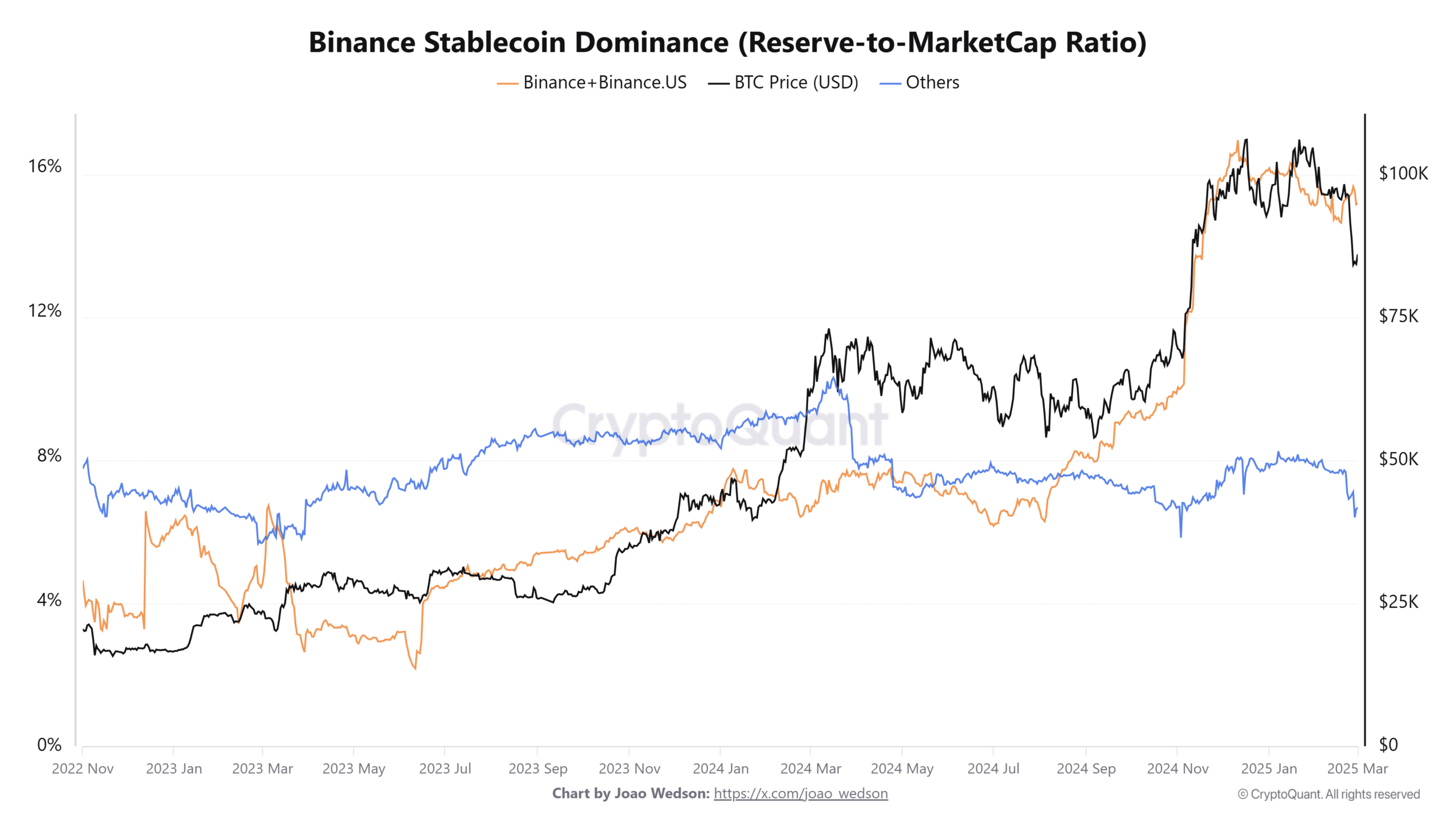

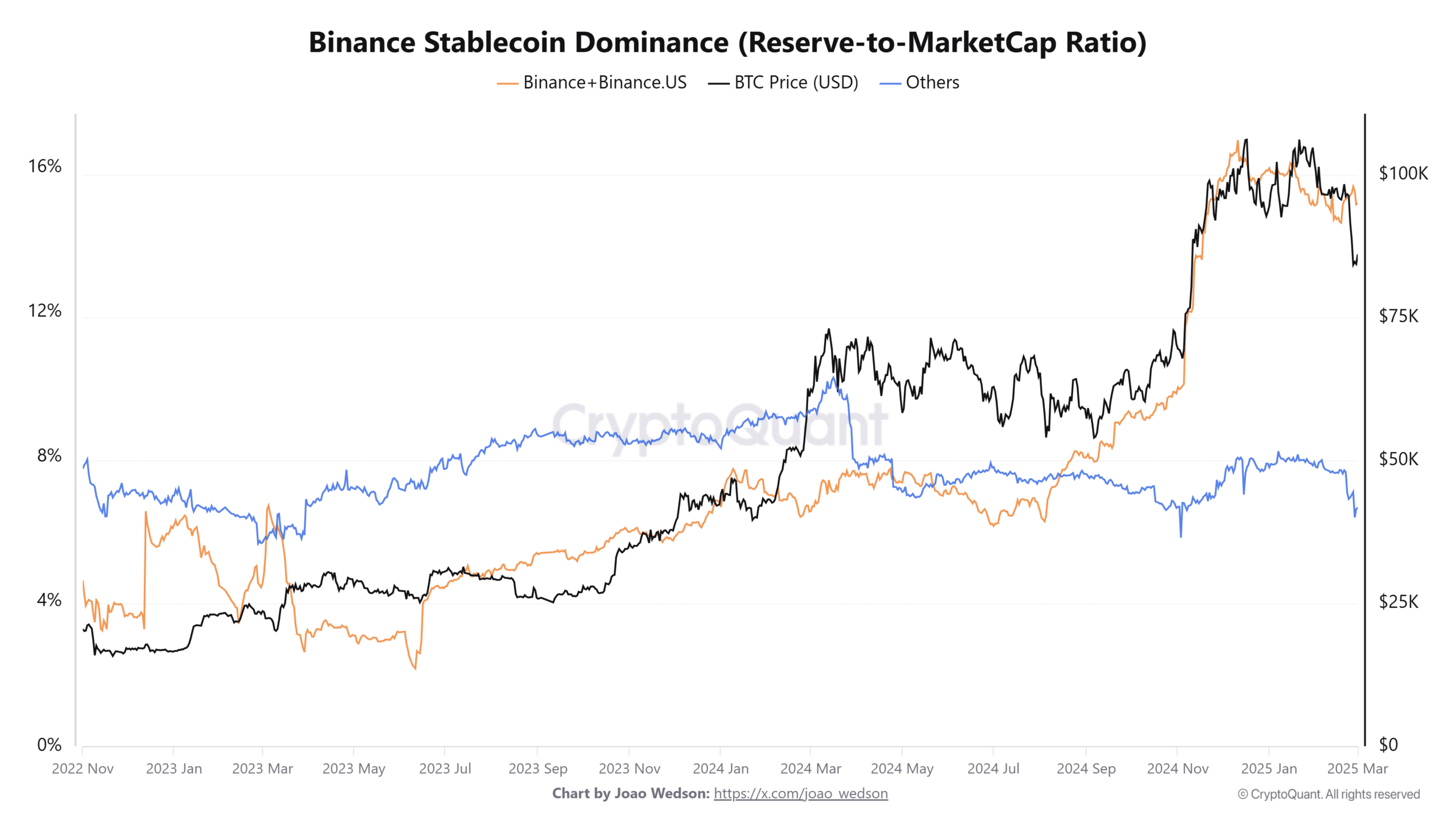

- Binance’s Stablecoin -Dominance fell from more than 16% to ~ 13%, which reflects a redistribution of trader capital.

- BTC Liquidity Conditions can shift if the stablecoin into Binance does not return in the coming days.

While market participants hunt for signs of Bitcoin’s [BTC] The next large move, a subtle but important shift takes place under the surface: Binance’s Stablecoin -Dominance is falling.

Given the enormous role of Binance in the global crypto -liquidity, the implications can stretch far beyond the exchange itself.

Let’s break down what the data say.

Binance Stablecoin reserves decline

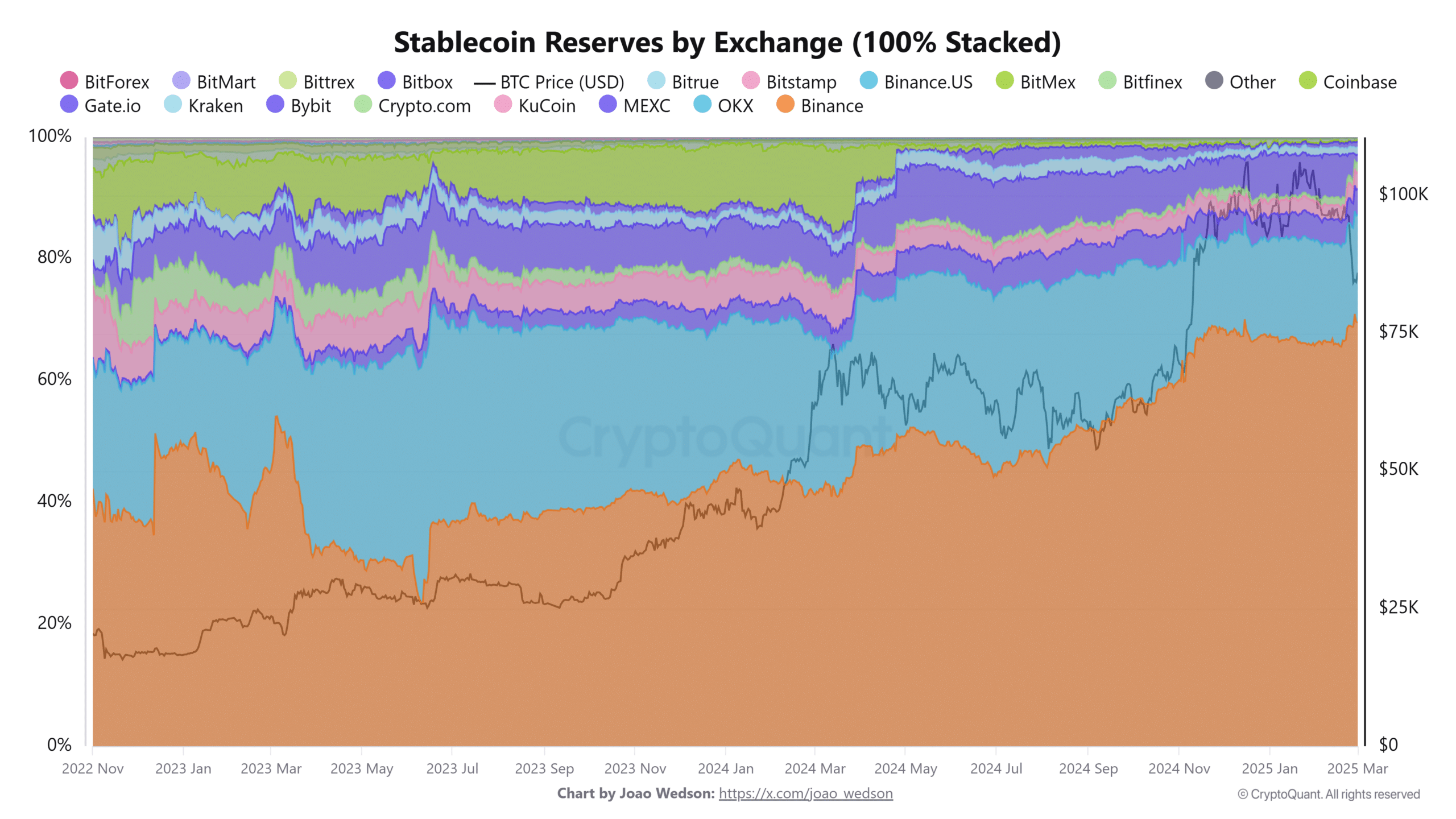

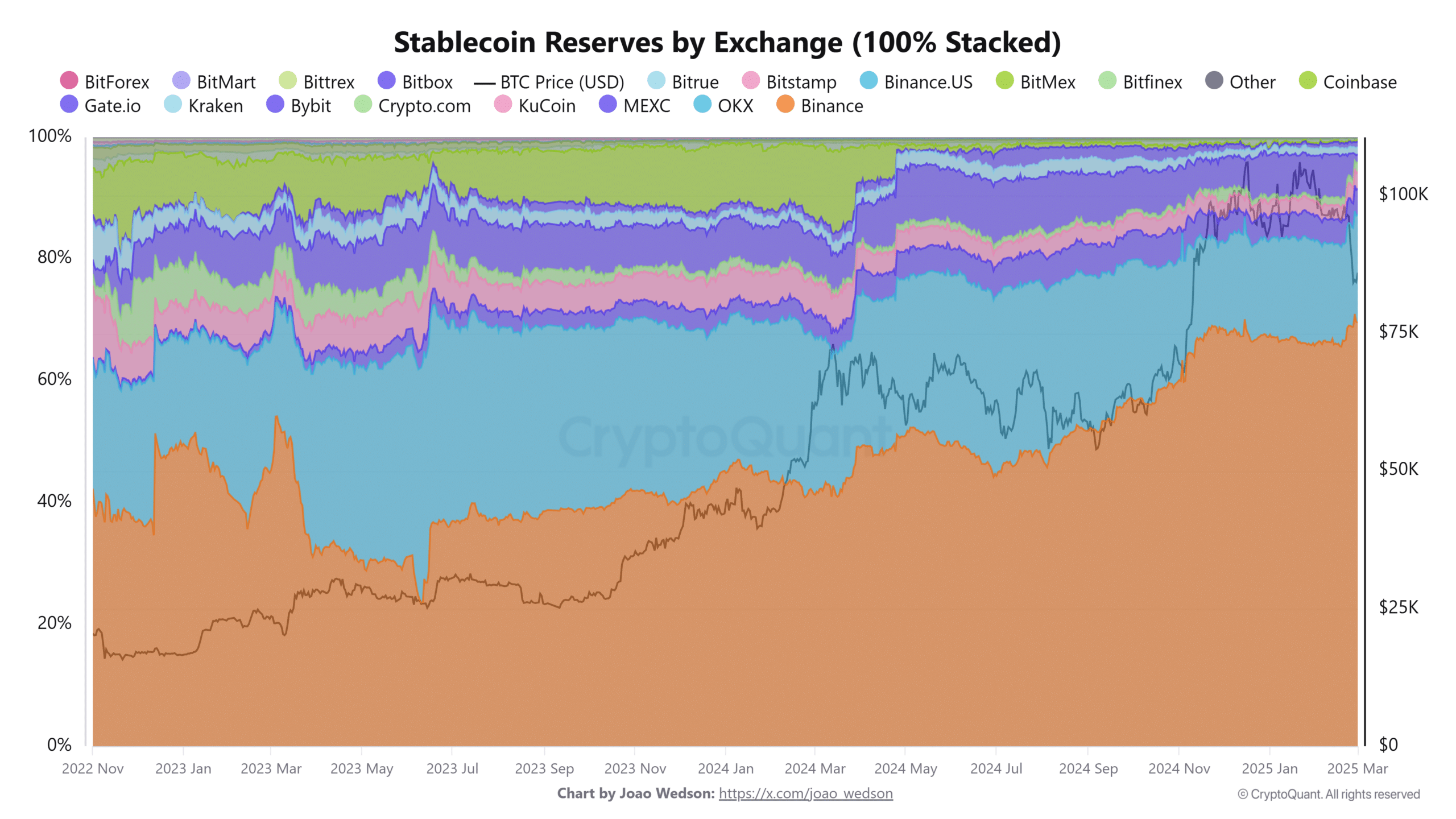

According to Cryptoquant’s 100% stacked graph of Stablecoin reserves per exchange, the handle of Binance over the total reserve cake has been visibly shrunken since January 2025.

At its peak, Binance accounted for more than 60% of the Stablecoin reserves about centralized fairs. However, that figure has now come closer to the 50%.

Source: Cryptuquant

This decrease takes place, even if BTC is traded in the range of $ 85k – $ 95k, and other fairs, in particular Coinbase and Kraken, have seen a relative increase in their share of reserves.

In theory, a falling Binance -reserve -Dominance could imply a redistribution of trader capital to other platforms or reduced the influx from Stabile to Binance itself.

Such a trend can reduce the liquidity depth of the exchange, so that the ability to absorb purchase/sales pressure, especially if BTC volatility peaks are weakened.

Loss of Dominance Momentum

Binance’s Stablecoin -Dominance compared to the total market capitalization reveals even sharper trends. At the beginning of 2024, the reserve-to-market cap ratio for Binance and Binance.sus was around 8%.

This metric steadily climbed to more than 16% by the end of 2024, but has since been slipped back to around 13%.

Source: Cryptuquant

The graph also shows a clear inverted correlation between Binance -Dominance and the broader participation of other trade fairs. While the dominance of Binance recently declined, the ‘others’ category showed a mild upward trend.

This can be interpreted as capital that diversifies to multiple locations instead of concentrating on one exchange.

Historically, a high spare-to-market cap ratio at Binance tends to precede or accompany strong BTC rallies while users are preparing to implement Stablecoins in the market.

Conversely, a decline can be careful, which suggests that users hold back elsewhere or distribute capital.

What this means for BTC price promotion

The falling dominance of Binance does not guarantee that a market for market is being granted, but refers to an important behavioral change.

With fewer stablecoins parked on the biggest exchange, the market could see a lower buy-side pressure at both shops and whales.

To make BTC break convincingly, his $ 95k ceiling is convincing, renewed inflow over trade fairs, in particular Binance, will probably be necessary. Until then, careful optimism can be the theme of the week.