- Three critical support and resistance levels are crucial for the next Bitcoin movement.

- Another important market sentiment remained at the bearish end, without a clear indication of the next step.

After the decrease of 8.03% in the past month, Bitcoin [BTC] Has maintained a steady position in the market, oscillating between small profit and decreases. In the last 24 hours it has been active by 0.81%.

Analysis emphasizes Bitcoin’s challenging position, in which indicators are increasingly a potential price decrease suggesting as the Bearish Sentiment dominates.

Key levels on the graph for Bitcoin

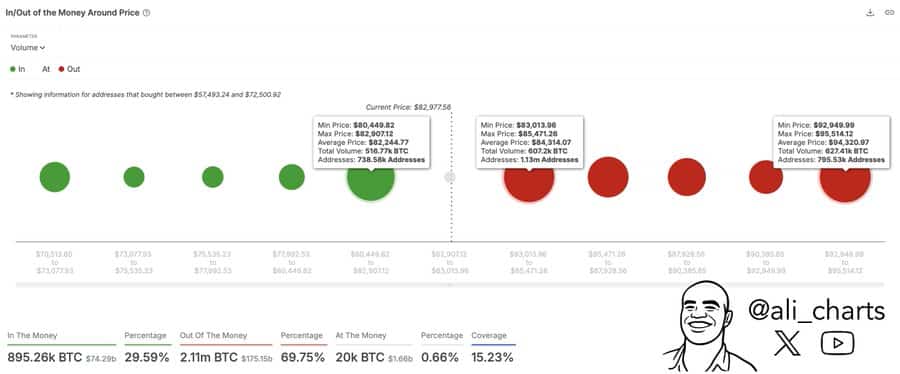

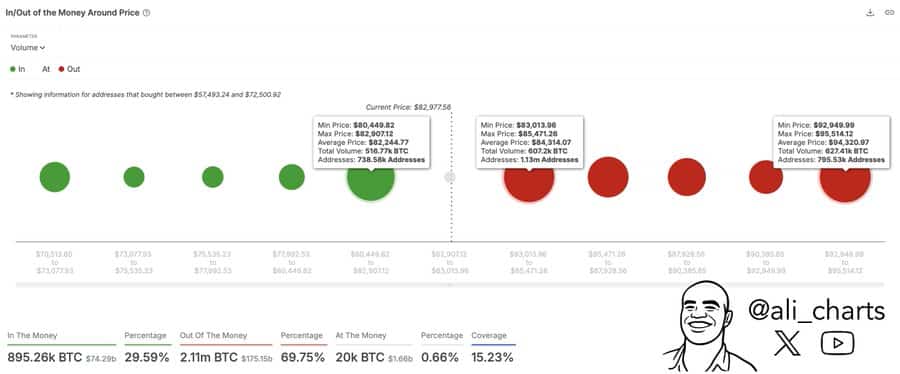

IntotheLock’s iN/out of the money around the price Data identifies Bitcoin at a critical point, with 516,770 BTC buying orders placed at the support level of $ 82.244.77.

At the same time, two resistance levels amount to $ 84.314.07 and $ 94.320.97, with sales orders of 607,200 BTC and 627.470 BTC respectively.

Source: Intotheblock

The next price movement remains uncertain. Ambcrypto took an increase in the capital influx that increases 350%.

It rose from $ 1.82 billion to $ 8.2 billion. However, the asset prices have not demonstrated a significant corresponding increase. This may indicate that the capital is stopped in the market. It can be used later in a more favorable position.

Markets insist on a drop

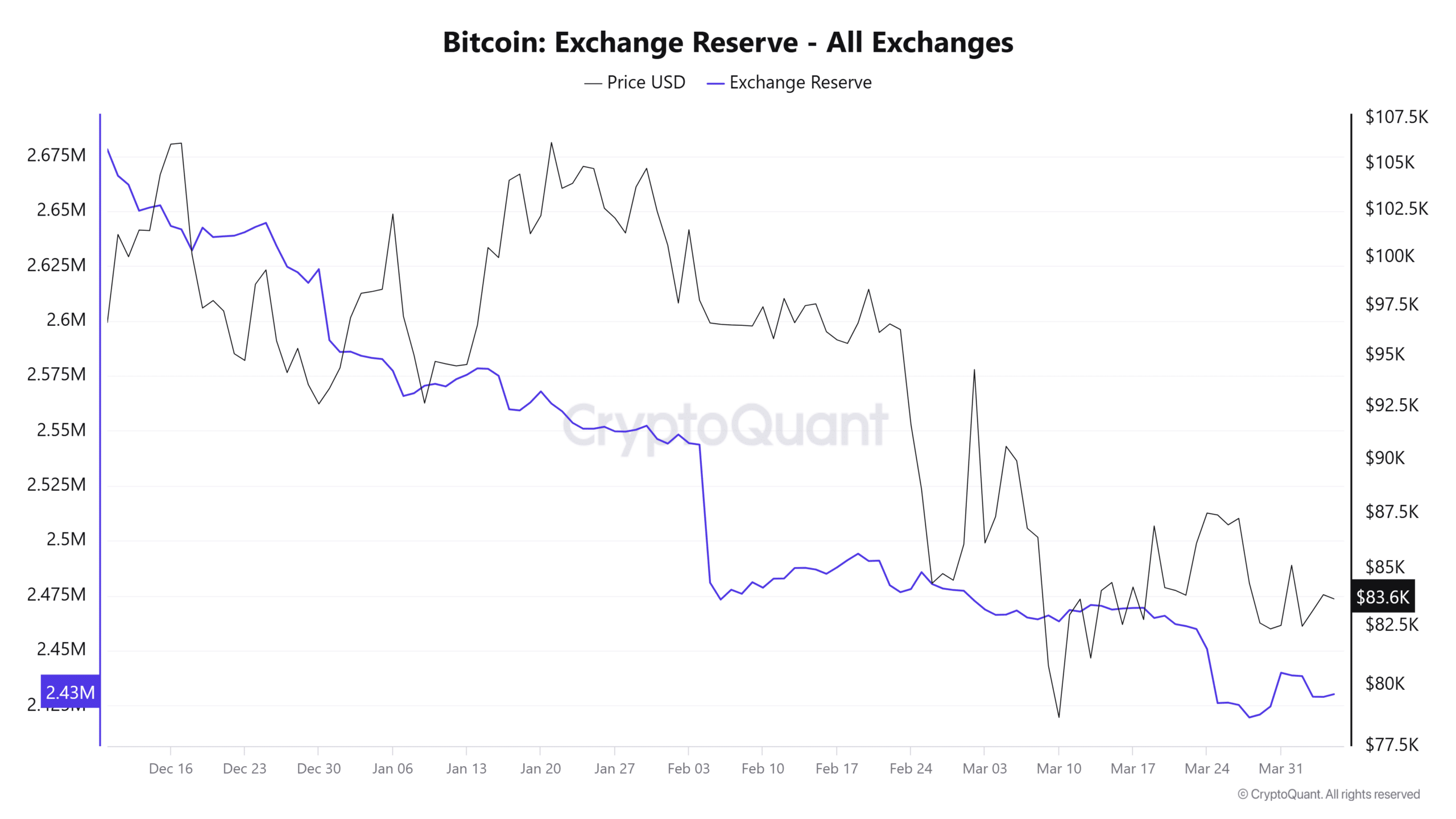

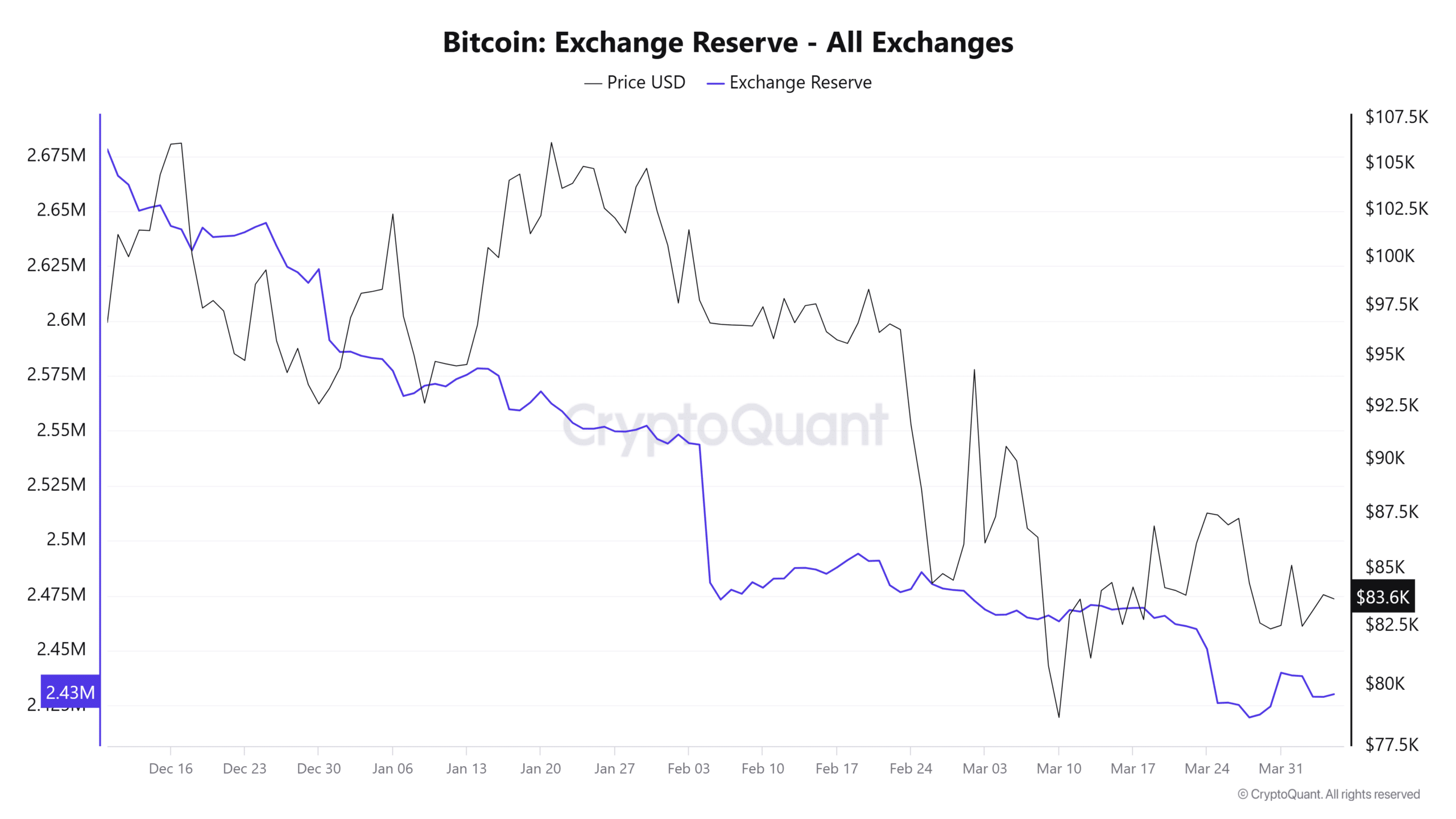

Analysis of market activity shows a push to the disadvantage. At the time of writing there was a slight increase in the amount of bitcoin on exchanges, because the exchange reserves grew to 2.43 million.

An increase in exchange reserves means that market participants relocate their assets from private portfolios to fairs in preparation to sell. If this takes place, Bitcoin can see a price fall.

Source: Cryptuquant

Exchange Netflow has become positive and intensively bearish sentiment. An increase in Netflow suggests that Bitcoin has been transferred to exchanges, which may increase the sales pressure.

This indicates that the Bitcoin market probably loads to the $ 82,000 support zone.

However, capital inflow at this level could generate the price of Bitcoin higher, which might have sufficient momentum to break the resistance levels at $ 84,000 and $ 94,000.

More bearish coordination in its place

There has been a continuous sales pressure in the derivatives market, whereby the sales volume continues to grow.

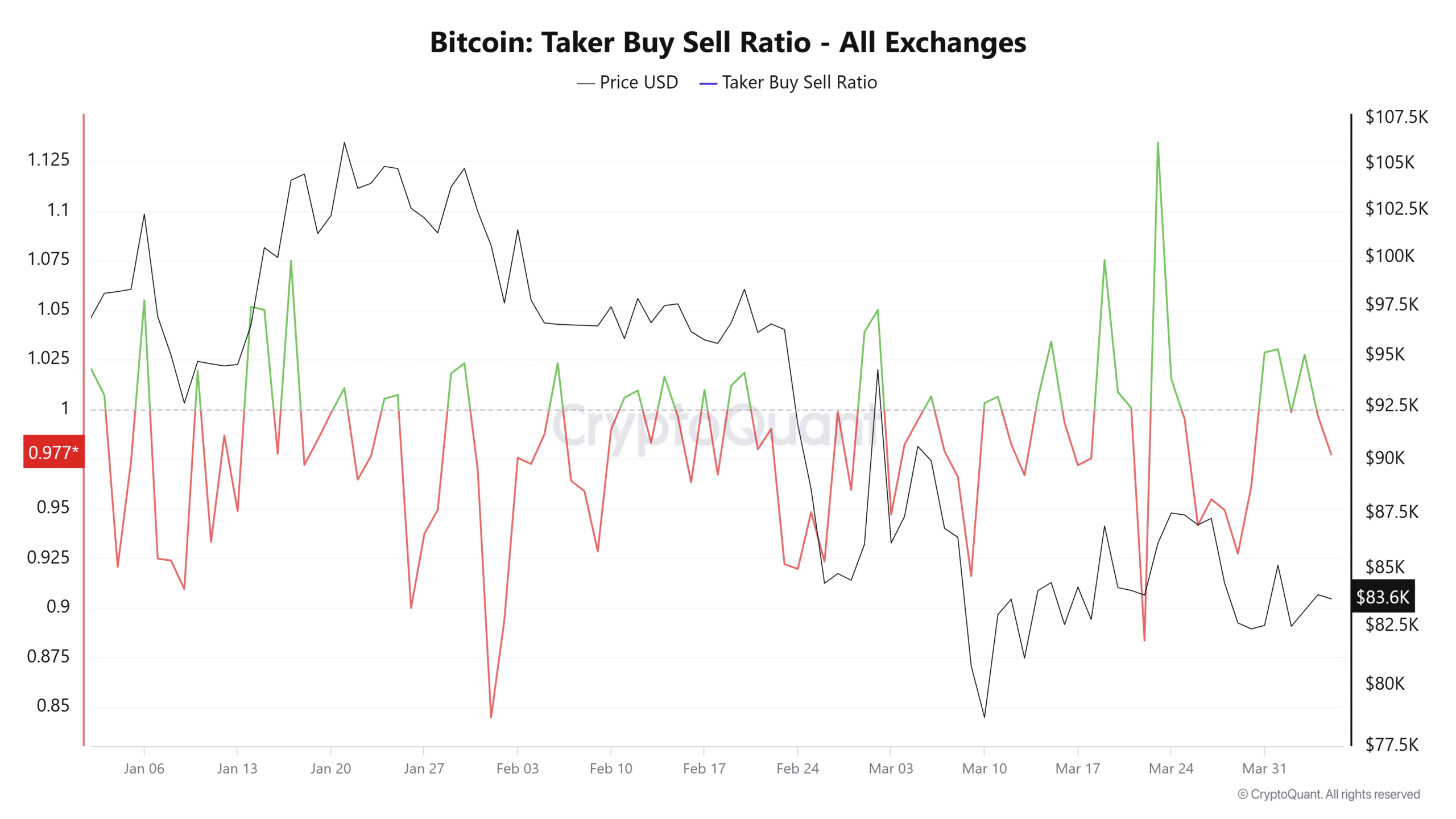

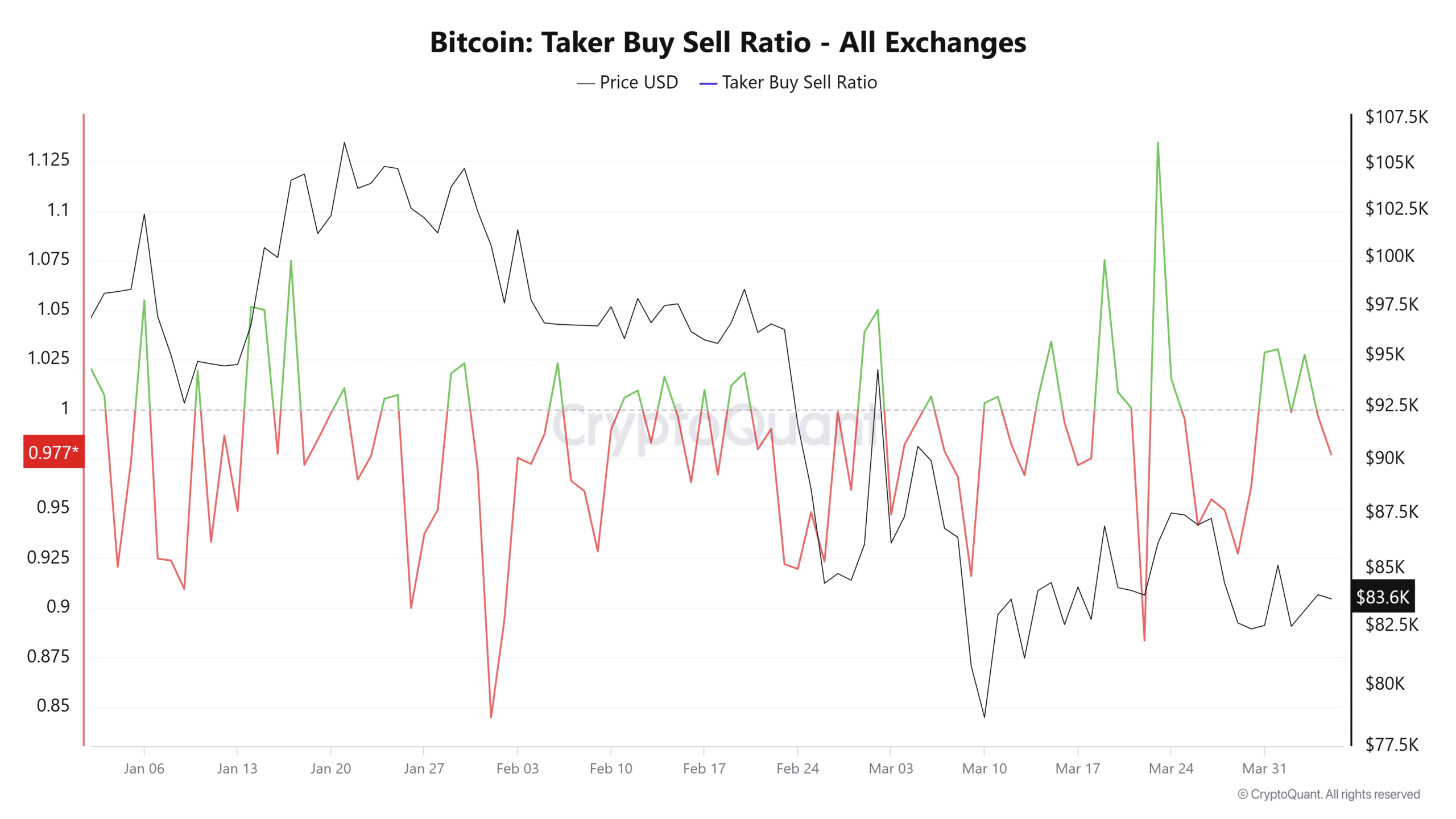

According to the Taker Buy/Sell Ratio – which uses a scale of 1 (above for buying, and below to sell) – the current lecture is 0.977 and trending down.

Source: Cryptuquant

If this ratio continues to fall, it indicates an increase in the sales volume. This indicates that bears get control of the market. It is in line with the aforementioned potential market direction.