TL; DR

-

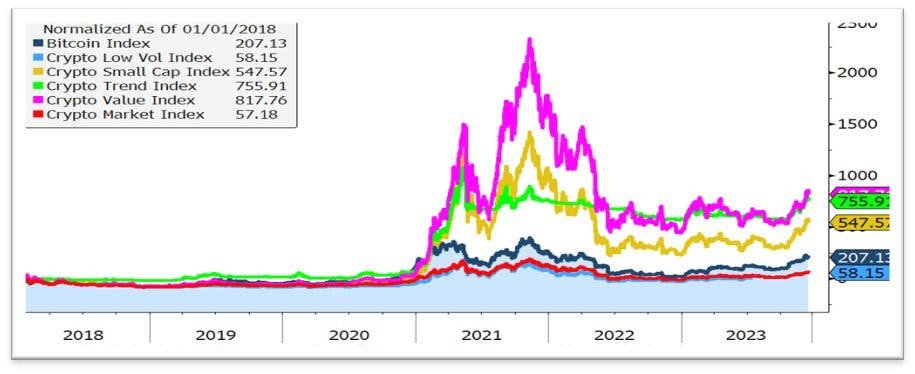

As cryptocurrency becomes widely accepted and regulated, its volatility will decrease – meaning its “opportunity velocity” will decrease.

-

This means that larger initial investments and longer terms are required to achieve the kind of returns we have achieved in the current market.

Full story

In today’s ‘fun fact’ we saw it on Twitter which made us go ‘huh, that’s nice'” news:

@Jamie1Coutts made an interesting analogy:

“The perfect parallel for today’s #crypto market? The American stock market of the early 20th century.”

Unfortunately, he doesn’t provide any real evidence to back up the statement other than “trust me bro” anecdotes…

Buuuut – we can kind of see what he’s referring to:

‘In the pre-1933 and 1934 Securities Act era, the US stock market operated in a ‘loose’ regulatory environment, was highly fragmented, dominated by large whales, and was subject to information asymmetry.

>>> Very much like today’s crypto markets”

Our takeaway?

If (IF!) Jamie is here, it means:

As cryptocurrency becomes widely accepted and regulated, its volatility will decrease – meaning its “opportunity velocity” will decrease.

That’s an unnecessarily nice way of saying…

Larger initial investments and longer terms will be required to achieve the kind of returns we have achieved in the current market.

For example, Bitcoin goes from $16,000 in January to $42,000 today? Regulation and wider adoption will likely push these prices and timeframes higher.

So the next time we face the loss of face and panic that causes downside volatility, we’ll remind ourselves of this story.