Bitcoin’s price trend over the past week has been a source of concern for the majority of the crypto community. This has pretty much been the case for other cryptocurrencies on the market, with several large-cap tokens reversing their recently built gains.

However, some investors view the recent price drop as a rare bull market opportunity as they continue to fill their coffers with assets of their choice. Specifically, the latest on-chain data shows significant buying activity among a certain class of investors.

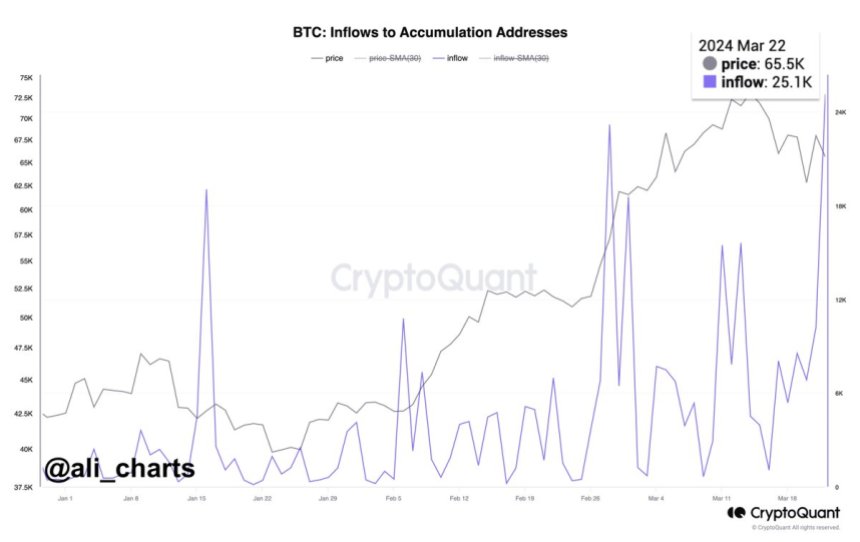

25,000 BTC flows to accumulation addresses in one day

Prominent crypto expert Ali Martinez revealed via a message on Xthat on Friday, March 22, more than 25,000 BTC (estimated at approximately $1.6 billion) was moved to accumulation addresses. This figure represents the highest amount transferred to these wallets in a single day so far in 2023.

The metric of interest here is the inflow to accumulation addresses on the Bitcoin blockchain. For context, a Bitcoin accumulation address refers to an address that has zero outgoing transactions and maintains a balance of at least 10 BTC.

A chart showing the inflows to Bitcoin accumulation addresses | Source: Ali_charts/X

However, this classification excludes digital wallets associated with centralized exchanges and miners and has less than 2 non-dust incoming transfers. It also does not include addresses that have not seen activity for more than seven years.

The increased flow of coins to this class of wallet addresses is evidence of substantial BTC accumulation by entities that view the crypto as a long-term investment. It indicates that certain players with a lot of money are accumulating Bitcoin in anticipation of a potential increase in value.

Furthermore, this major acquisition by long-term investors highlights the increasing adoption of Bitcoin as a store of value. Meanwhile, it could be an indicator of short-term bullish price movements.

Bitcoin price overview

At the time of writing, Bitcoin is valued at $64,636, reflecting a price increase of just 1% in the past 24 hours. This price change is somewhat negligible considering the major cryptocurrency’s deep retracement earlier this week.

According to data from CoinGecko, the price of BTC has fallen 2.4% over the past week. Meanwhile, the market leader is currently about 13% off its all-time high of $73,798.

However, it was an overall positive performance for the Bitcoin price in March, after it surpassed the previous all-time high of $69,000 just over a week ago. And with a market cap of $1.26 trillion, BTC maintains its position as the largest cryptocurrency in the industry.

The price of Bitcoin struggles to hold above $64,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.