Este Artículo También Está Disponible and Español.

Avalanche has had to deal with ruthless sales pressure since mid -December, and wipes out more than 60% of its value and knew all the profit from the impressive rally of November 2024. The extensive downward trend has made investors uncertain about the short -term prospects, because because The entire market is struggling to regain regaining in the midst of continuous volatility. Recent price promotion, however, offers a spark of hope, because Avax stabilizes and seems to find a strong demand at crucial levels.

Related lecture

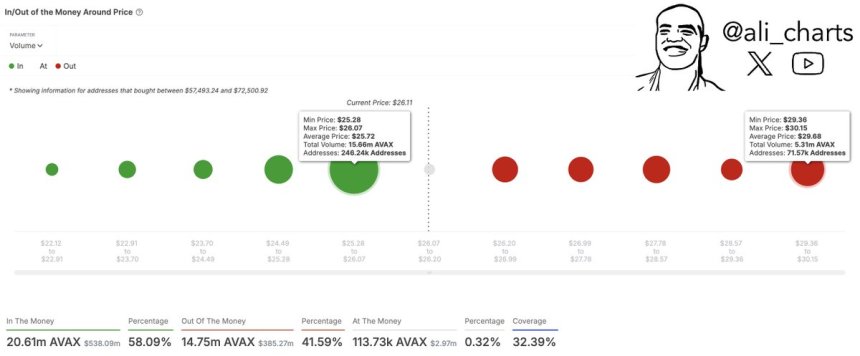

Top analyst Ali Martinez has shared important insights, with a potential recovery scenario for Avalanche. According to Martinez, Avax is above a critical demand zone between $ 25.30 and $ 26.10. This level acts as a strong support and offers the basis that is needed to shift the market sentiment. If the price remains above this zone, Avalanche could get the momentum that is necessary for a recovery rally, with a target of $ 30 in sight.

The coming days will be crucial for Avax, because investors look closely to look for signs of strength or a possible demolition. While the bearish sentiment of December lingers, this demand zone could be the launch platform for a turnaround, causing renewed optimism to be caused by both traders and long -term holders. Will Avalanche finally bounce back? Time will learn it.

Avalanche ready for a recovery

Avalanche has traded a state of indecision, where bulls are unable to push the price above $ 27 and bears that do not float further. These tug of war has kept the market in a tight reach, so that traders and investors are uncertain about the next big step. Although some analysts are optimistic about a potential recovery, others warn a continuation of the bearish trend that Avax has plagued since mid -December.

Martinez shared critically Insights on XEmphasize that Avalanche above an important demand zone is between $ 25.30 and $ 26.10. This level has worked as strong support in recent days, which prevents further disadvantage and Bulls has the opportunity to organize a comeback.

According to Martinez, this demand zone could offer the momentum that is needed for a meeting in the direction of the $ 30. However, the price must first erase the level of $ 27, which has proven to be a significant resistance point. If Avax succeeds in breaking this level, a rally can follow quickly.

In the coming days will be crucial for the Avalanche price action. Bulls must recover the $ 27 marking to shift the sentiment and attract more buyers. On the other hand, losing the most important support zone can result in a continuation of the Bearish trend, so that Avax may be brought to lower demand levels.

Related lecture

While the market is closely monitoring, all eyes are aimed at whether avalanche can collect the power for a recovery rally or collapse for further sales pressure. This indecision is the stage for a potentially explosive movement and traders must remain careful because the market finds its direction.

Avax pricing tests crucial offer

Avalanche (Avax) acts at $ 26.7 after an increase of 7% yesterday, which signals renewed Bulls efforts to regain control of price action. The $ 27 has emerged as a critical level of supply and acts as a barrier for further upward movement. Bulls are currently aimed at reclaiming this level, which the price has retained for a few days. If Avax can successfully push over $ 27 and delete the $ 28 resistance, a recovery rally momentum can win, which can stimulate the price to the $ 30 marking.

The current rally, however, faces challenges, because the sales pressure on these important levels remains strong. Losing the $ 25 support zone would probably stop the recovery attempt and lead to further consolidation under the key range that Avax is currently testing. A breakdown below $ 25 could bring Avalanche back to the demand zone of $ 23- $ 24, which extends the uncertainty around the short-term direction.

Related lecture

In the coming days will be crucial to determine whether Avax can keep its recent profit and reverse its bearish trend. For now, Bulls has to build on the momentum of yesterday by recovering the $ 27 marking and keeping them as support. This would be the stage for an outbreak above $ 28, which shifts the market sentiment in favor of a wider recovery rally.

Featured image of Dall-E, graph of TradingView