An analyst who continues to build a following with his long-term crypto calls warns that Bitcoin (BTC) is flashing a signal that could send the top digital asset to lower levels this month.

Pseudonymous analyst Rekt Capital tells his 349,300 X followers that the month of August prior to Bitcoin’s halving has historically been bearish for BTC.

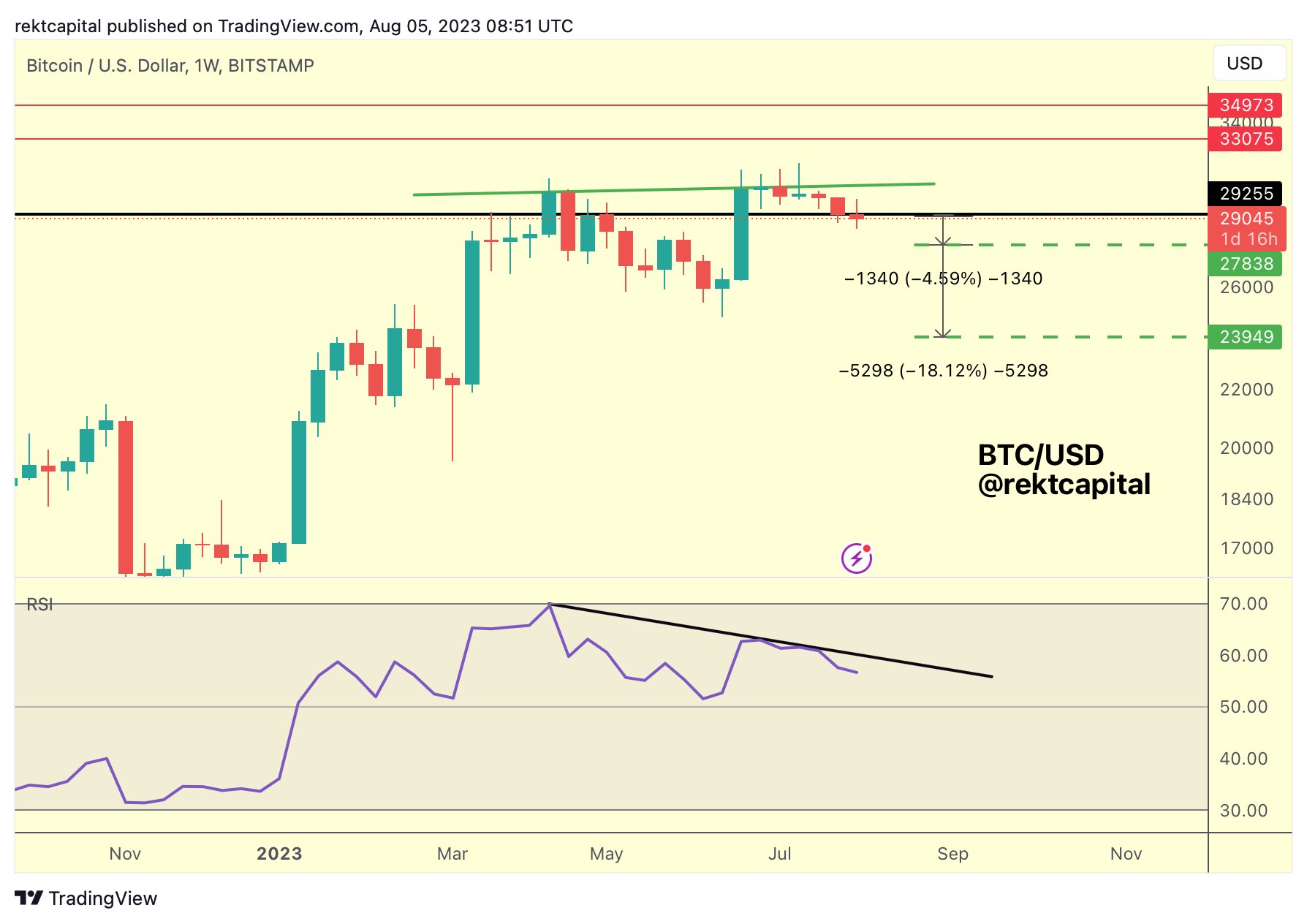

The trader also notes that BTC’s relative strength index (RSI) could be forming a bearish divergence on the weekly chart, which suggests waning momentum for the crypto king. According to Rekt Capital, Bitcoin could fall to as low as $24,000 if the bearish signal plays out.

“BTC weekly bearish divergence potentially forming.

If ~$29,250 acts as resistance, then the chances of this bear div playing out are higher.

Should that happen, what sort of downside could be expected this August?

It’s worth looking at the historical downside in prior Augusts, with an emphasis on pre-halving years (2015 and 2019).

After all, 2023 is currently a pre-halving year…

If BTC were to repeat the August 2015 downside, the price could drop -18% to ~$24,000

If BTC were to repeat the August 2019 downside, the price could only slightly dip at -4% to ~$28,000.”

According to Rekt Capital, the weekly bearish divergence does not necessarily mean that prices are guaranteed to go lower. He says that the bearish signal will likely be invalidated if Bitcoin manages to reclaim a key level or breaks the diagonal resistance of the RSI.

“The $29,250 BTC level is acting as resistance again.

If this continues, then there’s a greater chance this weekly bearish divergence will play out.

However, if the price reclaims ~$29,250 as support or the RSI breaks its downtrend, that’ll be the invalidation.”

At time of writing, Bitcoin is trading for $29,127.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney