A new metric data report from Dune, a platform that specializes in data analysis in chains, shows that Base and Arbitrum are the leading Laag-2 (L2) Blockchains through activities on chains and generating income.

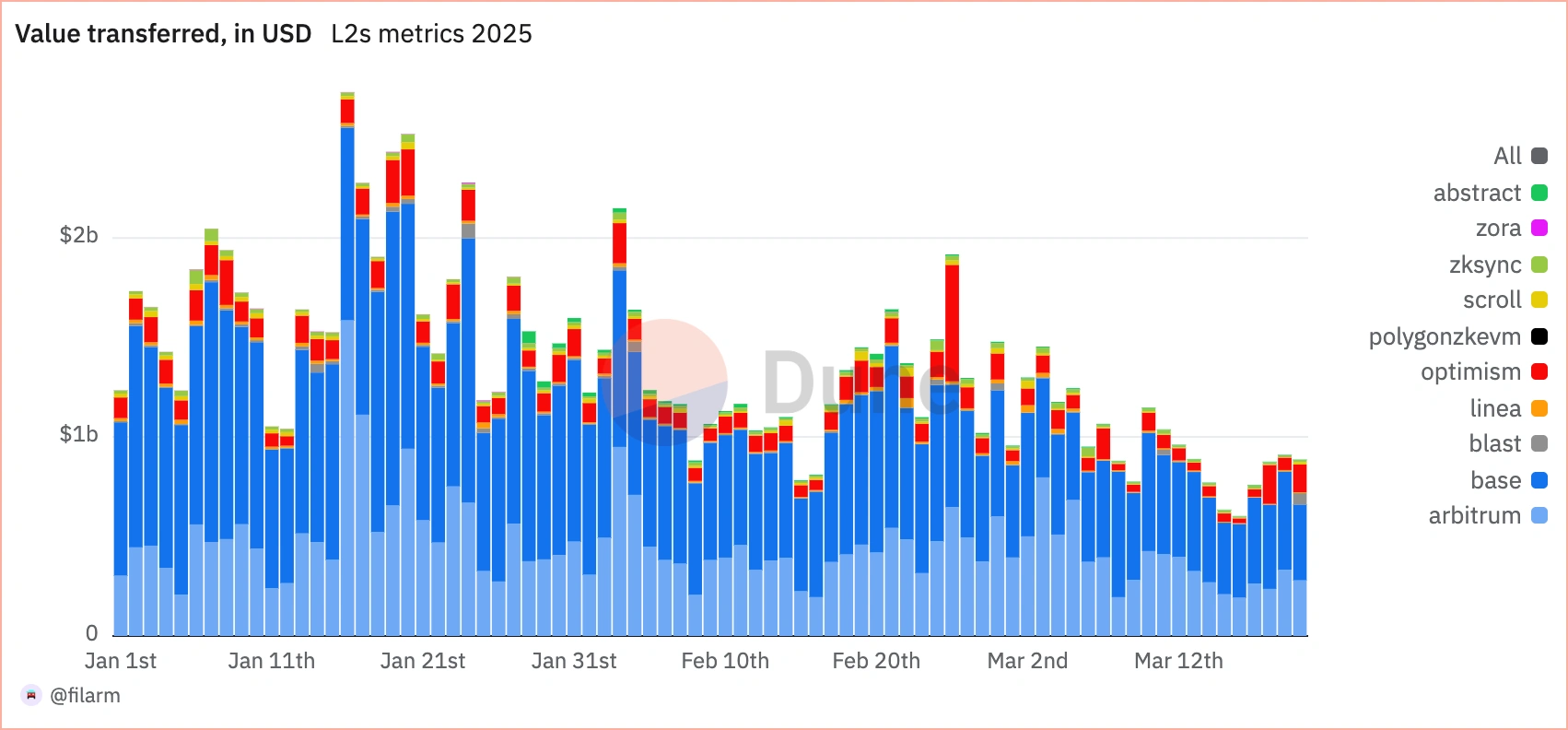

In terms of transferred value, Base and Arbitrum dominate the space with market shares of 55% and 35% respectively, with optimism at a distance remote.

Basic and arbitrum lead L2S transferred in terms of value in 2025. Source: Dune Analytics

However, the new data has provided information about the activities of other L2 block chains than Base and Arbitrum, which also lead to specific statistics such as value transferred by transaction and gas unit.

According to Dune, a high value per transaction often indicates meaningful use, such as defi-transactions or large transfers, about spam or low value interactions. It can reflect the ability of the blockchain to support user cases in practice that require a significant value movement, while the transferred value per gas unit reflects the economic density and the efficiency of the blockchain when dealing with valuable activities in relation to resources.

In this area, the data shows that block chains such as Skoll, ZKSync and Arbitrum take the lead in terms of their efficiency.

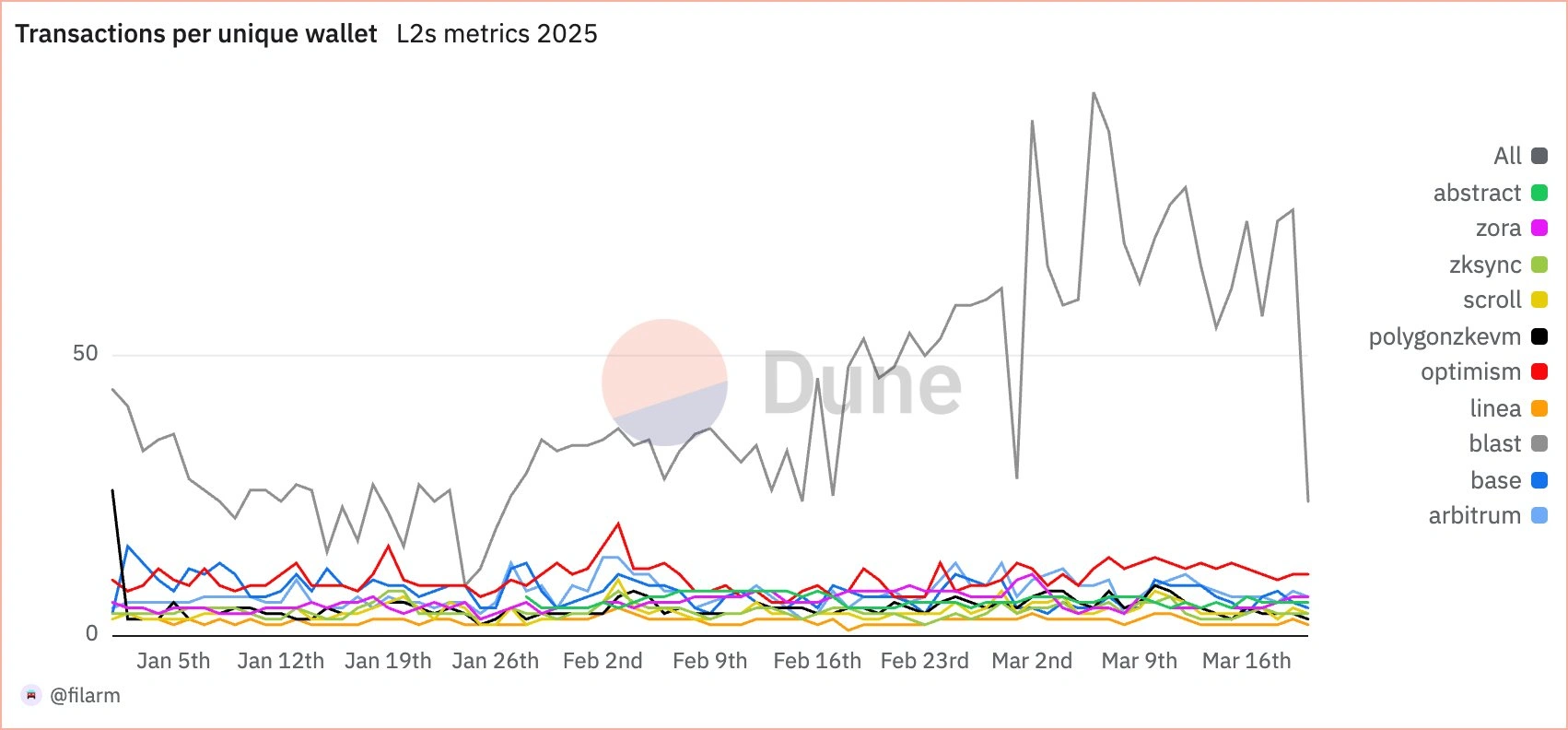

In a message about X (formerly Twitter), Filippo (@filippoarman) reports that the biggest winners in terms of the value of transactions are explosion and optimism per unique wallet. However, Dune also pointed out that this metric can sometimes be misleading because it is susceptible to distortions that are usually due to Sybil attacks.

Blast and optimism are the largest L2S winners in terms of value of transactions per unique wallet. Source: Dune Analytics

The gap between the block chains is becoming increasingly clear in the Revenue section (aka transaction tendon), which according to Dune is a great statistics because it represents the income (transaction costs), costs (L1 costs) and profit (L2 costs).

Base takes a large share in terms of transaction costs, accounting for more than 80% of the market share. Arbitrum moves between 5 and 10% and is followed by abstract and optimism in approximately 5 to 3% of the market share.

When analyzing this data, Filippo stated that in terms of income per transaction a statistics that sets light on how much profit the layer 2 blockchain generates on average from each transaction that is processed on a certain day, leads linea and then followed by Base, ZKSYNC and Polygon ZKEVM.

However, if it concerns the total profit (profit = turnover – L1 costs), the basis comes at the top again and is followed by arbitrum on the graph. Both block chains lead in terms of profit and profit per transaction.

Ethereum still dominates with 50%+ share with regard to DEX volume. Regarding the L2S, Base and Arbitrum, the load leads, where the basis lasts approximately 25 to 30% share and Arbitrum claims 15%, while others are far behind.

Ethereum still dominates NFT trading volume, with a share of more than 80%. ZKSYNC is second in the L2 front, with a share of 10% – 15%, followed by base (3.5%) and explosion (2.5%).

Base has turned out to be a high -quality income and profit, while Arbitrum has maintained a positive consistent statistics in almost all statistics. As the report shows, Base and Arbitrum are not only at the top; Some L2 -block chains, such as ZKSync, Scroll, Linea, Blast and Optimism, excel in certain statistics.

The Future of L2 -Blockchains on Ethereum

The report also reflects an increase in the performance and use of L2-Blockchains, which reflects the sentiments of Joseph Lubin, co-founder of Ethereum, following Joseph Lubin, who said that the future of the Ethereum-Blockchain is bound to L2 scale solution.

Lubin said this on the Digital Asset Summit, adding that the security of Ethereum and the developed infrastructure make it the best basis for improving networks, so that developers can build without a new Layer-1 network.

However, there is no absolute agreement with the position of Lubin, because investors consider L2 -Blockchains as parasitic for the Ethereum L1 -Blockchain, with reference that L2 -Blockchains adds little value to the L1 -blockchain compared to the value they distract from Ethereum.

Given the available user data and statistics, there is no doubt that L2 -Blockchains are here on Ethereum to stay, and the only way will be ahead of both layers to forge a mutual beneficial pact.