put-to-call ratio falls and implied volatility decreases.

Bitcoin [BTC] recently broke out of its stagnation around $51,000 and experienced a significant rise that left investors and bears alike grappling with the aftermath.

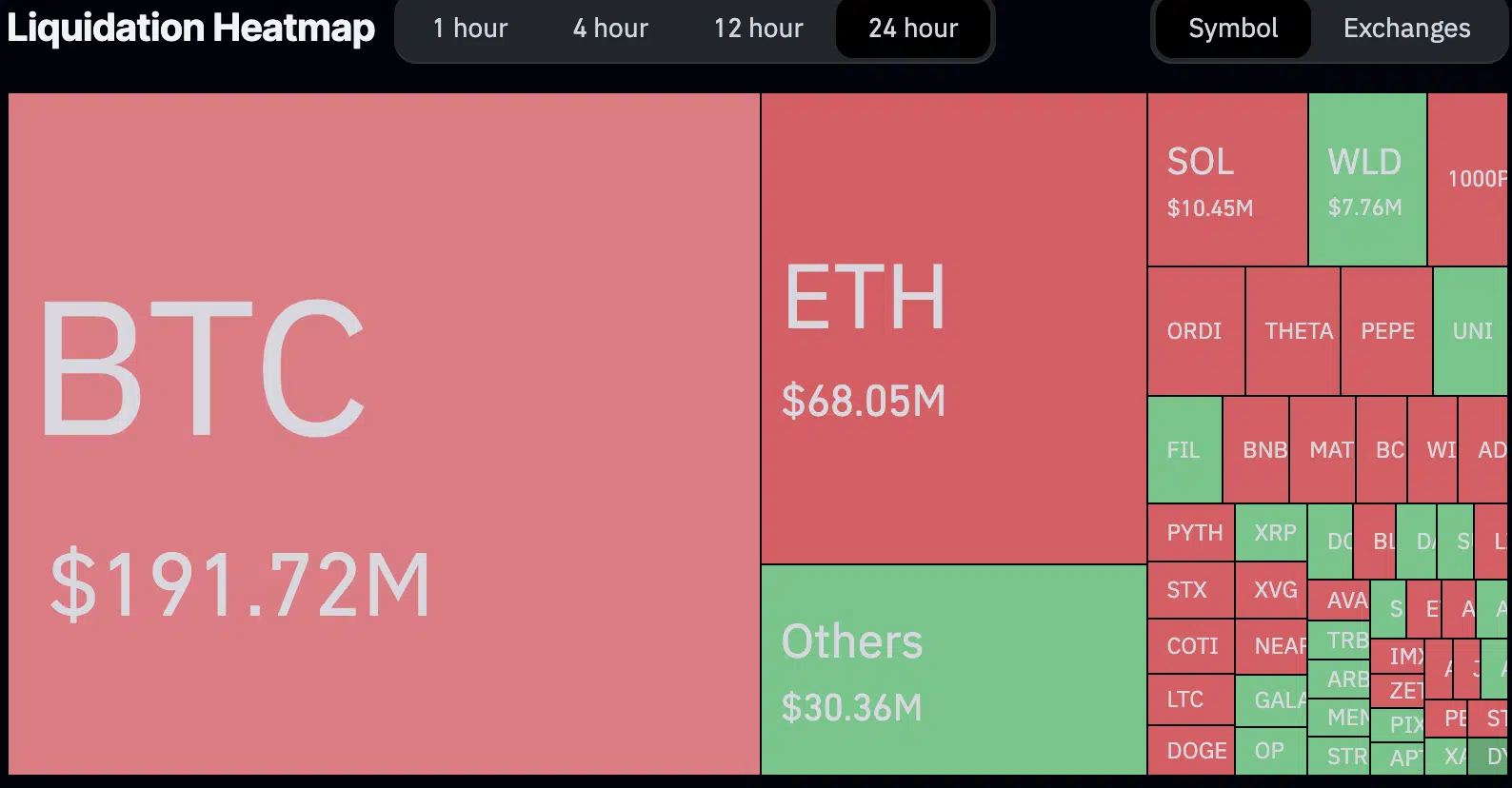

Liquidations are increasing

According to AMBCrypto’s analysis of Coinglass data, the surge in the past 24 hours resulted in $285 million in liquidations, with short orders taking a substantial hit of $211 million.

A staggering total of 74,800 individuals faced liquidation, with the largest order, worth $4.81 million, taking place on Binance for BTCUSDT.

On the one hand, the liquidation of short orders could contribute to upward pressure on Bitcoin’s price, potentially creating a more favorable environment for long positions.

Conversely, the sheer volume of liquidations reflects a market turmoil, indicating potential near-term volatility and uncertainty.

Looking at the behavior of traders

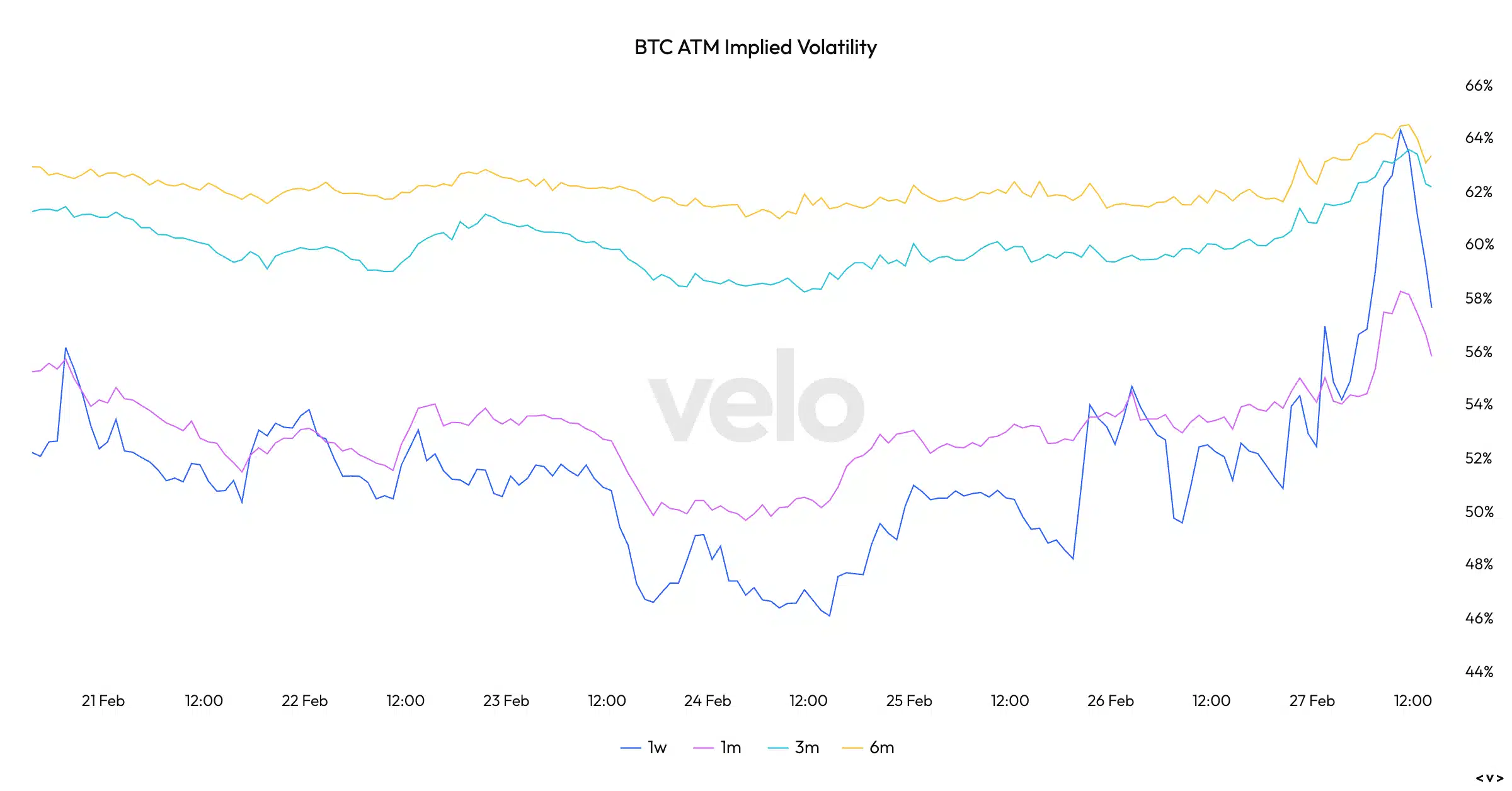

Furthermore, Bitcoin’s put-to-call ratio witnessed a decline during this period. This shift implies a decrease in bearish sentiment, as the ratio indicates the ratio of bearish (put) options to bullish (call) options.

A lower put-to-call ratio indicates more optimistic market sentiment, which could potentially contribute to the positive momentum of Bitcoin’s price.

Additionally, Bitcoin’s implied volatility, a measure of market expectations for future price movements, also saw a decline. While a decrease in volatility may indicate a more stable market, it may also indicate reduced speculative interest.

What are holders doing?

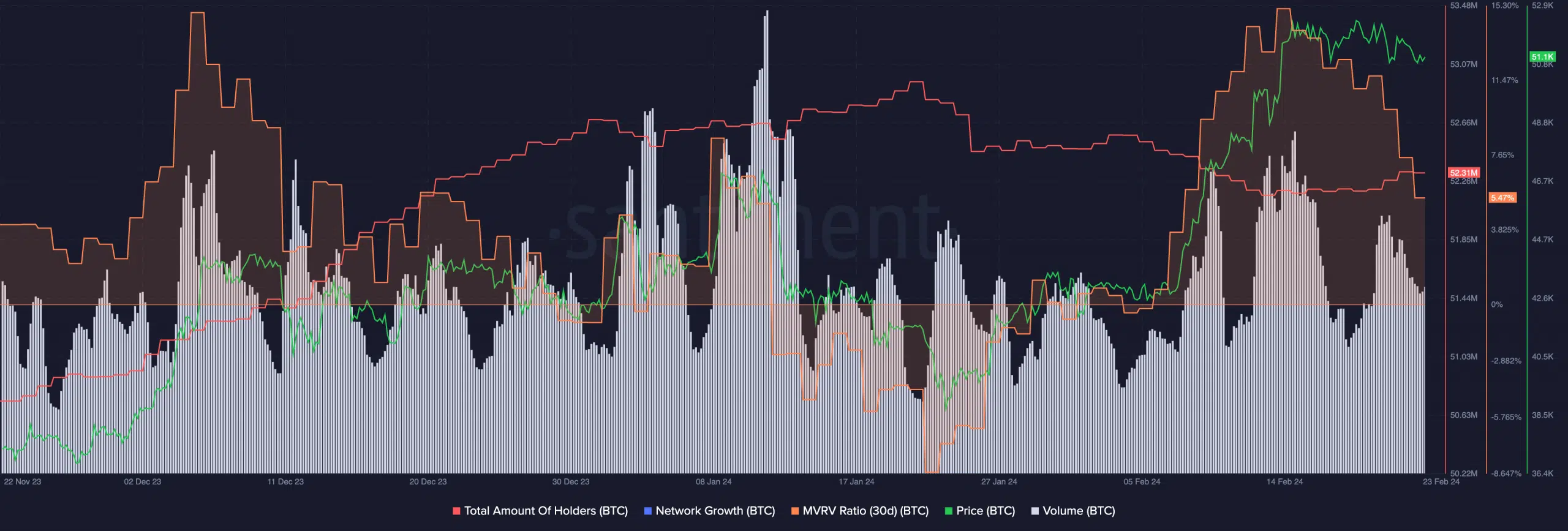

Examining MVRV ratios provided further insight into the selling pressure on BTC holders. The decline in the MVRV ratio indicates profit-taking among holders, despite the price increase.

Profit taking indicates confidence among the holders. However, it could also create selling pressure, potentially leading to short-term corrections.

Surprisingly, despite the increase in the price of BTC, the total number of holders did not increase to previous levels. This observation suggests that the recent price increase can be attributed to the accumulation of older holders, rather than an influx of new participants.

At the time of writing, BTC was trading at $56,308.79 and the price was up 9.66% in the past 24 hours.

Read Bitcoin’s [BTC] Price forecast 2024-25

The volume traded had also grown by 235.73% over the same period, reaching a total of $48,941,296,302.

If the optimism surrounding BTC continues, the price could soon reach $60,000.