- BNB is down 2.53% in the past day

- Market sentiment for BNB has turned negative, curbing the likelihood of a new bull cycle.

Although the crypto market has seen huge gains over the past week, Binance coin [BNB] has shaped a different path.

While the market expected CZ’s release from prison to build market confidence, it has failed to reflect this. As such, BNB has seen a significant decline in its price charts over the past week.

In fact, at the time of writing, BNB was trading at $581. This represented a decline of 2.53% over the past day. Moreover, the price has fallen by 2.07% on the weekly charts.

Previously, BNB had been on an upward trend, with an increase of 8.32%.

Despite the drop, trading volume has soared over the past day, rising 15.57% to $1.8 billion.

The increase in trading activity despite the price drop has analysts talking about the altcoin’s trajectory.

To that extent a popular crypto analyst Johnny Crypto suggested a potential upward trend, citing BNB’s continued growth.

Market sentiment

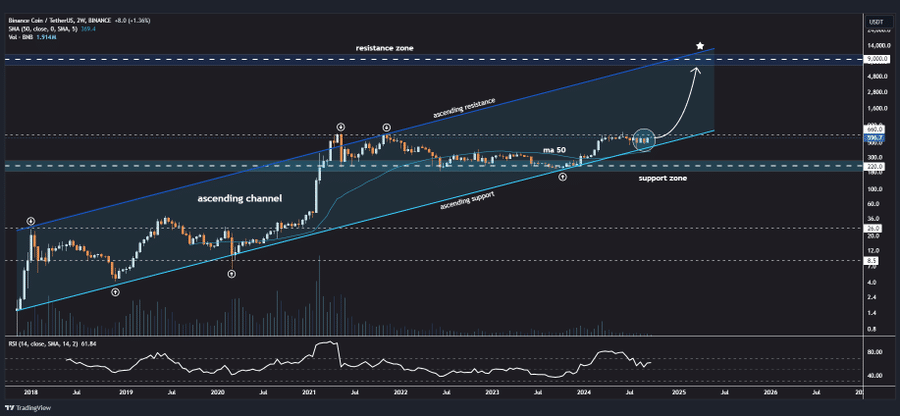

In his analysis, Johncy cited BNB’s long-term rising channel to predict further gains on price charts.

Source:

Based on this analysis, the altcoin has shown consistent growth in a long-term bullish channel.

This implies that BNB has steadily increased in value over time, creating higher highs and higher lows, which generally reflect a long-term bullish trend.

Therefore, if BNB reaches the top of the ascending channel under these conditions, it could indicate strong bullish momentum and the possibility of a breakout.

As such, with the possibility of a new bullish cycle, prices could be pushed towards the channel’s highest resistance level.

What the BNB graphs indicate

While the analysis offered by Johncy offered a promising outlook for BNB, the recent price movement does not reflect this. So the broader market has borne the brunt of BNB’s thirty-day recovery.

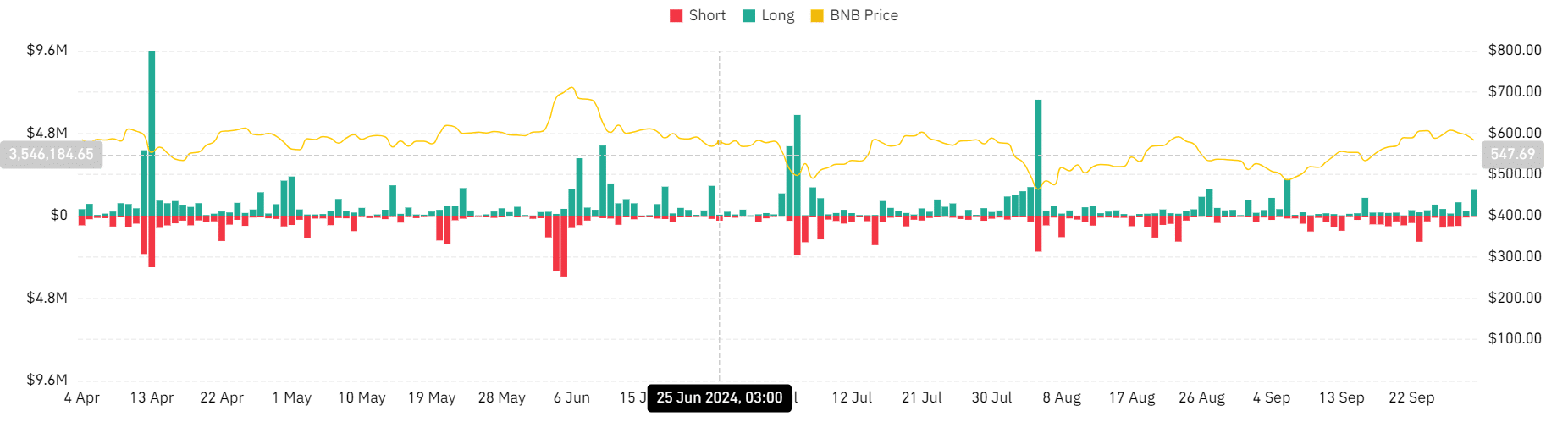

Source: Coinglass

For example, BNB’s liquidation for long positions has risen sharply over the past three days. At the time of writing, the liquidation for the long position was $1.5 million, while that for the short position was $26k.

Such a market condition suggested that those who bet on the market are being forced out of their position.

The fact that long position holders were unwilling to pay a premium to maintain their position reflected their lack of confidence in future price gains.

Source: TradingView

Moreover, the Relative Strength Index (RSI) has fallen over the past three days from 66 to 54.9 at the time of writing.

Over the same period, the RSI-based MA is above its RSI at 62, indicating that the uptrend has lost momentum. Therefore, BNB could see further correction or consolidation.

Likewise, a falling RSI suggested that the sellers were taking over the market, leading to selling pressure. So our previously observed spike in trading activity indicated a sell-off.

Source: Santiment

Finally, BNB’s Open Interest fell from $334 million to $314 million over the past three days, after rising at the start of the week.

This showed a shift in market sentiment, with investors closing their positions without new entrants.

Read Binance Coin’s [BNB] Price forecast 2024–2025

Simply put, BNB has seen a change in market sentiment from positive to negative. As such, current conditions do not support a short-term rally.

Therefore, based on prevailing market sentiment, BNB will return to the critical support level at $553 before another uptrend begins.