Bitcoin gained more than 10% last week as it regained the $60,000 price on Friday. After an initially negative performance in September, this recent price increase by the crypto market leader has generated a lot of positive sentiments among investors. However, a Cryptoquant analyst with the username CRYPTOHELL reports that this bullish momentum is being challenged by opposing forces that are driving the BTC market to a crossroads.

Bitcoin Market Forces at a Standstill – What Now?

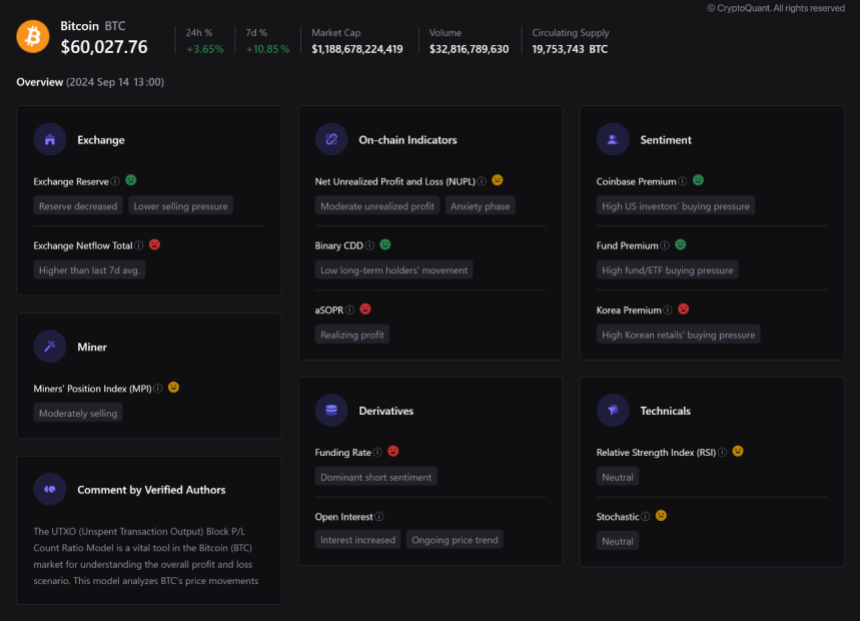

In one Quicktake post On Saturday, CRYPTOHELL stated that the current Bitcoin market is showing both optimistic and cautionary signals.

On the plus side, the crypto analyst notes that there has been a decline in BTC exchange reserves, indicating reduced selling pressure, with investors choosing to hold on to their holdings in anticipation of a future price gain. This bullish sentiment is further reinforced by strong demand from US-based investors, as evident in the demand for the Bitcoin spot ETFs and evidenced by figures such as the Coinbase Premium Index.

Alternatively, CRYPTOHELL states that there are market developments that may require some caution from investors.

First, the analyst highlights that there has been an above-average net flow from Bitcoin exchanges over the past seven days, which could indicate the presence of some significant selling pressure. Furthermore, the Adjusted Spent Output Profit Ratio (aSOPR), a key metric for assessing market sentiment, shows that there is a modest level of profit realization by investors, indicating selling pressure on Bitcoin.

Furthermore, this bearish sentiment is reinforced by negative funding rates in the derivatives market, meaning many traders are taking leveraged short positions in anticipation of a price drop.

The presence of these bullish and bearish factors has simultaneously pushed the BTC market into a “fear phase” where most investors are unsure about the digital asset. However, long-term investors are still largely inactive, which has a major positive effect on the bullish forces.

In conclusion, CRYPTOHELL states that the Bitcoin market is at a “decision point”, and as technical indicators also present a neutral position, future price movements may be influenced by significant changes in market sentiment and major news, possibly in the areas of adoption, regulation , etc.

BTC’s leverage ratio hits a new annual high

In other news: crypto analyst Ali Martinez has reported that Bitcoin’s total estimated leverage ratio across all exchanges has reached a new annual high. This development largely means that Bitcoin traders are taking more risks as they open more positions with borrowed money. While the use of leverage can generally lead to larger profits, it also carries the risk of significant losses that could lead to large-scale liquidations. So there is a need for more caution in the BTC market.

At the time of writing, Bitcoin is trading at $60,220, down 0.23% on the last day. Notably, Bitcoin trading volume has fallen by 51.83% and is valued at $15.74 billion.

Related Reading: Bitcoin Price Recovery Depends on This Key Market Indicator, Analyst Reveals