- Bitcoin is hovering in a critical zone and is inviting history to repeat itself.

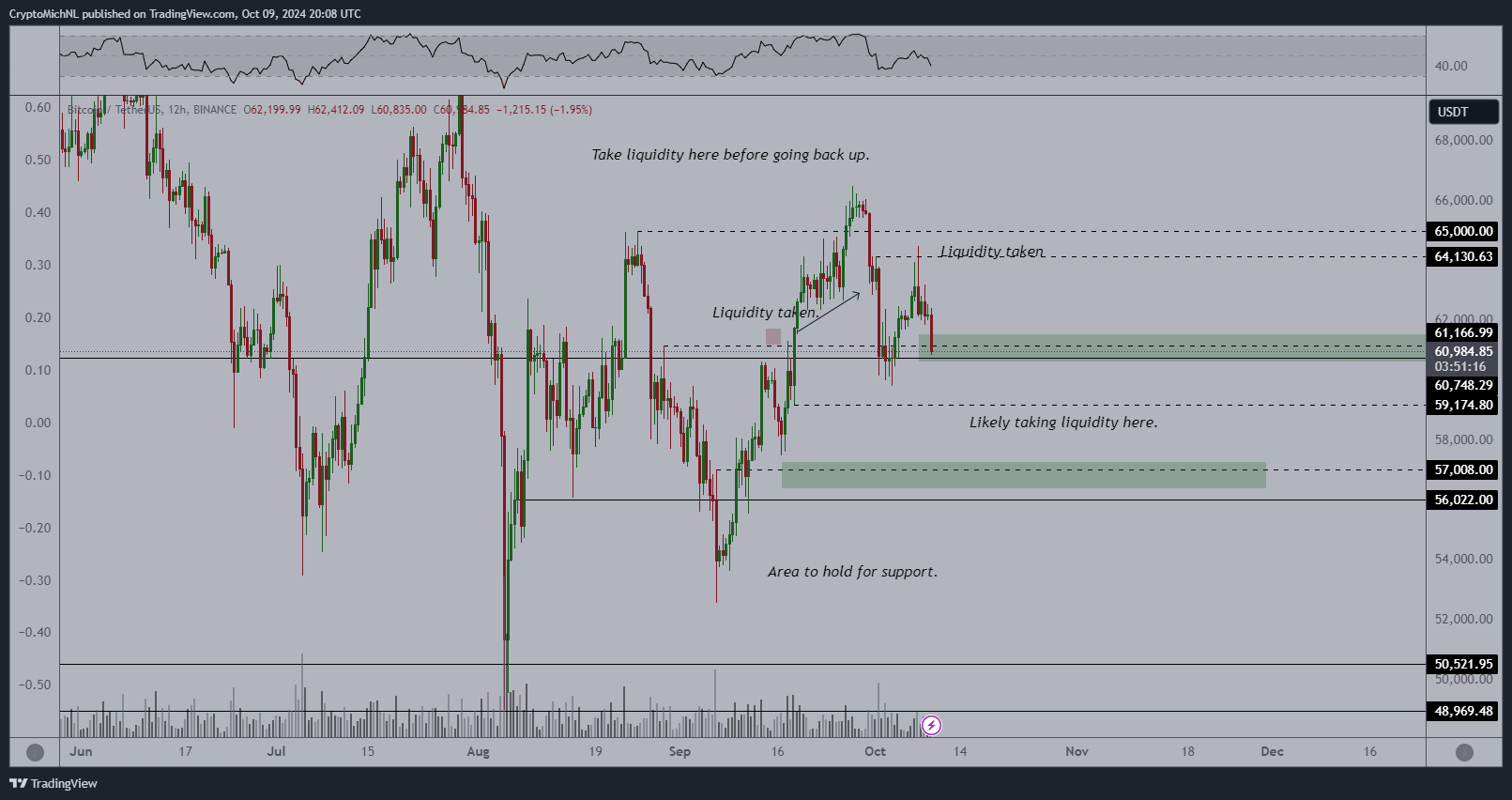

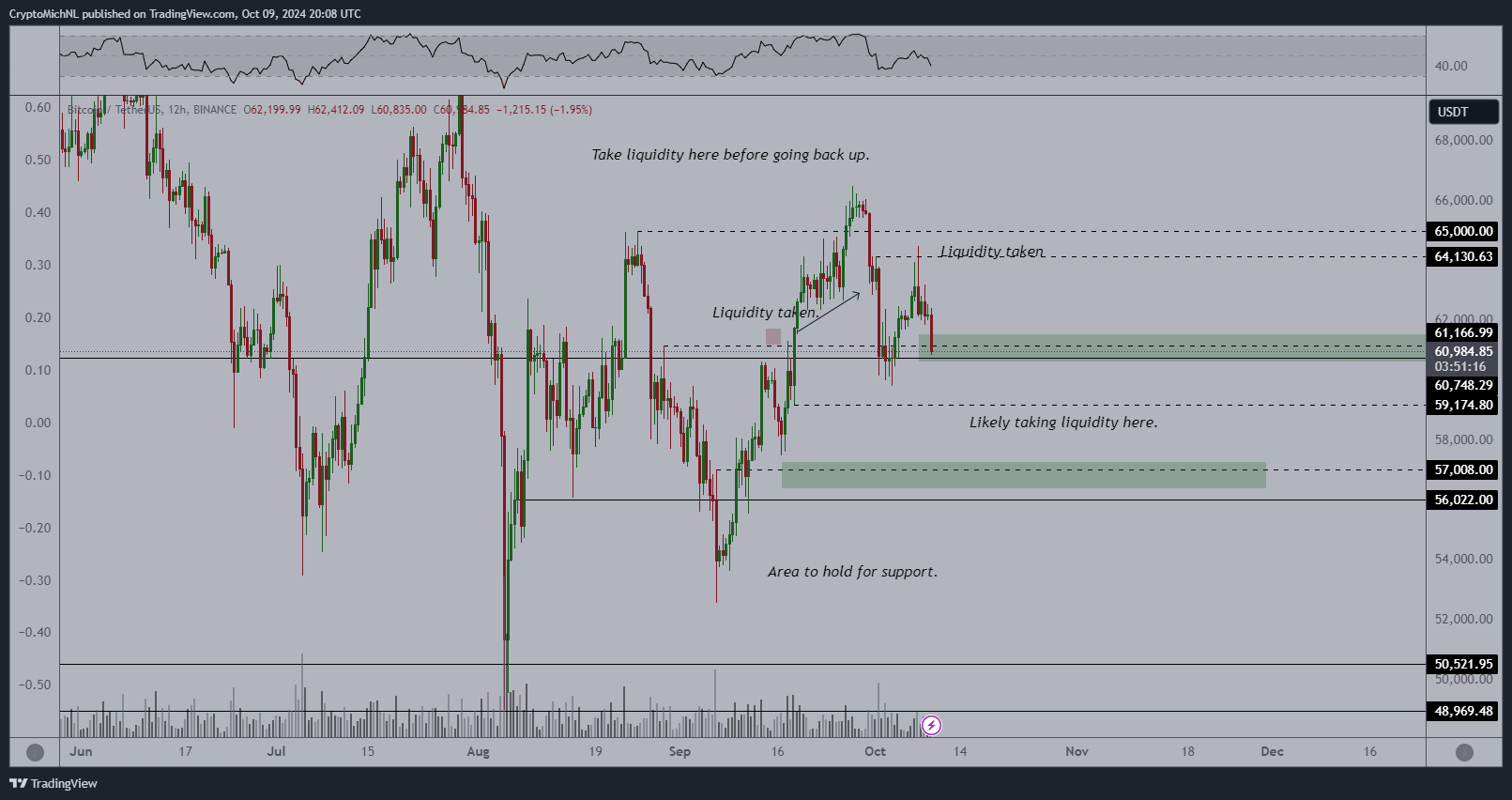

- BTC is likely to fall below $60,000 before a rally.

Bitcoin [BTC] remains the leading asset in the digital space, providing opportunities for traders and investors seeking long-term profits.

Bitcoin is at a crucial psychological turning point, a crucial range based on historical data from CryptoQuant. This key price zone often acts as a zone where traders’ optimism or pessimism comes to the fore depending on profitability.

Currently, the market is indicating an uptrend, but a decline below this zone could cause a shift in sentiment.

The historical data indicates that when Bitcoin prices remained within this range, the market continued its upward trend and supported the idea of a price increase.

Source: CryptoQuant

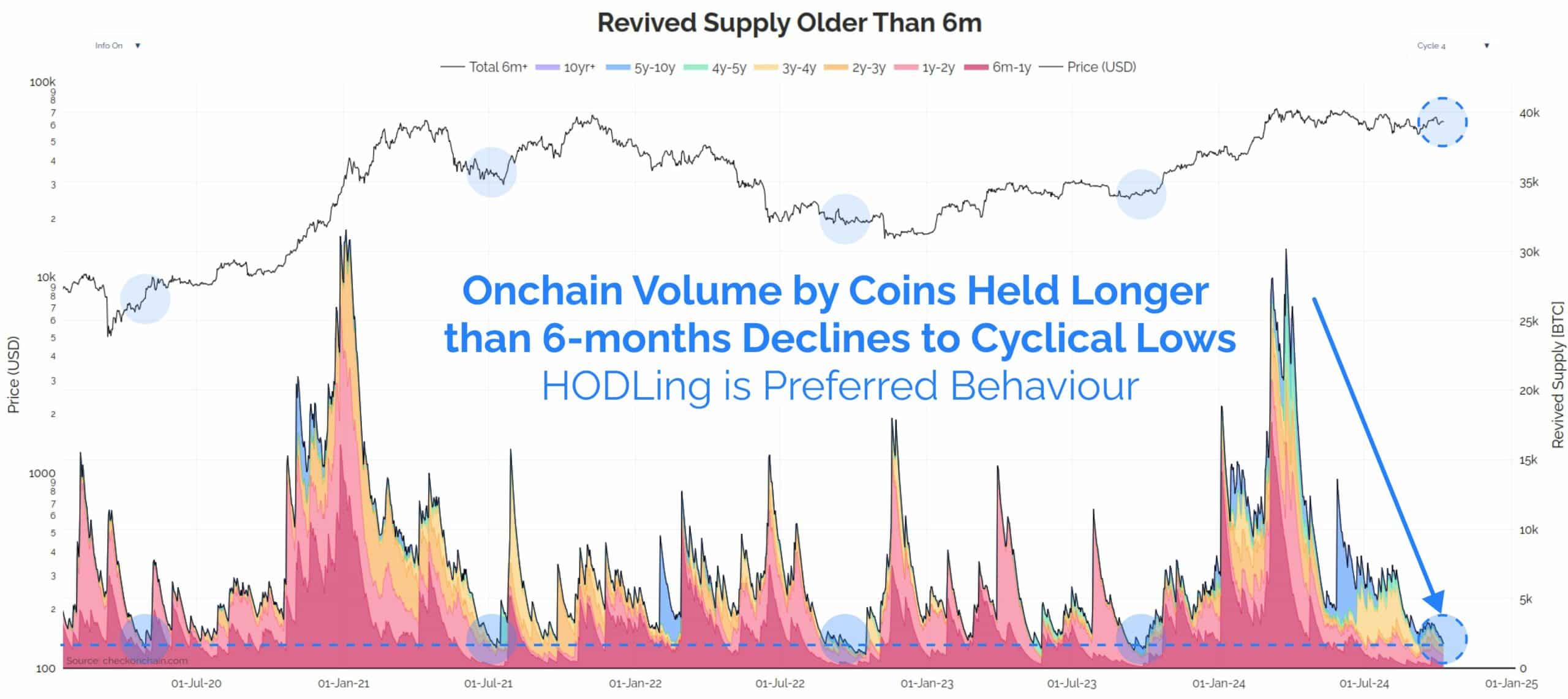

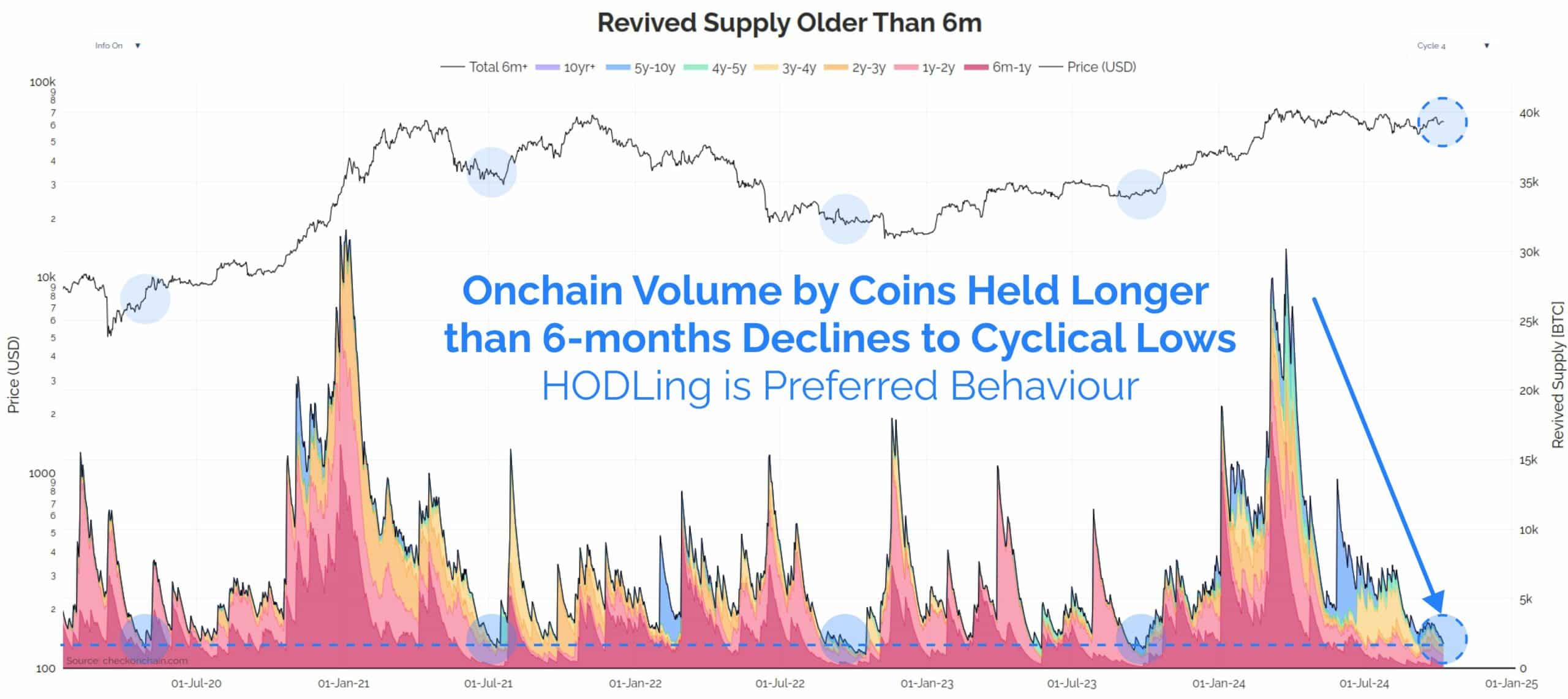

HODL mode despite price drop

Analyzing the market further, the chart indicates that Bitcoin holders are mostly in ‘HODL’ mode, showing confidence despite the volatility.

There is a possibility of a significant sell-off, causing a temporary decline and then a major rally to restart profit-taking behavior. Bitcoin holders, especially those with coins older than six months, remain inactive, signaling confidence in a rally.

Source: Checkonchain

However, a small dip could push BTC to the $60K level where it could bottom out and reverse, indicating that a rally is likely soon. The price action shows that Bitcoin continues to test lower levels in its current downtrend.

BTC is expected to maintain this level, but any corrections caused by negative market sentiment (FUD) could push the price below $60,000 before recovering.

Combined with technical indicators, the prospects for a rally remain strong as Bitcoin consolidates within its support range and prepares for a possible surge.

Source:

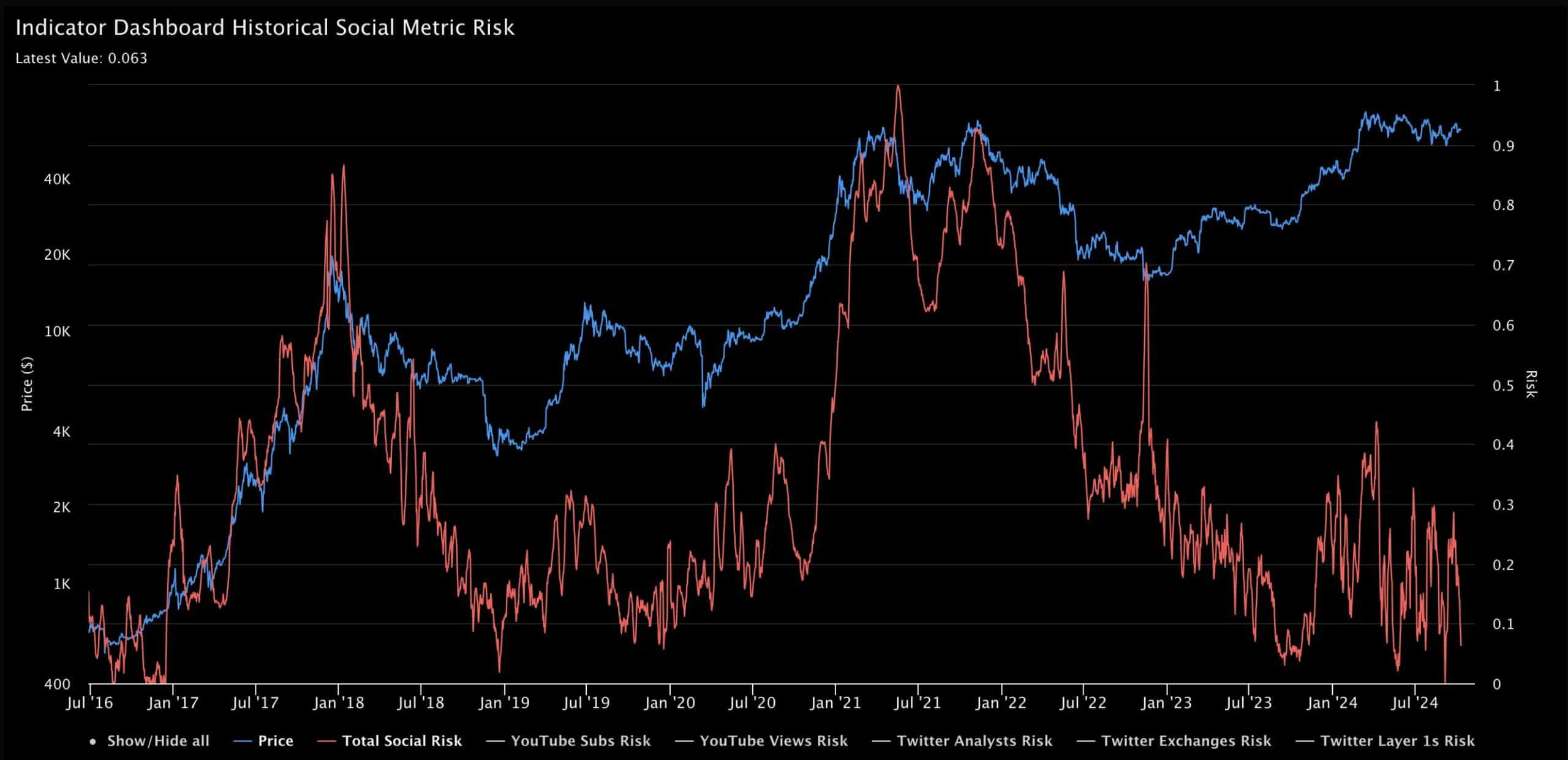

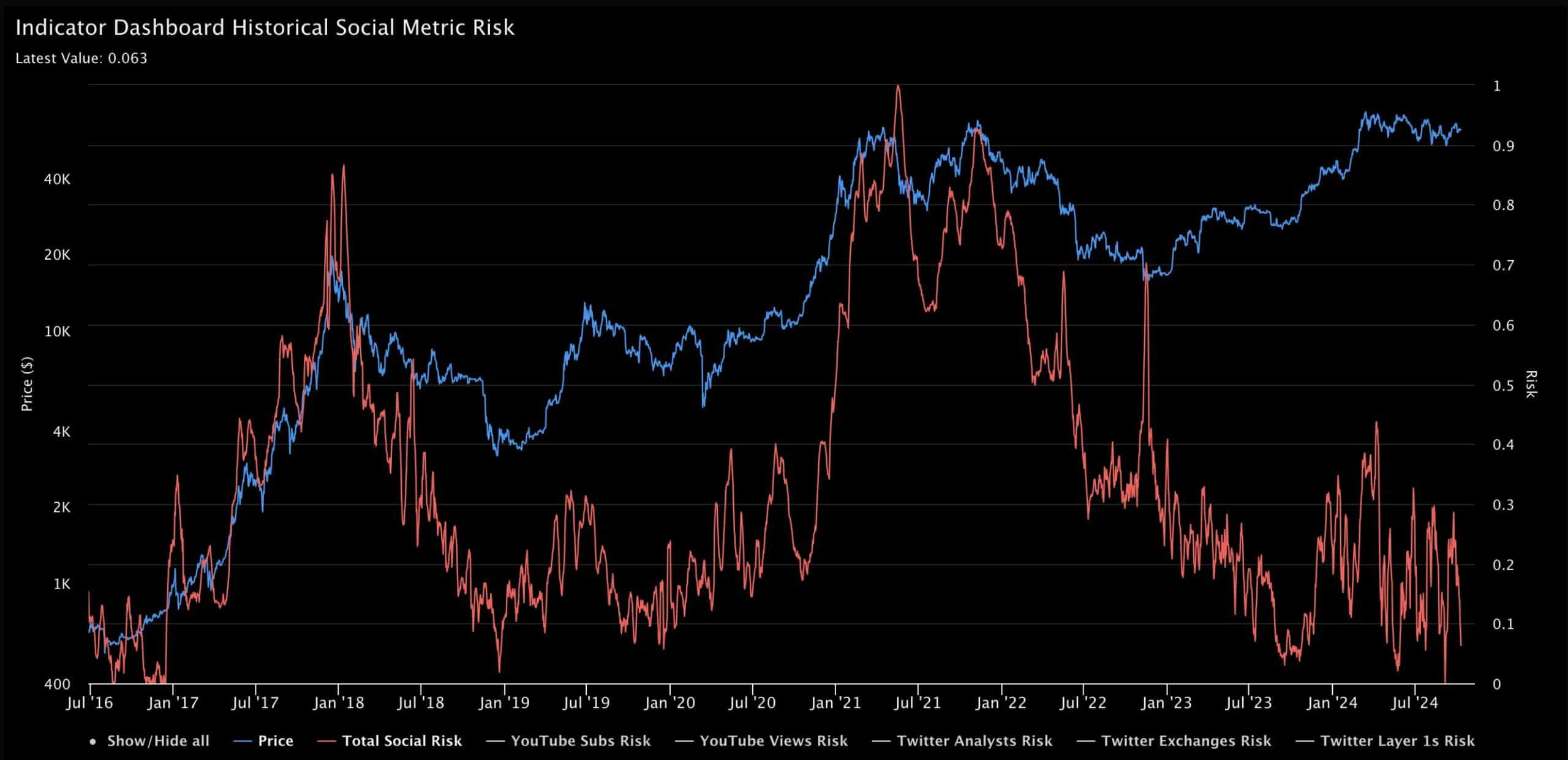

Social risk of BTC

Finally, social sentiment plays a crucial role in Bitcoin’s price movement. Public opinion and community involvement influence market activity, and Bitcoin social sentiment recently reached its highest level since the adoption of Bitcoin ETFs.

This spike could be related to recent speculation about Bitcoin’s creator, further fueling public interest. The positive social sentiment, combined with low social risk at these price levels, suggests that Bitcoin is preparing for significant upside.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Source: IntoTheCryptoverse

Traders are anticipating this potential breakout, which could mark the start of a new bullish cycle.

Bitcoin’s current price level offers potential for a rally. With historical data, technical indicators, and social sentiment all pointing to a rise, BTC looks poised to break higher. Investors may find this a good time to monitor the market for a possible upward move.