- Bitcoin made $5.42 billion in profits

- Rising net flows saw BTC face near-term selling pressure near $90,000

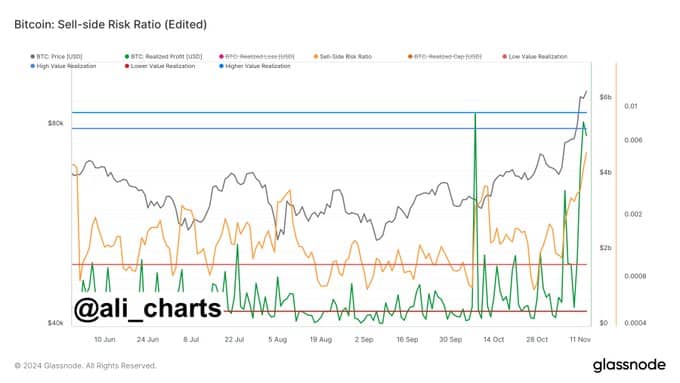

Bitcoin (BTC) has achieved a profit of $5.42 billion, according to the company market analyst Ali, while the sell-side risk ratio rose to 0.524%. This metric, which evaluates the balance between risk and reward for sellers, remains below historic highs, indicating that selling pressure is not yet at extreme levels.

Nevertheless, traders are advised to exercise caution as profit-taking increases.

Source: Glassnode

Realized profits rose faster than realized losses, with profits rising towards $8 billion, while losses were limited to around $1 billion at the time of writing. Such an imbalance is a sign of market optimism, as more investors take advantage of gains instead of selling at a loss.

The Bitcoin market remains resilient despite the recent price drop

Bitcoin traded above $91,000 at the time of writing, with a 24-hour trading volume of $84.43 billion. Although the cryptocurrency recently corrected on the charts, BTC rose just under 4% over the past 24 hours.

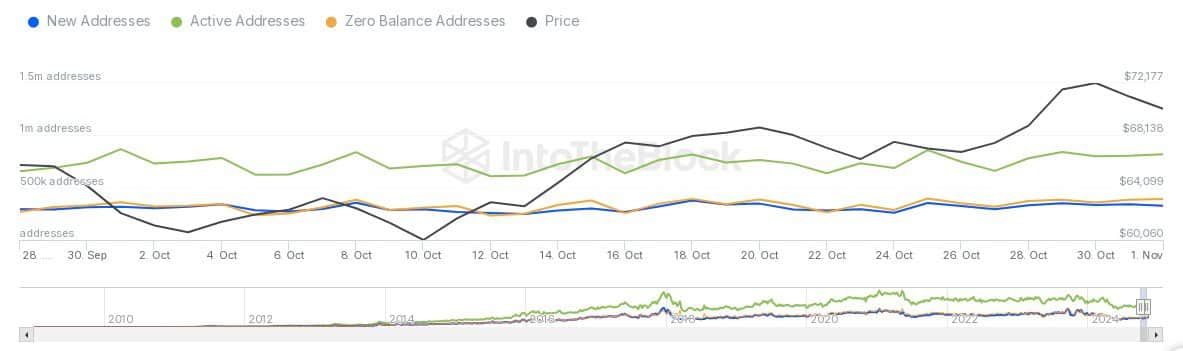

At the same time data from IntoTheBlock revealed that 307,000 addresses collected Bitcoin around an average price of $89,200. This level could act as a crucial zone of support or resistance depending on the direction of the market.

Source: IntoTheBlock

Bitcoin’s ability to maintain its price near this level will be closely watched as market participants assess its next move.

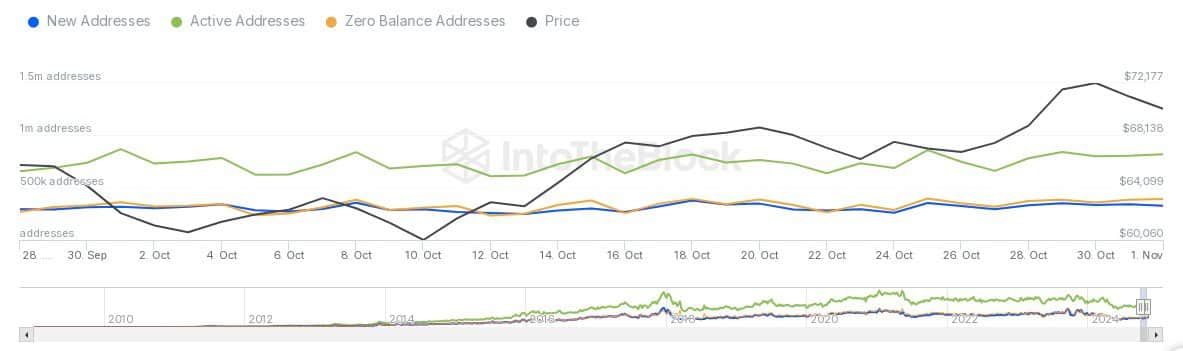

Network activity reflects growing adoption

The increase in the price of Bitcoin correlated with an increase in network activity. In fact, the data showed that both new and active addresses saw an increase – a sign of increased participation.

New addresses have also been steadily added, reflecting the new influx of users into the ecosystem. Active addresses, which represent participants in daily transactions, also increased to ~1.1 million, demonstrating sustained network engagement.

Source: IntoTheBlock

Meanwhile, the number of zero balance addresses has remained relatively flat, indicating no noticeable increase in dormant or abandoned wallets.

This trend can be interpreted as a sign of sustained trust and community involvement, even as Bitcoin’s price fluctuates on the charts.

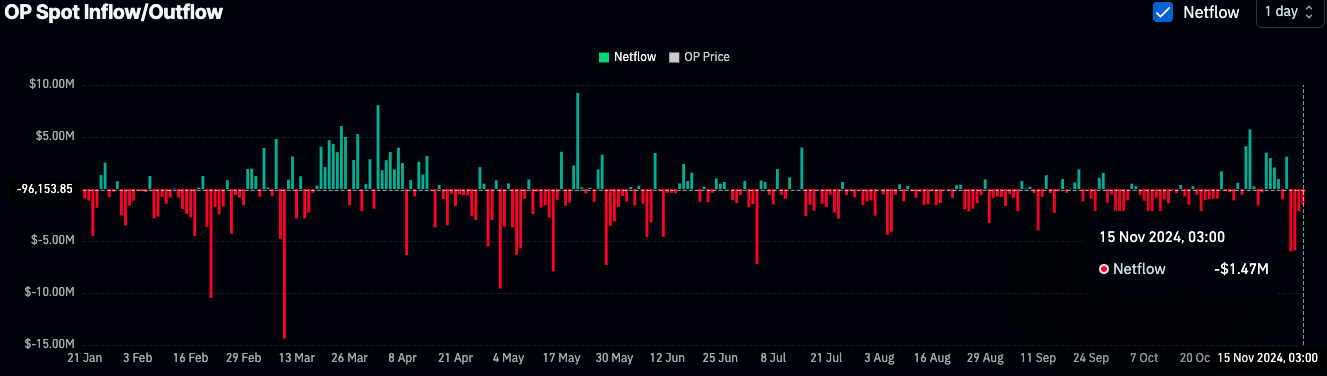

Short-term selling pressure?

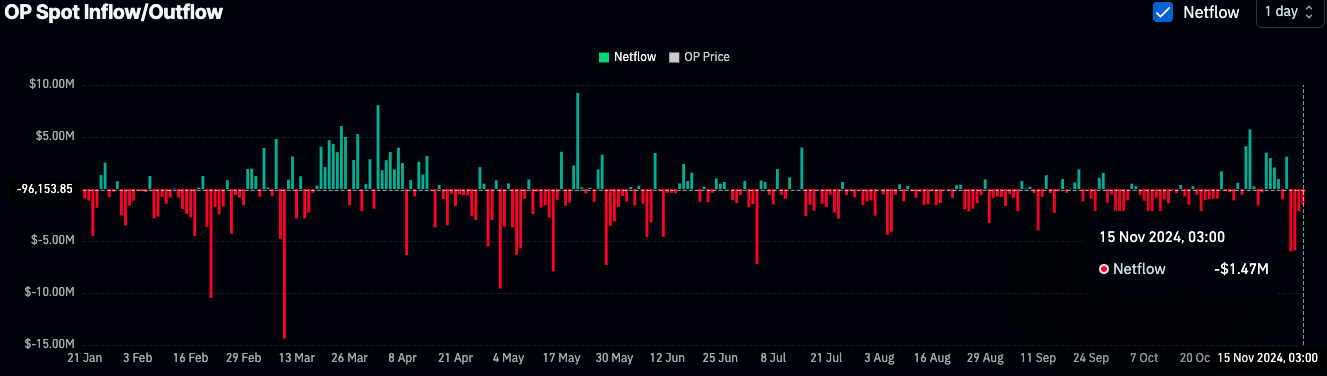

Net inflows of $128.46 million were recorded on November 15, indicating a possible increase in selling pressure.

Historically, higher inflows into stock markets have been associated with short-term corrections as traders look to capitalize on recent gains.

Source: Coinglass

And yet Bitcoin’s performance has remained strong, supported by periods of accumulation earlier this year. Between May and August, consistent negative net flows indicated large-scale withdrawals from stock markets, often linked to institutional or long-term investors.

This accumulation phase likely fueled Bitcoin’s recent rally, which saw its price rise from $25,000 to over $90,000.

Broader economic factors could determine Bitcoin’s future

According to a recent AMBCrypto reportThe uncertainty surrounding regulatory policies and sovereign debt levels could impact Bitcoin’s price trajectory.

The new government could introduce fiscal measures to tackle the debt problem, which could increase inflation risks.

Furthermore, with the Bitcoin/Gold ratio having peaked at 35, Bitcoin is now valued at 35 times the price of gold, which is an annual high. This is a sign of Bitcoin’s continued outperformance against traditional assets, even in times of macroeconomic uncertainty.