- With the crypto greed index at higher levels, asset prices may rise and market volatility may increase.

- However, current key metrics indicate a potential BTC short squeeze to $85K.

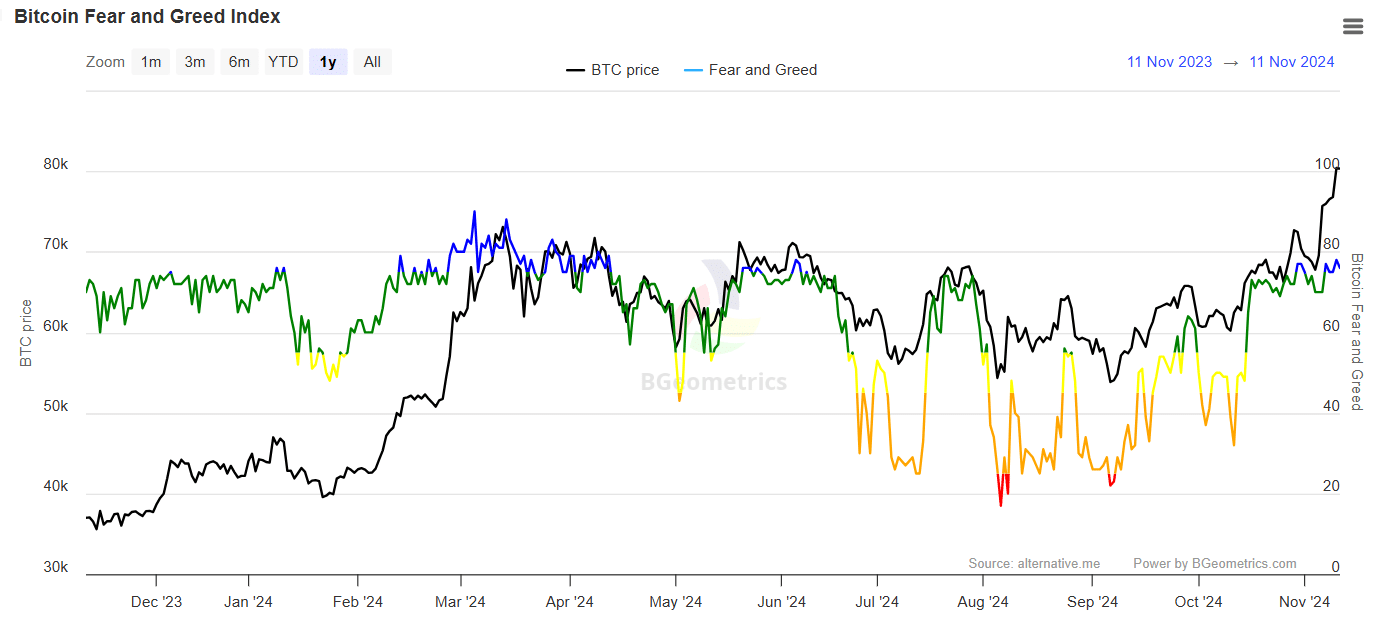

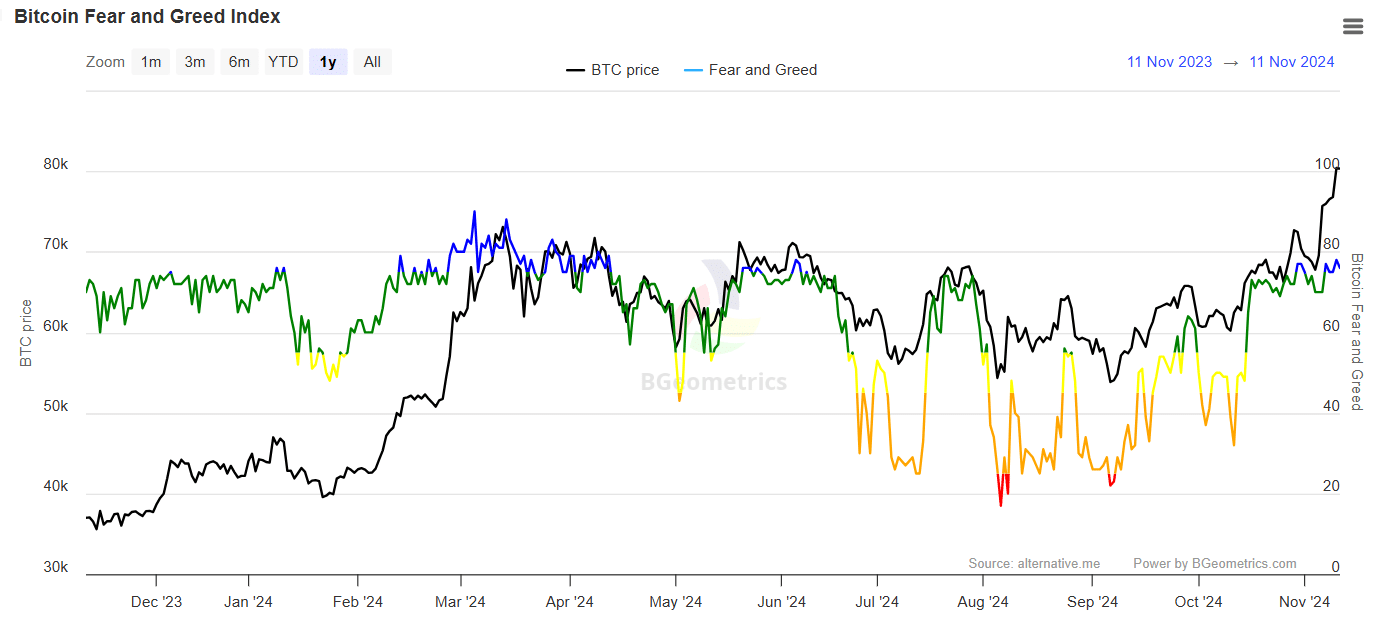

With almost all Bitcoin [BTC] holders of profits, market sentiment balances between greed and fear. While BTC is breaking records with a new ATH of $81,000, the crypto greed index has hit a seven-month high.

This situation is fragile because greater greed can push prices higher, but a sudden change in sentiment can lead to a quick sell-off.

Crypto greed index shows signs of overvaluation

For context, the crypto greed index helps investors gauge market emotions, which can have a major impact on buying and selling decisions. Facts from CoinMarketCap shows that the market is gradually descending into extreme greed.

Before Bitcoin reached $80,000, the market was in a greedy position. While high levels of greed suggest that investors are still seeking more upside, extreme greed could signal overconfidence, increasing the risk of a market correction as we saw during the March rally.

Source: BGeometrics

In March, when BTC reached the benchmark of $73,000, the crypto greed index peaked at 90. As the index signaled extreme greed, many investors decided to exit the market after reaping huge profits from the rally. Then the price returned to $67,000 in less than a week.

With the crypto greed index hitting a seven-month high and reflecting similar market sentiment, the question arises: does this indicate that BTC is due for a correction, especially with 100% of holders currently making profits?

Bulls bet on further rise

With BTC up over 2% from the previous day’s closing price despite entering a risky phase, it is clear that investors are optimistic about Bitcoin’s long-term potential.

This optimism is reflected in the high crypto-greed index, which currently indicates stronger than normal risk behavior in the market.

Simply put, investors may overlook potential risks in pursuit of outsized returns, indicating a willingness to remain invested despite signs of overvaluation.

However, this confidence must remain stable in the coming days to prevent BTC from falling below the crucial $80,000 level.

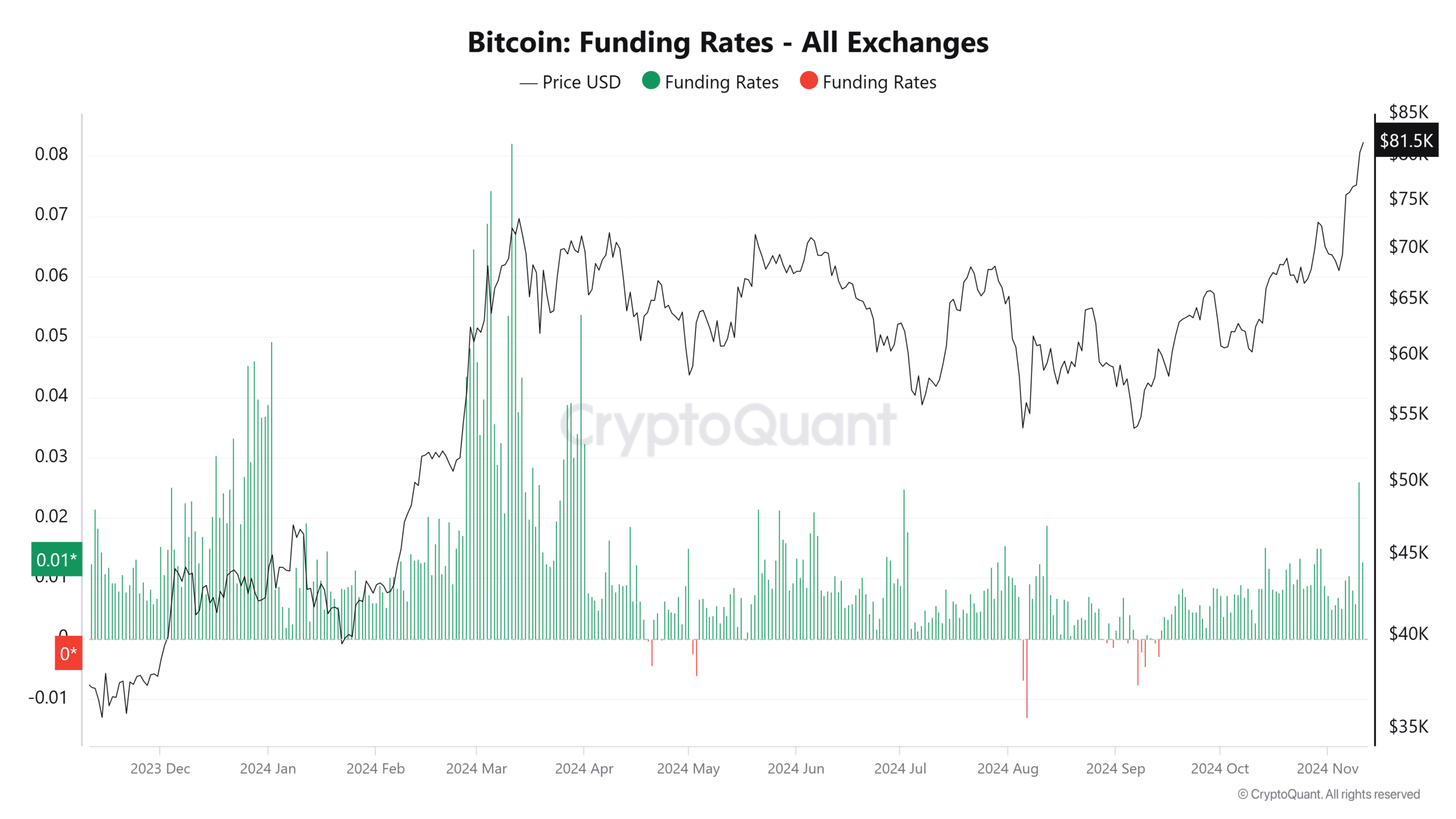

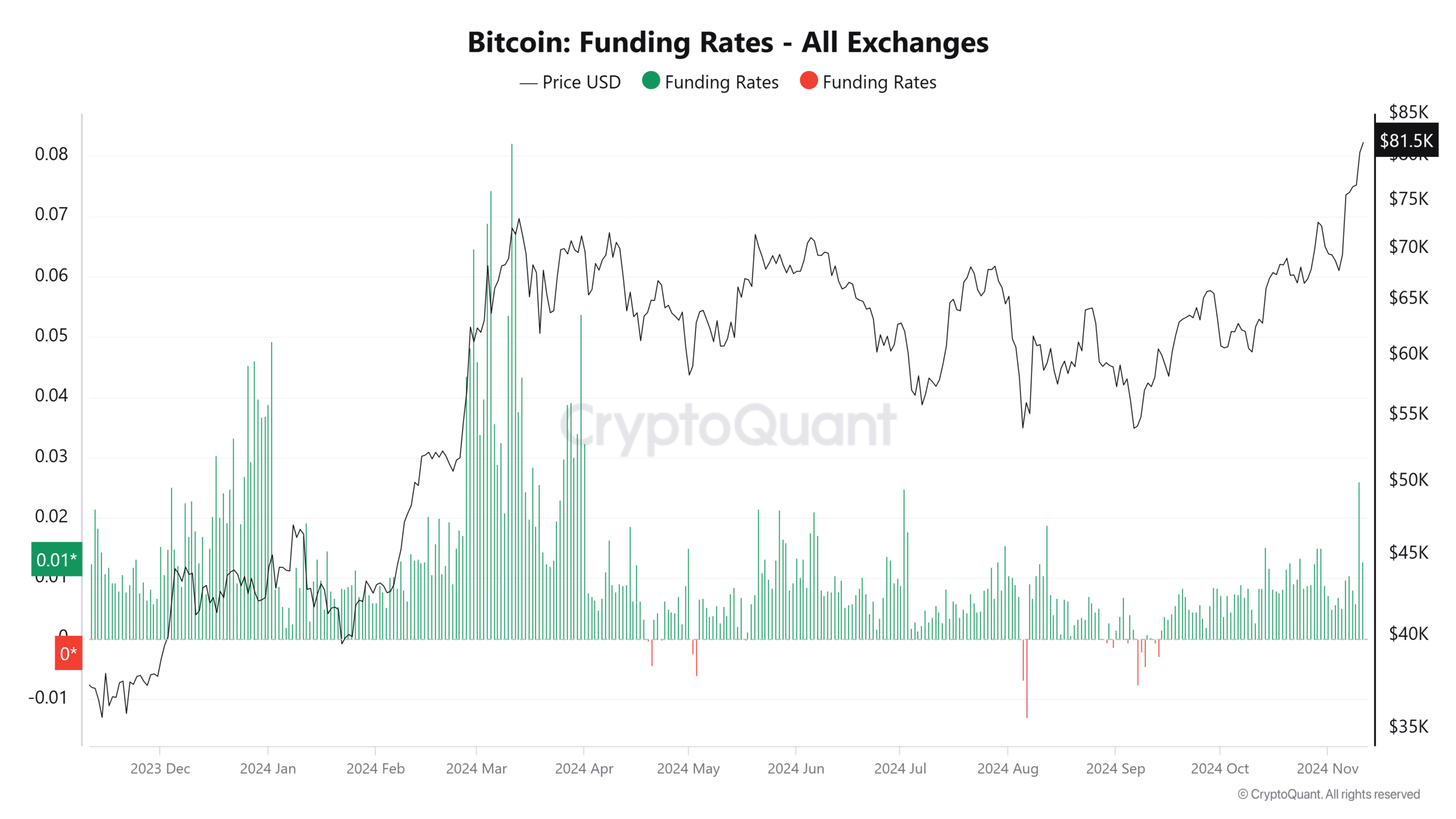

Source: CryptoQuant

In the derivatives market, bulls are currently dominating short sellers, strengthening the crypto greed index. While bullish activity remains strong, it still falls short of the intensity seen during the March rally.

Read Bitcoin’s [BTC] Price forecast 2024-25

However, the combination of robust whale accumulationnew bulls entering the market, a derivatives landscape dominated by longs, and a high greed index indicate that a top may still be far away.

This creates a favorable arrangement for a potential short squeezewhere BTC could rise to $85K before the end of the month as investor optimism and risk-taking reach unusually high levels.