- Bitcoin hits $ 111k Ath, Google surpasses the 6th largest worldwide assets in Market Cap.

- Macro -economic instability and rising inflation stimulate investors to prefer Bitcoin to gold and bonds.

Bitcoin [BTC] has just achieved a new chapter in financial history.

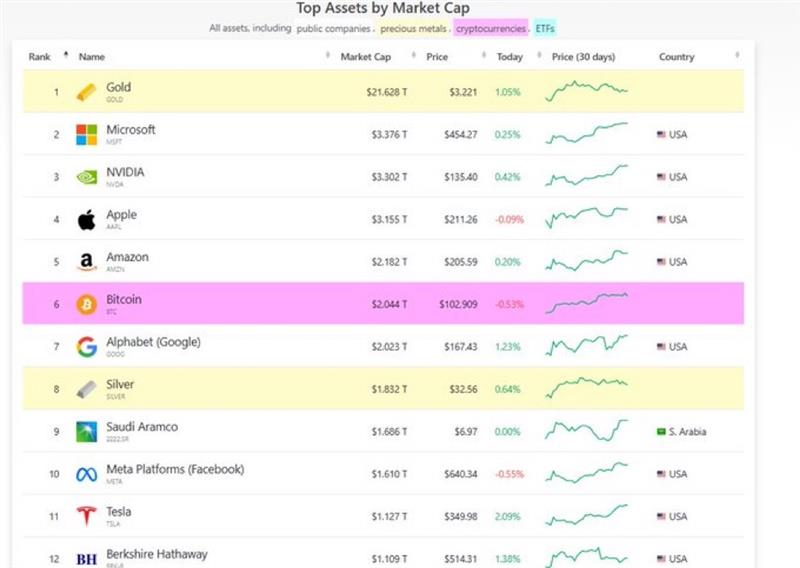

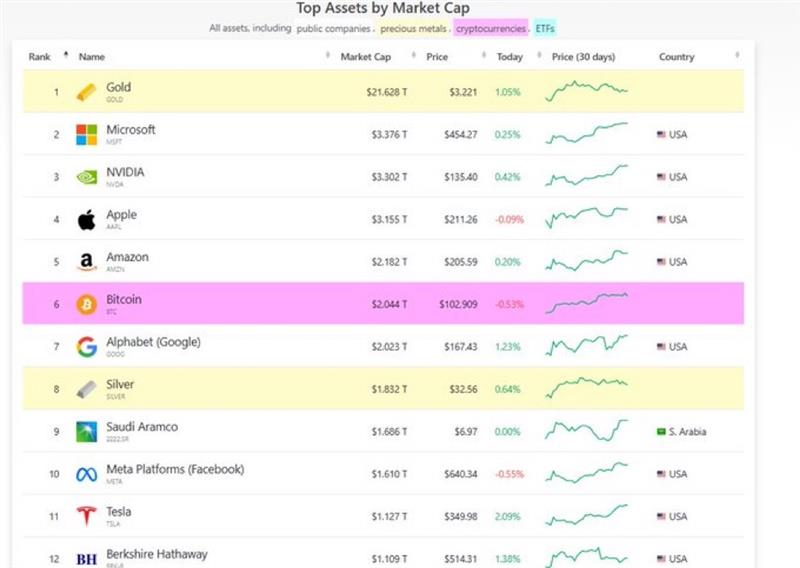

The King Crypto surpassed his previous record and hit a new $ 111K ATH for the first time and has overtaken Google in market value.

Bitcoin, arranged as the world’s sixth largest possession, is now just behind Gold, Microsoft, Nvidia, Apple and Amazon, who shows his growing weight in the global financial landscape.

Bitcoin breaks new terrain!

Bitcoin rose past $ 111k on May 21, raised a new all time and closed the Daily Candle at $ 110k on Binance.

Source: TradingView

The relocation is dopping a week of steady profit, with BTC climbing more than 10% since 17 May. In particular, the RSI was at 77.42 at the time of the press, which points to Overboughteconditions when traders pushed the prices into unknown territory.

Although the momentum remains strong, technical signals suggest that the rally could be a phase of increased volatility.

Bitcoin racet along Google!

With a market capitalization of more than $ 2.17 trillion, Bitcoin has officially surpassed Alphabet (Google) to claim the sixth place under the world’s largest assets.

It is now just behind Amazon, Apple, Nvidia, Microsoft and Gold. The milestone places Bitcoin for traditional heavyweights such as silver, Saudi -Aramco and Meta.

Source: X

With the increasing bullish momentum, BTC can’t go up anywhere.

What’s behind the Golf?

Bitcoin’s climb beyond the $ 2 trillion market capital is the result of changes in the external environment.

Source: X

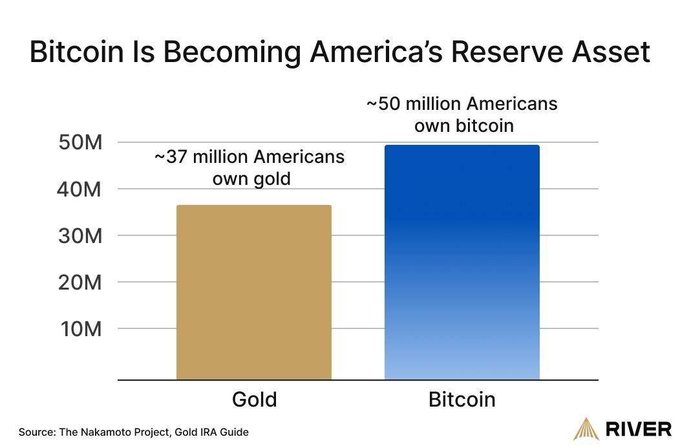

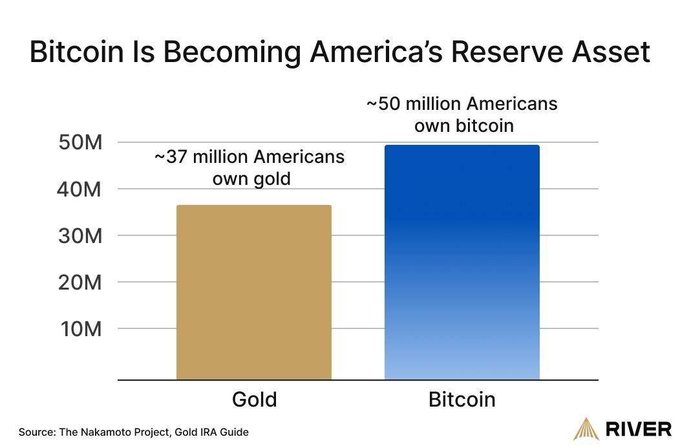

Bitcoin has reached his first trillion faster than most assets in history seen more and more As a hedge in a changing financial landscape.

In Japan, where inflation continues to climb, the King Coin Grip wins as a practical alternative to Fiat and traditional value walks of value.

In the US, concern about tax stability have added to his profession.

Robert Kiyosaki, author of ‘Rich Dad Poor Dad’, recently pointed to the failed American Treasury Bond auctions as a red flag, which suggests that trust in government debt is decreasing.

“Good news. Gold goes to $ 25,000. Silver to $ 70. Bitcoin up to $ 500 k to $ 1 million.”

His message Was clear: Americans turn to Bitcoin.

Source: X

This sentiment is confirmed in data that demonstrates bitcoin holders that exceed the collection of gold – a remarkable reversal in investor behavior.