Base, a low-two blockchain developed by Coinbase, has seen a significant increase in total value locked (TVL) in the last 24 hours after an important integration.

It comes in the midst of changing Windtjes in the US, with the pro-Crypto attitude of President Trump inspiring bold movements among sector players.

Base TVL rises 20% as Binance.us adds support

According to data about Defillama, BASE TVL has risen by $ 557 million. It moved from $ 2,778 billion on Thursday to $ 3,335 billion from this letter, an increase of 20% in the last 24 hours.

Base TVL. Source: Defillama

The increase in TVL suggests an increased volume of assets that is set, locked or deposited in the basic blockchain. A higher TVL indicates increased user activity, trust and acceptance, whereby users commit capital to the protocol.

In the meantime, this rise is following a remarkable announcement of Binance.US, the American arm of Binance Exchange, the world’s largest crypto -trading platform by volume statistics.

According to the announcement, Binance.us now supports the basis. This allows Ethereum (ETH) and Circle’s USDC (USD Coin) stablecoin transfers to the Layer-2 network.

“We are delighted to announce that Binance.us is now supporting the basics! From today you can deposit and record Ethereum (ETH) and USDC via basic,” said a fragment in the announcement.

The stock market emphasized that more assets will join Binance.US to the basic network, which indicates interest in developing integration. In the meantime, with the help of the blockchain from Base ETH and USDC, users can deposit and record directly from and to Binance.us.

This integration can strengthen accessibility for the exchange. In particular, Binance.us users can interact with the BASE ecosystem without bridging assets via Ethereum’s Mainnet. This is in the midst of the worries that the Mainnet of Ethereum is slow and expensive.

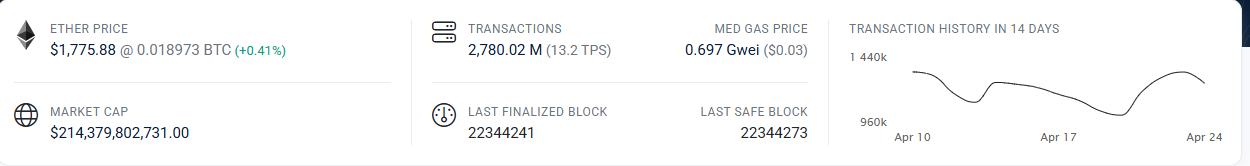

As an L2 scale solution, Base offers faster and Lower transactions compared to the Mainnet of Ethereum. Data on Etherscan show that the transaction supply of Ethereum is approximately 13.2 TPS. This can lead to network congestion and high gas costs during peak periods.

Ethereum TPS. Source: Etherscan

On the other hand, basic processes transactions off-chain, they bundle before they submit them in Ethereum. This method reaches higher transit and considerably lower costs, making it more cost -effective for users.

That is why the Integration Binance.us users enables ETH and USDC to move for Defi activities against a fraction of the costs.

In the meantime, this development comes only a few months after Binance.us USD deposits and recordings restarted via bank transfer after a two-year interruption.

Binance.us has suspended its USD payment and recording services after a controversial secrecht case and increasing regulatory pressure from 2023. But in the midst of shifted political rhetoric to crypto, stock markets seem to take daring steps.

“Now that we have survived, our goal is to help thrive crypto and enable all Americans to be freedom of choice,” said Binance.us Interim CEO Norman recently drove.

It is in line with a recent step of the Kraken Exchange. As Beincrypto reported, the BNB exchange in the US stated in a movement that marked a strategic shift in American crypto exchanges, which may indicate a wider token advice in the country.