Hedge fund manager Cathie Wood has doubled on shares of Coinbase (Coin) in the midst of the stock market crash caused by rate.

According to Cathiesark.comArk Invest placed three buy orders for Coinbase shares on 4 April, with more than $ 13 million, which means that Coin is the second largest possession in all its combined exchange-related funds (ETFs).

Coin is currently traded at $ 161, about 54% compared to its high in December 2024.

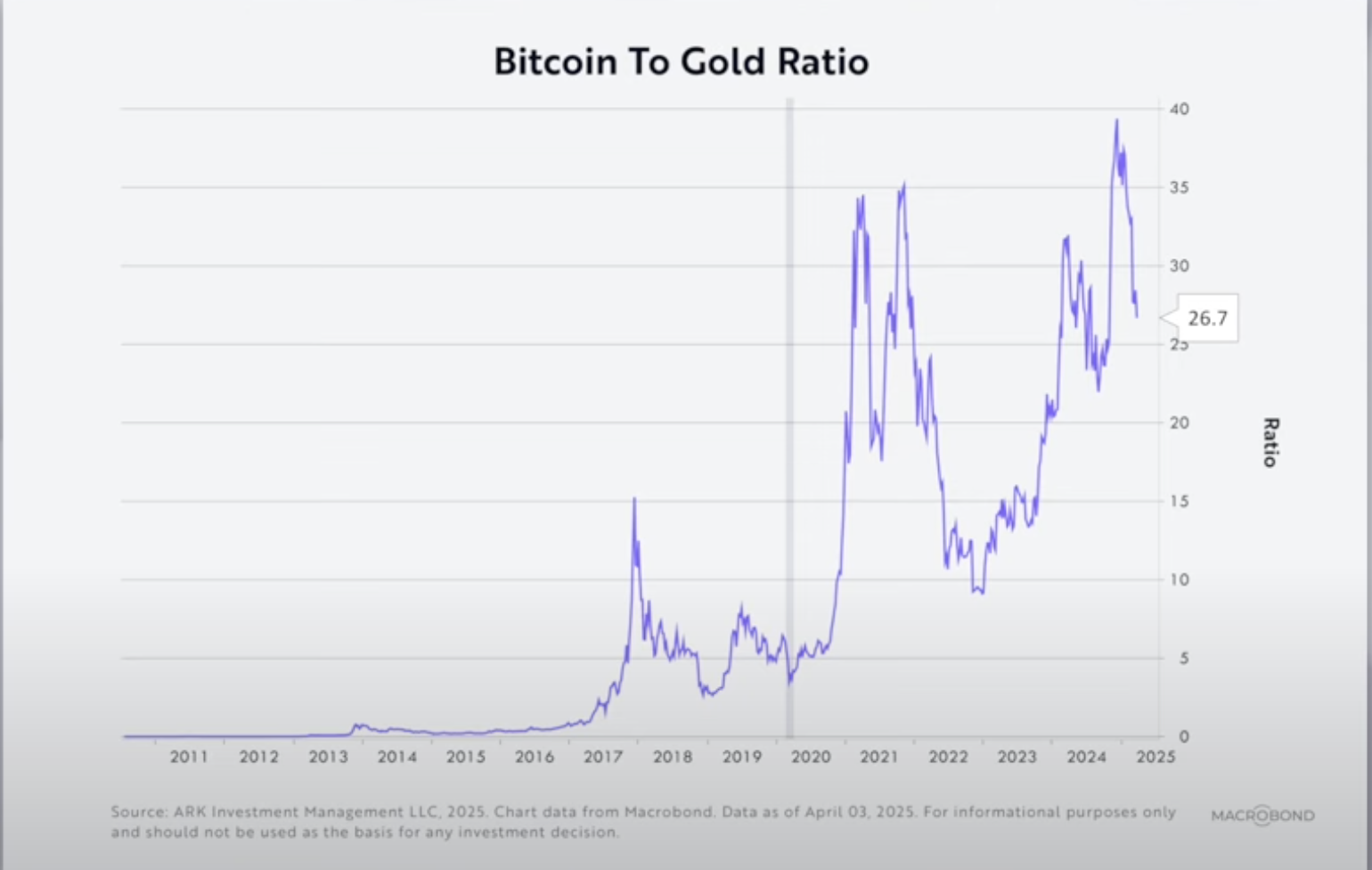

In a recent video update, wood out That she expects Bitcoin (BTC) to surpass in the coming months than surpassing gold. According to the investor, the BTC-to-Gouden Ratio has not broken its long-term upward trend.

“Gold has had a good run against Bitcoin. Bitcoin did very well in relation to gold in 2023 and 2024, but not this year. Nevertheless, we think over time, Bitcoin will appreciate it compared to gold, and as you can see, it has not broken the Uptrend line.”

Although Bullish on Bitcoin and Coinbase, Wood said last month that she expects that many other crypto assets will go to zero, in particular tokens in the memecoin space. In an interview with Bloomberg, Wood predicted that “millions” of memecoins would become worthless.

“What we think will happen is that there will be a number of frightening falls in the prices of some of these meme assets, and nothing is like losing money for people to learn. Now learn that the SEC and regulators take no responsibility for these memecoins …

The millions of memecoins will probably be worthless. When we talk about the Big Three – Bitcoin, Ethereum, Solana, the use cases for those and we think they will be very important in the coming years. Memecoins, not so. “

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Generated image: midjourney