This article is available in Spanish.

Avalanche has experienced an impressive 25% gain since Wednesday, driven by the Federal Reserve’s announcement of a 50 basis point rate cut. This has pushed AVAX to a critical resistance level, which will likely determine price action in the coming weeks. Currently trading near $28, the token is testing a key supply zone where analysts and investors are paying close attention to its next move.

Related reading

Many market participants are optimistic and predict that a break above this resistance could pave the way for an aggressive increase in AVAX’s price. This would likely push AVAX into a new uptrend, potentially leading to new highs and even a 50% increase for the token. However, if Avalanche fails to break this level, it risks a pullback that could cause prices to retest previous support levels.

Analysts highlight this moment as crucial in determining AVAX’s market direction, as broader crypto sentiment has become more bullish following the Federal Reserve’s recent decision. With increasing trading volume and investor interest, the coming days will be critical in determining whether Avalanche can maintain its momentum or suffer a short-term correction.

Avalanche testing of key supply levels

Avalanche has been one of the best performing altcoins in recent days, showing impressive strength amid a broader market rally. This recent momentum could just be the start of a more significant move for AVAX, as analysts and investors predict even bigger gains if the token continues to breach key supply levels.

One of the most respected figures in the crypto space, Carl Runefelt, shared a bullish one technical analysis of Avalanche on Xstating that AVAX has broken the falling wedge pattern, a classic indicator of bullish price action.

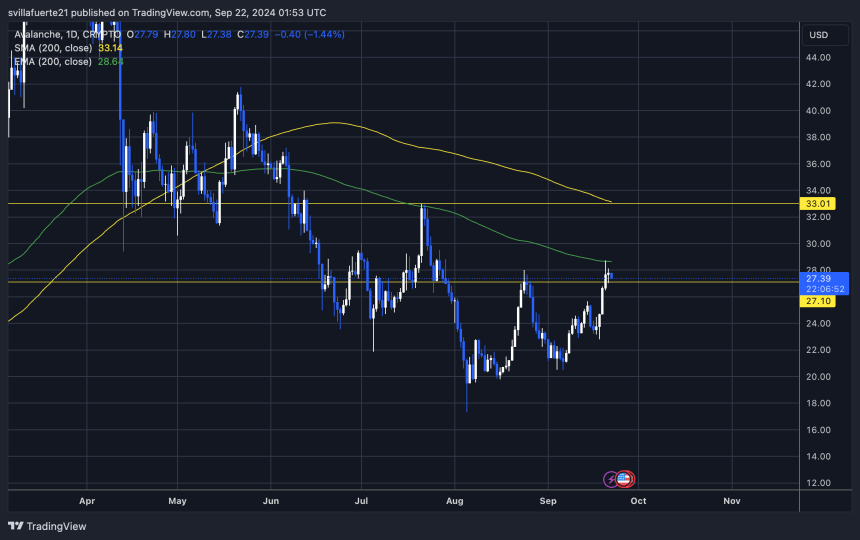

According to its analysis, AVAX has successfully retested the wedge and is now targeting medium-term price levels. Runefelt’s price targets for AVAX are $28, $33, $41.30, and $54, each representing crucial supply zones that the token must surpass to continue its upward trajectory. If AVAX reaches $41.30, it will reflect a 50% increase from the current price, which represents significant progress.

Related reading

Currently, Avalanche has reached a new high, confirming its strength. While the price may consolidate before making the next move, many investors believe this consolidation could be a stepping stone to a bigger move higher.

With broader market sentiment turning positive following the Federal Reserve’s recent rate cut, AVAX is well positioned to rise further, especially as more investors look to take advantage of its strong technical setup.

If AVAX can maintain this momentum, it could potentially lead to significant gains in the medium term.

Price levels to watch

AVAX is currently trading at $27.39 after testing the daily 200 exponential moving average (EMA) at $28.66. The token has seen an impressive 40% surge since early September, bringing it closer to crucial supply levels that will likely determine price action in the coming weeks.

If the bulls want to maintain momentum and extend the rally, AVAX must break the $28 resistance and reclaim the 1D 200 EMA as support. This would signal a more sustained uptrend and position AVAX for further gains.

Related reading

However, if the price struggles to stay above $25, a deeper correction could follow, bringing bearish pressure in the short term. Despite this risk, there remains an opportunity for AVAX to consolidate between $25 and $28, giving the token room to gather strength for a bigger rise in the near future. Investors are watching these levels closely as the market looks for direction.

Featured image of Dall-E, chart from TradingView