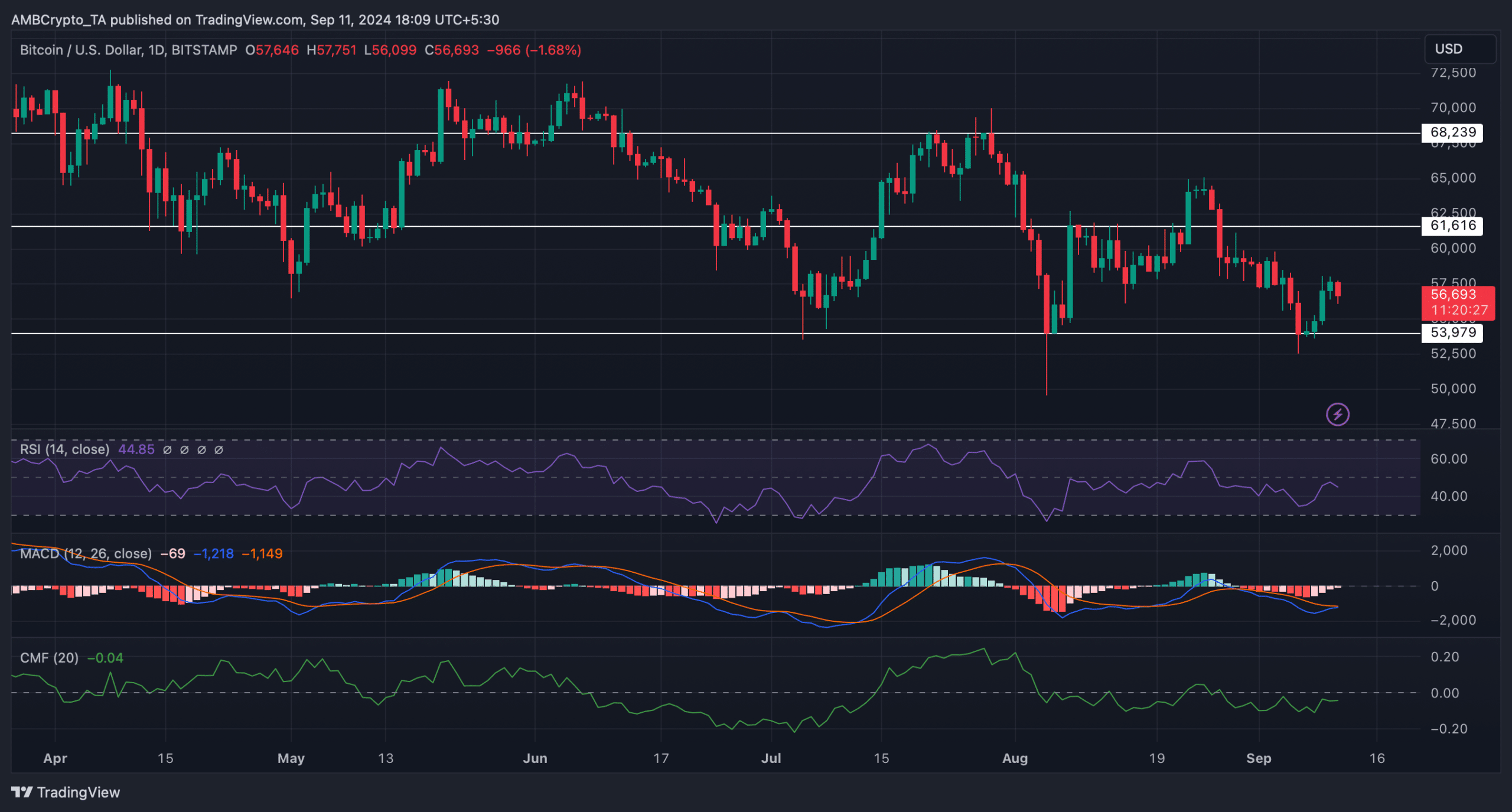

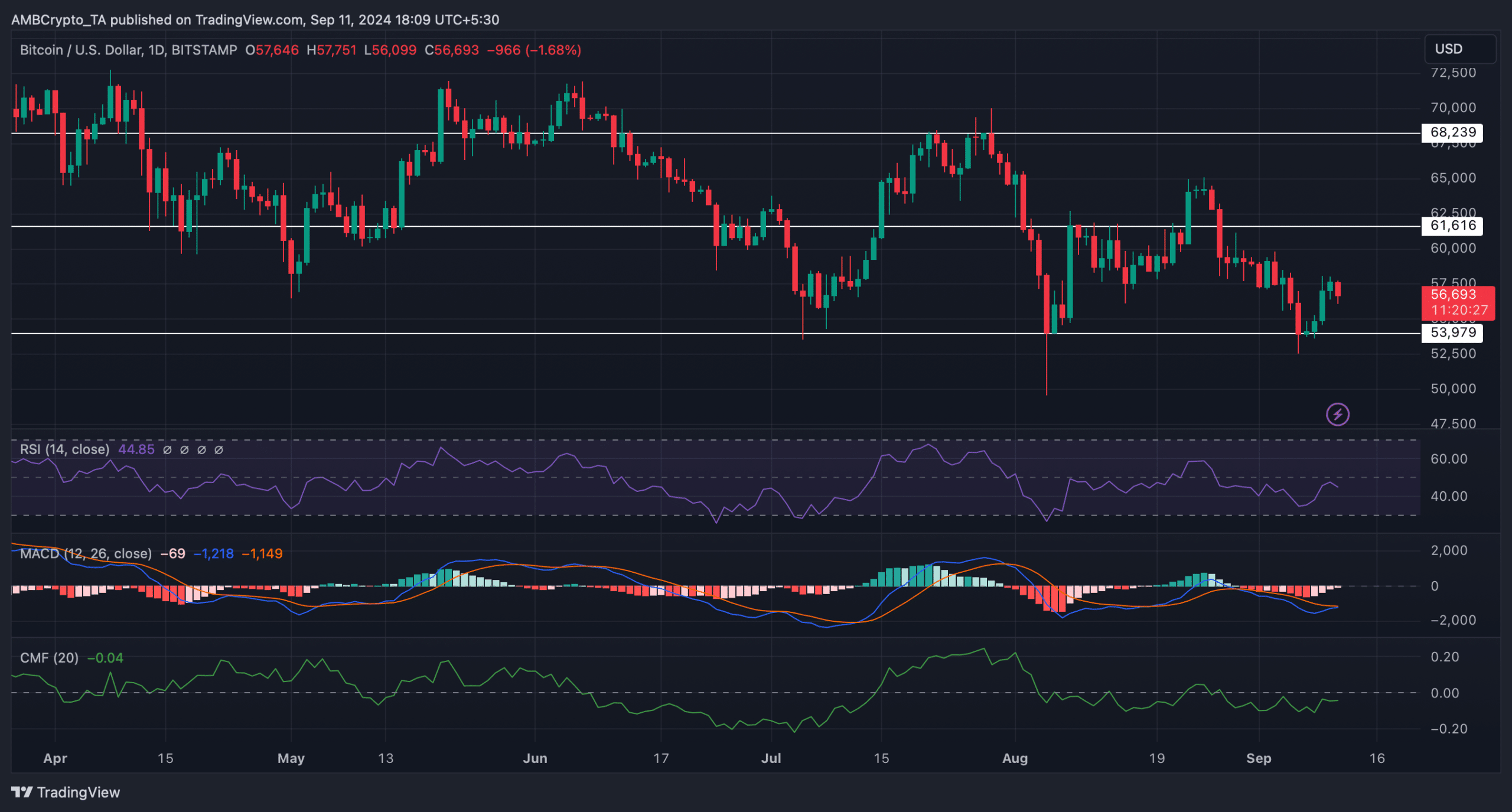

- Bitcoin’s trading chart showed a difference at press time.

- Bitcoin’s fear and greed index was also in the “greed” position at the time.

Bitcoin bears continued to exert control over the past month as Bitcoin’s [BTC] value fell by more than 3%. However, the coin showed signs of recovery as it broke above the psychological resistance at $56,000.

At the time of writing, BTC was trade at $56,632.98 with a market cap of over $1.12 trillion.

Meanwhile, JAVON, a popular crypto analyst, posted a tweet This reveals a bullish divergence on the king coin chart. The bullish divergence indicated a possible price increase in the coming days.

In fact, it could also push BTC to an all-time high.

Moreover, a CryptoQuant analysis also hinted at a price increase. According to the analysis, BTC’s foreign exchange reserve decreased. At the same time, the supply of stablecoins increased, indicating a bullish outlook for Bitcoin.

Source:

Bitcoin’s ATH coming soon?

AMBCrypto then checked various market indicators and metrics to see if they also hinted at a price increase that could push Bitcoin to an ATH.

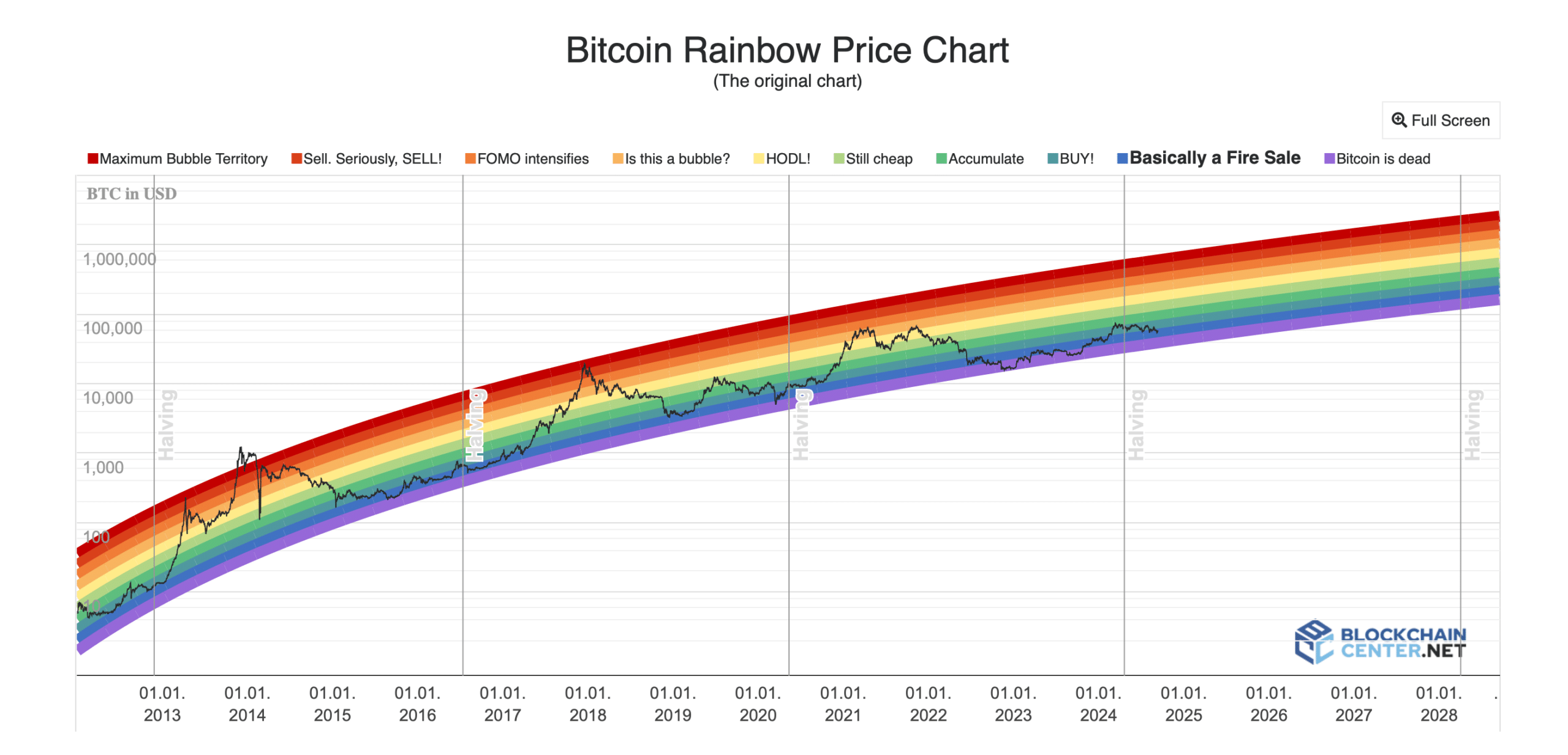

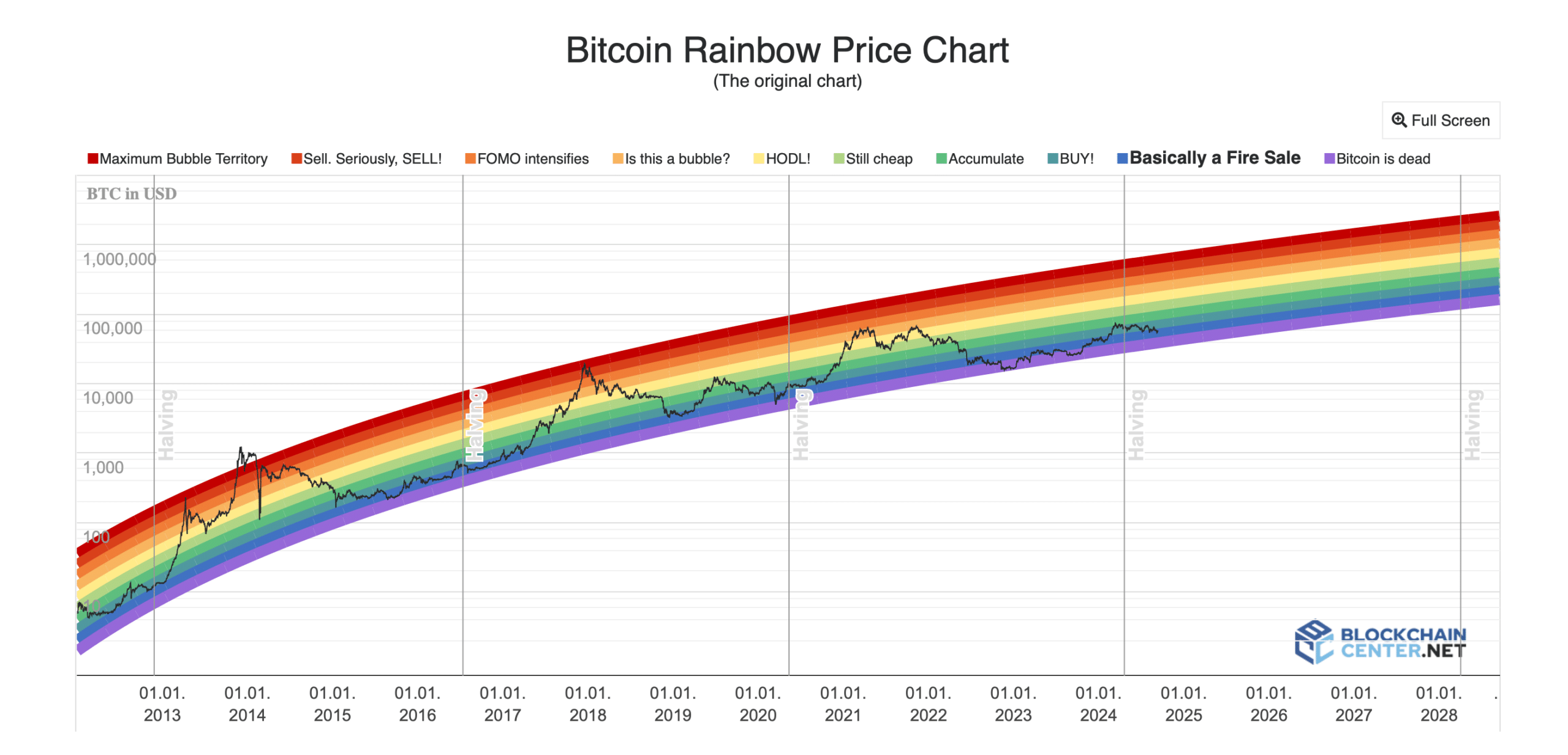

First we checked the Bitcoin Rainbow Chart. According to our analysis, BTC’s rainbow chart showed that the coin’s price was in the “Good Sell” zone.

Whenever the indicator reaches this level, it suggests that investors should consider buying as there is a good chance that the price of BTC will rise in the coming days.

Source: Blockchaincenter

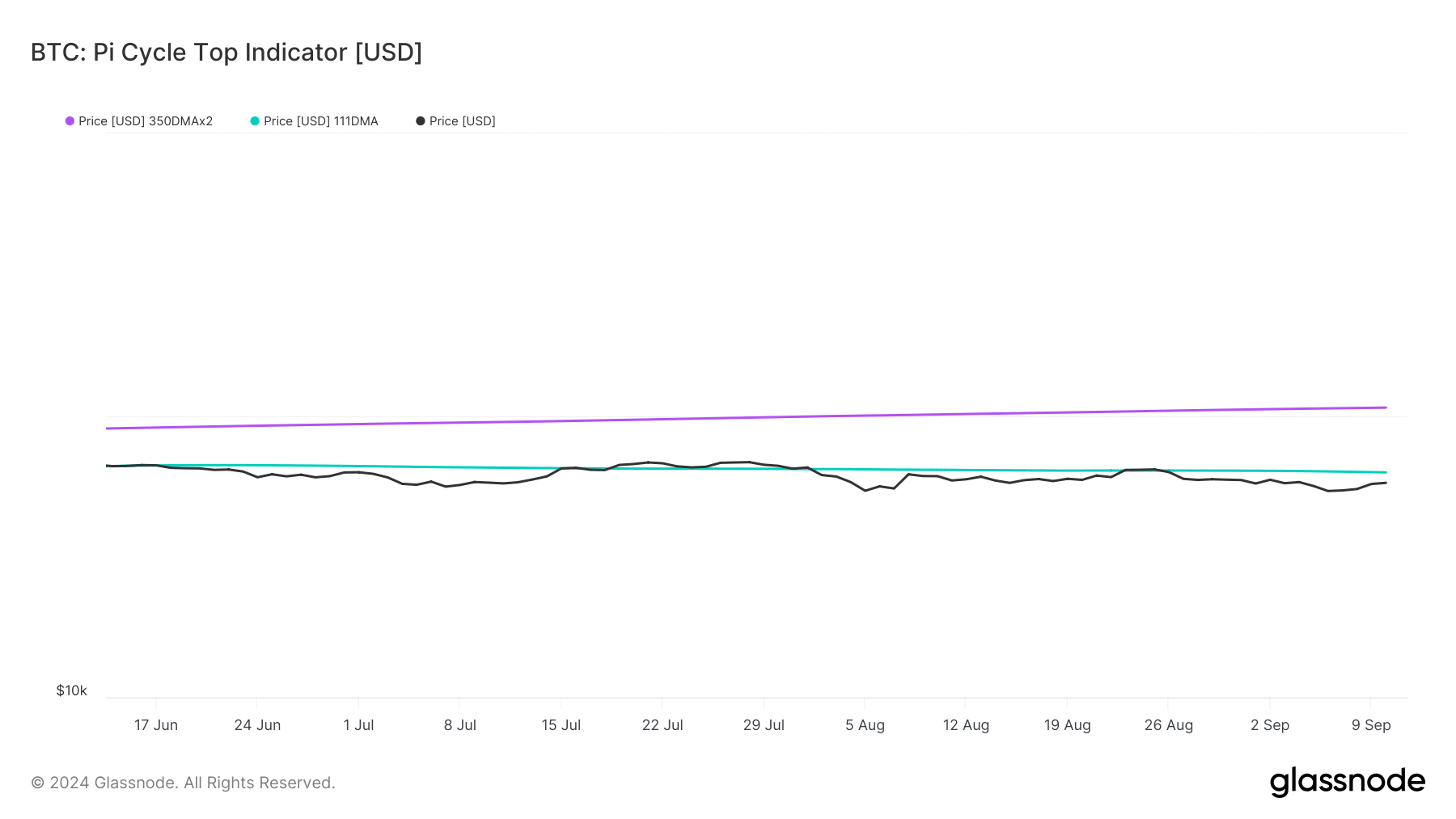

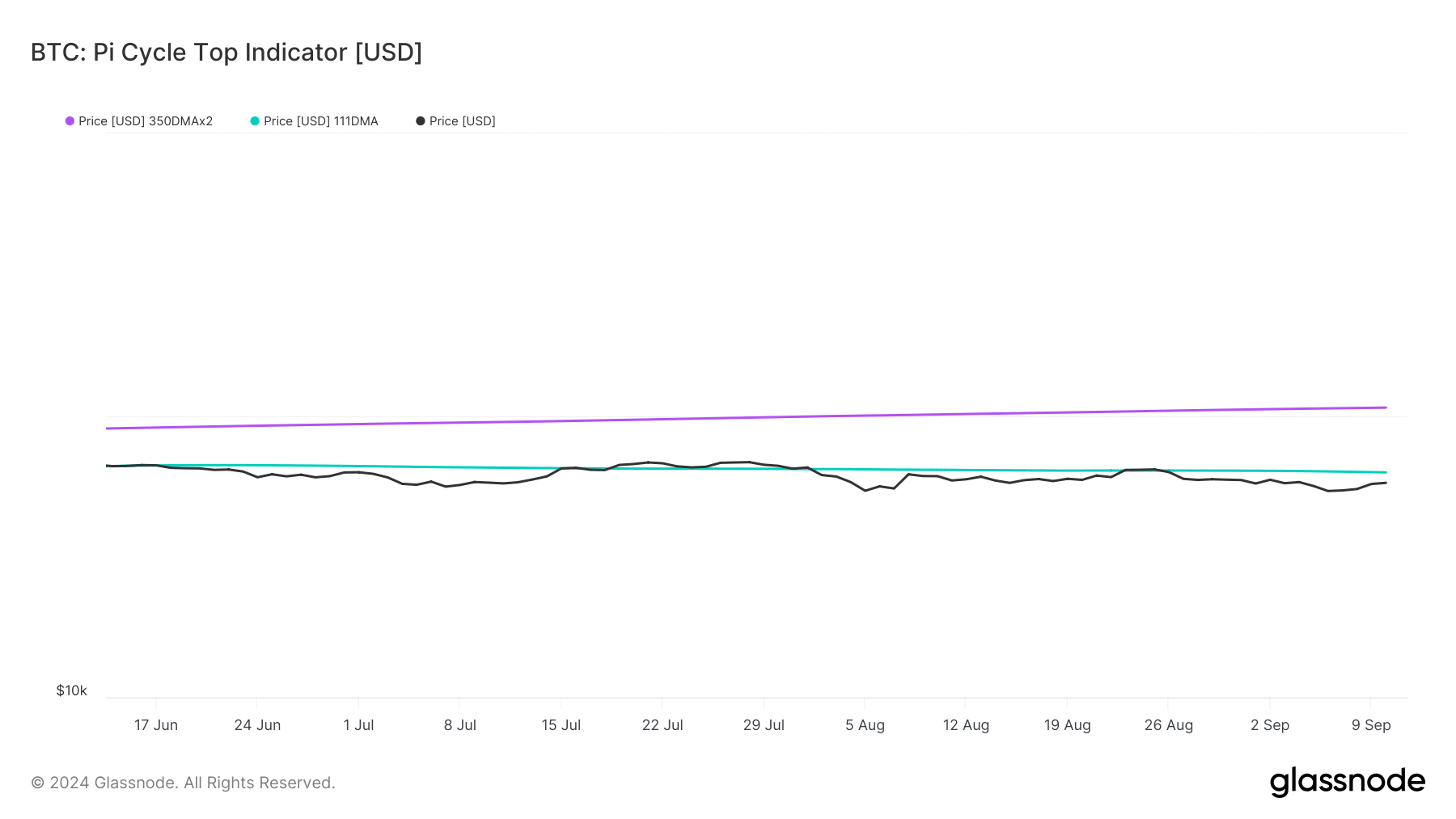

Next, we looked at Glassnode’s data. According to our look at the Pi Cycle Top indicator, BTC was trading well below its possible market bottom, which was $62k.

Therefore, if the BTC bulls push hard, it won’t be surprising to see the coin achieve at least that goal in the coming days.

Source: Glassnode

However, at the time of writing, Bitcoin fear and greed index was in the “greed” position. This suggested that there were chances of a price correction.

Therefore, AMBCrypto reviewed the coin’s daily chart to better understand what to expect.

Read Bitcoins [BTC] Price prediction 2024–2025

According to our analysis, BTC’s Chaikin Money Flow (CMF) registered a decline. The currency’s Money Flow Index (MFI) also recorded a similar decline.

These indicators suggested that investors might witness a decline in the price of BTC. However, the MACD showed a bullish edge in the market, indicating a price increase in the coming days.

Source: TradingView