Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Distitible and Español.

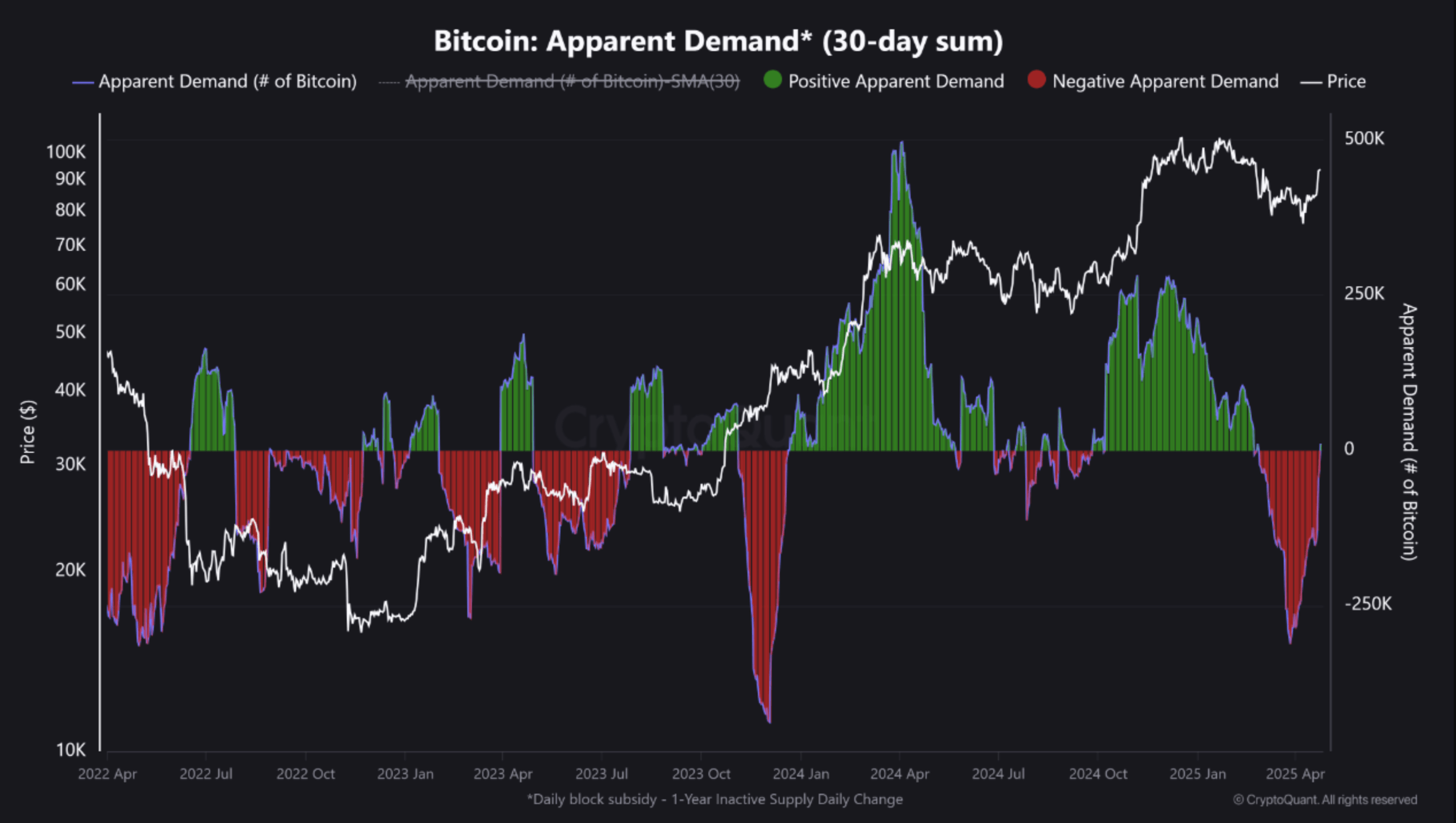

As Bitcoin (BTC) closer to the psychologically significant milestone of $ 100,000 Randt, various technical and on-chain indicators suggest that a large outbreak could be on the horizon. Such a statistics – the apparent demand from Bitcoin – has shown a strong rebound, demonstrated a renewed interest and persistent accumulation in the market.

Bitcoin sees a sharp rebound in clear question

According to a recent cryptoquant Quicktake post, the IT tech contribution pointed to a significant increase in the apparent demand from BTC. The most striking thing is that this key indicator has returned to a positive area after having spent several consecutive weeks in the red.

Related lecture

For the non-deded, Bitcoin’s apparent demand (30-day sum) measures the cumulative net demand for BTC in the past 30 days by following the accumulation of wallets and exchange outflows. A strong increase in this metric suggests a strong, long -term purchasing pressure that may indicate bullish sentiment and potential for a price rally.

The following graph illustrates this rebound in the apparent demand of BTC, which essentially reflects net changes in a year of inactive supply, adapted by daily block-releases and a metric designed to better represent organic demand growth.

Earlier, this metric had fallen deep in the negative area -under -200,000 (marked in red) -what suggests that the decreasing demand. The recent reversal in positive territory, however, indicates that long-slept capital flows back into the market. As noted in the post:

The demand villains is closely aligned with the recent price rebound above $ 87k, which means that this recovery is supported by real behavior on chains instead of purely speculative streams.

This marks the first positive apparent question that has been reading since February and corresponds to rising inflow into spot Bitcoin exchange-exchange funds (ETFs), as well as the growing accumulation by holders in the long term.

Facts SOSOVALUE shows that the VS -based spot BTC ETF’s have registered five consecutive days of net positive inflow, a total of more than $ 2.5 billion. The cumulative net entry into spot BTC ETFs is now at an impressive $ 38.05 billion.

Is a BTC rally in sight?

IT Tech noted that in the past, in the apparent demand, in the apparent demand, important rallies or periods of strong price support were preceded. If the current trend continues, BTC may have the momentum that is needed to challenge the level of $ 90,000 in the short term.

Related lecture

However, analysts warn that Bitcoin must keep his current support around $ 91,500 to maintain upwards Momentum. This level is especially important because it is close to the realized price of BTC holders in the short term, according to To cryptoquant employee Crazzyblockk.

Further add to these prospects, prominent crypto analyst stretches Capital emphasized That bitcoin has to secure a weekly close to $ 93,500 and win back as support to establish a clear path to $ 100,000. At the time of the press, BTC acts at $ 94,492, an increase of 2% in the last 24 hours.

Featured image of Unsplash, graphs of cryptoquant and tradingview.com