Non-fungible tokens have come a long way, according to Anjali Young, Abridged’s co-founder and COO. In an interview with BeInCrypto, Young pointed to the June 15 auction of “The Goose” NFT at Sotheby’s as a positive sign. While the NFT fine art market faces numerous challenges, including imprecise valuation, Young sees blockchain transparency as an asset.

2019 was the last stretch before a pandemic. For Web3 and crypto, it was also the year when the general public was introduced to non-fungible tokens (NFTs). One of the first to catch on was NBA’s Top Shot. After an explosion in popularity in early 2021, NBA Top Shot surpassed CryptoKitties and Decantraland to become the world’s largest NFT marketplace.

Sotheby’s auction a bullish sign

By 2021, the market had matured significantly. Legendary auctioneer Sotheby’s sold NFTs for $17 million as art world residents came to watch.

By the end of the year, the legendary auction house had made more than $100 million by selling digital collectibles alone, according to their own figures. At the time, their endorsement marked the transition of NFTs from a passing fad to prestigious digital artwork.

In October of that year, Sotheby’s even launched its own marketplace: Sotheby’s Metaverse.

However, that was before the bear market. But while interest in NFTs is down 95% from its peak in January 2022, according to Google Trends, the art and fashion world are two cliques that have continued to take them seriously.

Ringer’s “The Goose” NFT by generative artist Dmitri Cherniak sold last month for a hammer price of $5.4 million at Sotheby’s, the second highest ever for a digital collectible.

Young sees Sotheby’s recent auction numbers as a sign of the robustness of the NFT market. The sale generates positive outside attention, she said.

“In the run-up to the auction, Sotheby’s estimated that ‘The Goose’ would fetch between $2 and $3 million. By closing at $6.2 million and blowing its original 2021 sales price out of the water, “The Goose” exceeded all expectations,” Young continued.

“Having wins like this during a bear market is a testament to the staying power of this unique art form, in a way that many valuable sales during the peak NFT mania of yesteryear failed to fully capture,” she added.

NFTs have their own culture, says Anjali Young

In August 2021, 3AC co-founders Su Zhu and Kyle Davies purchased “The Goose” for approximately 1,800 ETH. A figure worth about $5.8 million at the time. In Sotheby’s recent auction, it went to a pseudonymous NFT collector named 6529.

“The fact that ‘The Goose’ has been reintroduced into the NFT community from a now-defunct hedge fund shows the passion and conviction of the space’s artists and collectors,” Young noted.

“So far, the buyer has expressed its belief that key crypto-cultural markets should originally remain in decentralized spaces. That’s why ‘The Goose’ was purchased collectively through an on-chain museum, and this recent auction shows that crypto has a culture of its own. One that should be celebrated and shared, even beyond our narrow borders.”

But Sotheby’s recent auction is half of two stories. Because regardless of the exciting subculture of NFTs, or the occasional auction story that erupts in the mainstream press, NFTs are old news. At least for most people.

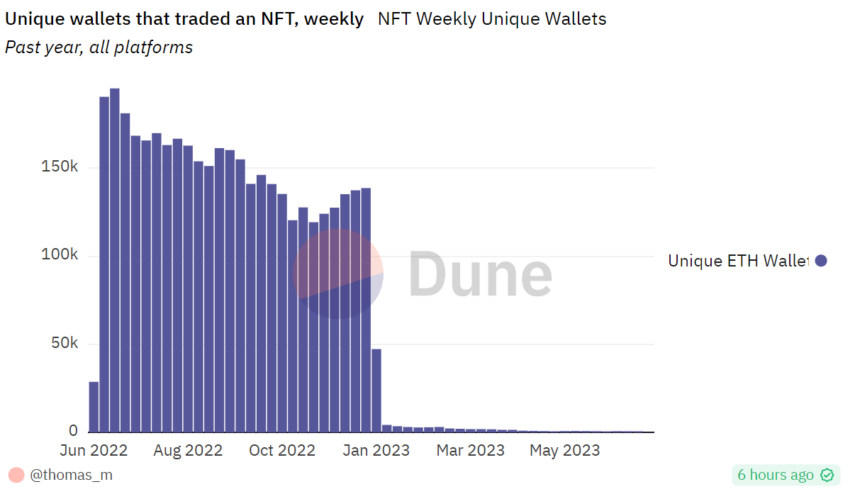

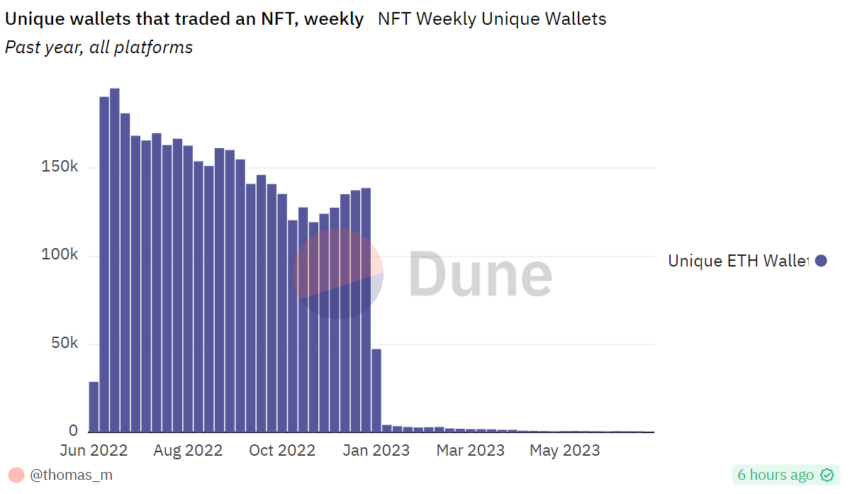

According to data from Dune, the weekly numbers of wallets trading Ethereum NFTs collapsed in January 2023 and never recovered. NFT trading is clearly a minority occupation – at least for now.

Source: Dune

Fashion has lingered

However, according to Young, Sotheby’s recent event wasn’t just about trade-in value. So maybe those fixated on record prices are missing the point?

“The conversations mostly revolved around the sheer beauty and impact of what it means to be at this special intersection of art, technology and community. Not so much the constant chatter about rock-bottom prices that some would expect after reading media coverage of the auction,” she said.

Young also sees potential for the sector as fashion brands have entered (and stayed) the space. Demonstrating that, at least in the eyes of some, NFTs are not a passing fad.

“During the day [my recent] While visiting Europe, I noticed a growing excitement around brands and NFTs outside of the US,” said Young. “We are starting to see luxury fashion brands such as Gucci, Louis Vuitton and Lacoste embrace NFTs, with many more to come. waiting in the sidelines to learn and eager to join in when the time is right for them.”

Learn more about unique digital collectibles and their potential: NFTs explained: what are non-fungible tokens and how do they work?

At the same time, Young also sees significant barriers to the wider adoption of NFTs. One of them is education.

Does the average Joe fully understand what they are apart from expensive monkey JPEGs? She remains skeptical.

“I wouldn’t say the basic concept of NFTs is as widely understood as it could be. Cultural and educational barriers to its adoption certainly exist around the world. These are areas we need to focus on as we strive to make NFTs more mainstream.

A more transparent market

One of the nagging concerns about NFTs and the market around them is price accuracy. How do investors know that what they are buying is a “quality” NFT? How do you know you’re not buying into an over-hyped collection that will soon be overshadowed by the next flavor of the month?

In comparison, high-quality art is widely recognized as one of the most manipulated markets in the world. And one that prefers to keep the price of established artists (whose artwork is already in the collections of the very wealthy) at a very high level.

How is the NFT market different if we don’t even know the identity of the pseudonymous trader 6529?

“Inaccuracies happen in all sorts of valuations, from real estate to corporate stocks,” Young admitted. “There is no absolute measure of truth in any of these domains. However, the advantage of NFTs and other crypto assets is that all transactions are openly visible on the blockchain.”

Young considers the degree of transparency involved here to be unprecedented.

“While it is true that there is no foolproof method to determine value, this level of transparency puts us on a more favorable trajectory compared to many other markets.”

NFTs are more than art

“The value of art will always be financially subjective and socially prohibitive,” said Young.

As 6529 aptly put it, long-lasting generative art on the chain is magical in the sense that, “unlike almost any other art form, neither the artist nor the first collector knows what the piece will be the moment it is collected. ”

While the focus shouldn’t always be on NFTs as art or speculative assets, Young said. Part of the education deficit with NFTs is the lack of understanding of how they are so much more.

“They’re already being used in a variety of ways,” says Young. “From online club memberships, to gaming integrations, to access to exclusive real-life events. They are also used as proof of participation and attendance, loyalty points and even as elements of digital identity.”