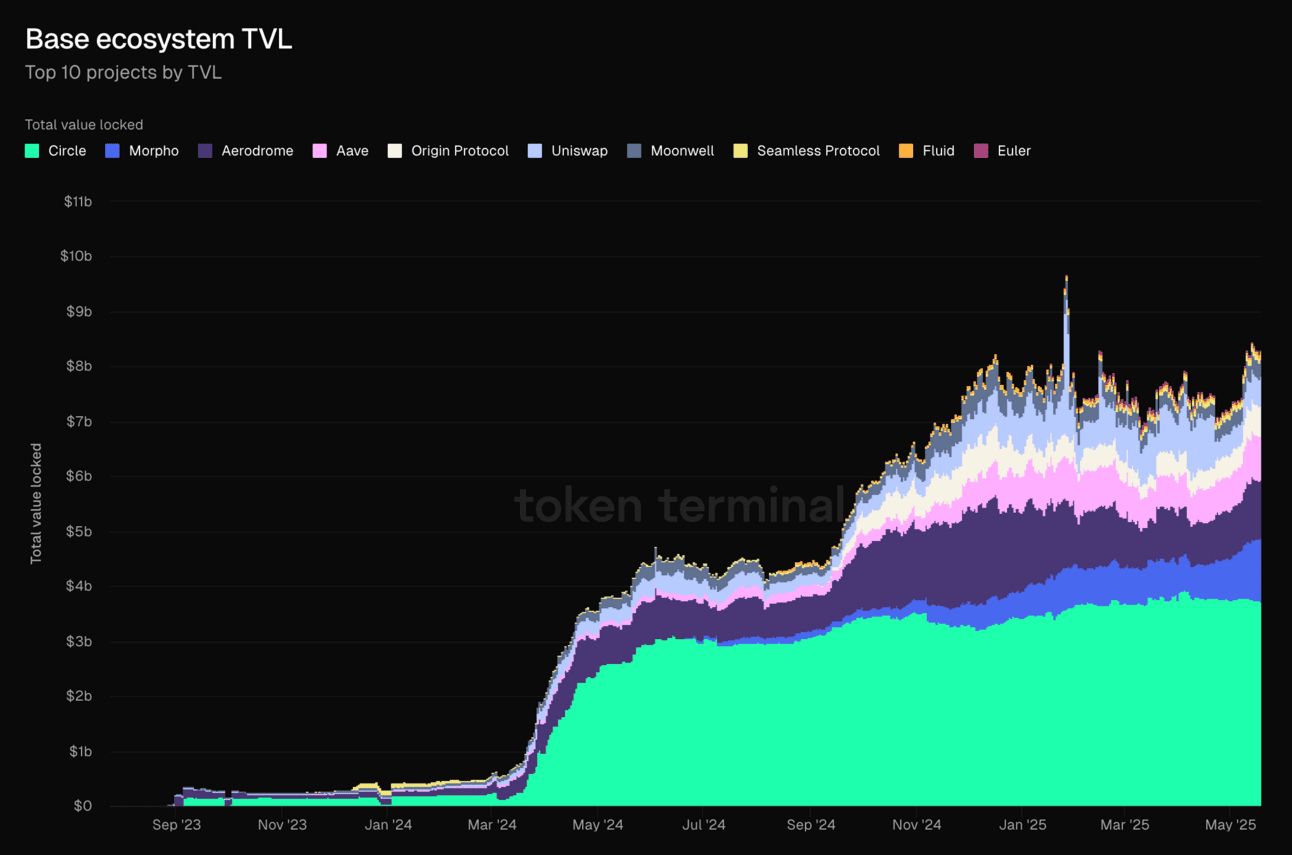

The total value locked (TVL) in Base, the Ethereum Layer 2 (L2) network developed by Coinbase, has more than doubled in the past year.

Base’s TV has risen from $ 3.9 billion to $ 8.4 billion in the last 12 months, according to data from Token Terminal. The rise has made the leading L2 blockchain made by Ecosystem TVL – This refers to the total US dollar value of assets that has been deposited in applications in a blockchain. For context, the Ecosystem of Ethereum currently has $ 213.9 billion in TVL.

In the past month alone, the BASE TVL has grown by almost 16%, according to data from Token Terminal. Arbitrum One currently has the second highest TVL under L2 networks, followed by Polygon POS in the third place.

Base Ecosystem TVL

The Jump in Base TVL shows that more users trust and use the network. An important motivation behind this, according to experts, is that Binance.us now supports ETH and USDC on the base. This integration, announced earlier this year, makes it easier for people to use the network without moving assets via the Mainnet of Ethereum.

Token Terminal notes that the top six protocols on the basic network are good for 93% of the total Eco System TVL. These protocols include Morpho, Aerodrome and Uniswap. And of the top applications on the base, most support from Coinbase (Circle) or Coinbase Ventures (Morpho, Aerodrome, Uniswap, Fluid, Euler, etc.), noted the tokenminal report.

Stablecoins Boost TVL

In addition, approximately 45% of the total Ecosystem TVL comes from Stablecoin -superior deposits, mainly in Circle’s USDC and EURC. USDC is currently the second largest stablecoin through market capitalization at almost $ 61 billion, according to Defillama.

In recent years, the Stablecoin market has a huge increase in the fact that institutional interest is growing and facilitates the regulations. The market capitalization of the sector is around $ 245 billion, an increase of almost $ 3 billion in the past week alone. Tether’s USDT leads with a market capitalization of $ 153 billion.