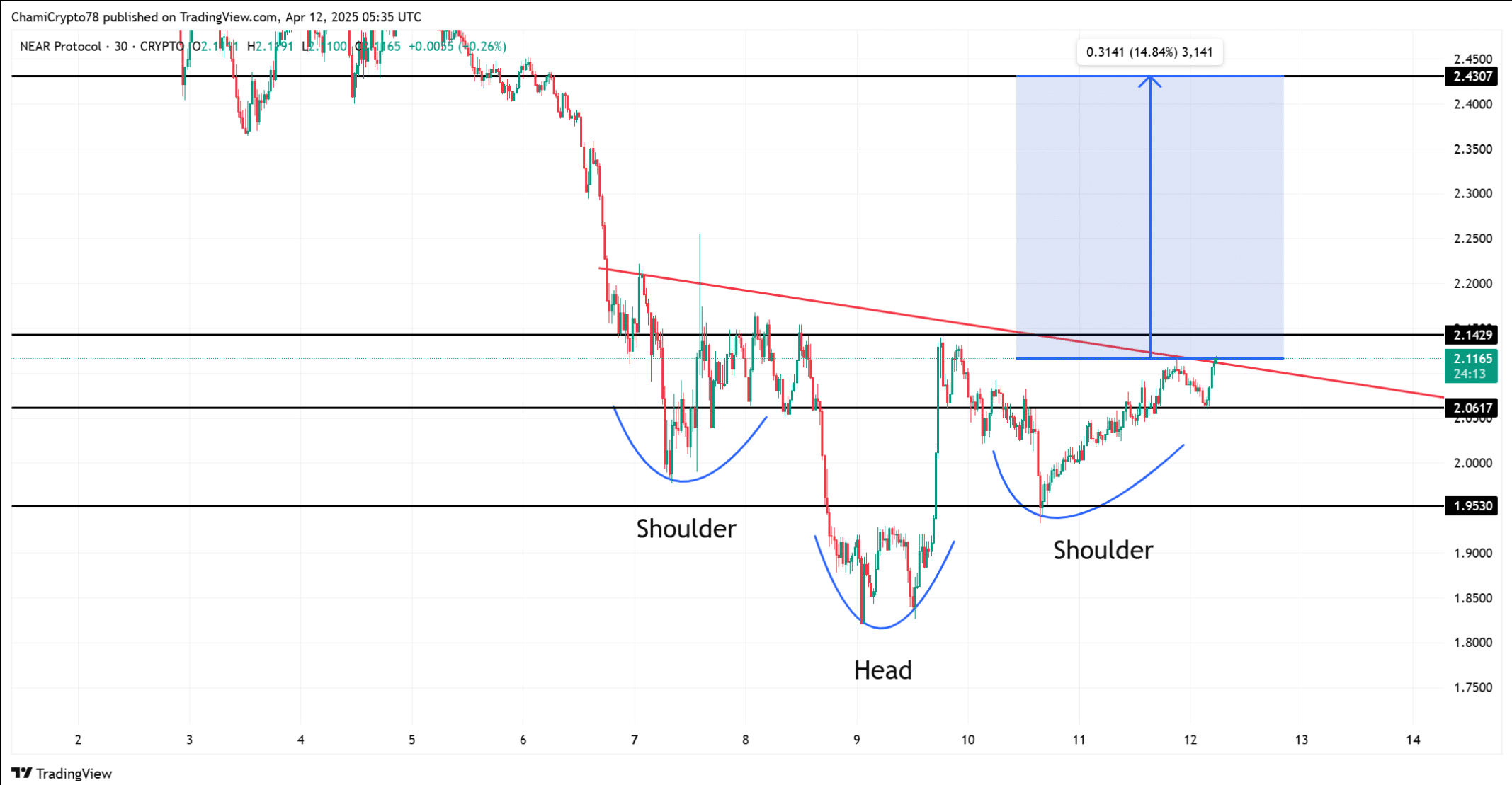

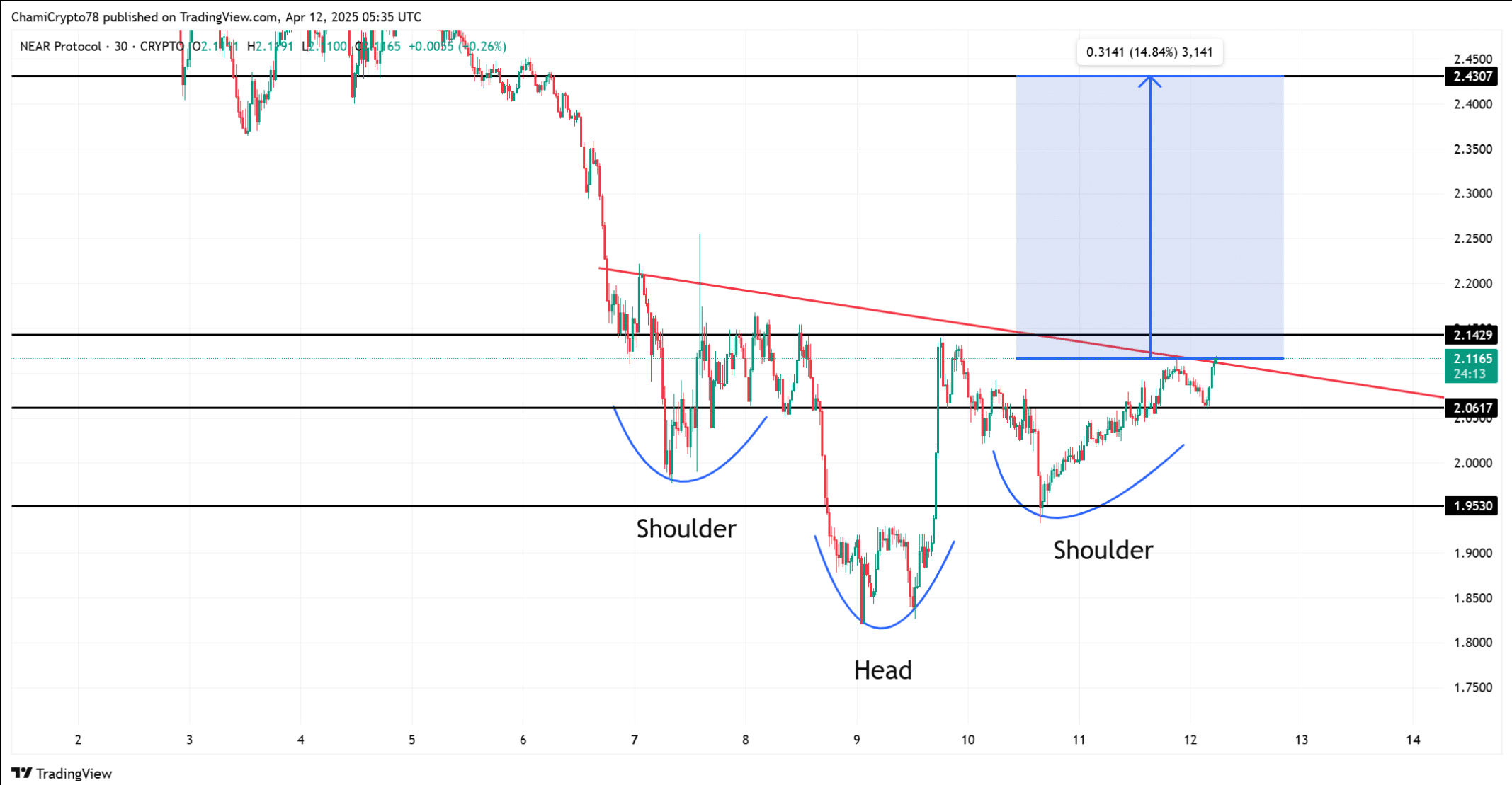

- Near a bullish has tested in reverse head and shoulder pattern with a strong resistance at $ 2.14

- Short liquidations and rising social interest hinted through to build the momentum for a possible outbreak

Near the protocol [NEAR]” At the time of the press seemed to be Signs of a potential rebound show, supported by rising market capitalization and moderate price gains. In fact, market capitalization increased by 4.47% to $ 2.55 billion – a sign of careful optimism among investors. However, this came at a time when the trade volume of 24 hours fell by 15.66% to reach $ 148.48 million.

At the time of writing, near $ 2.12, an increase of 4.26%. Despite the rise in the price, the volume decrease, however, indicated a weak trader. This also suggested that the recent profits might miss the strength needed to activate a persistent rally, unless the purchasing pressure increases meaningfully.

Can the inverse main and shoulders pattern an outbreak steps?

The graph of the neighborhood unveiled a well-defined inverted head-and-shoulder structure-Vaken a sign of a bullish reversal in the making. The neckline was just above $ 2.14, with remarkable support levels at $ 2.06 and $ 1.95.

The price seemed to test this neckline, and an outbreak above it could feed a movement of 14.84% to the projected target of $ 2.43. The symmetry of this pattern, with clearly shaped shoulders and a centrally low, improves its reliability.

However, traders must remain careful, because this bullish setup requires a strong volume confirmation. Without such a catalyst, the rally can get stuck and the pattern can lose its meaning.

Source: TradingView

Mount short liquidations like Bearish Betting

Liquidation data underline the growth pressure on short sellers. In the past few sessions, short liquidations reached $ 31.42k, which exceeds many long liquidations, which amounted to only $ 10.46k. Binance alone was good for $ 21.25k in short liquidations, which shows that many traders have misunderstood the direction of the market.

In addition, Bybit and OKX also saw remarkable wipeouts with the short side, which suggests that bears are pressed as the price edges get higher. This imbalance in liquidations can act as a hidden director of Momentum because forced outputs of short positions create sudden price recordings.

Source: Coinglass

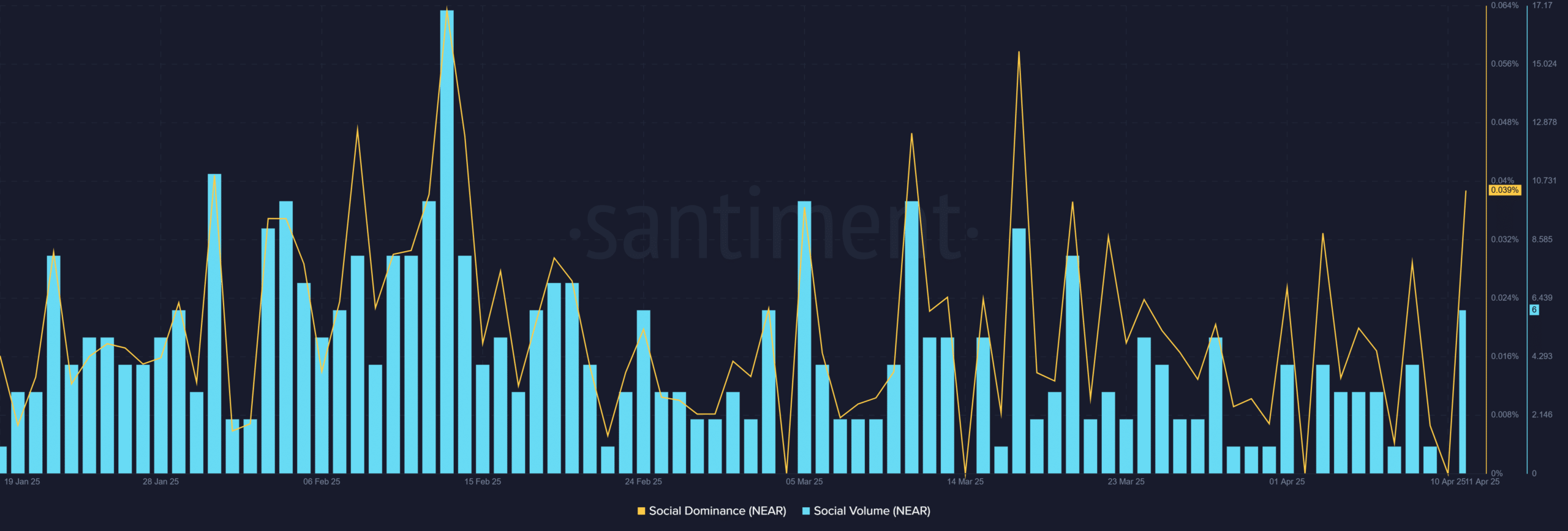

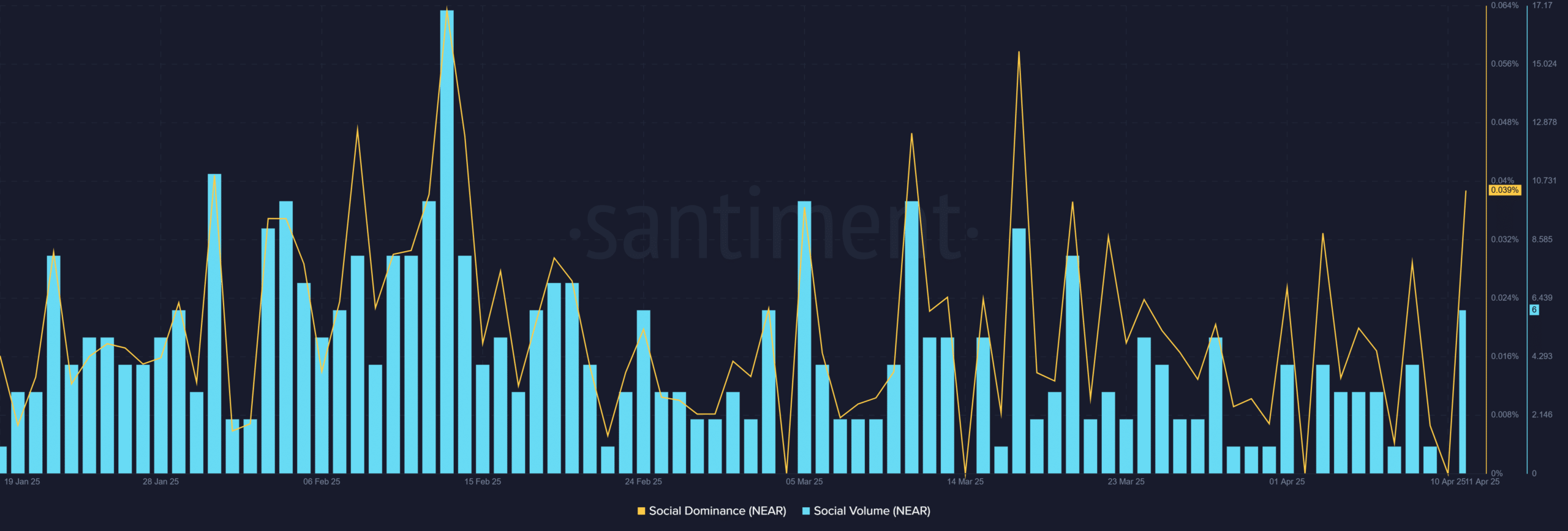

Rising social volume hints on growing interest

Social statistics also emphasized that almost the visibility among retail traders regains. The social volume climbed to 6, while the dominance rose to 0.039% – which marked the highest activity in recent weeks.

Although these figures remain moderate, they underlined a shift in sentiment that could accelerate if price action confirms the bullish pattern. Therefore, if the breakout occurs, the growing of babbling on social platforms can help to have the further demand and FOMO-driven buying offside.

Source: Santiment

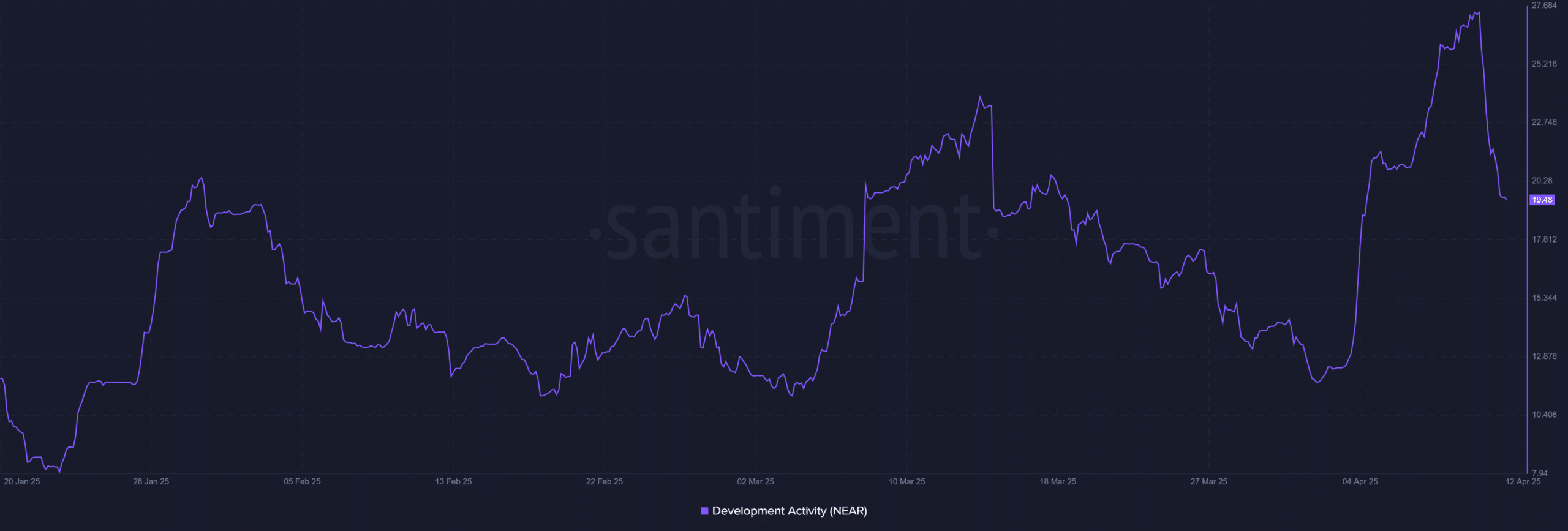

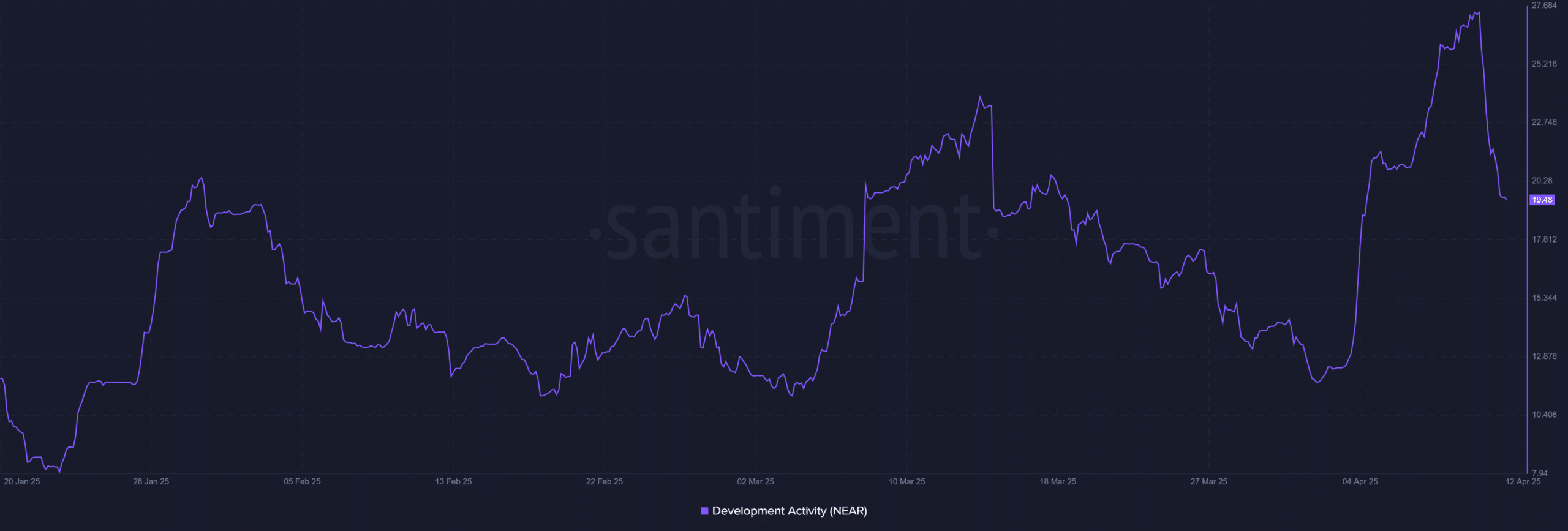

Developer activity cools down, but remains strong

Finally, development statistics in chains revealed a slight delay in construction activity. Near’s development activity score fell from a peak from 27.68 to 19.48 by 12 April. Although this decline can indicate a temporary break after intense upgrades, this did not yet suggest a reversal in the trend.

In fact, developers remain actively involved and they continue to perform almost better than many projects in its category in terms of contributions at code level. That is why every rebound in activity can further strengthen investor confidence in the viability of the long -term long -term.

Source: Santiment

Could almost be made up for his next big rally?

Near Protocol forms a bullish structure that can form the scene for an outbreak. The reverse main and shoulder pattern emphasized a potential movement of 15%, while liquidations with short side and the rising social involvement were at a growing momentum.

However, the real test lies in breaking the $ 2.14 neckline with a strong volume. If this happens in addition to renewed commitment of developers and increasing interest, it can almost be on its way for an important meeting to $ 2.40.