- Dogecoin has struggled to establish a bullish trend after November’s run

- The realized CAP HODL waves showed some encouraging signs for buyers

Dogecoin [DOGE] rose 18% in 36 hours, moving from Monday’s low of $0.3097 to $0.3653 on Wednesday. This move caused the memecoin to retest the $0.36 resistance zone, which had been a key area of demand and then supply since mid-November.

The decline in daily active addresses was a concern, but other metrics indicated some HODL behavior and accumulation. A rise in Open Interest and analysis of the DOGE/BTC pair showed that the $0.3 level could be a bottom for Dogecoin in 2025. Buyers are showing signs of intent to head towards the $0.7 highs and beyond to go?

Research into the behavior of Dogecoin holders

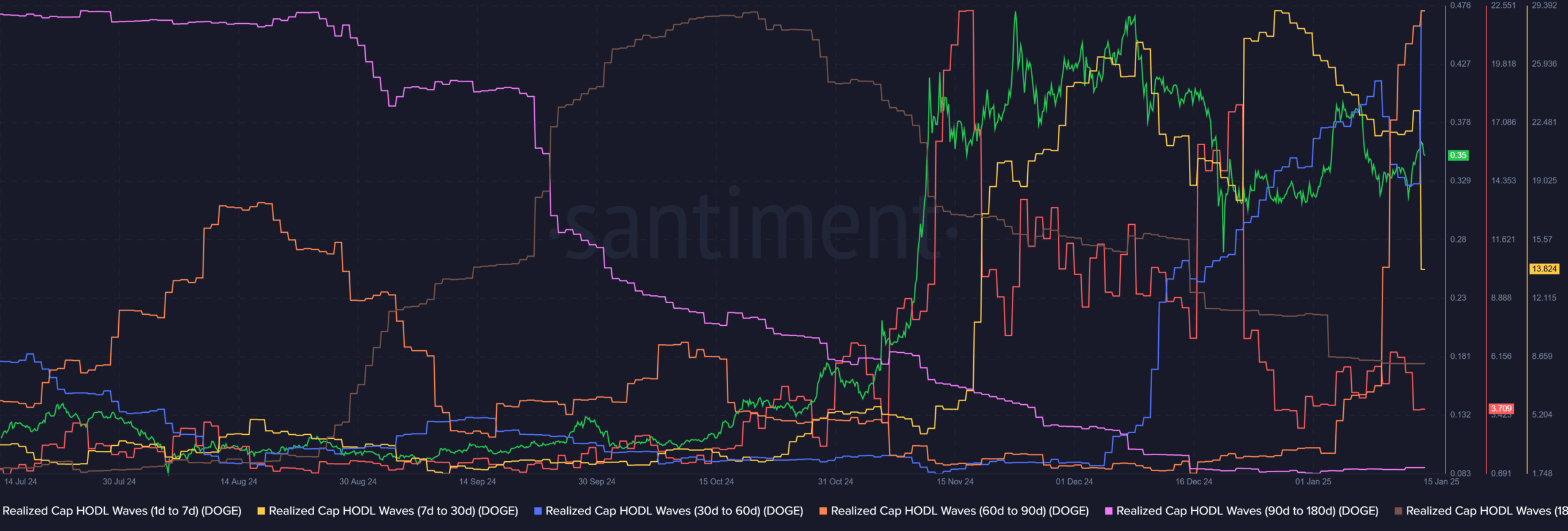

Santiment data showed the realized cap-HODL waves over different temporal intervals. Realized cap is a concept that uses the value of each coin when it was last traded to calculate market capitalization. Typically, the current market price is multiplied by the circulating supply to determine the market capitalization.

This difference in calculation provides a more accurate estimate of a crypto asset’s value and can be used to create various other metrics such as MVRV.

The realized cap HODL waves in the chart below are a percentage value. The HODL waves are calculated as a percentage of the total realized limit for each time interval of holders. It can provide a sharper insight into the behavior of market participants.

Source: Santiment

The graph outlined the growth of the realized limit from 7 days to 90 days. This indicated an increase in trading or buying activity over this short to medium period. At the previous cycle top in April 2021, the 30-60 day realized cap HODL waves reached nearly 49% per month after DOGE’s all-time high.

At the time of writing, this HODL wave was 27%. The 1-7 day HODL wave has also been waning in recent weeks. Typically, when there is a surge, this cohort of short-term holders has a vastly higher realized cap rate, reaching 52% around the top of the previous cycle.

Realistic or not, here is DOGE’s market cap in BTC terms

Meanwhile, HODL waves from 90 days to 365 days have also declined in percentage terms. This meant that longer term holders sold their tokens and realized profits. This could be a result of the shift in market sentiment over the past six weeks.

The reduced near-term HODL waves made these holders reluctant to sell and expected more gains. The increase in the 7-90 day realized cap HODL waves was also encouraging.