- Bitcoin’s Piek In exchange CDD inflow, has yielded historically non-linear results.

- The most important factor? Market sentiment and macro -readidity trends.

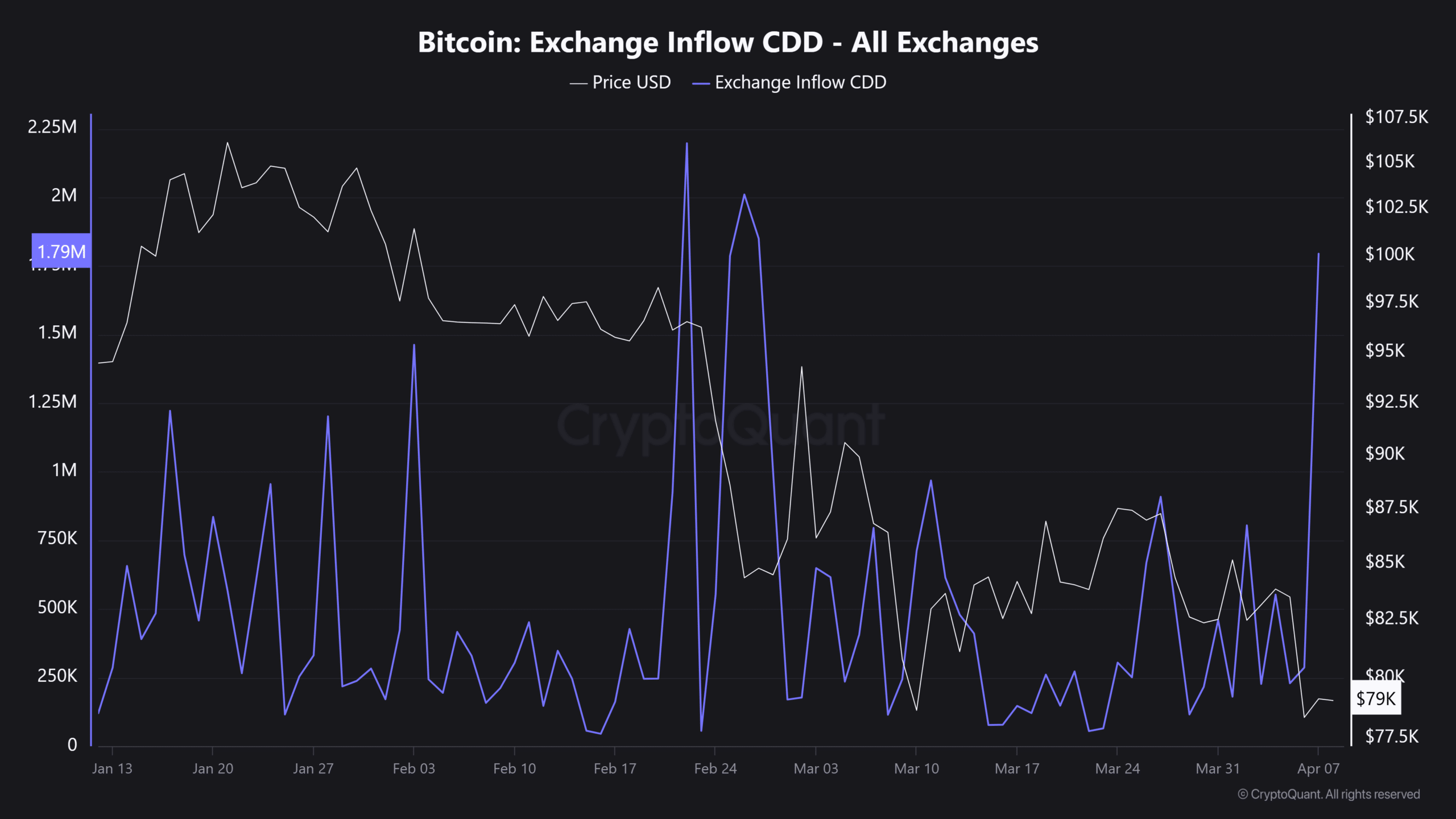

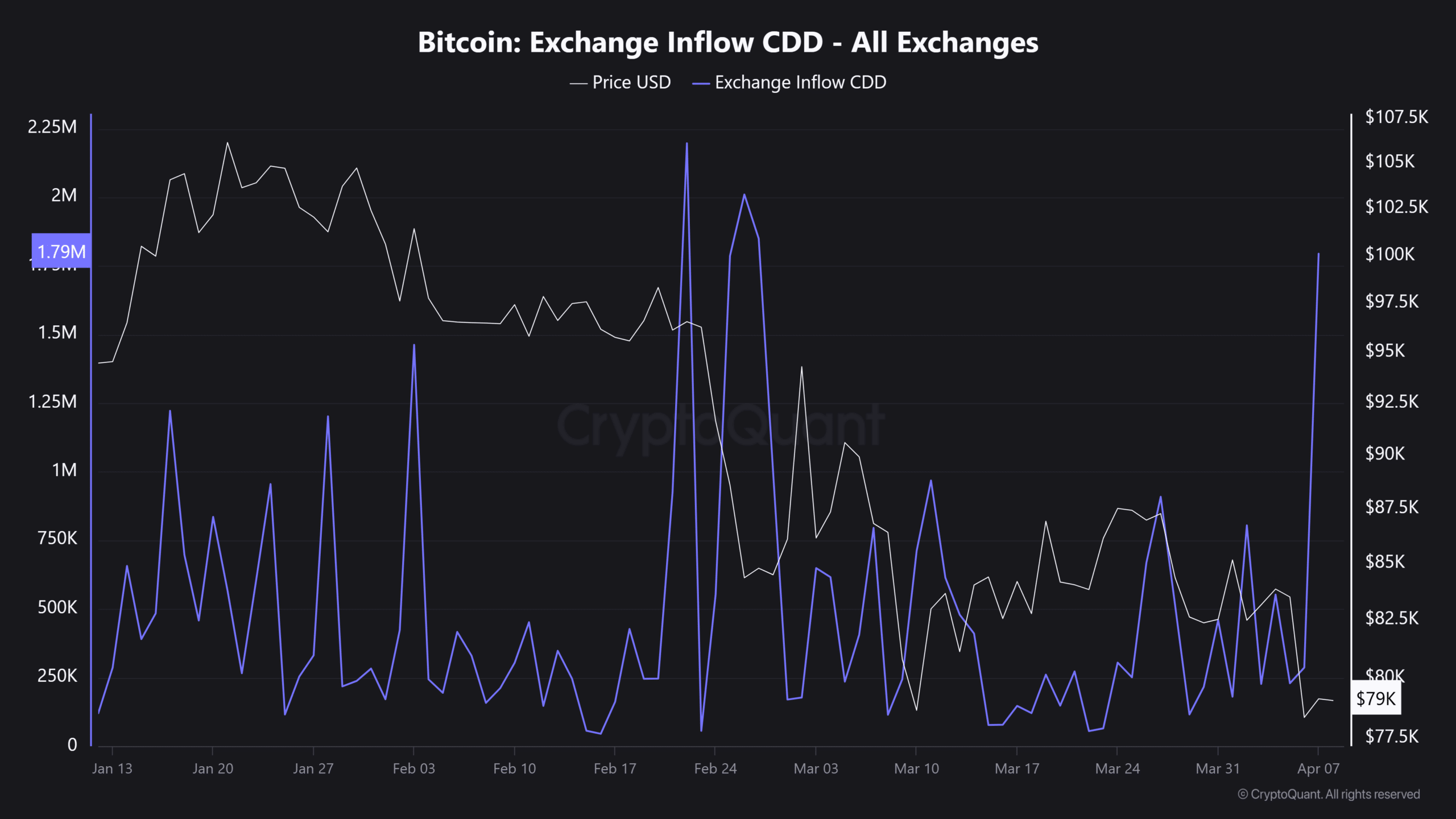

Bitcoin [BTC] I just fallen under $ 75k, the lowest in five months, exactly like the exchange rate CDD spiked. This raises an important question: losing long -term holders trust, or is this a tactical liquidity shift?

A rising CDD is often preceded by the sale, but it can also indicate capital that runs in derivatives for cover or leverage.

If the inflow remains increased, the sales pressure could build. But if this is only repositioning, Bitcoin might be preparing for the next move with high volatility.

Historical CDD -Spikes and their market impact

Historically, CDD spikes had mixed results. Although they sometimes precede sharp corrections, there have also been cases where Bitcoin collected post-spike.

As a result, signaling smart money positioning instead of panic sales.

On February 22, for example: a remarkable CDD over voltage tailored to BTCs 19% deviation from $ 96,186 to $ 78,173 within a week. Data on chains Confirmed a 12K BTC decrease in the long-term holder (LTH) Supply, which reinforced a distribution event.

Source: Cryptuquant

On March 5, 2024, however, Bitcoin came to the highest highlight of $ 73k, which marked an increase of 16% within a week. In particular, this rally followed a red candlestick with 6.4% single day.

That is why a possible exhaustion -shake suggests before the price eviction. It is a common market behavior in which the price dives to shake out weak hands before they get higher.

However, there is an important development. Similar to the Rally of February, Lth Stover Saw a sharp decline, indicating that Bitcoin was moved to exchanges. Nevertheless, BTC’s price rating defied expectations.

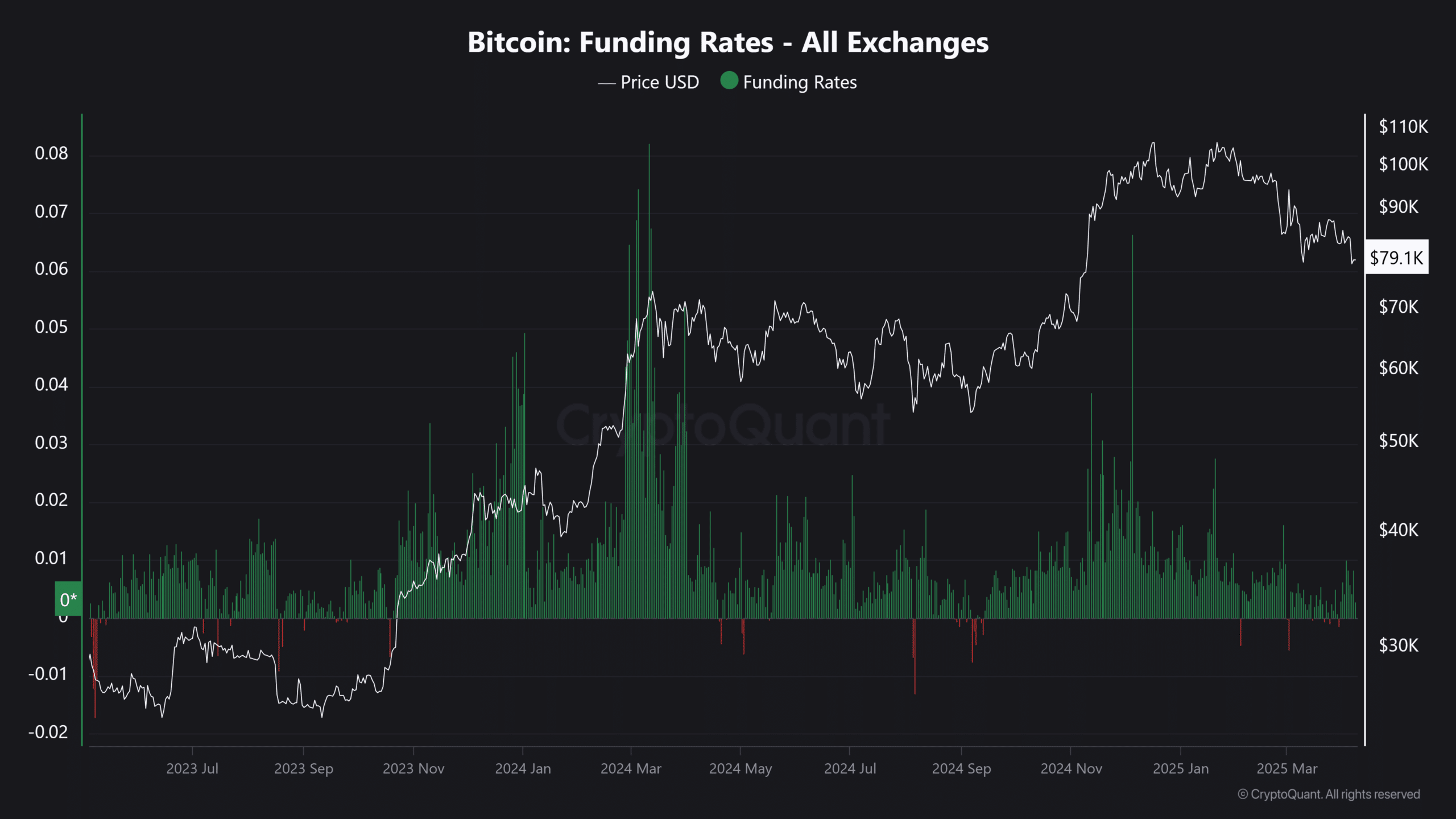

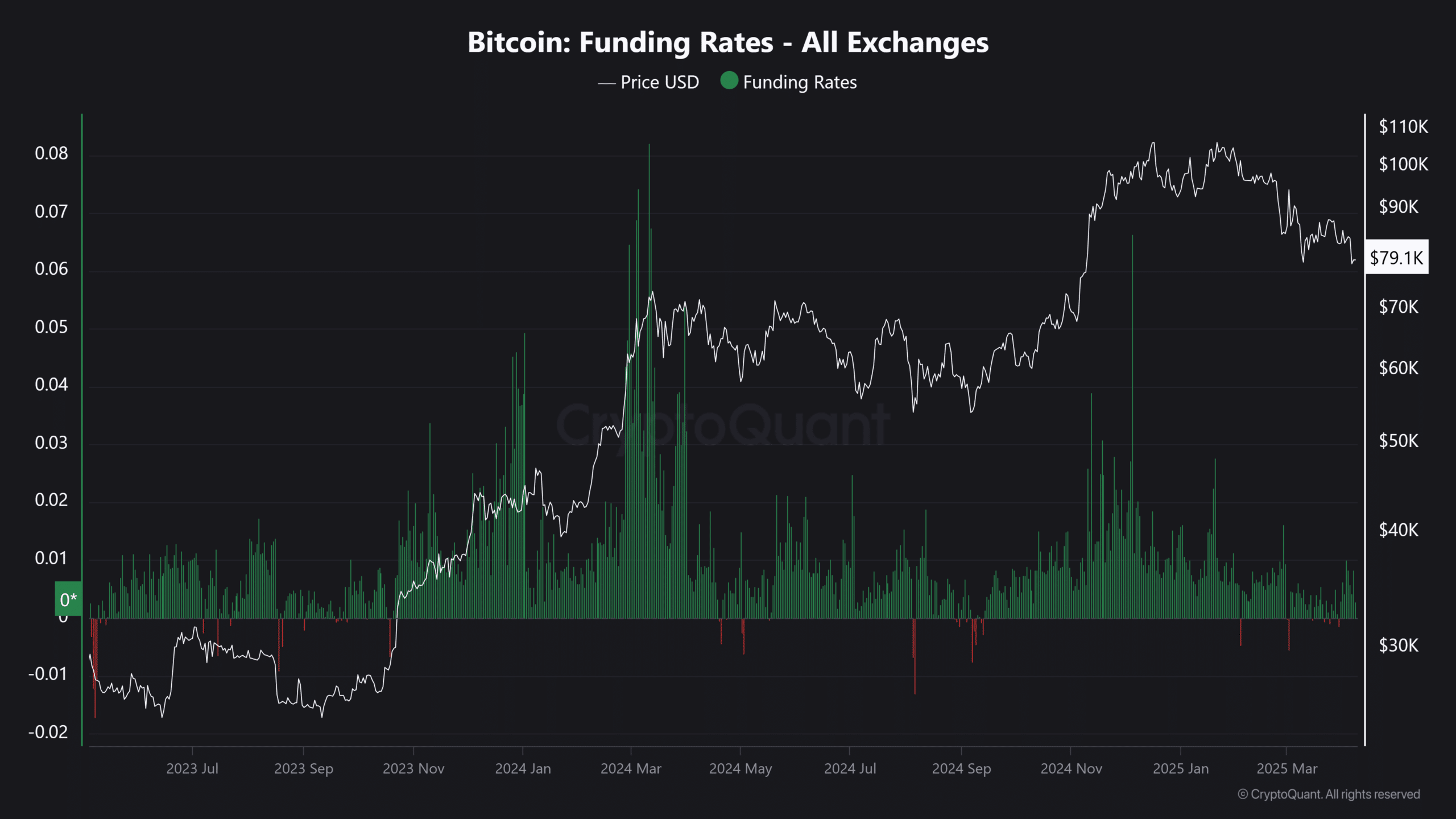

A crucial insight arose on further investigation. During the Rally of March, Open Interest (OI) streamed From $ 32.01 billion to $ 35.81 billion.

This confirms that Futures markets actively stimulated the price promotions. In other words, LTH-Liquidity was not pure, but fed by livered long positions.

Bitcoin at a decision point: re -test or rebound?

On April 6, Bitcoin’s Exchange inflow cdd was 286k. Only a day later it rose to around 1.8 million – a huge peak of 529%. This indicated that older BTC was moved to exchanges.

The most important question now is whether this peak will lead to a correction in February style or the resilience of Mirror March.

Interestingly, BTC recovered 1.10% the day after this increase to close to $ 79,164, suggesting that the market saved the initial wave of liquidity.

Trends on the chain offer extra insights. Short -term holder (StH) delivery has fallen to a low-month-old low, while the LTH food remains stable, indicating that long-term conviction remains intact.

In the meantime, the financing percentages (FR) are in accordance with the levels of March, which strengthens the idea that the activity of derivatives plays a dominant role in price action.

Source: Cryptuquant

In addition, Open Interest (OI) has recovered The $ 51 billion marking, which indicates high liquidity that flows into leverage.

With financing percentages, however, skewed crooked in the direction of Longs, over -positioned positions can be confronted with liquidation as STHs continue to sell.

The silver lining? Despite the CDD peak, no major sale pressure has always been released. If Bitcoin follows the rally structure of March, this lost resistance levels could recover faster than expected.