Avalanche (AVAX) rose to a notable six-month peak of $20 this past week and has attracted significant investor attention, prompting an investigation into the fundamental drivers behind this impressive upward price move.

Some analysis has pinpointed GameFi’s resurgence within the Avalanche ecosystem as a crucial catalyst that could potentially fuel additional gains for AVAX.

Specifically, AVAX revisited the $20 threshold on Monday, marking an important milestone as this price level had not been seen since April 2023.

The resurgence of GameFi as a major growth catalyst suggests that the intersection of decentralized finance and gaming applications within the Avalanche network is promising.

As the market absorbs this rebound, questions naturally arise about the sustainability of the bullish momentum and the underlying factors that contributed to the recent breakout in AVAX’s price.

In light of these developments, a deeper analysis is warranted to understand the potential extent to which the bulls can propel this rally and the broader implications of the GameFi revival within the context of the Avalanche ecosystem.

AVAX market cap currently at $6 billion. Chart: TradingView.com

As optimism permeated the cryptocurrency sector, ecosystem prosperity saw a widespread revival across networks.

Avalanche (AVAX) seamlessly joined this trend and confirmed its participation in the prevailing positive sentiment within the crypto space. This collective rise underscored the buoyancy of several networks, including AVAX, as they navigated the evolving landscape of the digital asset market.

Meanwhile, TraderJoe, a prominent decentralized exchange (DEX) on the Avalanche network, has witnessed impressive growth, marked by a significant increase in trading volume and fees collected over a specific period.

Watching @TraderJoe_xyz as a doubles match, on both Avalanche and Arbitrum.

– Trading volume +112%

– Costs +146%

– Supply-side fees increased to $138,000

– Trading volume per chain: 74% Avalanche/ 25% ArbitrumTrader Joe enjoys the volume of both stories. pic.twitter.com/0BkP3zzU7V

— Emperor Osmo

(@Flowslikeosmo) November 13, 2023

Trading volume saw an increase of more than 100%, indicating a significant increase in user activity on the platform. At the same time, fees generated from trading activities increased by an impressive 146%, reaching a substantial amount of almost $140,000.

At the time of writing, AVAX was trading at $17.03, down 6.5% in the past 24 hours, and down a solid 32.4% in the past seven days, data from Coingecko shows.

This increase in supply-side fees underlines the increasing use of the TraderJoe platform within the Avalanche network. The distribution of trading activities shows that a substantial majority, accounting for 74%, took place on the Avalanche chain, highlighting the platform’s popularity within the Avalanche network. The remaining 25% of trading took place on Arbitrum [ARB].

Avalanche network activity tells a different story

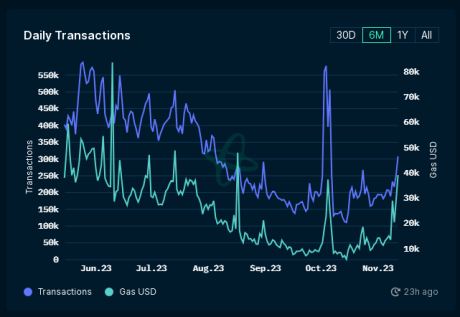

As this developed, another interesting aspect was observed in the network: in the last quarter activity on the Avalanche network experienced a decline, with both transaction volume and active addresses on the prominent “C-Chain” decreasing compared to the previous quarter of 2023.

Source: Nansen

Data sourced from DeFi Llama shows that Avalanche’s Total Value Locked (TVL) fell nearly 30% in the third quarter, from $706 million to $512 million. Although there has subsequently been a 10% recovery in TVL to $564 million, daily transactions remain at a lower level of 232,000.

Source: Nansen

AVAX price at risk?

Nansen’s data shows that daily active users peaked at 86,000 in the third quarter, down from 117,000 in the previous quarter. Daily active transactions also saw a decline, ranging from 136,000 to 504,000, a significant shift from the previous range of 200,000 to 550,000. Notably, on October 15, this measure reached a low of 110,000.

While these numbers don’t bode well for the near past, it remains a complex question whether this decline will jeopardize AVAX’s price trajectory. Broader market sentiment and the network’s adaptability to emerging trends, especially in the dynamic domain of decentralized finance, are likely to play a crucial role in determining the future of AVAX’s price.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from iStock