- Bitcoin miners have sold off a significant chunk of BTC after a mild surge, cashing in on profits.

- If the market top slips, miners’ capitulation could increase.

Bitcoin [BTC] Miners have recently sold off a significant portion of their holdings just as mining problems reached record levels.

This is a crucial moment: if miners do not show confidence in a recovery, it could signal an impending bearish run.

Bitcoin miners are at a crucial juncture

The mining community owns about 9% of Bitcoin’s total supply and is expanding capacity amid record high mining woes.

Historically, miner capitulation – when Bitcoin miners quit due to low profits – often signals local price bottoms during bull markets.

The last time this happened was on July 5, when BTC fell to $56K after testing the $71K ceiling. Miners exited due to tight profit margins, contributing to the price floor.

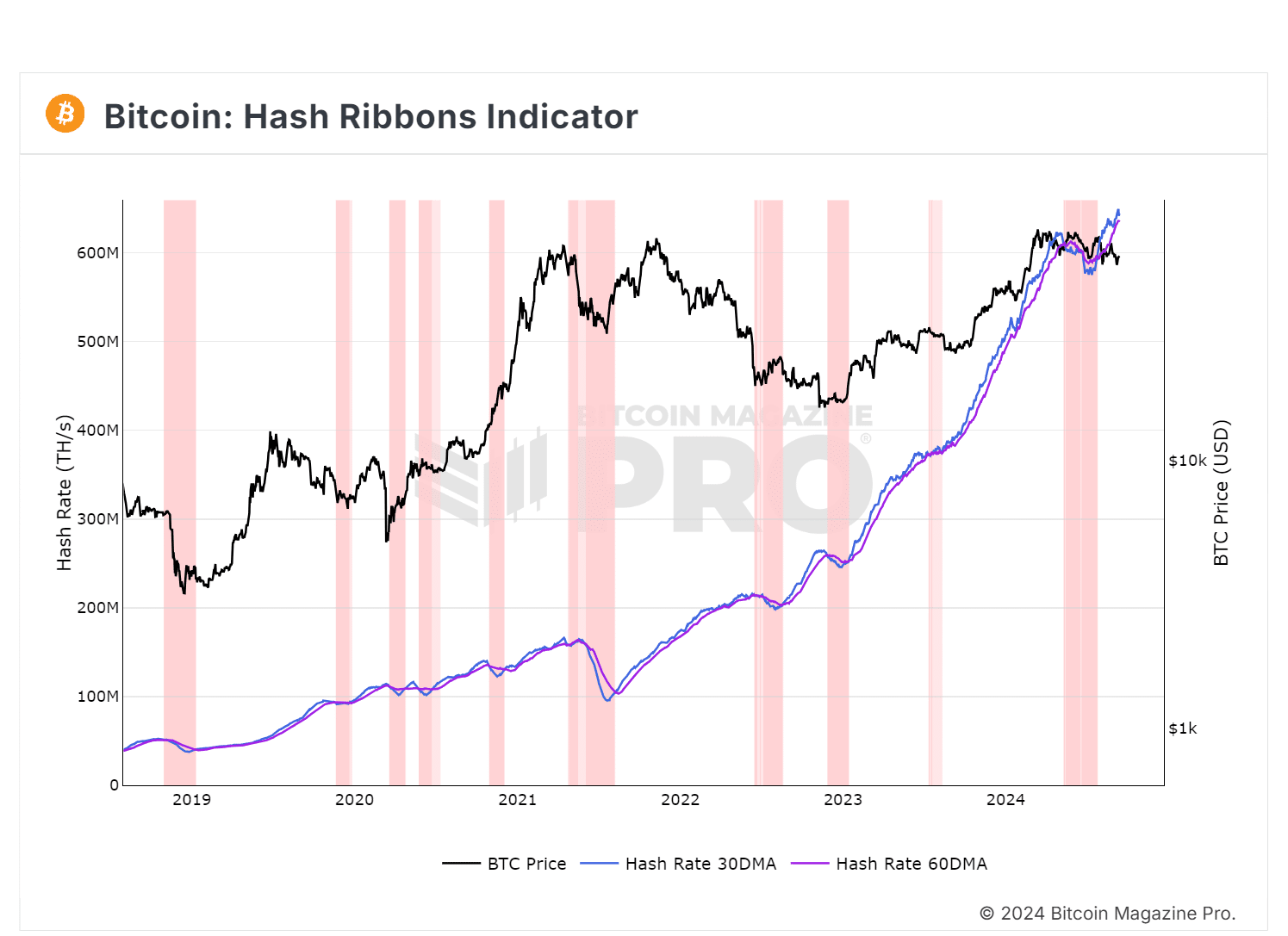

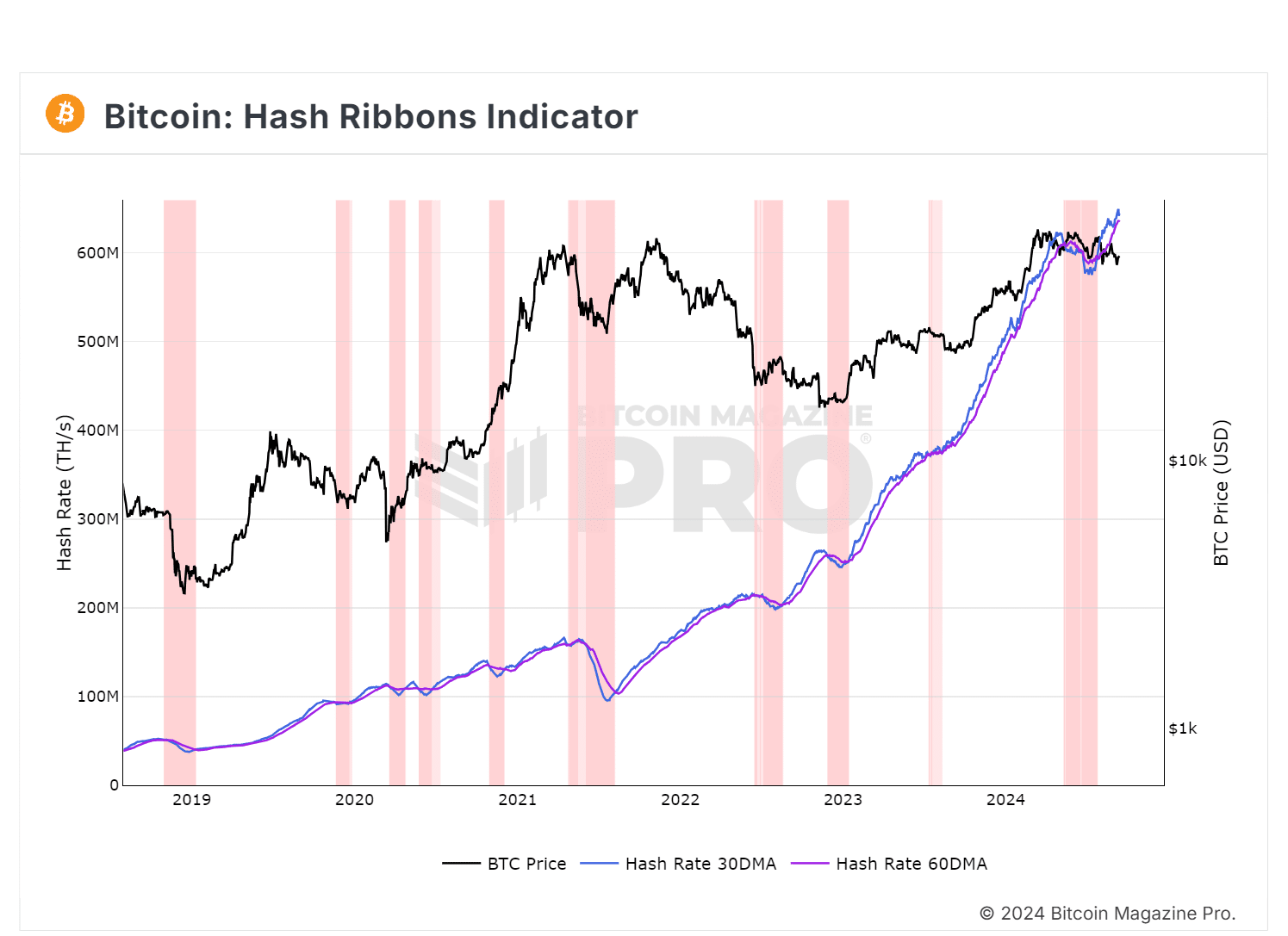

Source: Bitcoin Magazine Pro

The chart showed the 30-day MA above the 60-day MA, indicating a buy signal for hash ribbons. This proposed mass capitulation of miners may have ended, suggesting miners are staying in despite the volatility.

However, a prominent one analyst noted that Bitcoin miners sold around 30,000 BTC after BTC briefly surpassed $58,000, likely delivering strong gains.

Perhaps capitulation now signals both the tops and bottoms of the market. The key is to see who capitulates first.

Falling reserves could be a sign of a market top

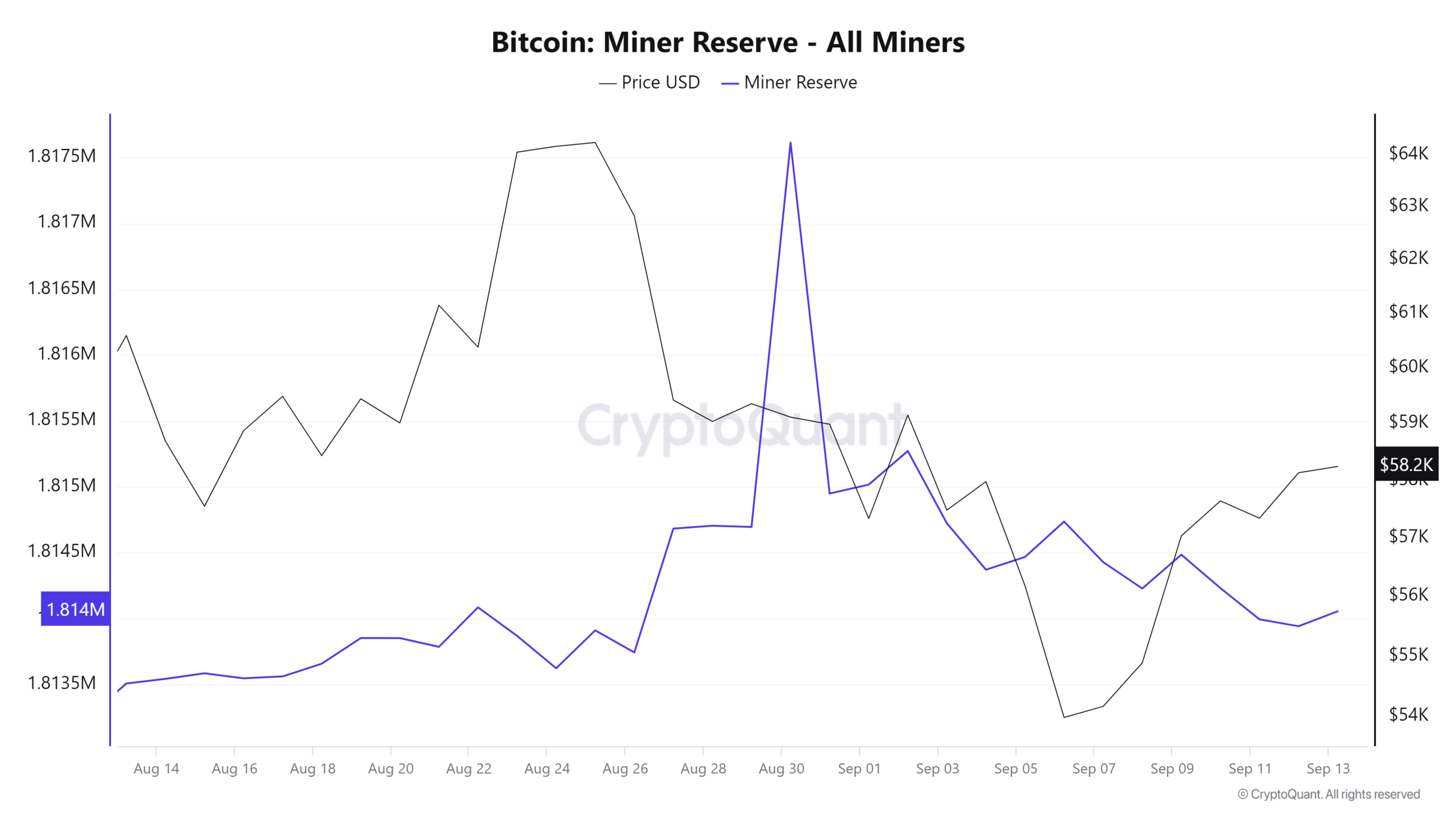

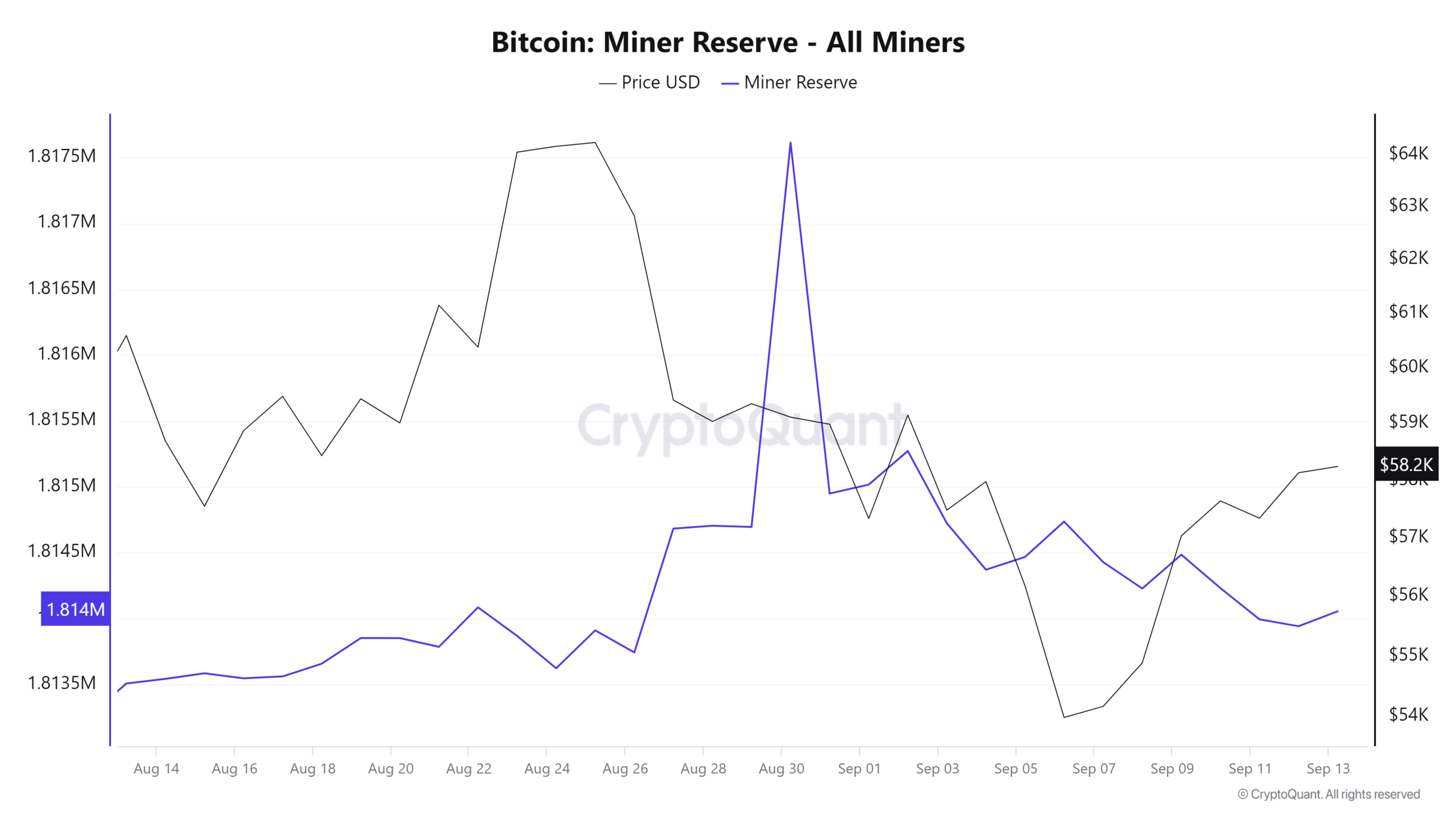

While the chart above suggested that miners typically find exits at the bottom of the market, AMBCrypto explored whether approaching a price top could lead to miners exiting.

Interestingly, as BTC approaches $60,000, Bitcoin miners are reducing their reserves, possibly to safeguard profits, reinforcing this hypothesis.

Source: CryptoQuant

With mining problems at an all-time high, many miners are cashing in on profits to cover their expenses. This could create selling pressure as BTC approaches its next market top.

However, those who can weather the volatility can continue to hold their Bitcoin as indicated by the buy signal.

Read Bitcoin’s [BTC] Price forecast 2024–2025

The real concern is if BTC hits a market bottom and fails to hold the $57,000 range; Miners’ capitulation could increase.

In this scenario, Bitcoin miners could offload large amounts of BTC not because of low profits, but to limit larger losses.