Billionaire venture capitalist Chamath Palihapitiya says markets are ripe for a strong rally as a flood of capital looks to find a new home.

In a new episode of the All-In Podcast, the billionaire says the macro picture is starting to look positive for the United States.

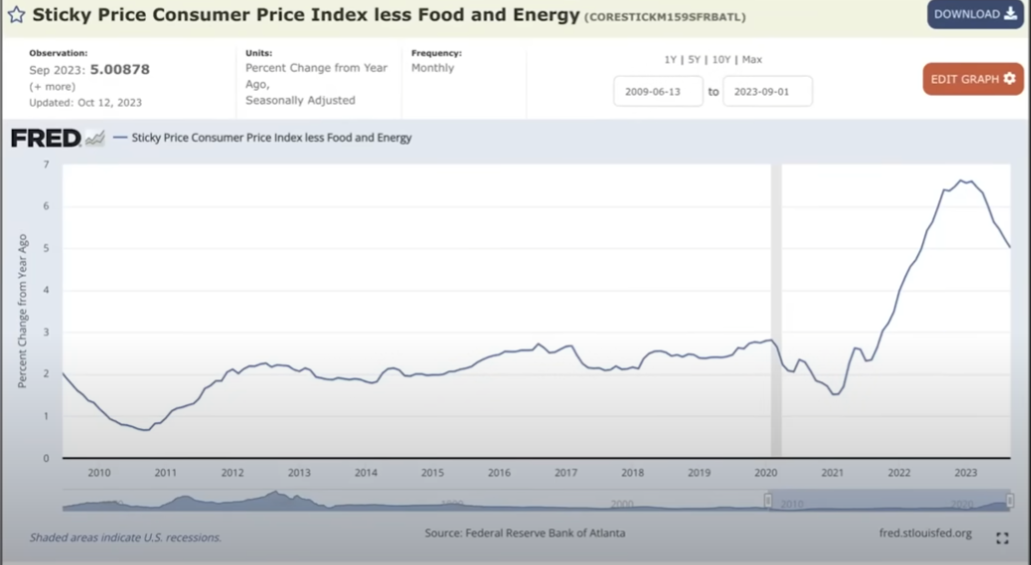

The Social Capital founder first looks at the consumer price index (CPI), which tracks the country’s inflation over time. According to Palihapitiya, the CPI is starting to tilt, indicating that high inflation rates are a thing of the past.

“We’re really in a good place in terms of inflation. If you think about what’s going to happen over the next six months, that’s largely in the bag… There is a lag effect on a handful [CPI] components, especially rents, and if you factor them into this inflation rate, you’ll see that it turns around very, very quickly.

So we know that inflation is falling. It will continue to decline.”

Palihapitiya then looks at the amount of capital stored in money market funds. According to the venture capitalist, trillions of dollars of capital could leave money market funds and flow into the stock market in pursuit of higher profits.

“I think the outline is broadly as follows. There is less money in the system. That’s positive.

There is more money on the sidelines… Look at the amount of money in money market funds – $6 trillion and growing, so that is a very positive sign: money will need a home…

So that’s trillions of dollars that need to be deployed. Now you are introducing interest rate cuts and that is a real accelerator. More than likely, I think this means that the markets are poised to do quite well, especially the stock markets.”

Palihapitiya concludes his analysis by saying he is optimistic about the prospects for the US economy, with the Federal Reserve set to cut interest rates in mid-2024.

“Inflation is mainly in the rear-view mirror. The rates will be reduced halfway through this year. It looks like the economy is going to have a soft landing. That is actually very favorable for the sitting president. It’s also good for stocks. It is good for us… I think we have undergone a fundamental change.”

I

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3