- Bitcoin is up 39.72% in the past month.

- One analyst predicted a December rally to $140,000, citing historical performance.

After the US presidential election, Bitcoin [BTC] saw an exponential increase, from a low of $66,000 to a new all-time high of $99,800.

However, since reaching this high, the price has undergone a market correction, returning to $90,742. This increased market volatility has left crypto analysts conflicted, with some optimistic about a rise of over $100,000 while others saw a potential decline.

One of these optimistic analysts is the popular crypto analyst Ali Martinezwho has proposed a meeting in December, citing the US presidential elections.

Historical Performance of Bitcoin

In his analysis, Martinez stated that Bitcoin rose historically strongly in December following the US presidential elections.

Source:

According to him, BTC has made significant gains over the past two cycles. As such, BTC rose from a low of $17,570 to a high of $29,300 in 2020, marking an increase of 66.84%.

In 2016, BTC rose from $740 to a high of $981. This was an increase of 32.56%.

This historical pattern shows Bitcoin experiencing price pumping in December after the US presidential election.

So if history is anything to go by, we could see BTC making significant gains throughout the month. In this regard, Martinez predicted that the King could score between $125,000 and $140,000.

What the graphs say

Although Bitcoin has retreated since reaching its current ATH, the king coin remained in a bullish phase. As such, prevailing conditions only point to potential profits on price charts.

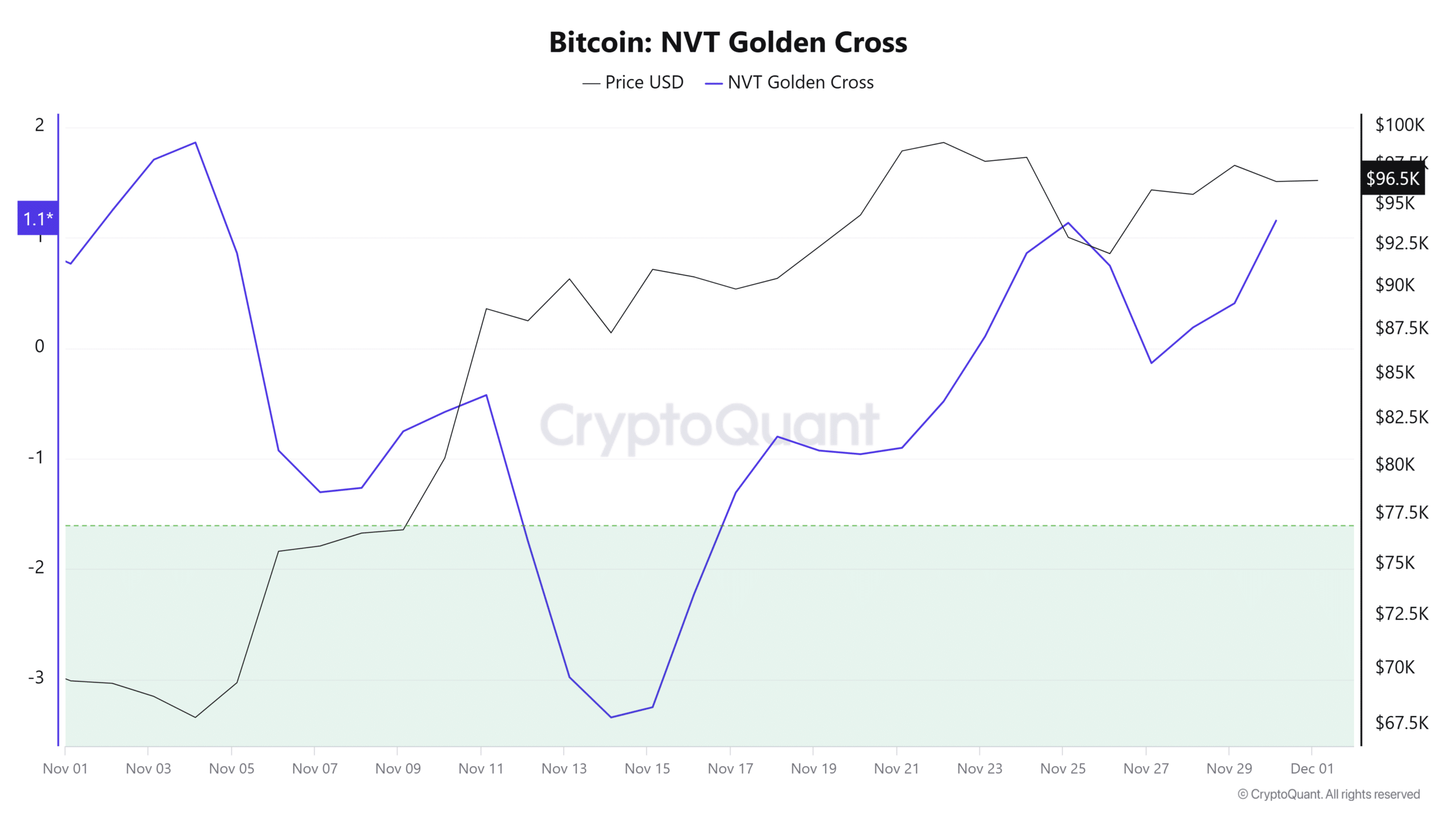

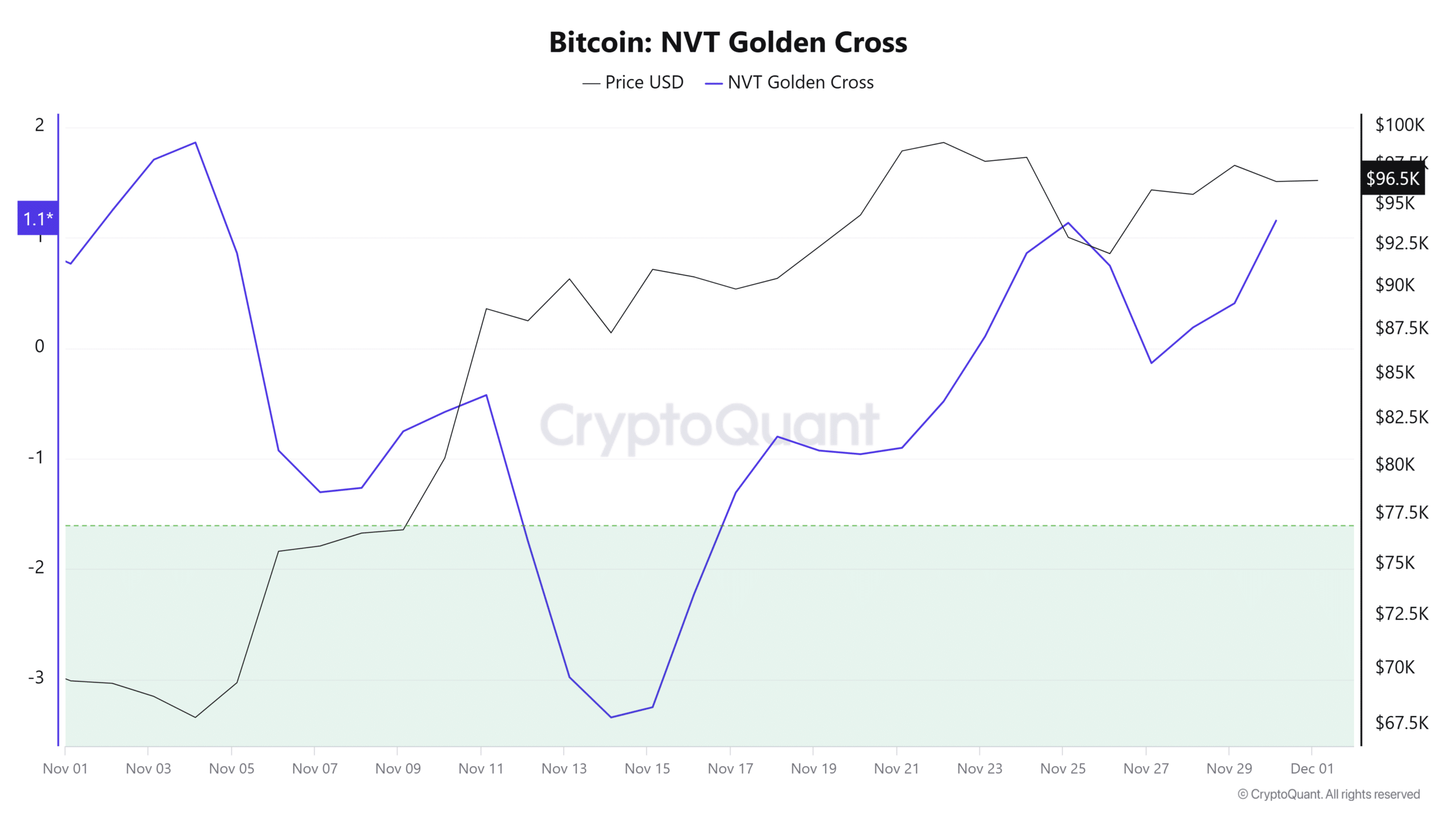

Source: Cryptoquant

For example, the Bitcoin NVT Golden Cross has risen from -0.13 to 1.1 at the time of writing. When the golden cross of NVT rises, it indicates long-term confidence in the asset’s growth trajectory.

As such, investors value the network beyond current on-chain operations and see growth potential regardless of transaction volume.

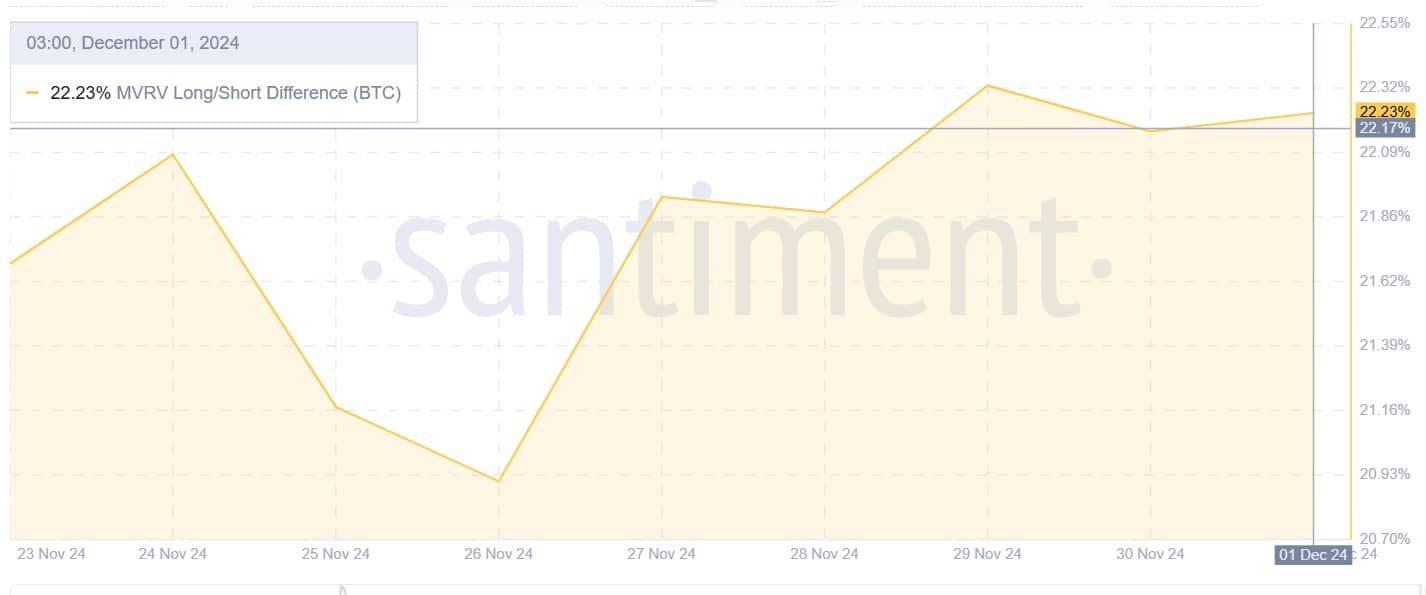

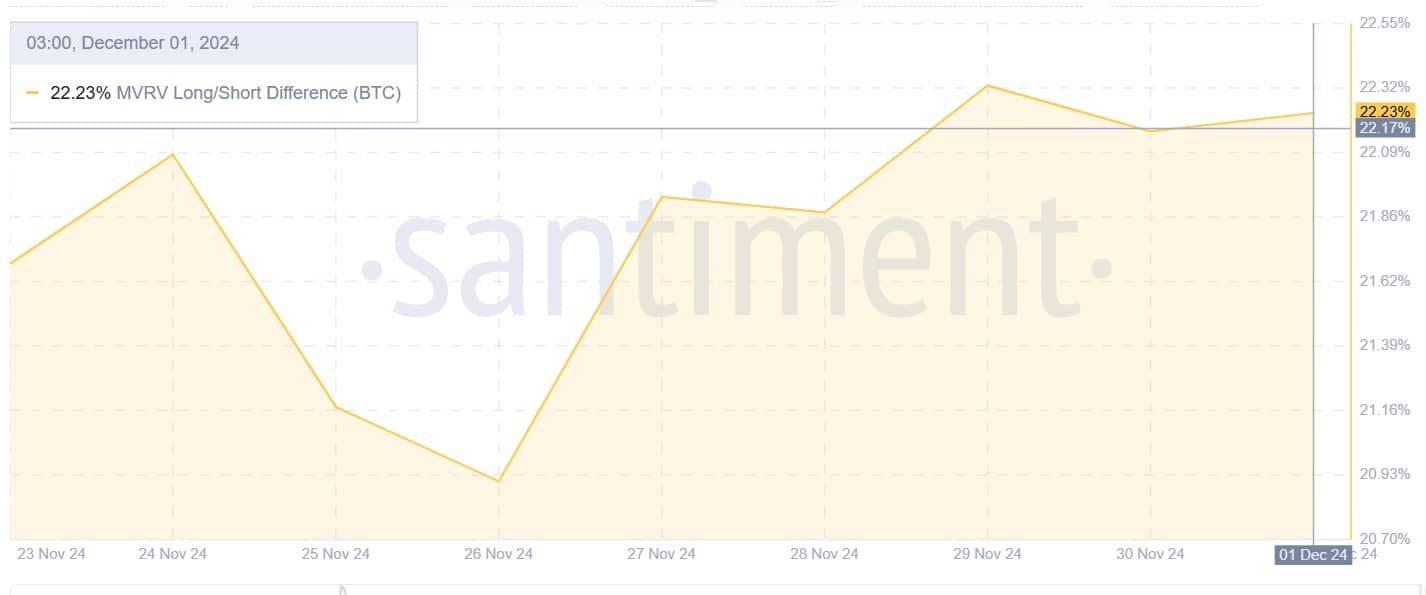

Source: Santiment

Moreover, this long-term confidence is further evidenced by the rising MVRV difference between long and short term.

A strong rise in this indicator indicates that long position holders are increasingly confident, even though they are currently making profits.

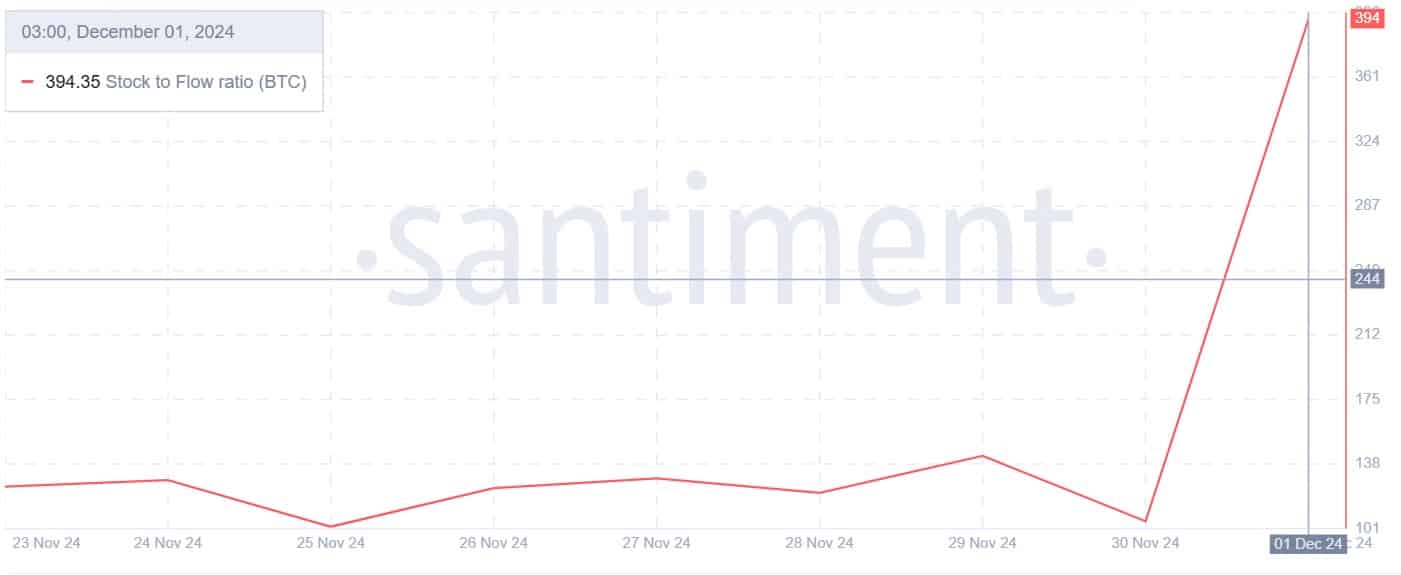

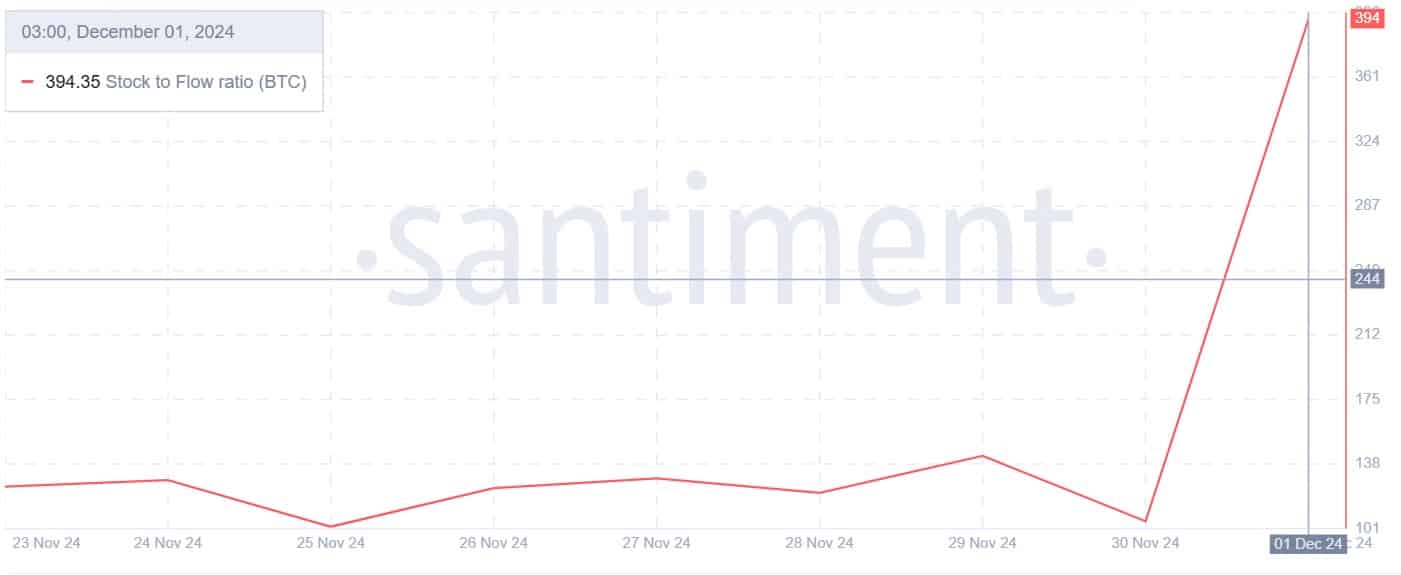

Source: Santiment

Finally, Bitcoin’s stock-to-flow ratio has risen from a low of 105 to 494 at the time of writing. An increase in the SFR shows that BTC is currently scarce and in low supply.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Normally, scarcity is the true measure of Bitcoin’s value, and when it is scarce and demand rises, prices rise.

In short, Bitcoin is well positioned for more gains. The recent market setback appears to be just a correction before a new uptrend begins.