- The recent weak sentiment has been marked by extended outflows of Binance stablecoins.

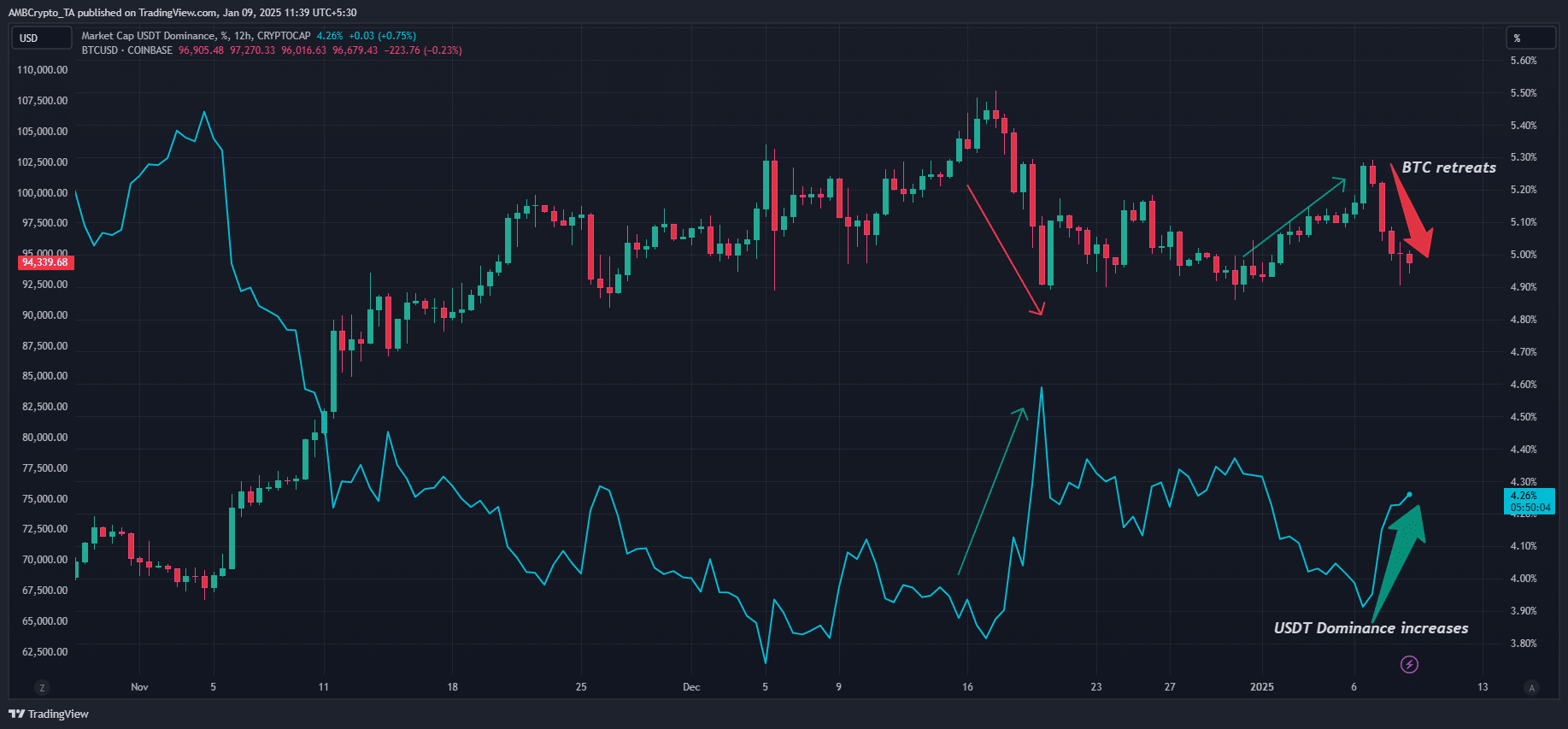

- USDT’s dominance also increased as investors chose to preserve capital when markets plummeted.

This week’s risk-off sentiment has unnerved some crypto investors, forcing most to lock in their profits or opt out altogether to preserve capital.

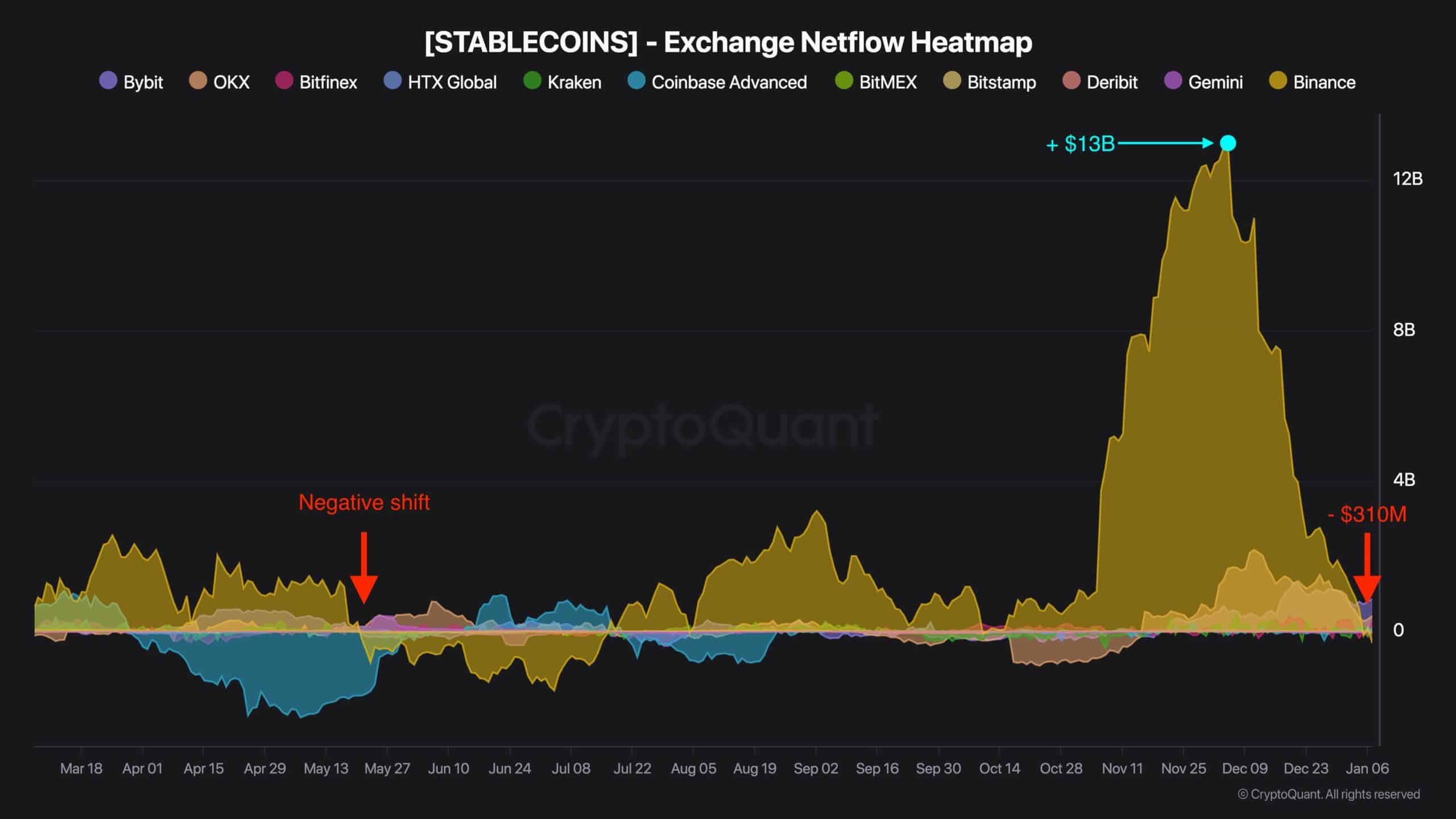

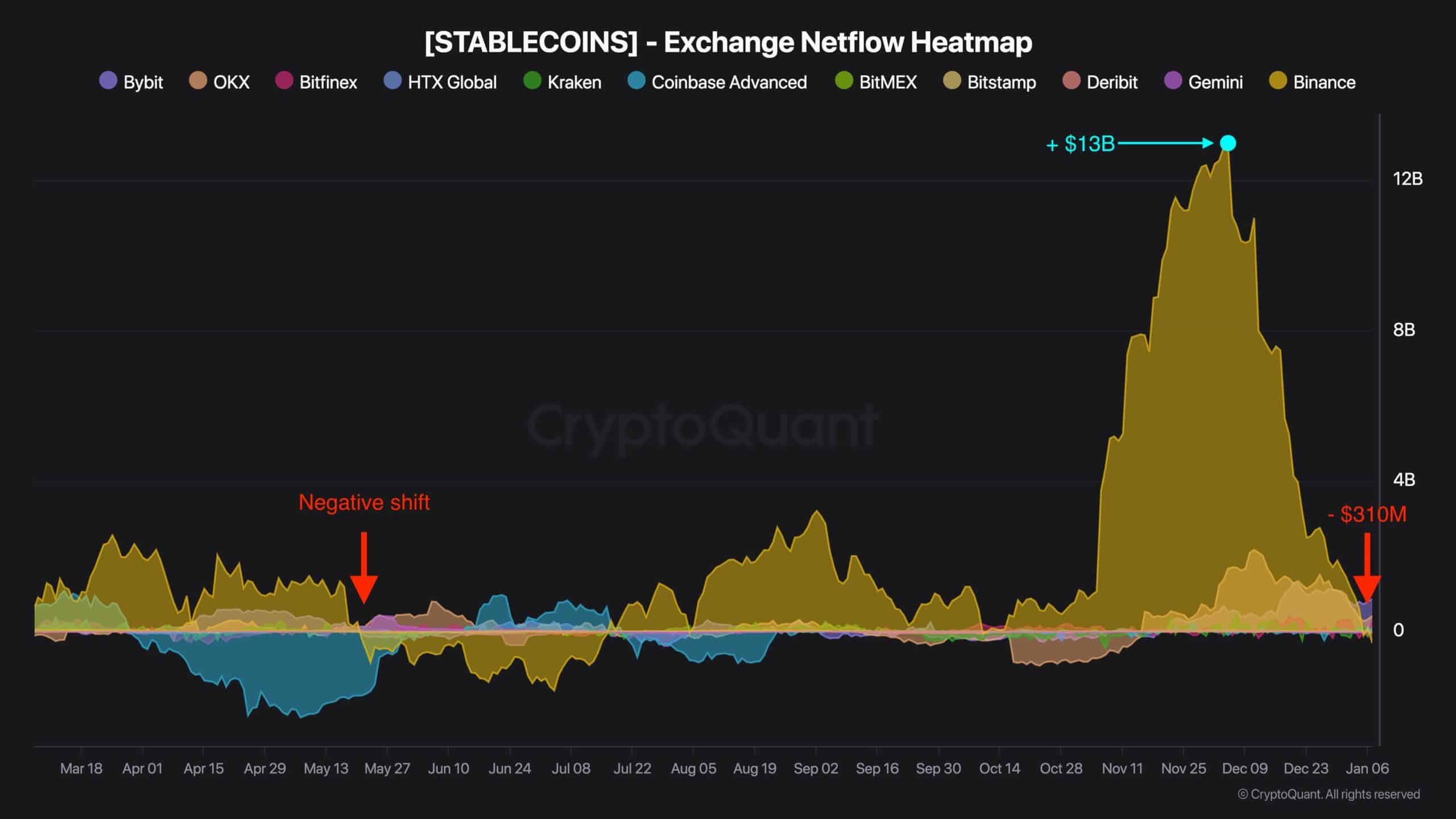

According to pseudonymous CryptoQuant analyst Dark Fost, Binance stablecoins’ reversal from an inflow of +$13 billion in November to an outflow of $310 million in early January mirrored last summer’s BTC market slump.

He declared,

“We are currently witnessing a sea change in the dynamics of stablecoin flow on Binance. This type of trend reversal was last observed in May 2024, just before Bitcoin’s sharp price drop over the summer.”

Source: CryptoQuant

Bitcoin market on edge

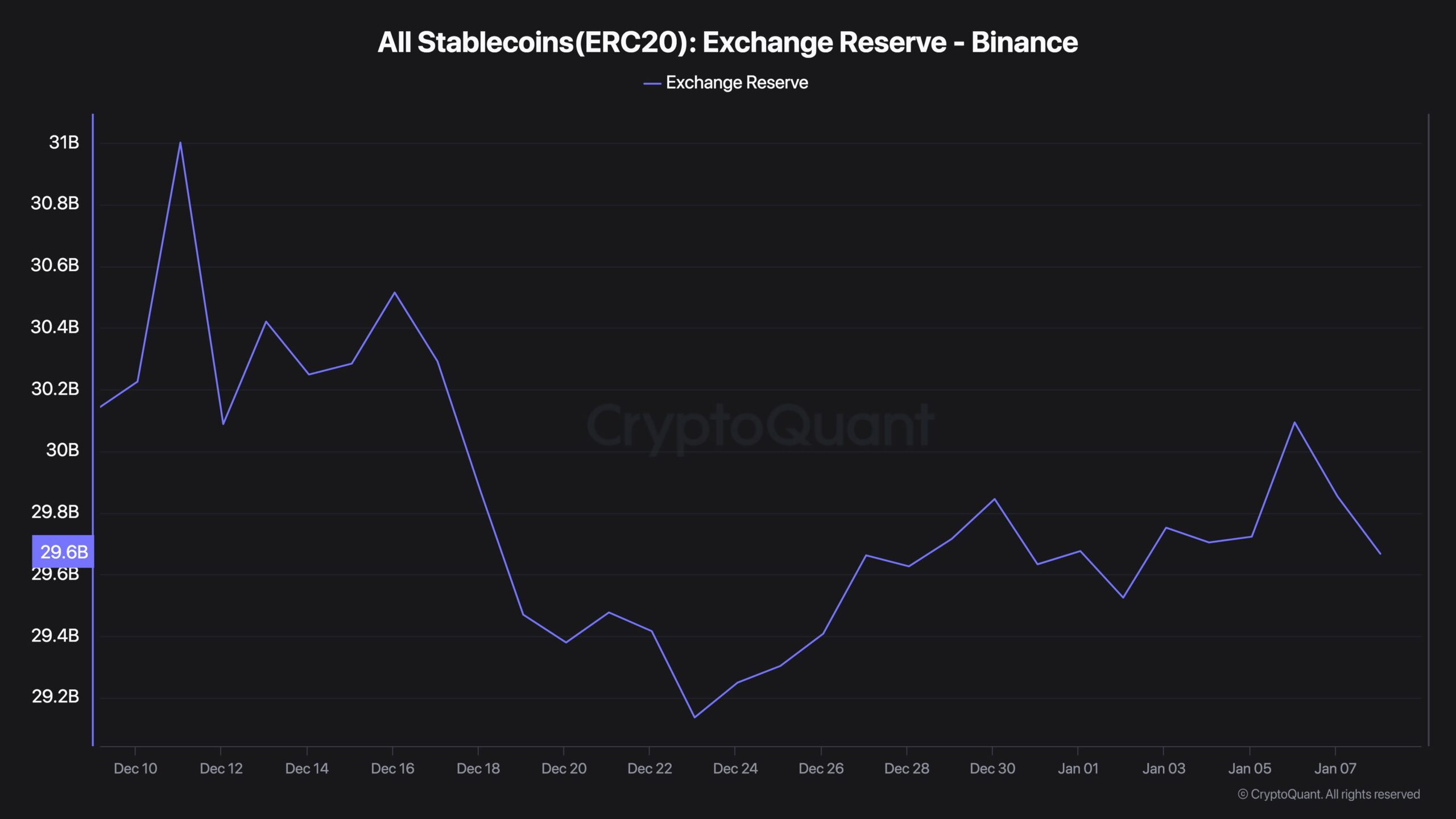

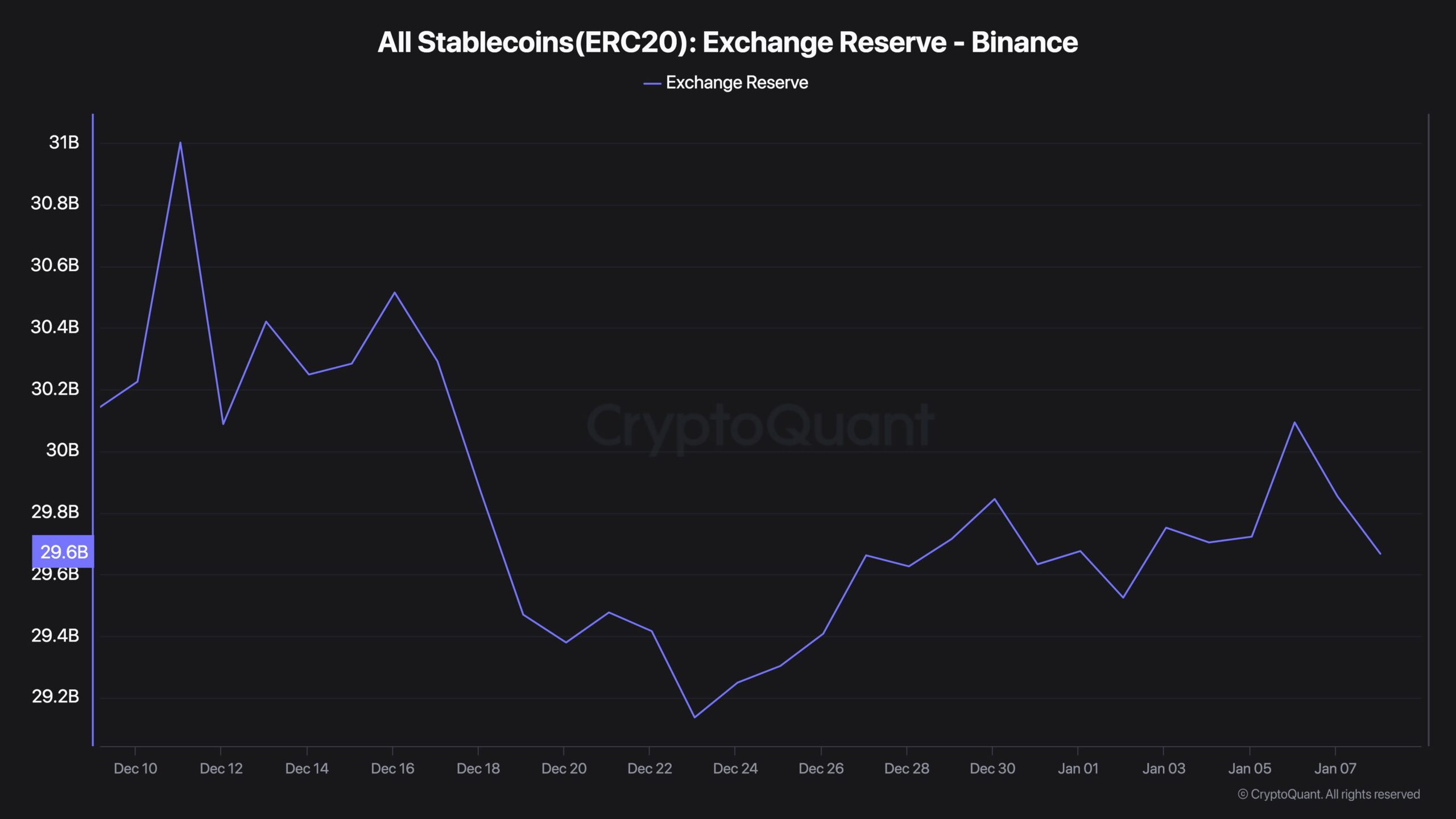

Fost added that tepid stablecoin inflows typically indicate weak purchasing power.

However, he warned that continued outflows seen since mid-December underlined market caution and could hit the economy. Bitcoin [BTC] prospects.

“While a reduction in stablecoin inflows signals weakening buying pressure, outright stablecoin outflows indicate a larger market shift, with investors leaning toward caution.”

Source: CryptoQuant

The weak market sentiment was caused by persistent US inflationThis reinforces the Fed’s slow rate-cutting path, which could stagnate asset risks.

Furthermore, the hawkish FOMC minutes and news that the US government would reportedly be allowed to sell Silk Road’s seized BTC dampened market optimism.

The increasing dominance of Tether (USDT) also confirmed Dark Fost’s concerns. The indicator is inversely correlated with the BTC price, and the recent highs marked the local top at $108,000 and $102,000.

Some analysts, such as Peter Brandt, previously warned that BTC’s inverse head-and-shoulders pattern could drag the price to the $75,000 level if it breaks below $90,000.

Source: TradingView (USDT Dominance vs BTC Performance)

Whether USDT dominance will rise above 4% again and allow BTC to recover remains uncertain.

However, Benjamin Cowen and CoinDesk’s senior analyst James Van Straten downplayed the recent drop in BTC as a typical January pullback during the year after the halving.

At the time of writing, the asset was trying to stabilize above $94,000.