- Avalanche on the weekly and daily time frame shows strength.

- AVAX’s on-chain data looked good.

Avalanche [AVAX] continues its expansion into traditional finance, with ParaFi Capital looking to tokenize some of its $1.2 billion on the blockchain. The development is in line with AVAX’s growing momentum as its price action shows potential for higher gains.

AVAX is currently consolidating within a falling wedge pattern on the daily chart, which began after the previous bull cycle ended in April.

Analysts are closely watching the AVAX/USDT pair, with expectations that a breakout above the $28 level could trigger momentum towards the $50 mark. This could result in a return on investment of more than 104%.

However, failure to break $28 could lead to a retest of the support levels at $24.9 or $17.25.

Source: TradingView

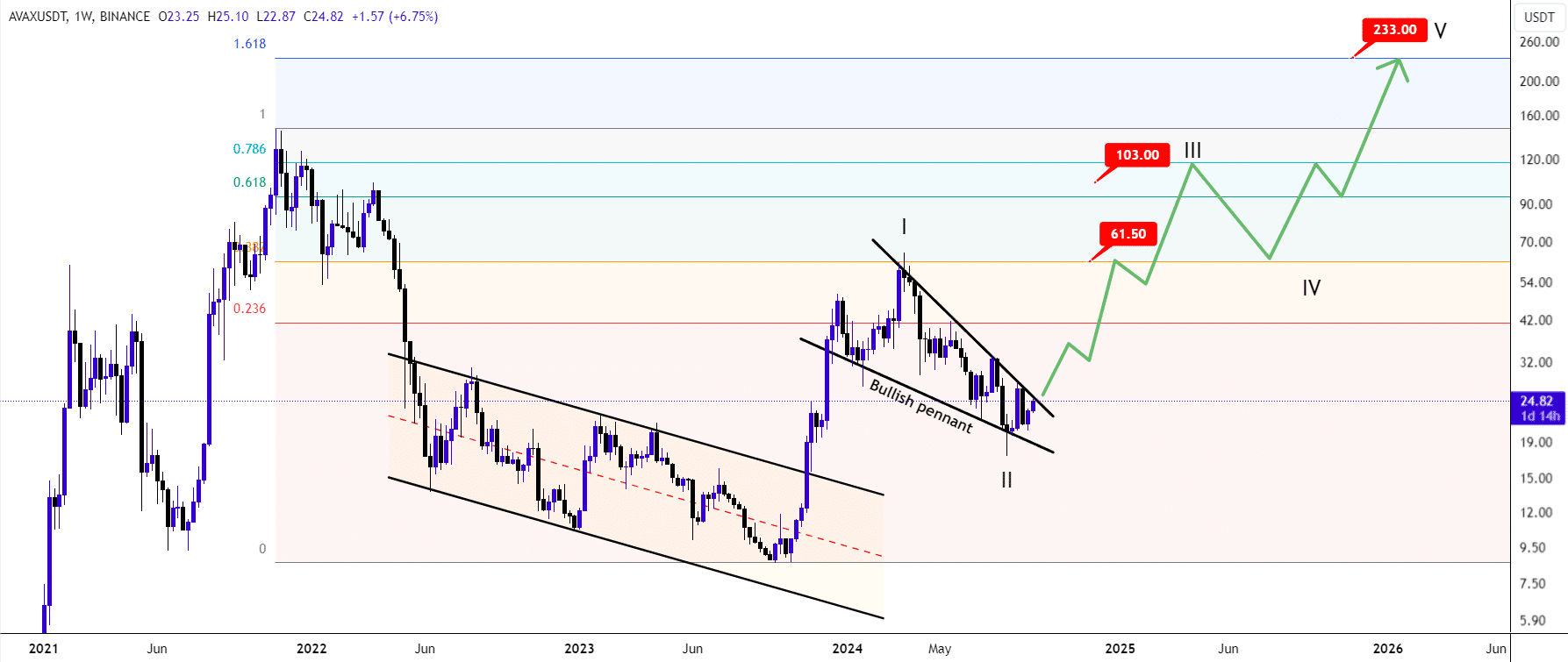

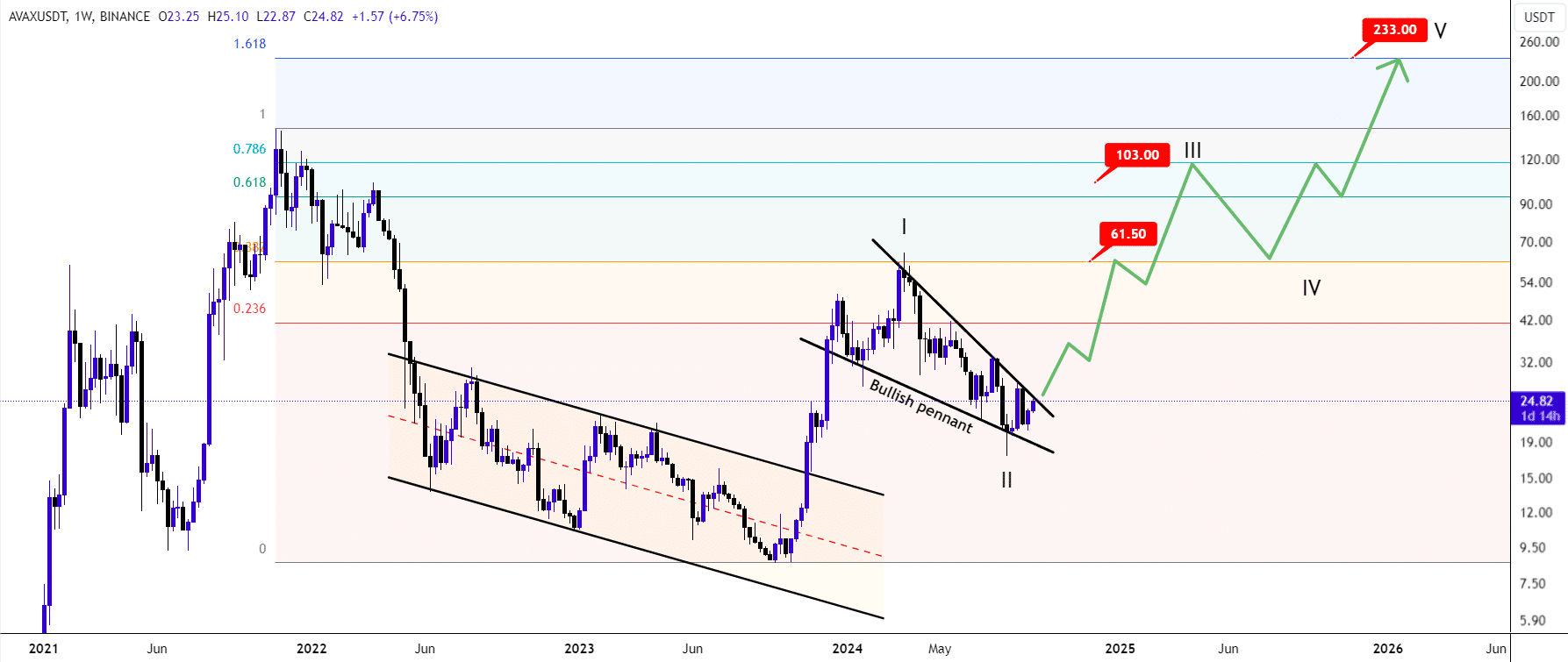

On the weekly time frame, AVAX/USDT has completed its second wave of correction and the bullish pennant pattern is also over.

The next step is expected to be the third bullish wave, which may reach the Fibonacci zones of 0.618 to 0.786 before another correction and then further upside.

Short-term goals are set at $61.50, medium-term goals are set at $103, and long-term goals are set at $233. This higher timeframe outlook indicates a bullish trend for AVAX, with significant potential for long-term gains.

Source: TradingView

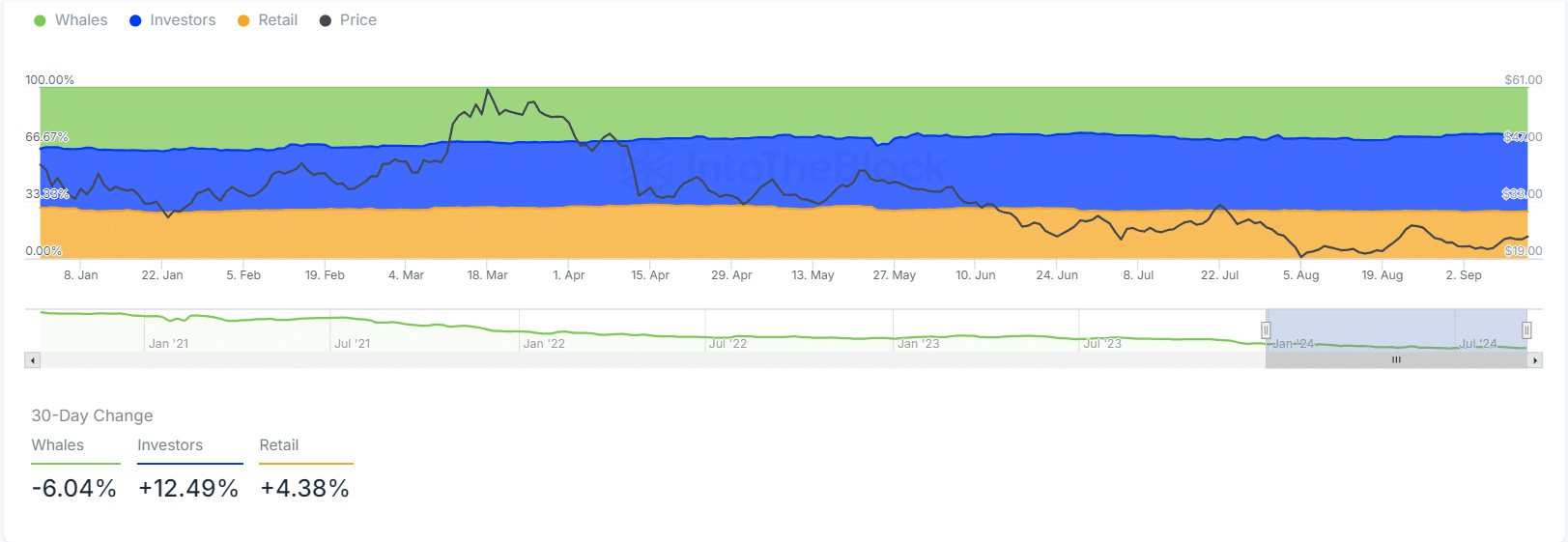

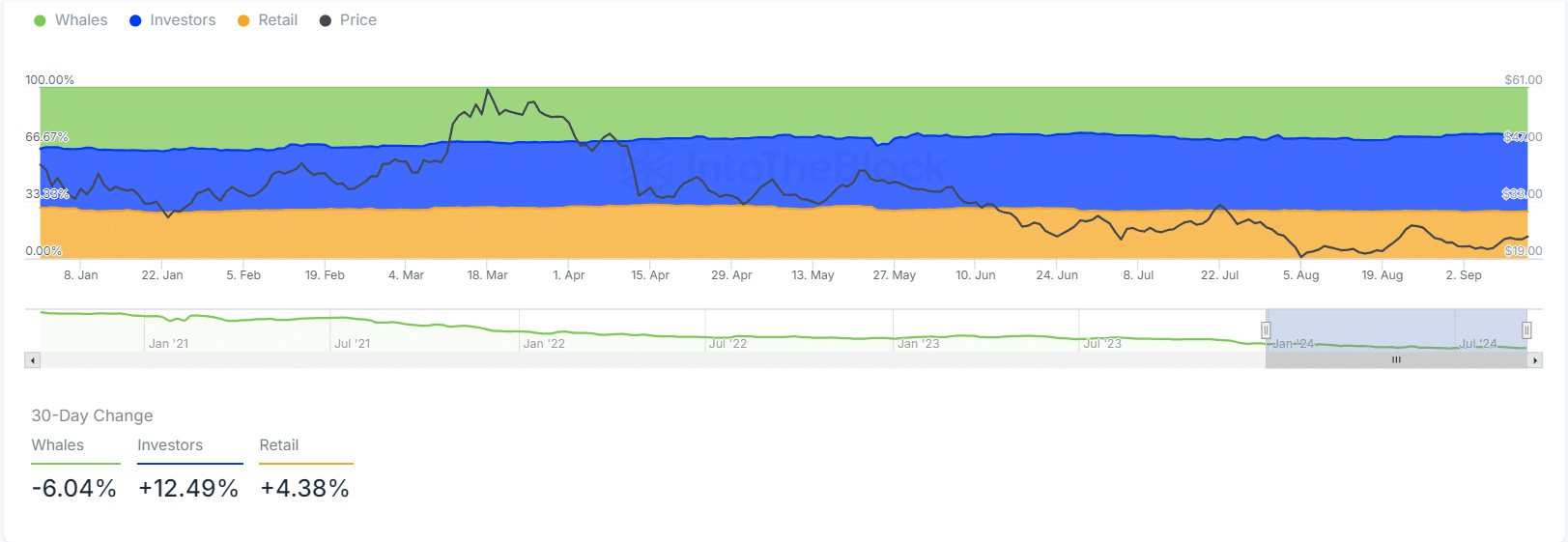

Historical ownership concentration

On-chain metrics also support a bullish outlook for Avalanche. AVAX stakes are up 6%, the total value of DeFi (TVL) is up 11%, and stablecoins on the Avalanche blockchain are up 13%.

These factors reflect the growing trust in the network.

Furthermore, historical ownership concentration shows minimal changes, with a notable increase in retail ownership by 4.38% and investor ownership by 12%.

Source: IntoTheBlock

Whale ownership saw a slight decline of 6%, but the overall trend remains bullish, supported by strong price action.

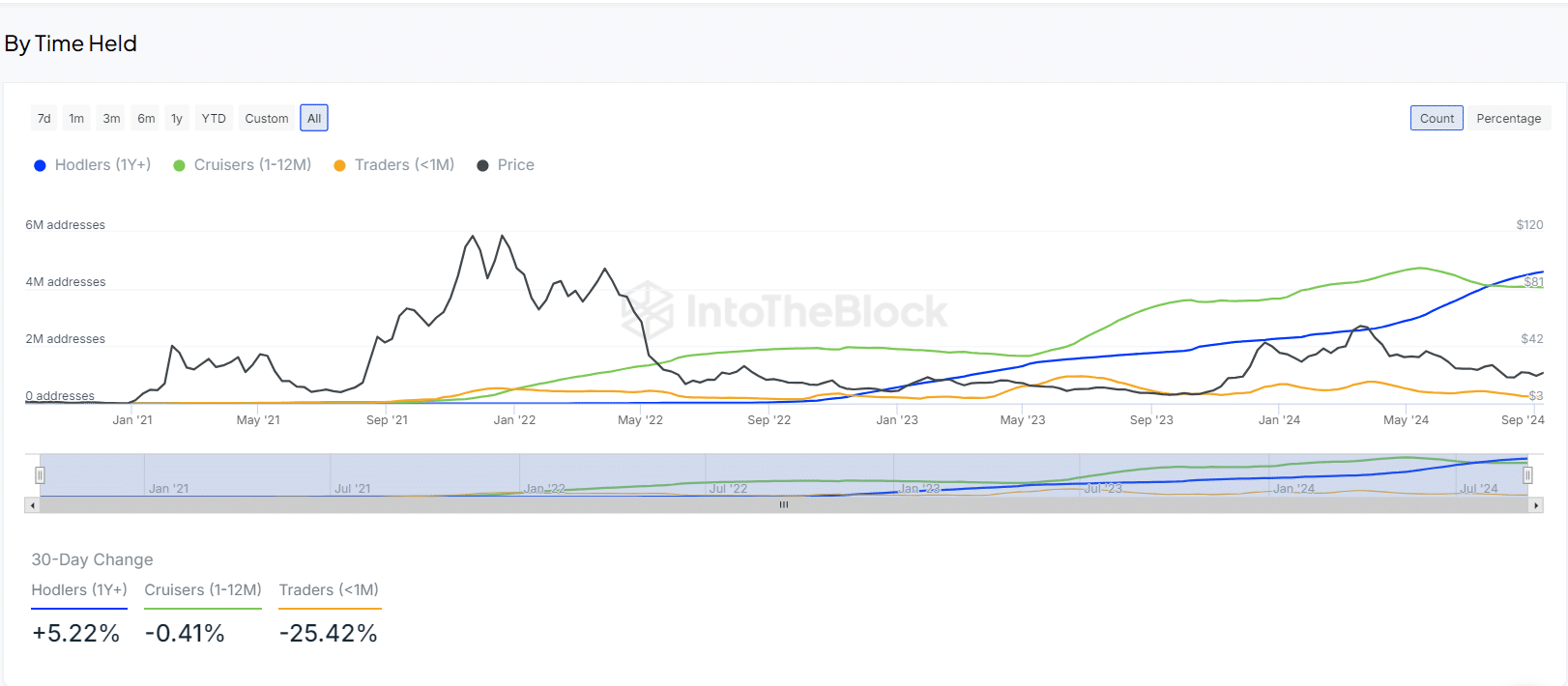

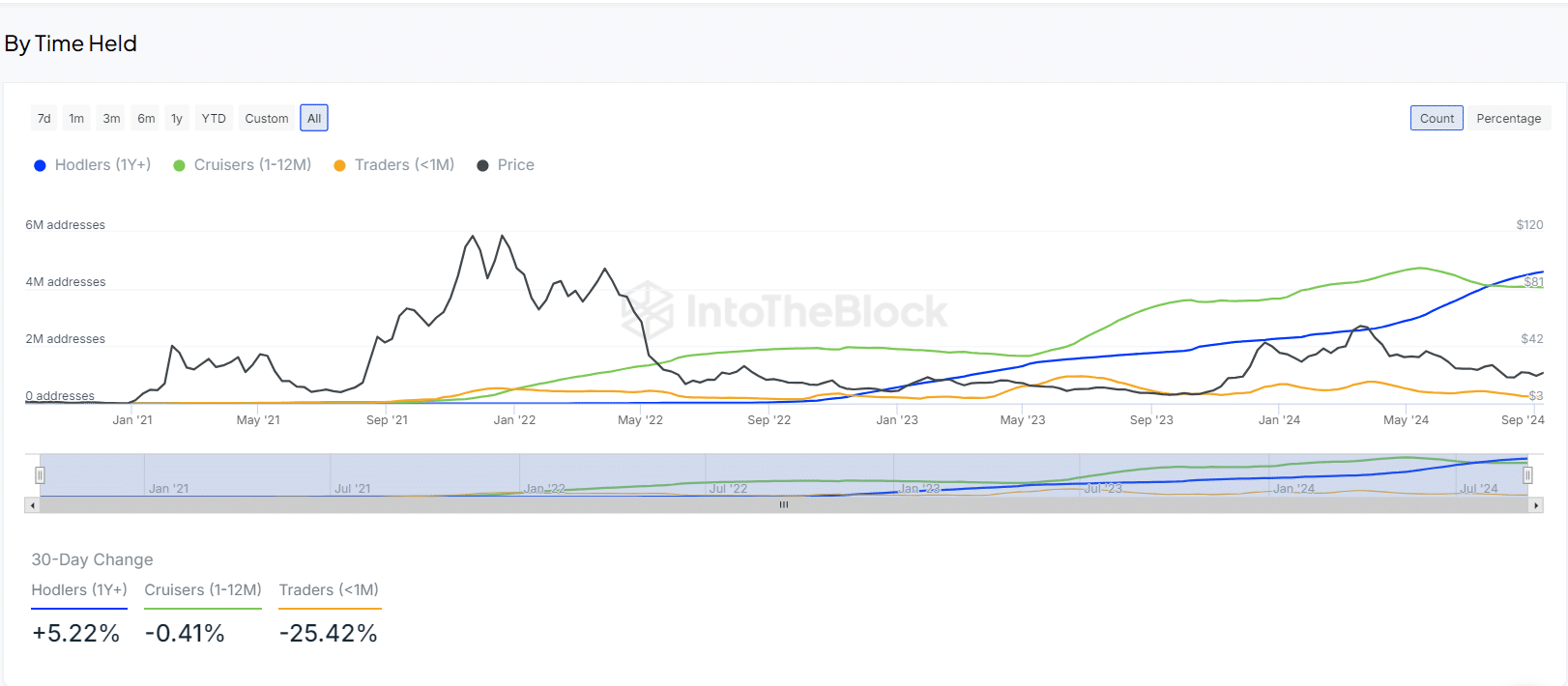

Avalanche addresses based on time

Furthermore, the analysis of Avalanche tokens over time reveals an increase in the number of long-term holders.

Investors who held AVAX for more than a year saw a 5% increase, while investors who held between one and 12 months experienced a small decline of 0.4%.

Although day traders are more active, they hold AVAX for shorter periods and contribute to higher activity in the chain.

Source: IntoTheBlock

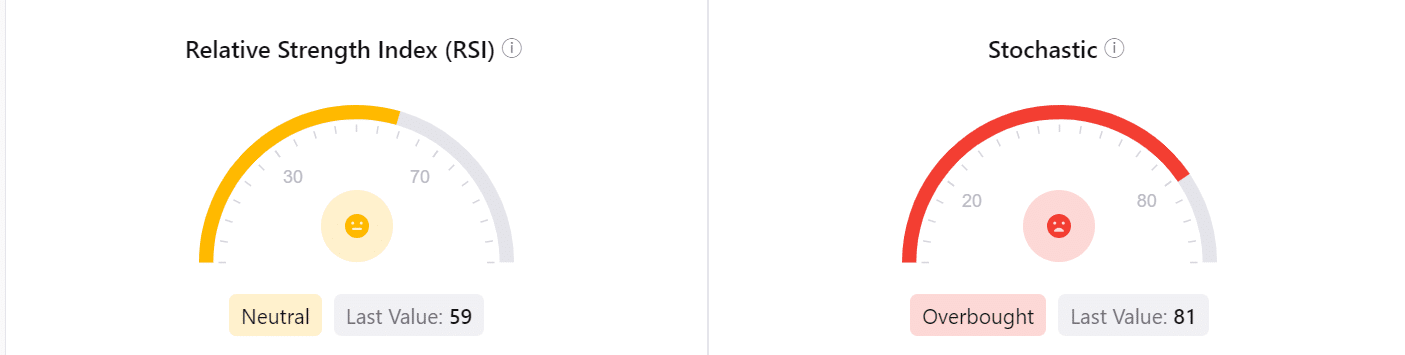

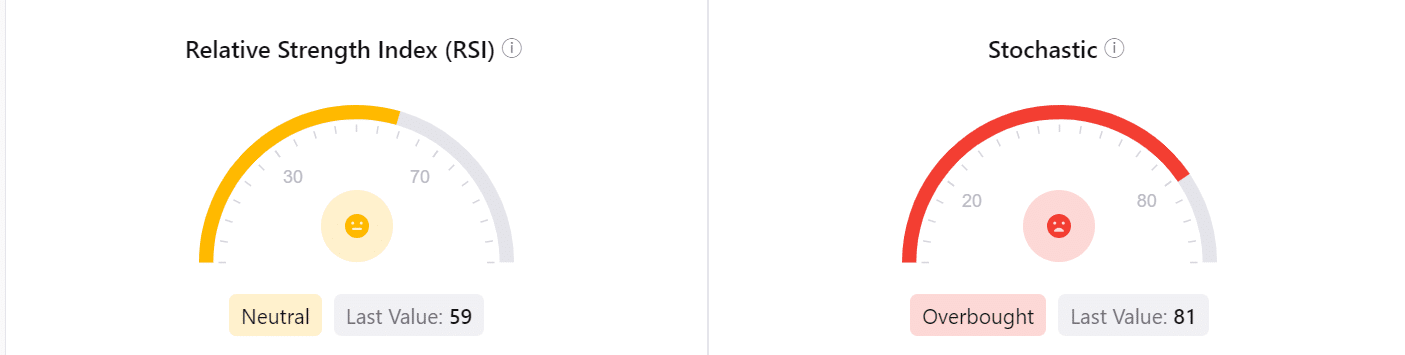

RSI is neutral

The relative strength index (RSI) indicates a neutral reading of 59, while the stochastic RSI stands at 81, indicating an overbought situation.

Despite the overbought signal, this is not always a harbinger of a turnaround. In fact, it often signals bullish momentum for AVAX, especially when other indicators are not signaling a downturn.

Is your portfolio green? Check out the Avalanche Profit Calculator

Traders view this as an optimistic sign that AVAX’s price is going up.

Source: CryptoQuant

With these bullish signals across technical, on-chain, and proprietary metrics, AVAX appears poised for further price gains in the short and long term.