- AVAX was testing a crucial level of support, with on-chain metrics showing positive signs.

- Altcoin liquidity levels are in a potential near-term retracement, but the overall market remains bullish.

Avalanche [AVAX] had witnessed a 24% price increase in the last 48 hours after bouncing back from the $22 price level.

The altcoin tested a critical previous support level for the symmetrical triangle around $28 at the time of writing.

If this technical pattern is not broken, it could turn support into resistance, potentially hampering the altcoin’s bullish momentum.

Source: TradingView

AVAX’s positive sentiment

AMBCrypto’s further analysis of the on-chain metrics revealed some encouraging signs. At the time of writing, there was a 49% increase in whale activity and a 14% increase in trading volume, according to IntoTheBlock.

Source: IntoTheBlock

This suggested that larger market participants and active traders were actively involved in AVAX, possibly indicating positive sentiment.

Short-term retracement in prospect?

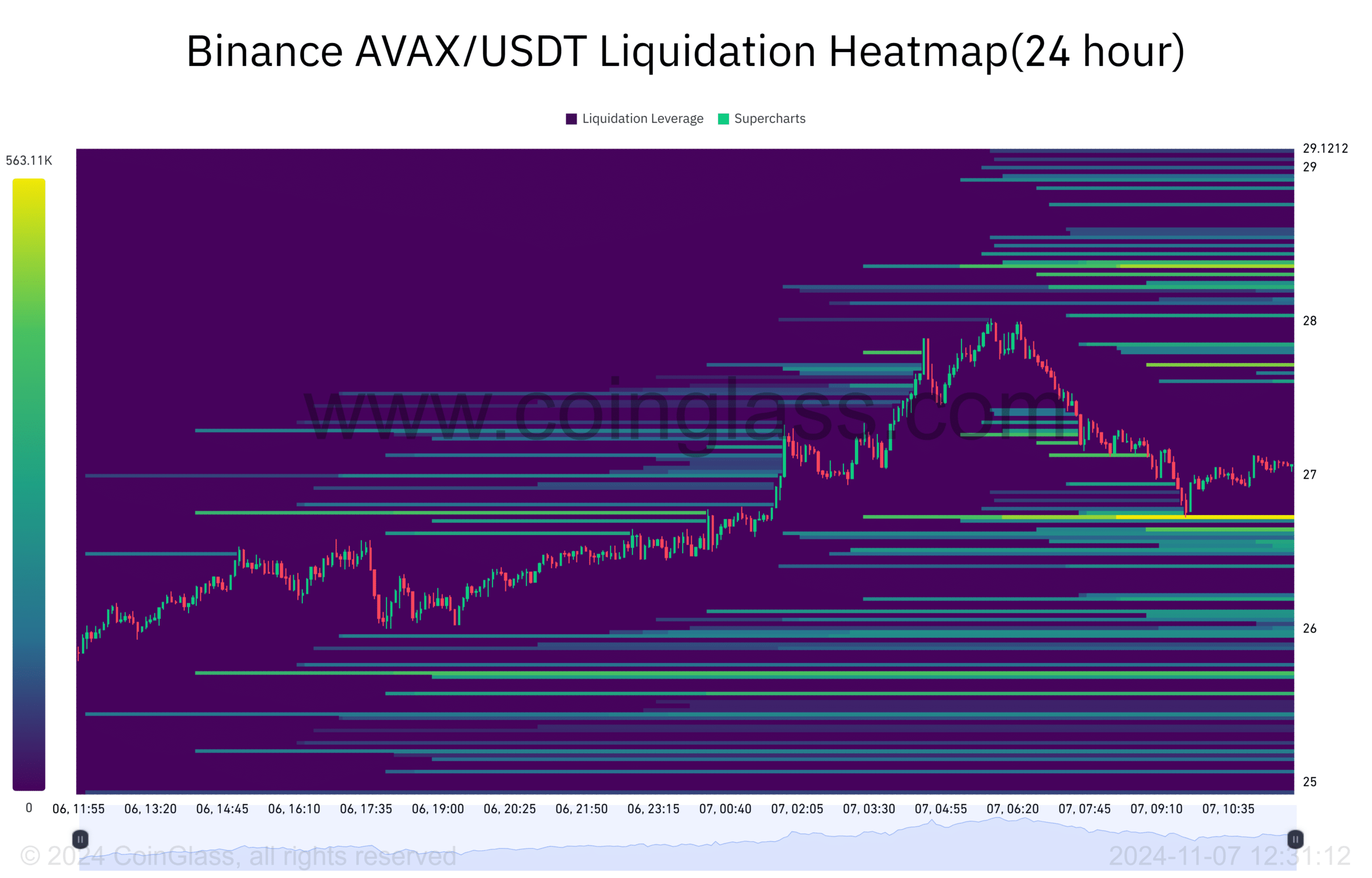

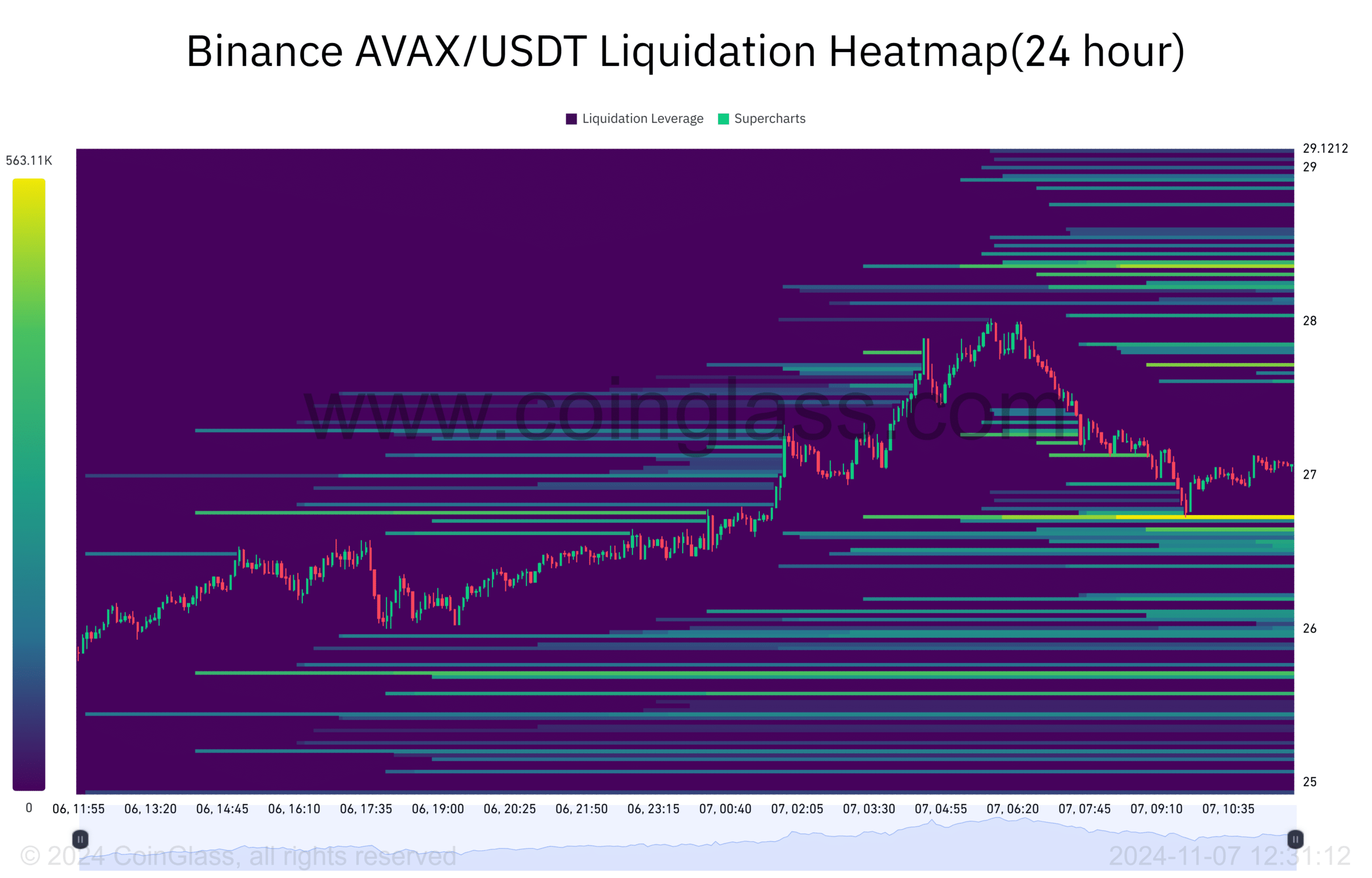

The liquidation heatmap data further complicated the picture.

AMBCrypto’s look at Coinglass data indicated a significant AVAX liquidation pool worth 563K at the $26.73 level, suggesting a near-term retracement could be on the cards.

This level could act as support or resistance depending on the market reaction and the extent of the whale push and trading activity.

In the case of Avalanche, whales dove into the market, as evidenced by the rising number of large transactions.

AVAX could then see a short retracement before an expected rally after the next liquidations are taken advantage of.

Source: Coinglass

What’s next for AVAX?

As AVAX tests the previous symmetrical triangle support, investors will be closely watching the market’s reaction.

Read Avalanche Price Forecast 2024–2025

If support holds and becomes a new resistance price level, the altcoin could see bullish momentum continue into a further price rally.

However, if the resistance level at $28.16 holds, the market could witness a retracement in the near term.