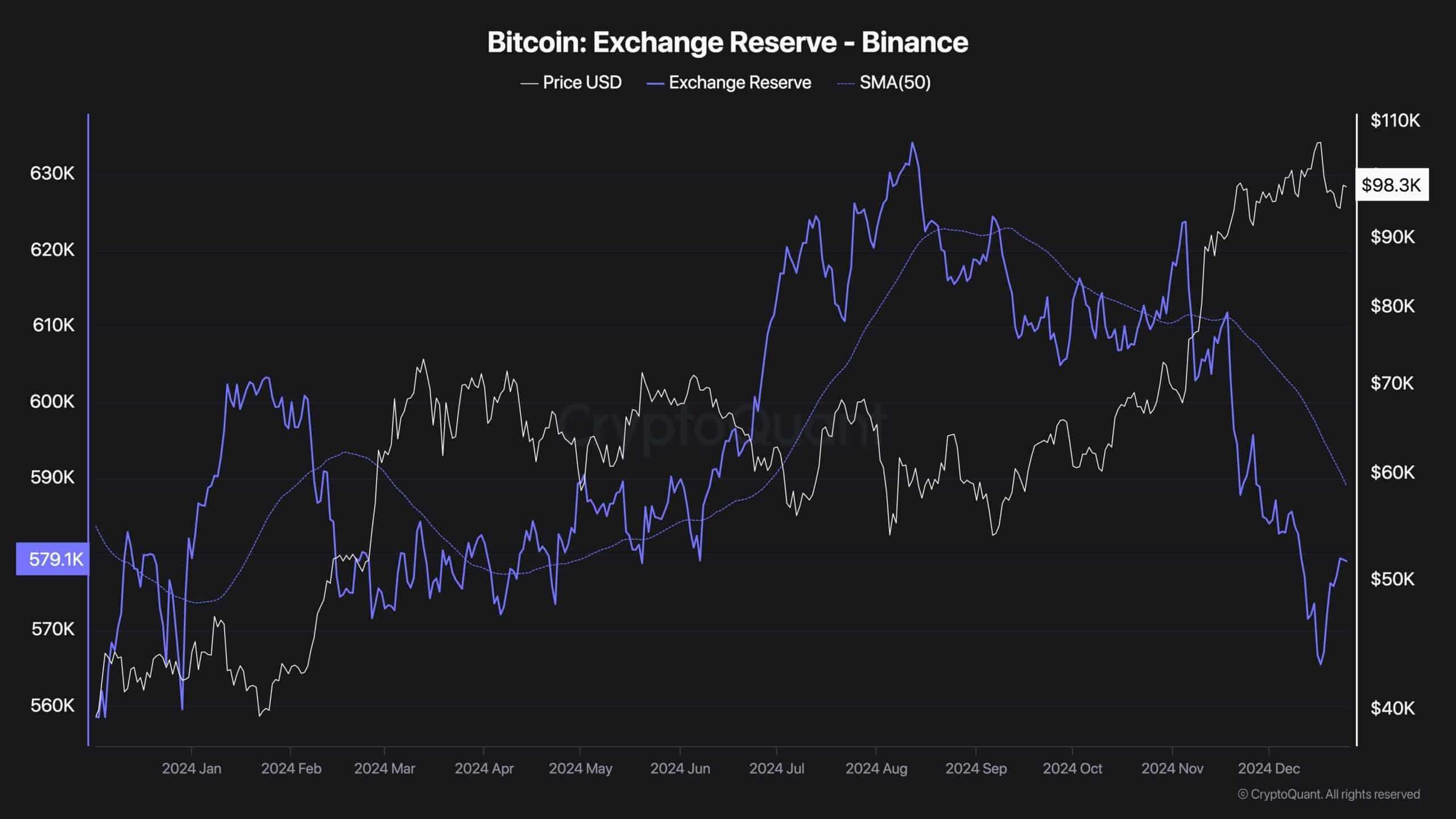

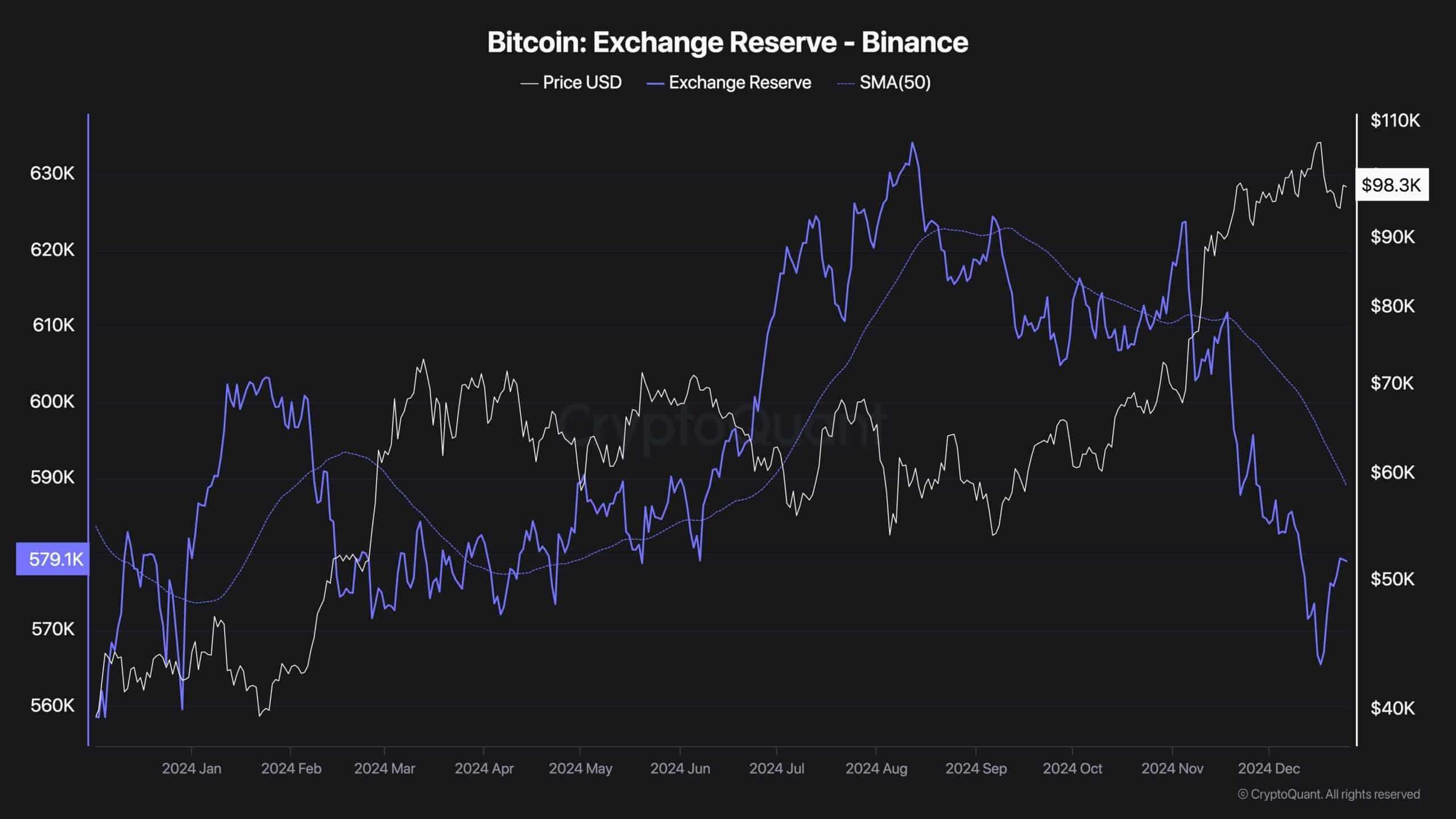

- The Binance BTC reserve has fallen from over 630,000 BTC to 579,000 in four months.

- Can BTC Surge Above $105,000 Amid Looming Demand Shock?

Binance exchange Bitcoin [BTC] the reserve has fallen to its January 2024 low, a trend that a CryptoQuant analyst viewed as a positive outlook for the asset in the long term.

Since August, Binance’s reserve has dropped from 630,000 BTC to almost 580,000 BTC.

These low levels were last seen in January, just before US BTC ETFs went live and triggered a 90% pump. noted pseudonymous analyst Dark Fost.

Source: CryptoQuant

Bitcoin: More Rally or Price Range?

The dwindling reserve meant that more BTC was moved out of Binance for self-custody, indicating a potential price increase in the future.

Fost added that the outflow reinforced BTC’s positive long-term outlook.

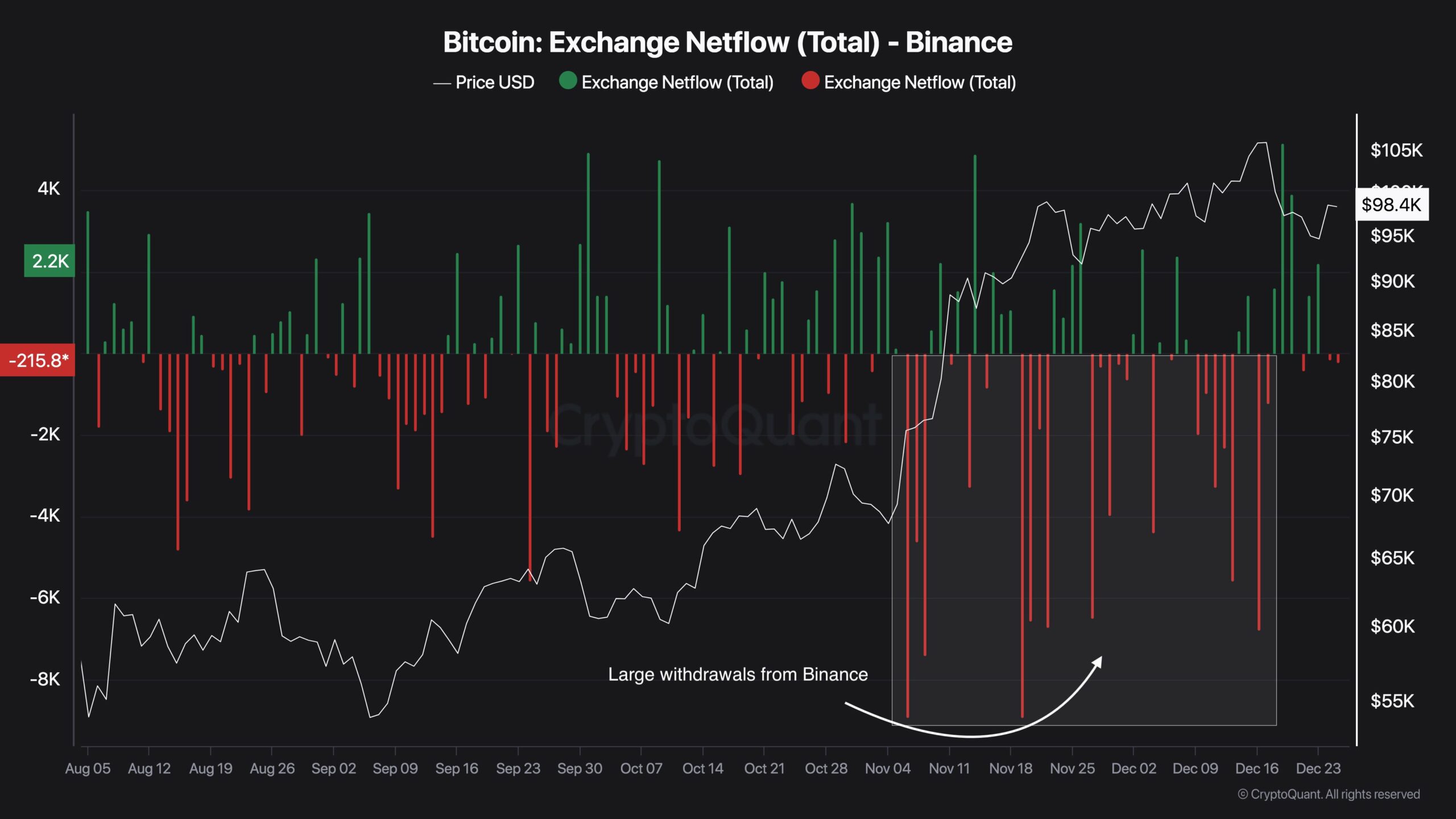

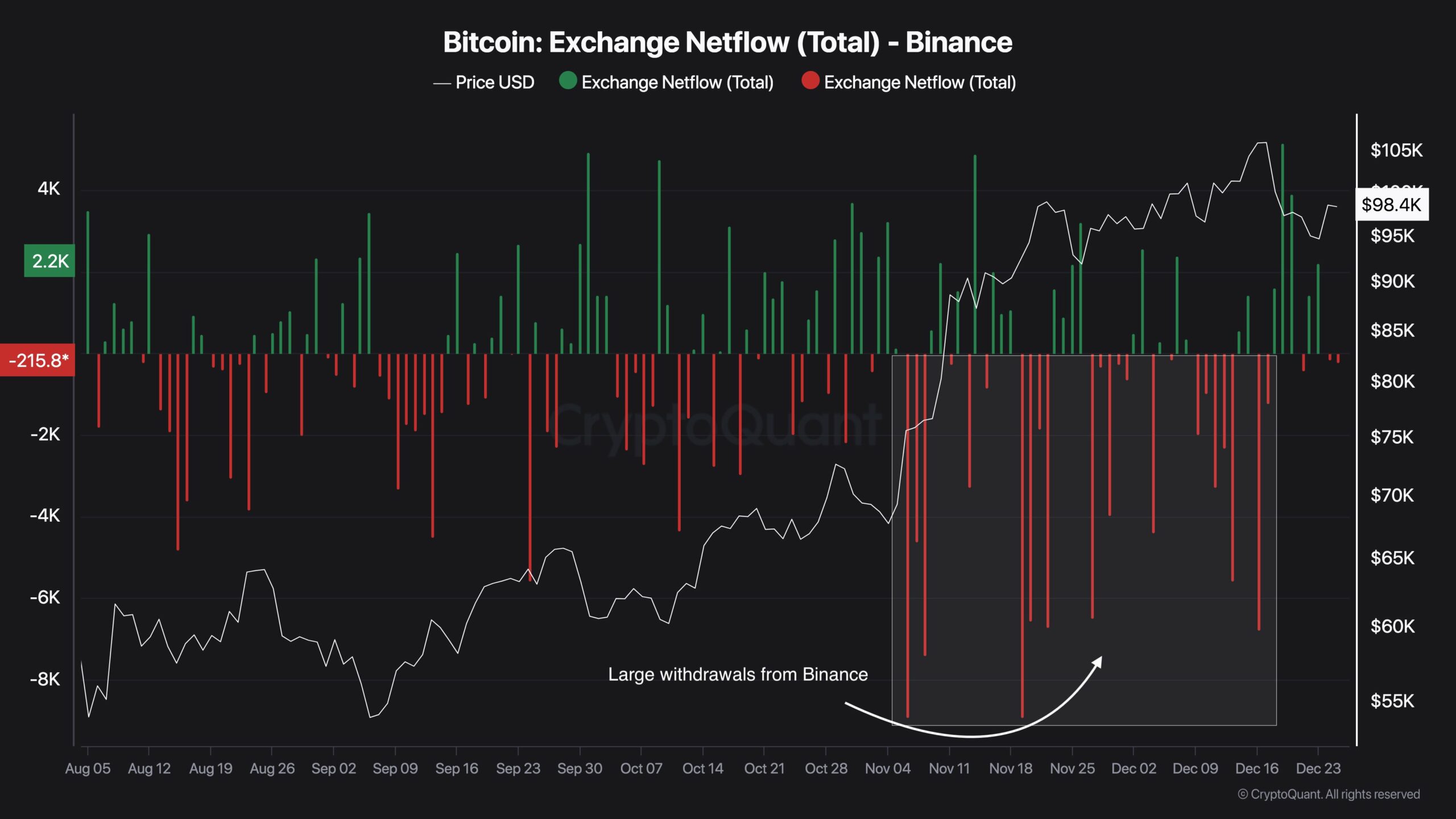

Source: CryptoQuant

Interestingly, the decline in BTC reserves on the Binance exchange in August and December also coincided with the cryptocurrency pumping to an all-time high of $108,000.

So, now that Christmas is behind us and the focus shifts to Trump’s upcoming inauguration, what’s next for BTC?

Bitget Research lead analyst Ryan Lee expected BTC to hover between $94,000 and $105,000, with a possible breakout after the holidays. He said,

“The expected trading range for BTC this week is $94,000 – $105,000. The price is expected to exceed $105,000 after Christmas.”

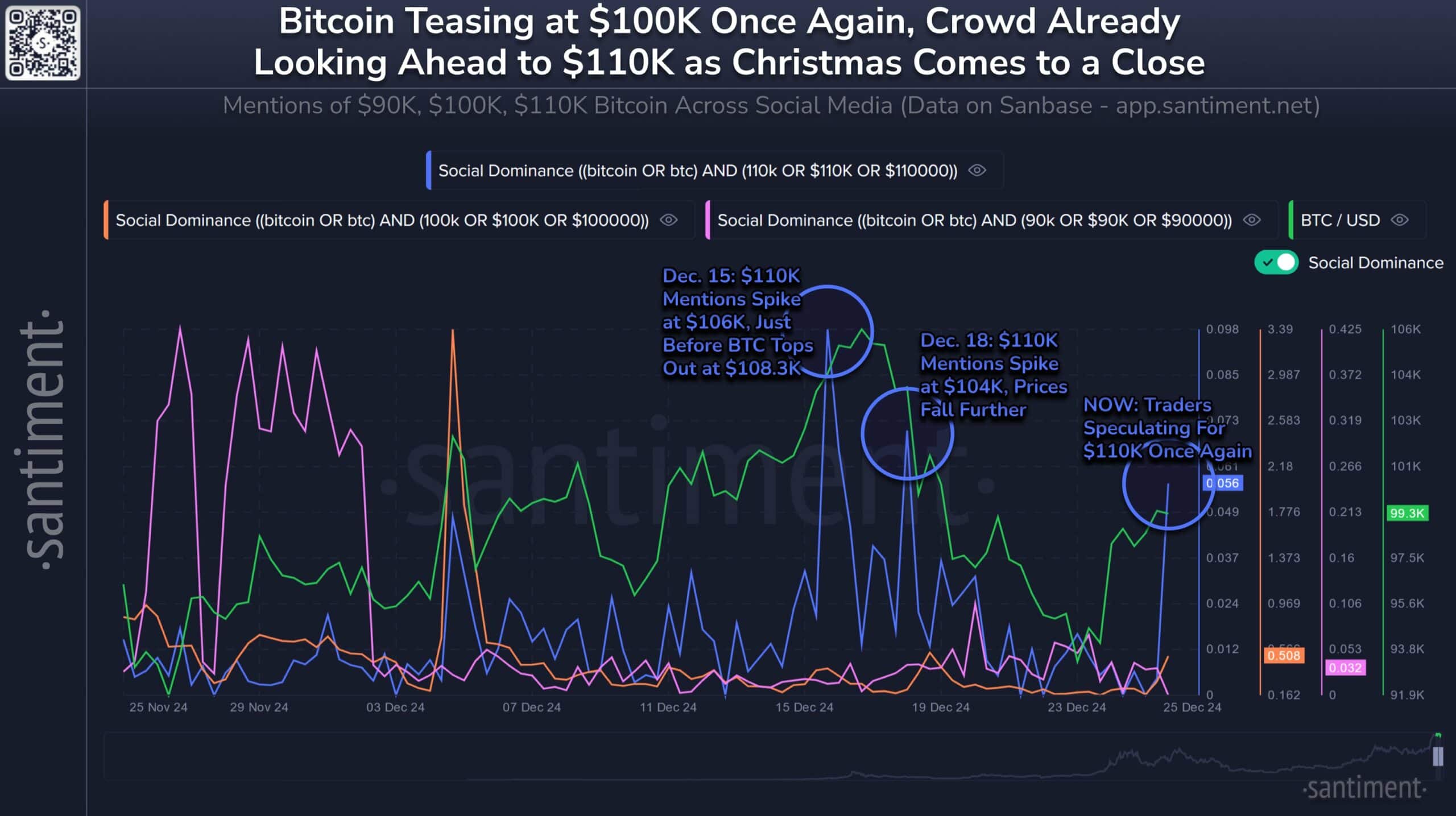

Since Christmas Eve, BTC has flirted with $100,000, increasing bullish calls toward $110,000 in recent hours.

But Santiment warned that a breakout to $110,000 would likely happen when people least expect it. The analytics company declared,

“Traders are now bullish again, with speculation over $110,000 running rampant. Historically, we won’t see $110,000 Bitcoin until the public least expects it, as this image shows.”

Source: Santiment

At the time of writing, BTC was valued at $97.8K, about 10% away from its all-time high of $108.3K.