Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

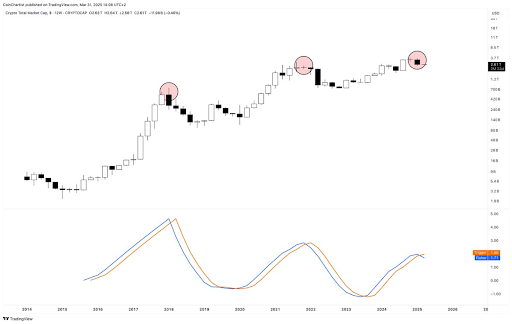

Technical expert Tony Severino Has warned that the Bitcoin and Altcoins Fischer transformation -indicator has reversed Beerarish for the first time since 2021. The analyst has also revealed the implications of this development and how it can affect this crypto assets.

Bitcoin and Altcoins Fischer Transform -Indicator become Bearish

In one XSeverino revealed that the total crypto-market capitalization has turned Fisher Transform for the first time since December 2021 for the first time. Previously, the Beerarish indicator had reversed in January 2018. In 2021 and 2018, the Total crypto -market capitalization Fell 66% and 82% respectively. This offers a bearish look at Bitcoin and Altcoins, which suggests that they could suffer a huge crash soon enough.

Related lecture

In another X-post, the technical expert revealed that Bitcoin’s 12 weeks Fischer -transformation Also reversed bearish. Severino noted that this indicator turns prices into a Gaussian normal distribution to smooth out price data and filter out noise. In the process it helps help by generating clear signals that help determine the most important turning points of the market.

Severino claimed that this indicator never missed a top or bottom call at the 12-week period, indicating that Bitcoin and Altcoins have indeed been attacked. The expert has been warning for a while that the Bitcoin -top is possible and that a huge crash could be on the horizon for the flagship Crypto.

He recently pointed to the Elliott Wave theory and market cycles to explain why he is no longer bullish Bitcoin and Altcoins. He also emphasized other indicators, such as the parabolic SAR (stop and backwards) and the average directional index (ADX), to demonstrate that the Bullish Momentum of BTC fades. The expert also warned that a BTC sales signal could send to a super trend -NeerWaartse trend, where the flagship Crypto dropped to as low as $ 22,000.

A different perspective for BTC

Crypto analyst Kevin Capital has given a different perspective on the Bitcoin price action. While he notes that BTC is in a correction phase, he confirmed that it will soon be over. Kevin Capital claimed that the question is not whether this phase will end. Instead, it is about how strong Bitcoin’s bounce will be and whether the flagship Crypto will make new highlights or take a matte lower high, followed by a bear market.

Related lecture

The analyst added that the Bitcoin price action when that time comes, can also be followed with the help of other methods, such as money flow, macro -fundamentals and the total spot volume. The most important focus is on the macro fundaments that market participants are looking forward to Donald Trump’s long -awaited mutual rates, which will be announced tomorrow.

At the time of writing, the Bitcoin price acts at around $ 83,000, an increase of approximately 1% in the last 24 hours, according to facts Van Coinmarketcap.

Featured image of Unsplash, graph of TradingView.com