- BTC fell 3.5% on Monday following Powell’s comments on Fed rate cuts.

- The asset remained above the key short-term support at $63,000, but will it hold?

Bitcoin [BTC] and US stocks fell during the intra-day trading session on Monday, September 30. BTC fell 3% to reach $63,000, coinciding with Fed Chairman Jerome Powell’s comments on expectations for rate cuts.

Speaking in Nashville at the National Association for Business Economics conference, he showed no preference for a faster or slower pace of rate cuts.

He provided two more rate cuts, each by 25 basis points, before the end of the year.

“If the economy develops as expected, that would be two more cuts by the end of the year, amounting to a total reduction of half a percentage point more.”

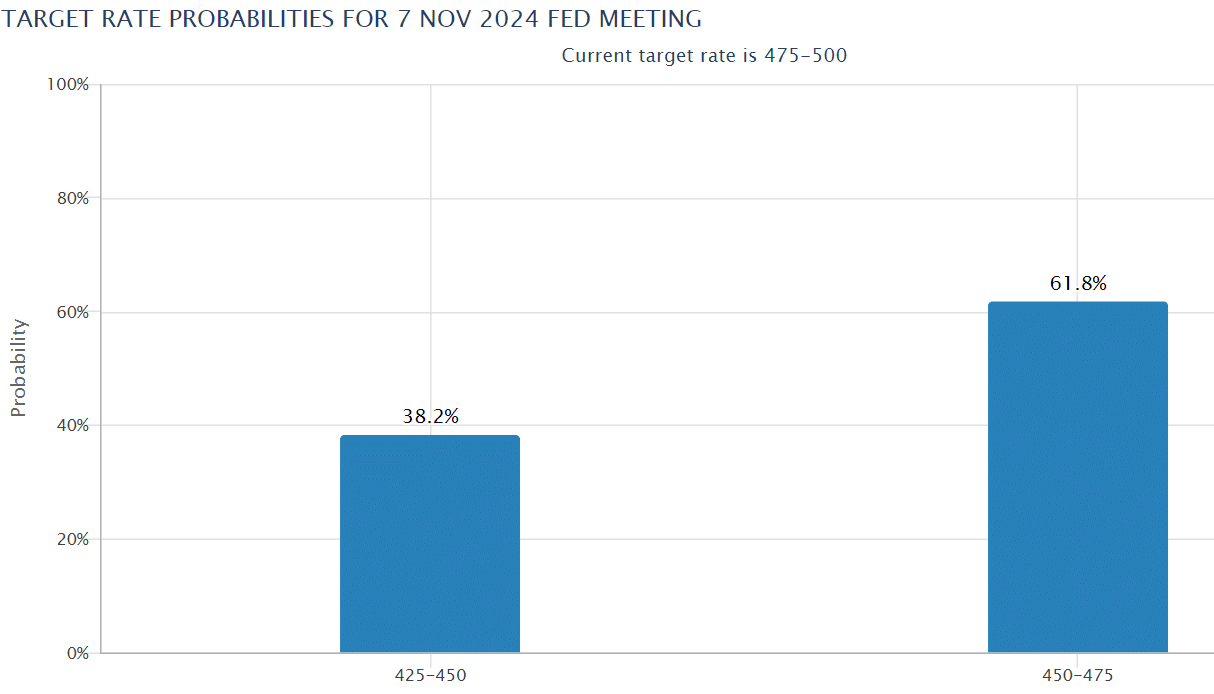

Revision of Market Expectations for Fed Rate Cut

Last week, the market expected an additional aggressive cut of 50 basis points in November, similar to the move in September.

Source: CME FedWatch

However, at the time of writing, interest rate traders were pricing higher chances of 25 bps versus 61.8% after Powell’s comments.

On the contrary, the probability of a 0.50% reduction fell from 53% last Friday, September 27, to 38.2%.

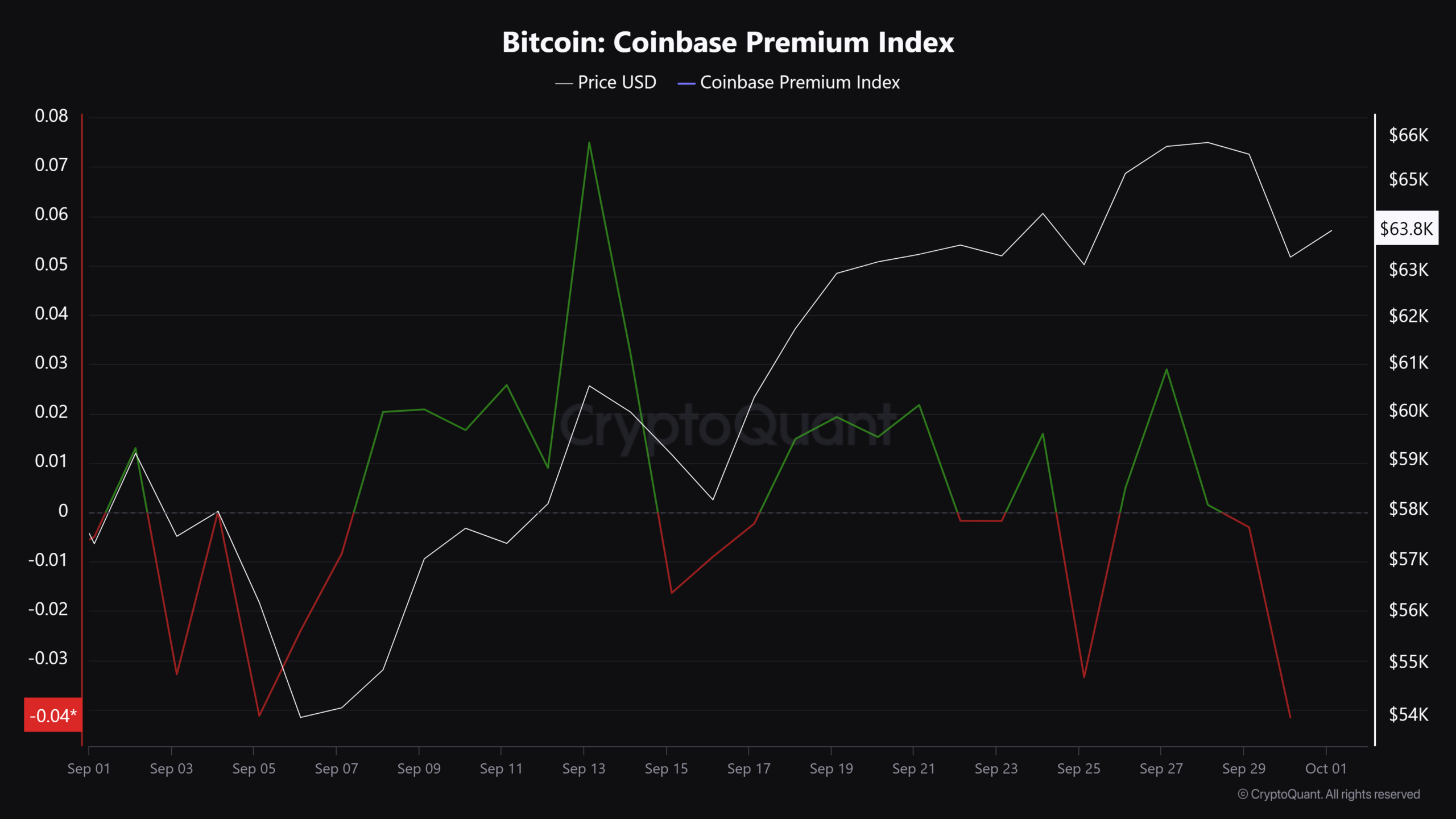

This has led to a shift in sentiment heading into the new week, ahead of crucial US workers updates. Notably, US demand for BTC fell from last Friday’s positive value to negative value on November 1, according to the Coinbase Premium Index.

Source: CryptoQuant

Compared to the nearly $500 million daily inflow into US spot BTC ETFs last Friday, the products raised just $61.3 million on Monday, September 30.

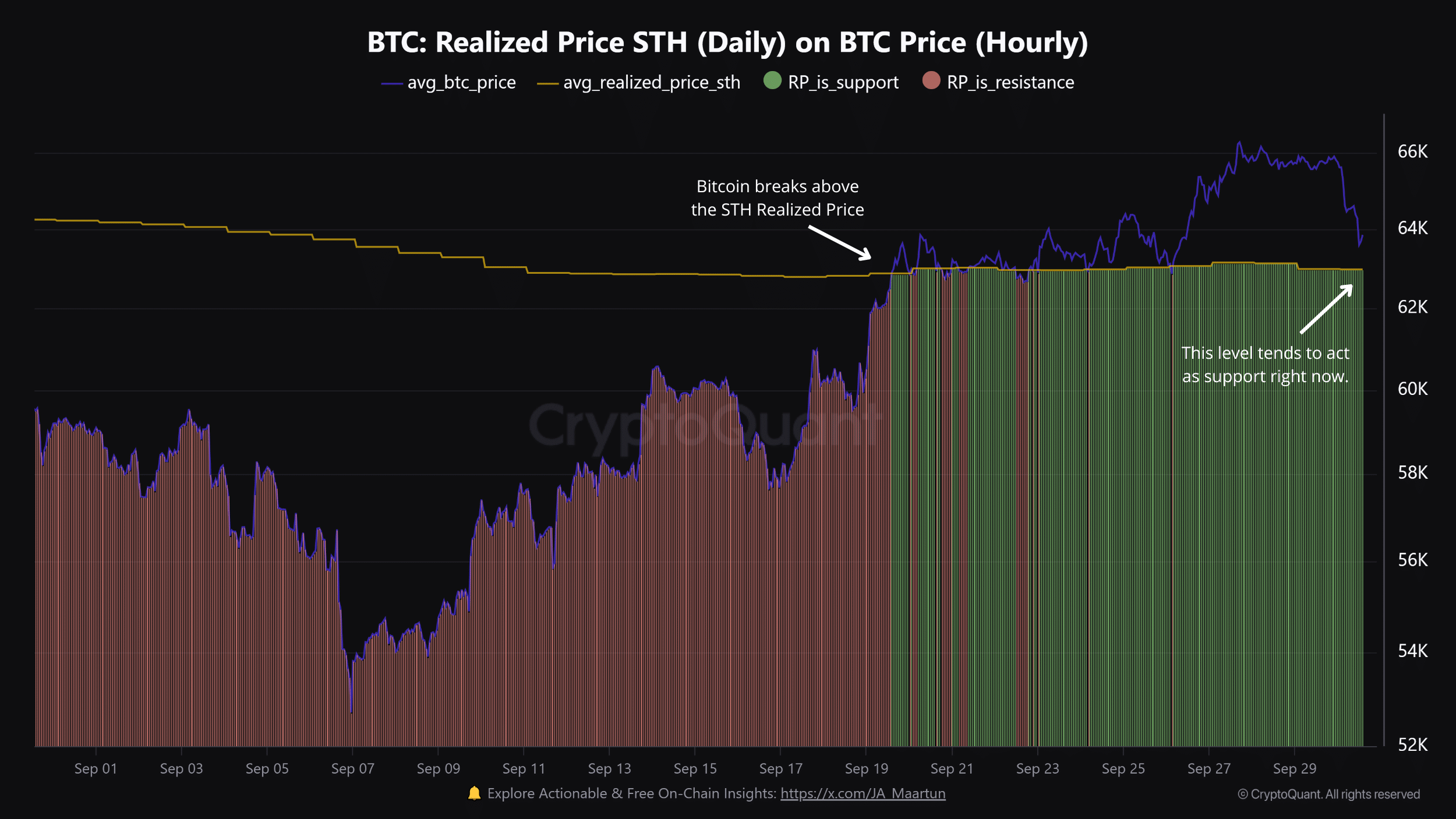

That said, the $63K level could be crucial support in the near term. As noted by CryptoQuant, the level was the short-term holders’ realized price (STH) and had acted as support since mid-September.

Source: CryptoQuant

At the time of writing, BTC was valued at $63.9K, ahead of crucial US labor market updates.

Another potential positive catalyst was a growing signal that the Fed’s quantitative tightening (QT) was coming to an end, as more and more institutions tap into the Fed’s Repo Facility. This could inject more liquidity from the Fed and boost risky assets.

However, rising geopolitical tensions in the Middle East could also challenge BTC’s Uptober expectations and are worth monitoring.